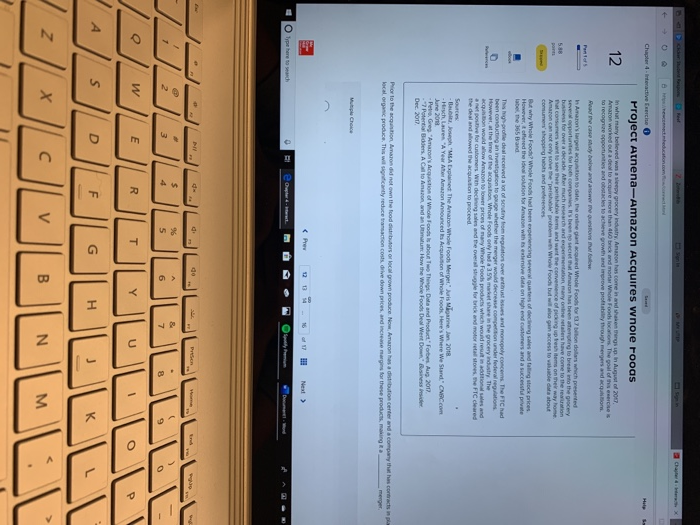

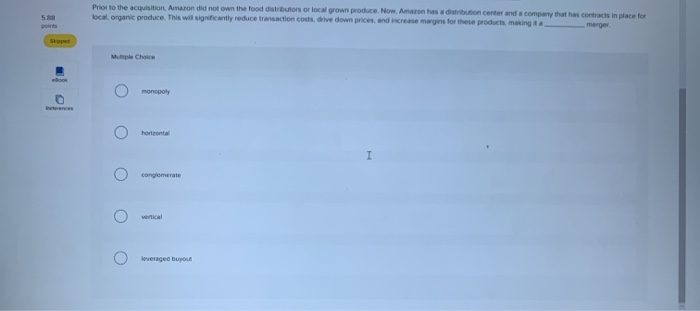

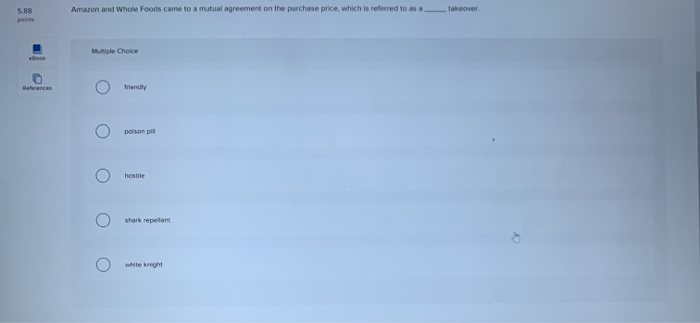

Chapter 4 - Interactive Perche Project Athena-Amazon Acquires wnole Fooas A worked oude recogne opportuni r e more than to brick and montar Wolf tat e growth and prove prot e The goal of these ger and acquiom. case bwanawe Son haron's largest action to date on e d Whole F o o ds which presented business for over a decade. Aber much research and experimentation many online retailers have come to the reason Pat consumers want to see the perso ns and want the convenience of picking up them on the way home common shopping habits and preferences However, it offered the ideal solution for Amazon with extensive data on high end customers and a successful da S o m regulator over antists and monopoly concerns The FTChad en concordan tigation to be whether the merger would decrease competition under federal regulations However, at the time o n Whole Foods only had a 35 share the grocery industry. The au would wann wer prices on yo r anet positive for customers with decling sales and the overall struggle for brick and m ore stores, the FTC cleared Ball Joseph MSA Explained The Amazon Whole Foods Merger" Juris Migare. Jan 2018 --Hirch, Laure A Year of Amon Announced Acquion of Whole Food Ple's Where We Stand Cocom - Petr Greg "Ano's Austion of Wolfs bu Thing Data and Product Forbes Aug 2017 -7 Potentiaders, A C o mandan Umum How the Whole Foods Deal Went de Prior to the action donaron and not own the food a bors or local grown produce Now Amazon has a distribution center and a company that has contracts local organic produce. This will incantly reduce transaction couldive down prices, and incre a for these product making a ED *** = "_ Prior to the action Amaranth not own the food distributors of local grown produce. Now, Aaron has a o ncentrando com local organic produce this will significantly reduce transaction cod e down prices and i m ages for the product mang that has contracts in place for monopoly conglomerate C) venged buyout Amaron and Whole Foods came to a mutual agreement on the purchase price, which is referred to as a fakeover poison hoste shark repetans O white knight In 1992. Whole Foods became selling shares of stock at $2.05 per share ! o o private corporation o Dute corporation o o wille Whole Foods CEO John Mackey was enthusiastic when he announced the merger, some argue that mergers can hurt companies by Multiple Choice o forcing managers to ou O boosing stock prices O streaming the operations O increasing market value O reducing start Prior to the acquisition Whole Foods we receiving a lot of pressure from shareholders to make significant changes including an overal of the individuals elected to oversee the general operations of the corporation C) board of directors Wareholders side director Chapter 4 - Interactive Perche Project Athena-Amazon Acquires wnole Fooas A worked oude recogne opportuni r e more than to brick and montar Wolf tat e growth and prove prot e The goal of these ger and acquiom. case bwanawe Son haron's largest action to date on e d Whole F o o ds which presented business for over a decade. Aber much research and experimentation many online retailers have come to the reason Pat consumers want to see the perso ns and want the convenience of picking up them on the way home common shopping habits and preferences However, it offered the ideal solution for Amazon with extensive data on high end customers and a successful da S o m regulator over antists and monopoly concerns The FTChad en concordan tigation to be whether the merger would decrease competition under federal regulations However, at the time o n Whole Foods only had a 35 share the grocery industry. The au would wann wer prices on yo r anet positive for customers with decling sales and the overall struggle for brick and m ore stores, the FTC cleared Ball Joseph MSA Explained The Amazon Whole Foods Merger" Juris Migare. Jan 2018 --Hirch, Laure A Year of Amon Announced Acquion of Whole Food Ple's Where We Stand Cocom - Petr Greg "Ano's Austion of Wolfs bu Thing Data and Product Forbes Aug 2017 -7 Potentiaders, A C o mandan Umum How the Whole Foods Deal Went de Prior to the action donaron and not own the food a bors or local grown produce Now Amazon has a distribution center and a company that has contracts local organic produce. This will incantly reduce transaction couldive down prices, and incre a for these product making a ED *** = "_ Prior to the action Amaranth not own the food distributors of local grown produce. Now, Aaron has a o ncentrando com local organic produce this will significantly reduce transaction cod e down prices and i m ages for the product mang that has contracts in place for monopoly conglomerate C) venged buyout Amaron and Whole Foods came to a mutual agreement on the purchase price, which is referred to as a fakeover poison hoste shark repetans O white knight In 1992. Whole Foods became selling shares of stock at $2.05 per share ! o o private corporation o Dute corporation o o wille Whole Foods CEO John Mackey was enthusiastic when he announced the merger, some argue that mergers can hurt companies by Multiple Choice o forcing managers to ou O boosing stock prices O streaming the operations O increasing market value O reducing start Prior to the acquisition Whole Foods we receiving a lot of pressure from shareholders to make significant changes including an overal of the individuals elected to oversee the general operations of the corporation C) board of directors Wareholders side director