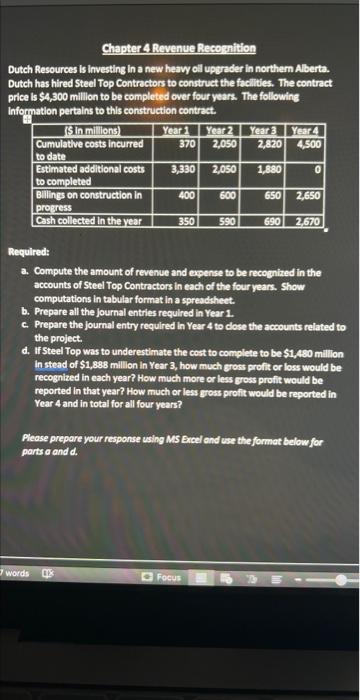

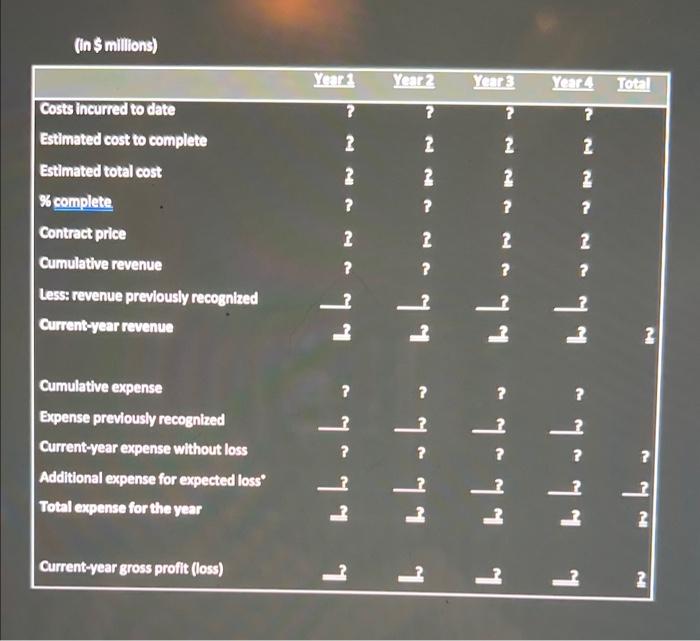

Chapter 4 Revenue Recornition Dutch Resources is investing in a new heavy oll upgreder in northem Alberta. Dutch has hired Steel Top Contractors to construct the facilties. The contract price is $4,300 million to be completed over four years. The following Information pertains to this construction contract. Required: a. Compute the amount of revenue and expense to be recognized in the accounts of Steel Top Contractors in each of the four years. Show computations in tabular format in a spreadsheet. b. Prepare all the journal entries required in Year 1. c. Prepare the journal entry required in Year 4 to close the accounts related to the project. d. If Steel Top was to underestimate the cost to complete to be $1,480 million In stead of $1,888 million in Year 3, how much gross profit or loss would be recognized in each year? How much more or less gross profit would be reported in that year? How much or less gross profit would be reported in Year 4 and in total for all four years? Please prepare your response using MS Excel and use the format below for parts a and d. (insmillions) Chapter 4 Revenue Recornition Dutch Resources is investing in a new heavy oll upgreder in northem Alberta. Dutch has hired Steel Top Contractors to construct the facilties. The contract price is $4,300 million to be completed over four years. The following Information pertains to this construction contract. Required: a. Compute the amount of revenue and expense to be recognized in the accounts of Steel Top Contractors in each of the four years. Show computations in tabular format in a spreadsheet. b. Prepare all the journal entries required in Year 1. c. Prepare the journal entry required in Year 4 to close the accounts related to the project. d. If Steel Top was to underestimate the cost to complete to be $1,480 million In stead of $1,888 million in Year 3, how much gross profit or loss would be recognized in each year? How much more or less gross profit would be reported in that year? How much or less gross profit would be reported in Year 4 and in total for all four years? Please prepare your response using MS Excel and use the format below for parts a and d. (insmillions)