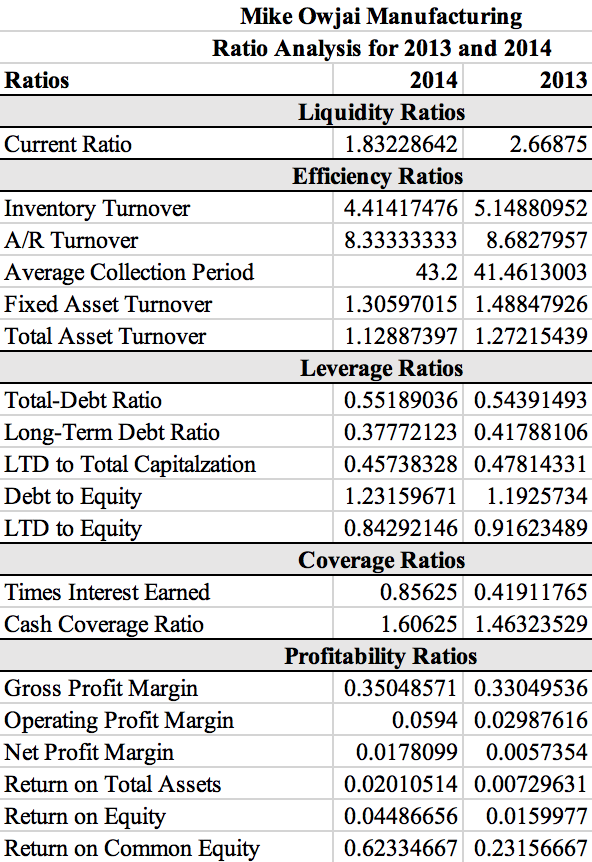

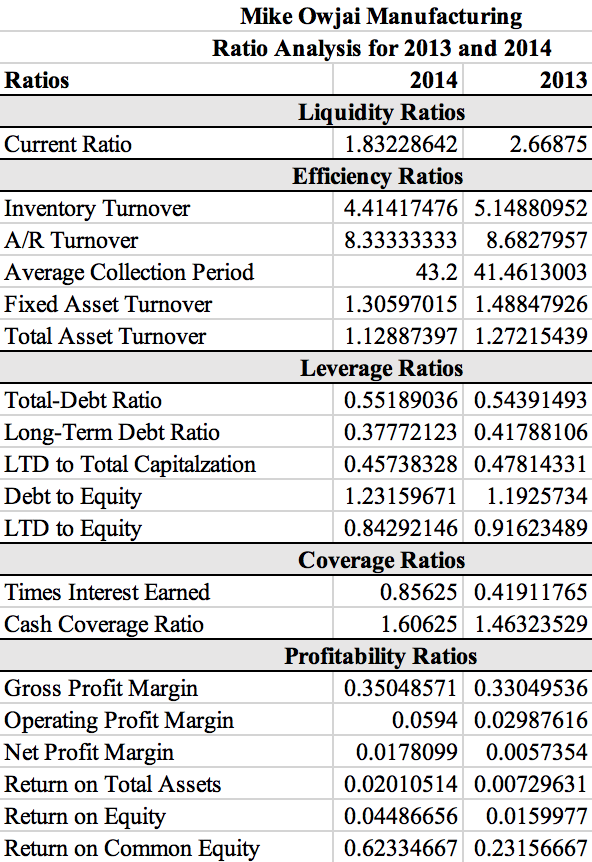

Chapter 4, Problem 1P. Bookmark Show all steps: 0 ON a. Set up a ratio worksheet similar to the one in Exhibit 4-6, page 131, and calculate all of the ratios for Mike Owjai Manufacturing. b. Identify at least two areas of potential concern using the ratios. Identify at least two areas that have shown improvement. c. In 2014 Mike Owjai Manufacturing's ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (4-29). Now use the extended DuPont method from (4-33). d. Mike Owjai Manufacturing has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income. The WACC is 11%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy? Mike Owjai Manufacturing Ratio Analysis for 2013 and 2014 Ratios 2014 2013 Liquidity Ratios Current Ratio 1.83228642 2.66875 Efficiency Ratios Inventory Turnover 4.41417476 5.14880952 AR Turnover 8.33333333 8.6827957 Average Collection Period 43.2 41.4613003 Fixed Asset Turnover 1.30597015 1.48847926 Total Asset Turnover 1.12887397 1.27215439 Leverage Ratios Total-Debt Ratio 0.55189036 0.54391493 Long-Term Debt Ratio 0.37772123 0.41788106 LTD to Total Capitalzation 0.45738328 0.47814331 Debt to Equity 1.23159671 1.1925734 LTD to Equity 0.84292146 0.91623489 Coverage Ratios Times Interest Earned 0.85625 0.41911765 Cash Coverage Ratio 1.60625 1.46323529 Profitability Ratios Gross Profit Margin 0.35048571 0.33049536 Operating Profit Margin 0.0594 0.02987616 Net Profit Margin 0.0178099 0.0057354 Return on Total Assets 0.02010514 0.00729631 Return on Equity 0.04486656 0.0159977 Return on Common Equity 0.62334667 0.23156667 Chapter 4, Problem 1P. Bookmark Show all steps: 0 ON a. Set up a ratio worksheet similar to the one in Exhibit 4-6, page 131, and calculate all of the ratios for Mike Owjai Manufacturing. b. Identify at least two areas of potential concern using the ratios. Identify at least two areas that have shown improvement. c. In 2014 Mike Owjai Manufacturing's ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (4-29). Now use the extended DuPont method from (4-33). d. Mike Owjai Manufacturing has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income. The WACC is 11%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy? Mike Owjai Manufacturing Ratio Analysis for 2013 and 2014 Ratios 2014 2013 Liquidity Ratios Current Ratio 1.83228642 2.66875 Efficiency Ratios Inventory Turnover 4.41417476 5.14880952 AR Turnover 8.33333333 8.6827957 Average Collection Period 43.2 41.4613003 Fixed Asset Turnover 1.30597015 1.48847926 Total Asset Turnover 1.12887397 1.27215439 Leverage Ratios Total-Debt Ratio 0.55189036 0.54391493 Long-Term Debt Ratio 0.37772123 0.41788106 LTD to Total Capitalzation 0.45738328 0.47814331 Debt to Equity 1.23159671 1.1925734 LTD to Equity 0.84292146 0.91623489 Coverage Ratios Times Interest Earned 0.85625 0.41911765 Cash Coverage Ratio 1.60625 1.46323529 Profitability Ratios Gross Profit Margin 0.35048571 0.33049536 Operating Profit Margin 0.0594 0.02987616 Net Profit Margin 0.0178099 0.0057354 Return on Total Assets 0.02010514 0.00729631 Return on Equity 0.04486656 0.0159977 Return on Common Equity 0.62334667 0.23156667