Answered step by step

Verified Expert Solution

Question

1 Approved Answer

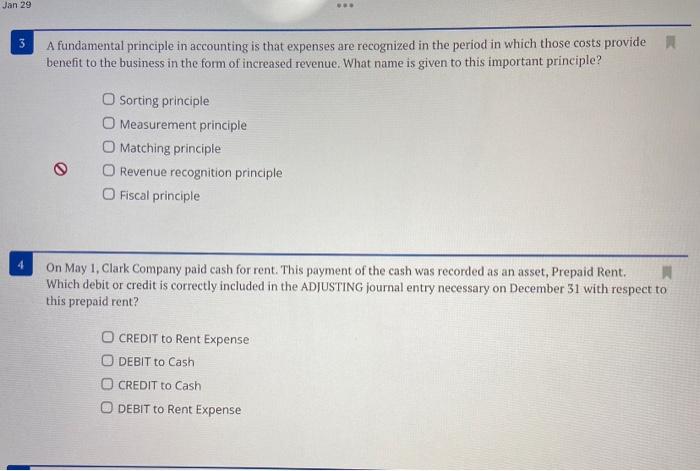

chapter 5 !! 290T A fundamental principle in accounting is that expenses are recognized in the period in which those costs provide benefit to the

chapter 5 !! 290T

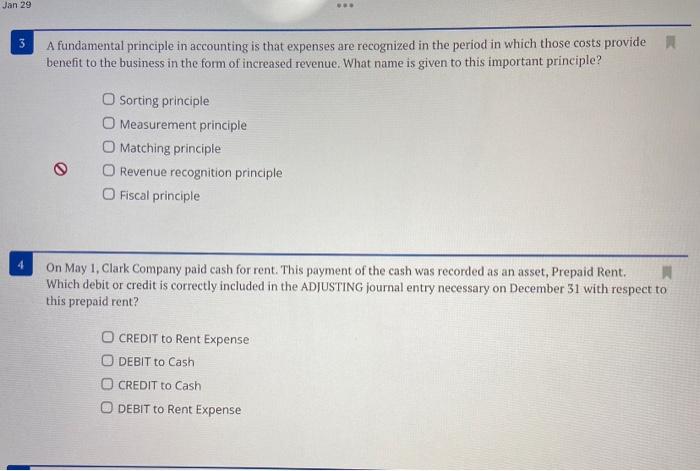

A fundamental principle in accounting is that expenses are recognized in the period in which those costs provide benefit to the business in the form of increased revenue. What name is given to this important principle? Sorting principle Measurement principle Matching principle Revenue recognition principle Fiscal principle On May 1, Clark Company paid cash for rent. This payment of the cash was recorded as an asset, Prepaid Rent. Which debit or credit is correctly included in the ADJUSTING journal entry necessary on December 31 with respect to this prepaid rent? CREDIT to Rent Expense DEBIT to Cash CREDIT to Cash DEBIT to Rent Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started