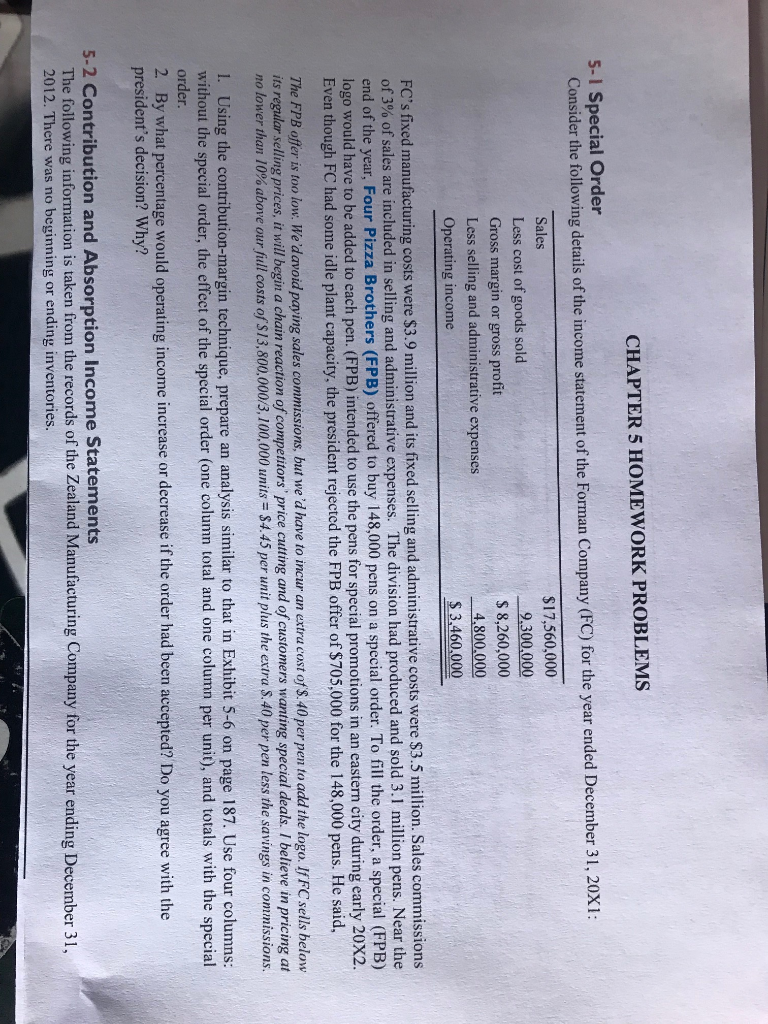

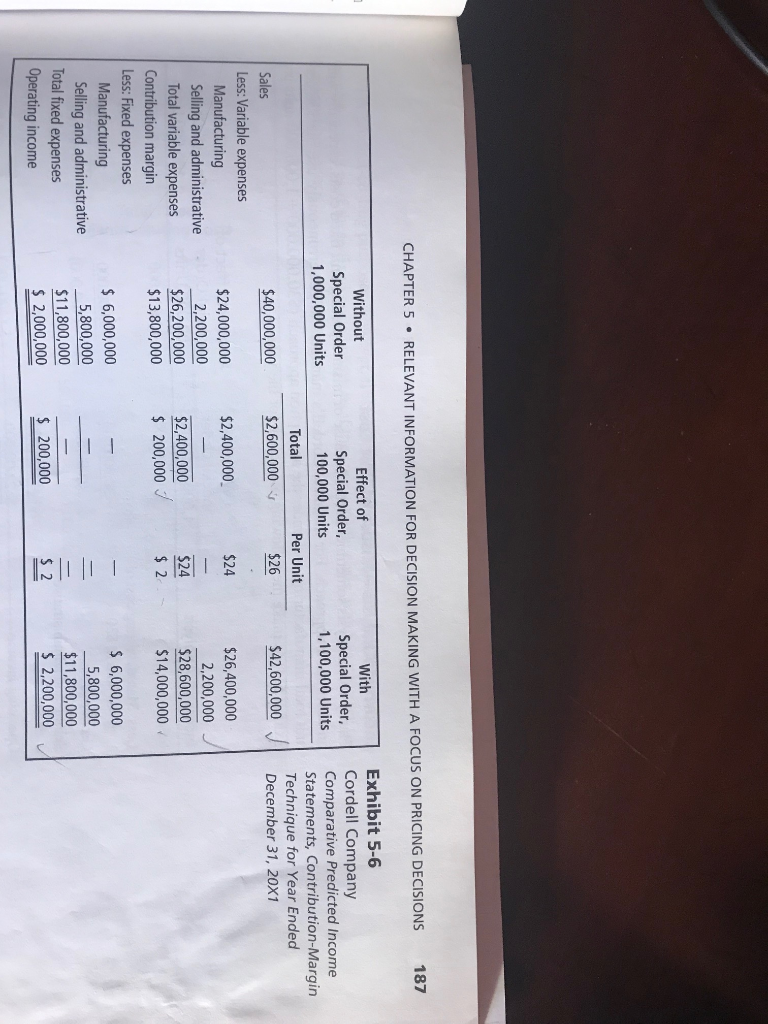

CHAPTER 5 HOMEWORK PROBLEMS 5-I Special Order ider the following details of the income statement of the Forman Company (FC) for the year ended December 31, 20XI Sales Less cost of goods sold Gross margin or gross profit Less selling and administrative expenses Operating income $17,560,000 9.300,000 s 8,260,000 800,000 $3,460,000 4, FC's fixed manufacturing costs were $3.9 million and its fixed selling and administrative costs were $3.5 million. Sales commissions included in selling and administrative expenses. The division had produced and sold 3.1 million pens. Near the end of the year, Four Pizza Brothers (FPB) offered to buy 148,000 pens on a special order. To fill the order, a special (FPB) logo would have to be added to cach pen. (FPB) intended to use the pens for special promotions in an eastern city during early 20X2 Even though FC had some idle plant capacity, the president rejected the FPB offer of $705,000 for the 148,000 pens. He said, The FPB offer is too low. We'd avoid paying sales commissions, but we'd have to incur an extru cost of $. 40 per pen to add the logo. If FC sells below ts regular selling prices, it will begin a chain reaction of competitors price cutting and of customers wanting special deals. I believe in pricing at $4.45 per unit plus the extra $ 40 per pen less the savings in commissions. lower than 10 % above our full costs o $13,800,000/3 100,000 units 1. Using the contribution-margin technique, prepare an analysis similar to that in Exhibit 5-6 on page 187. Use four columns: without the special order, the effect of the special order (one column total and one column per unit), and totals with the special order. 2 By what percentage would operating income increase or decrease if the order had been accepted? Do you agree with the president's decision? Why? 5-2 Contribution and Absorption Income Statements The following information is taken from the records of the Zealand Manufacturing Company for the year ending December 31, 2012. There was no beginning or ending inventories CHAPTER 5 RELEVANT INFORMATION FOR DECISION MAKING WITH A FOCUS ON PRICING DECISIONS Exhibit 5-6 With Without Special Order 1,000,000 Units Effect of 0 Special Order, 100,000 Units Special Order, Cordell Company 1,100,000 Units Comparative Predicted Income Statements, Contribution-Margin Per Unit Total $2,600,000 42,600,000 Technique for Year Ended $26 24 S24 Sales Less: Variable expenses $40,000,000 $24,000,000 2,200,000 $26,200,000 $13,800,000 $26,400,000 2,200,000 $28,600,000 $14,000,000 $2,400,000 Manufacturing Selling and administrative Total variable expenses $2,400,000 2 s 200,000 $ 2 Contribution margin Less: Fixed expenses 6,000,000 5,800,000 $11,800,000 2,000,000 6,000,000 5,800,000 $11,800,000 2,200,000 Manufacturing Selling and administrative Total fixed expenses Operating income 200,000