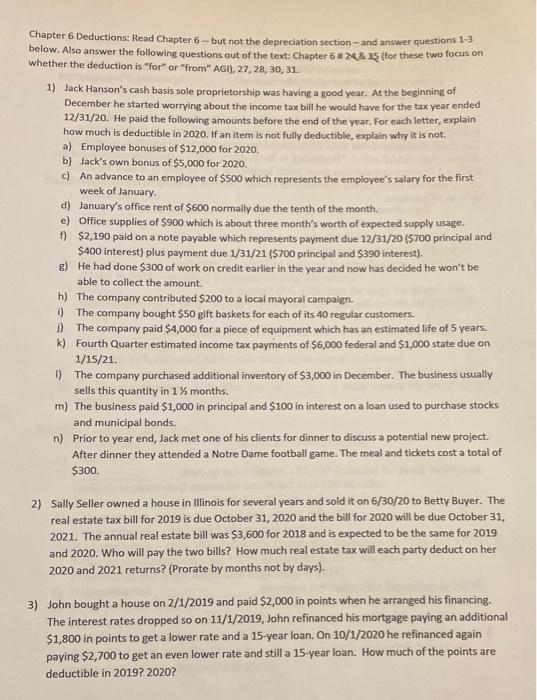

Chapter 6 Deductions: Read Chapter 6 - but not the depreciation section - and answer questions 1-3 below. Also answer the following questions out of the text: Chapter 6 # 24 & 25 (for these two focus on whether the deduction is "for" or "from" AGI), 27, 28, 30, 31. 1) Jack Hanson's cash basis sole proprietorship was having a good year. At the beginning of December he started worrying about the income tax bill he would have for the tax year ended 12/31/20. He paid the following amounts before the end of the year. For each letter, explain how much is deductible in 2020. If an item is not fully deductible, explain why it is not. a) Employee bonuses of $12,000 for 2020. b) Jack's own bonus of $5,000 for 2020. c) An advance to an employee of $500 which represents the employee's salary for the first week of January d) January's office rent of $600 normally due the tenth of the month. e) Office supplies of $900 which is about three month's worth of expected supply usage. +) $2,190 paid on a note payable which represents payment due 12/31/20 ($700 principal and $400 interest) plus payment due 1/31/21 ($700 principal and $390 interest). e) He had done $300 of work on credit earlier in the year and now has decided he won't be able to collect the amount. h) The company contributed $200 to a local mayoral campaign. The company bought $50 gift baskets for each of its 40 regular customers. D. The company paid $4,000 for a piece of equipment which has an estimated life of 5 years. k) Fourth Quarter estimated income tax payments of $5,000 federal and $1,000 state due on 1/15/21. D) The company purchased additional inventory of $3,000 in December. The business usually sells this quantity in 1% months. m) The business paid $1,000 in principal and $100 in interest on a loan used to purchase stocks and municipal bonds. n) Prior to year end, Jack met one of his clients for dinner to discuss a potential new project. After dinner they attended a Notre Dame football game. The meal and tickets cost a total of $300. 2) Sally Seller owned a house in Illinois for several years and sold it on 6/30/20 to Betty Buyer. The real estate tax bill for 2019 is due October 31, 2020 and the bill for 2020 will be due October 31, 2021. The annual real estate bill was $3,600 for 2018 and is expected to be the same for 2019 and 2020. Who will pay the two bills? How much real estate tax will each party deduct on her 2020 and 2021 returns? (Prorate by months not by days) 3) John bought a house on 2/1/2019 and paid $2,000 in points when he arranged his financing. The interest rates dropped so on 11/1/2019, John refinanced his mortgage paying an additional $1,800 in points to get a lower rate and a 15-year loan. On 10/1/2020 he refinanced again paying $2,700 to get an even lower rate and still a 15-year loan. How much of the points are deductible in 2019 2020? Chapter 6 Deductions: Read Chapter 6 - but not the depreciation section - and answer questions 1-3 below. Also answer the following questions out of the text: Chapter 6 # 24 & 25 (for these two focus on whether the deduction is "for" or "from" AGI), 27, 28, 30, 31. 1) Jack Hanson's cash basis sole proprietorship was having a good year. At the beginning of December he started worrying about the income tax bill he would have for the tax year ended 12/31/20. He paid the following amounts before the end of the year. For each letter, explain how much is deductible in 2020. If an item is not fully deductible, explain why it is not. a) Employee bonuses of $12,000 for 2020. b) Jack's own bonus of $5,000 for 2020. c) An advance to an employee of $500 which represents the employee's salary for the first week of January d) January's office rent of $600 normally due the tenth of the month. e) Office supplies of $900 which is about three month's worth of expected supply usage. +) $2,190 paid on a note payable which represents payment due 12/31/20 ($700 principal and $400 interest) plus payment due 1/31/21 ($700 principal and $390 interest). e) He had done $300 of work on credit earlier in the year and now has decided he won't be able to collect the amount. h) The company contributed $200 to a local mayoral campaign. The company bought $50 gift baskets for each of its 40 regular customers. D. The company paid $4,000 for a piece of equipment which has an estimated life of 5 years. k) Fourth Quarter estimated income tax payments of $5,000 federal and $1,000 state due on 1/15/21. D) The company purchased additional inventory of $3,000 in December. The business usually sells this quantity in 1% months. m) The business paid $1,000 in principal and $100 in interest on a loan used to purchase stocks and municipal bonds. n) Prior to year end, Jack met one of his clients for dinner to discuss a potential new project. After dinner they attended a Notre Dame football game. The meal and tickets cost a total of $300. 2) Sally Seller owned a house in Illinois for several years and sold it on 6/30/20 to Betty Buyer. The real estate tax bill for 2019 is due October 31, 2020 and the bill for 2020 will be due October 31, 2021. The annual real estate bill was $3,600 for 2018 and is expected to be the same for 2019 and 2020. Who will pay the two bills? How much real estate tax will each party deduct on her 2020 and 2021 returns? (Prorate by months not by days) 3) John bought a house on 2/1/2019 and paid $2,000 in points when he arranged his financing. The interest rates dropped so on 11/1/2019, John refinanced his mortgage paying an additional $1,800 in points to get a lower rate and a 15-year loan. On 10/1/2020 he refinanced again paying $2,700 to get an even lower rate and still a 15-year loan. How much of the points are deductible in 2019 2020