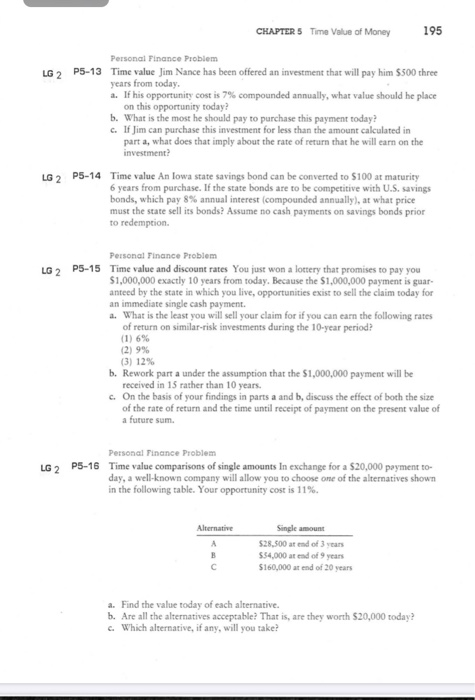

CHAPTER 5 Time Value of Money 195 LG 2 P5-13 Personal Finance Problem Time value Jim Nance has been offered an investment that will pay him $500 three years from today. a. If his opportunity cost is 7% compounded annually, what value should he place on this opportunity today? b. What is the most he should pay to purchase this payment today? C. If Jim can purchase this investment for less than the amount calculated in part a, what does that imply about the rate of return that he will earn on the investment? LG 2 P5-14 Time value An lowa state savings bond can be converted to $100 at maturity 6 years from purchase. If the state bonds are to be competitive with U.S. savings bonds, which pay 8% annual interest (compounded annually), at what price must the state sell its bonds? Assume no cash payments on savings bonds prior to redemption LG P5-15 Personal Finance Problem Time value and discount rates You just won a lottery that promises to pay you $1,000,000 exactly 10 years from today. Because the $1,000,000 payment is guar anteed by the state in which you live, opportunities exist to sell the claim today for an immediate single cash payment. a. What is the least you will sell your claim for if you can earn the following rates of return on similar-risk investments during the 10-year period? (1) 6% (2) 9% (3) 12% b. Rework part a under the assumption that the $1,000,000 payment will be received in 15 rather than 10 years. c. On the basis of your findings in parts a and b, discuss the effect of both the size of the rate of return and the time until receipt of payment on the present value of a future sum. LG 2 P5-16 Personal Finance Problem Time value comparisons of single amounts in exchange for a $20,000 payment to day, a well-known company will allow you to choose one of the alternatives shown in the following table. Your opportunity cost is 11%. Alternative Single amount $28,500 at end of 3 years $54,000 at end of 9 years $160,000 at end of 20 years a. Find the value today of each alternative. b. Are all the alternatives acceptable? That is, are they worth $20,000 today? c. Which alternative, if any, will you take