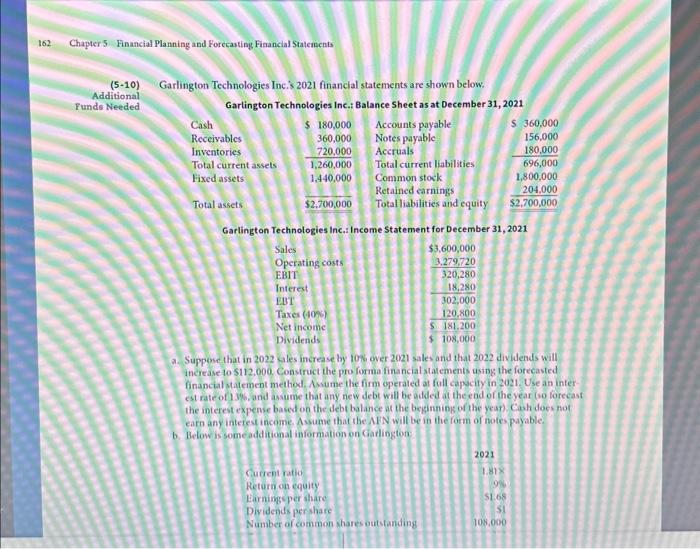

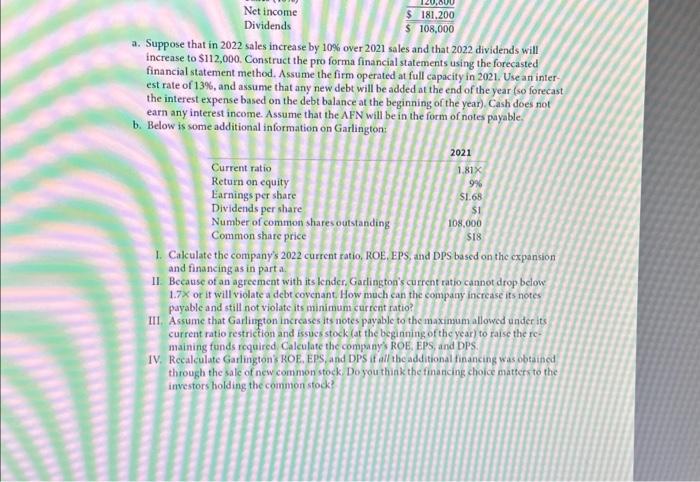

Chapter 5 Financial Planning and Forecasting Financial Statements (5-10) Garlington Technologies Inc;s 2021 financial statements are shown below. Additional Funds Needed Gartington Technologies Inc.: Balance Sheet as at December 31, 2021 Garlington Technologies Inc.: Income Statement for December 31, 2021 a. Suppose that in 2022 Gles increase by 100w ower 2021 sales and that 2022 dividends will increase to $112,000. Construct the pro forma financial statements using the forecasted financial statement method, Asume the firm operated at full capocity in 2021 . Use an interest rate of 136 , and assume that any new debt will be added at the end of the year foo lorecast the interest expense based on the Jebt balance at the beginning of the year). Cash does not earn any interest income. Assume that the AFN will be in the form of notrs payable. b. Below is someadditional information on Garlington a. Suppose that in 2022 sales increase by 10% over 2021 sales and that 2022 dividends will increase to $112,000. Construct the pro forma financial statements using the forecasted financial statement method. Assume the firm operated at full capacity in 2021. Use an interest rate of 13%, and assume that any new debt will be added at the end of the year (so forecast the interest expense based on the debt balance at the beginning of the year). Cash does not earn any interest income. Assume that the AFN will be in the form of notes payable. b. Below is some additional information on Garlington: 1. Calculate the company's 2022 current ratio, ROE, EPS, and DPS based on the expansion and financing as in part a. II. Because of an agreement with its lender, Garlington's current ratio cannot drop below 1.7 or it will violate a debt covenant. How much can the company increase its notes payable and still not violate its minimum current ratio? III. Assume that Garlington increases its notes payable to the maximum allowed under its current ratio restriction and issues stock (at the beginning of the year) to faise the remaining funds required, Calculate the company's ROE. EPS, and DPS. IV. Recalculate Garlington's ROE. EPS, and DPS if all the additional financing was obtaincd through the sale of new common stock. Do you think the financing choice matters to the investors holding the common stock