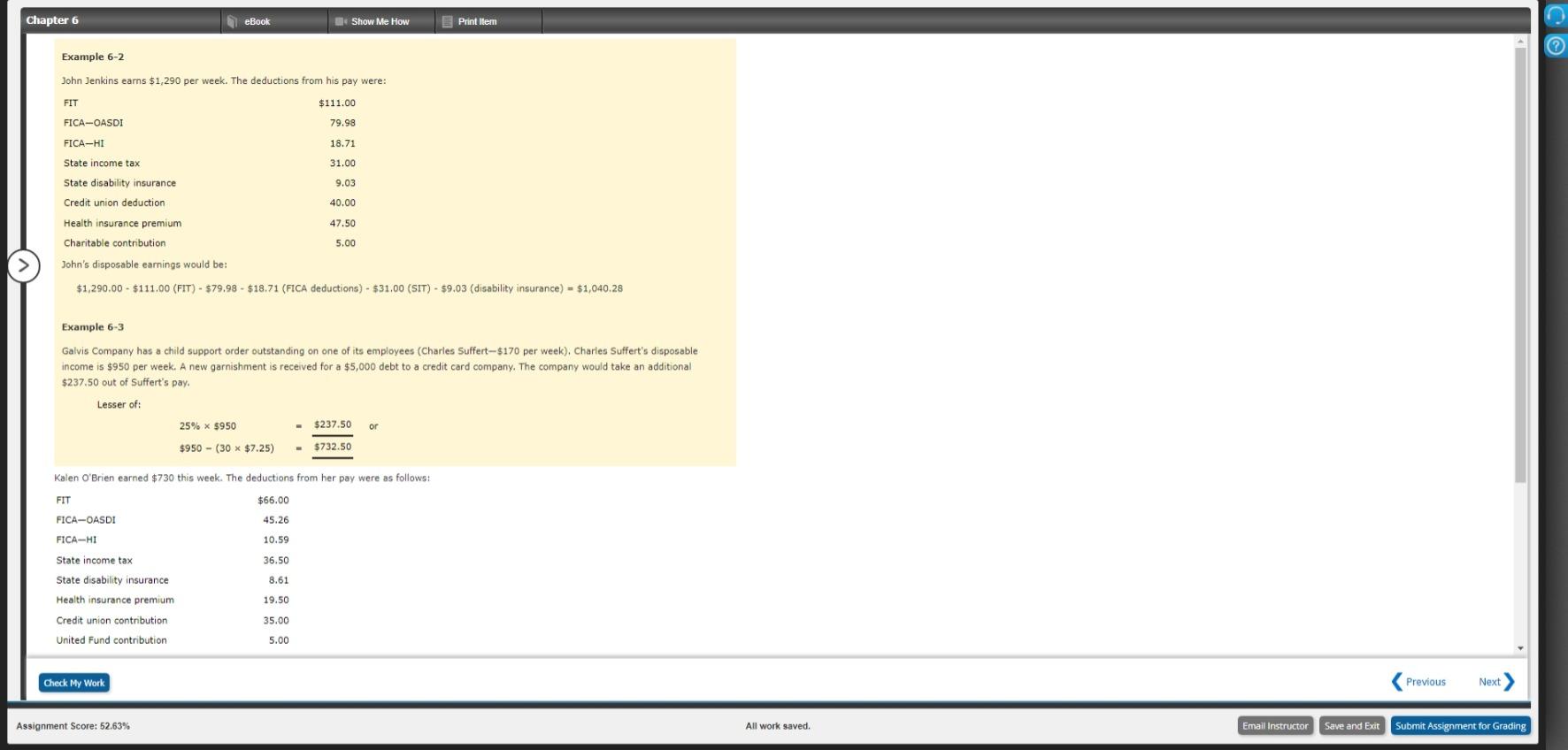

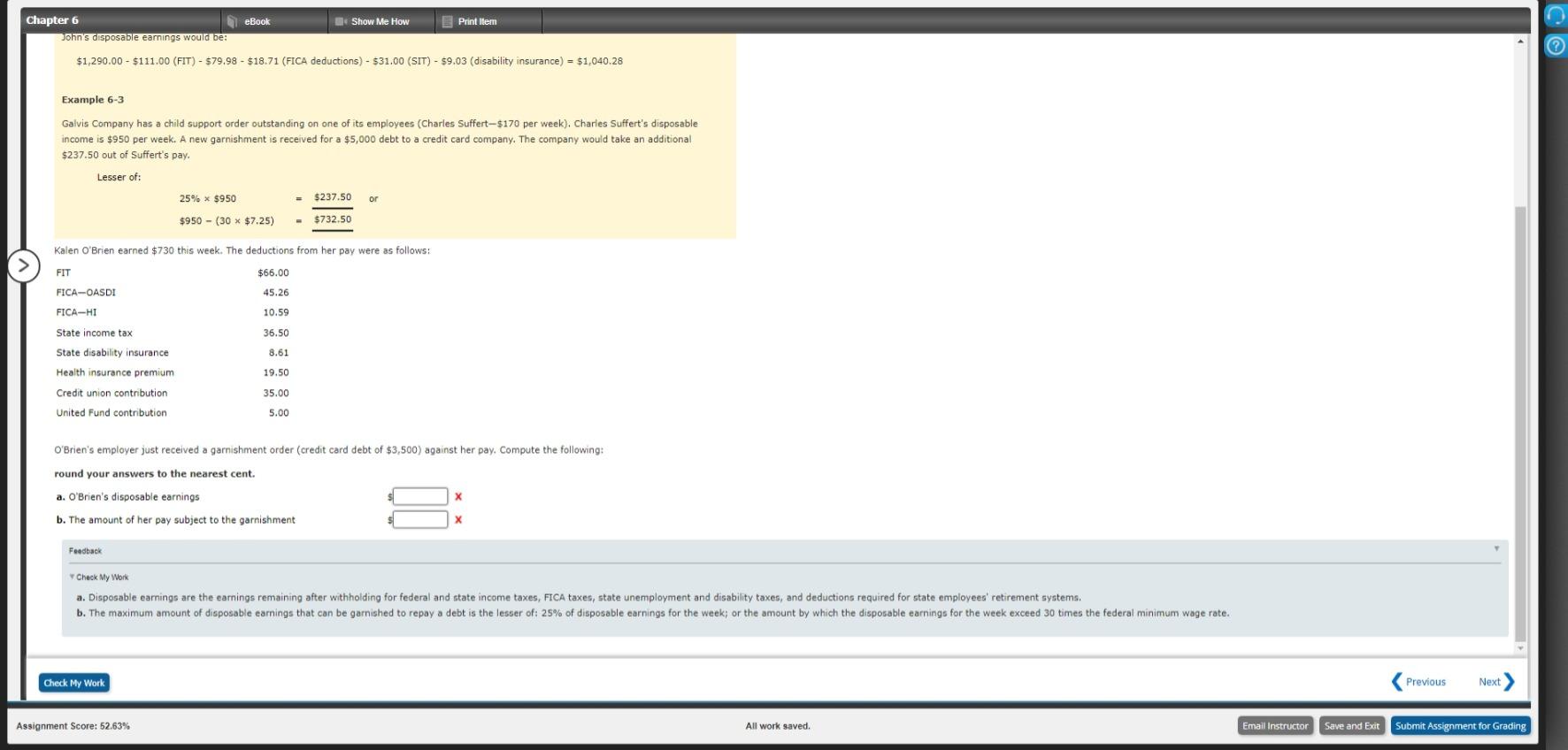

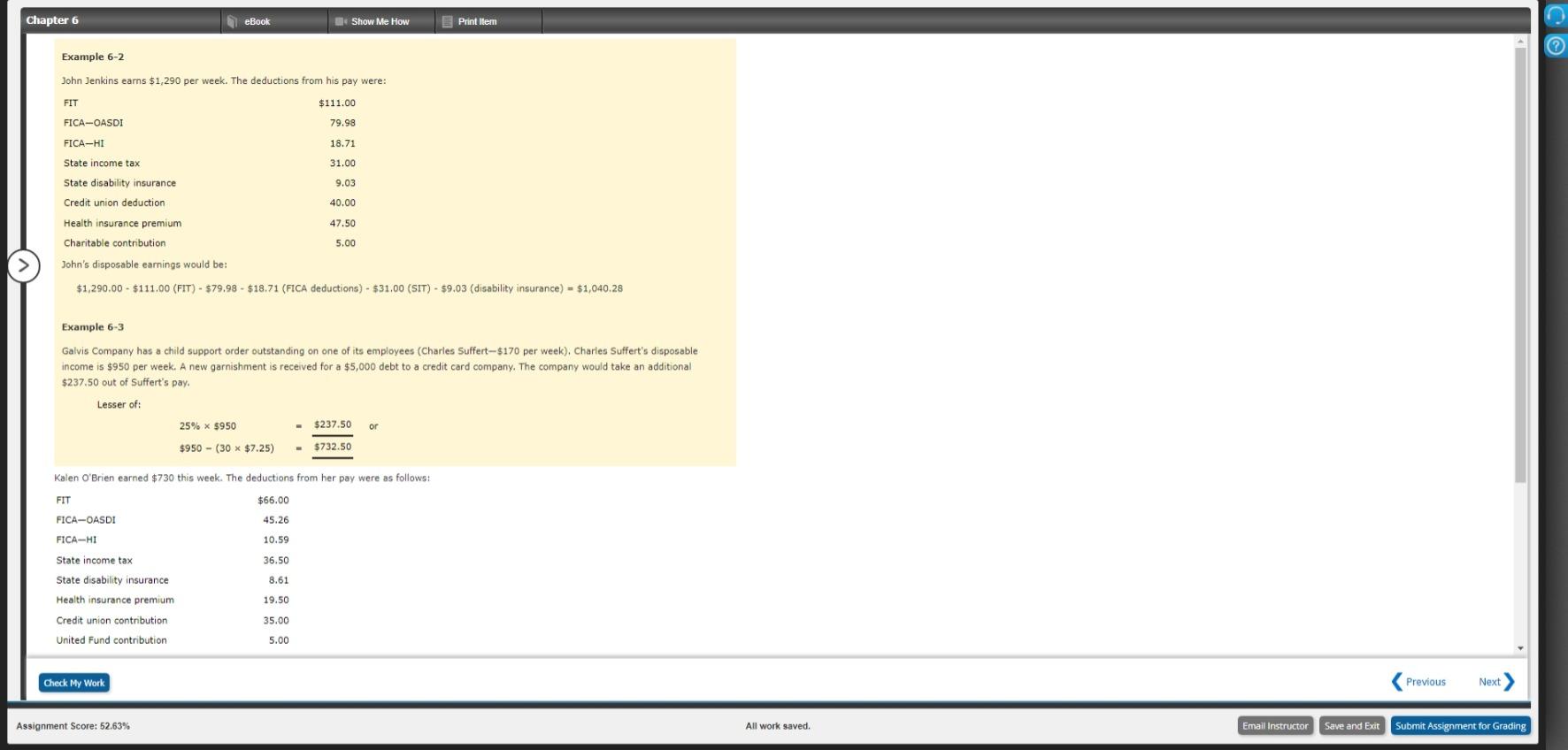

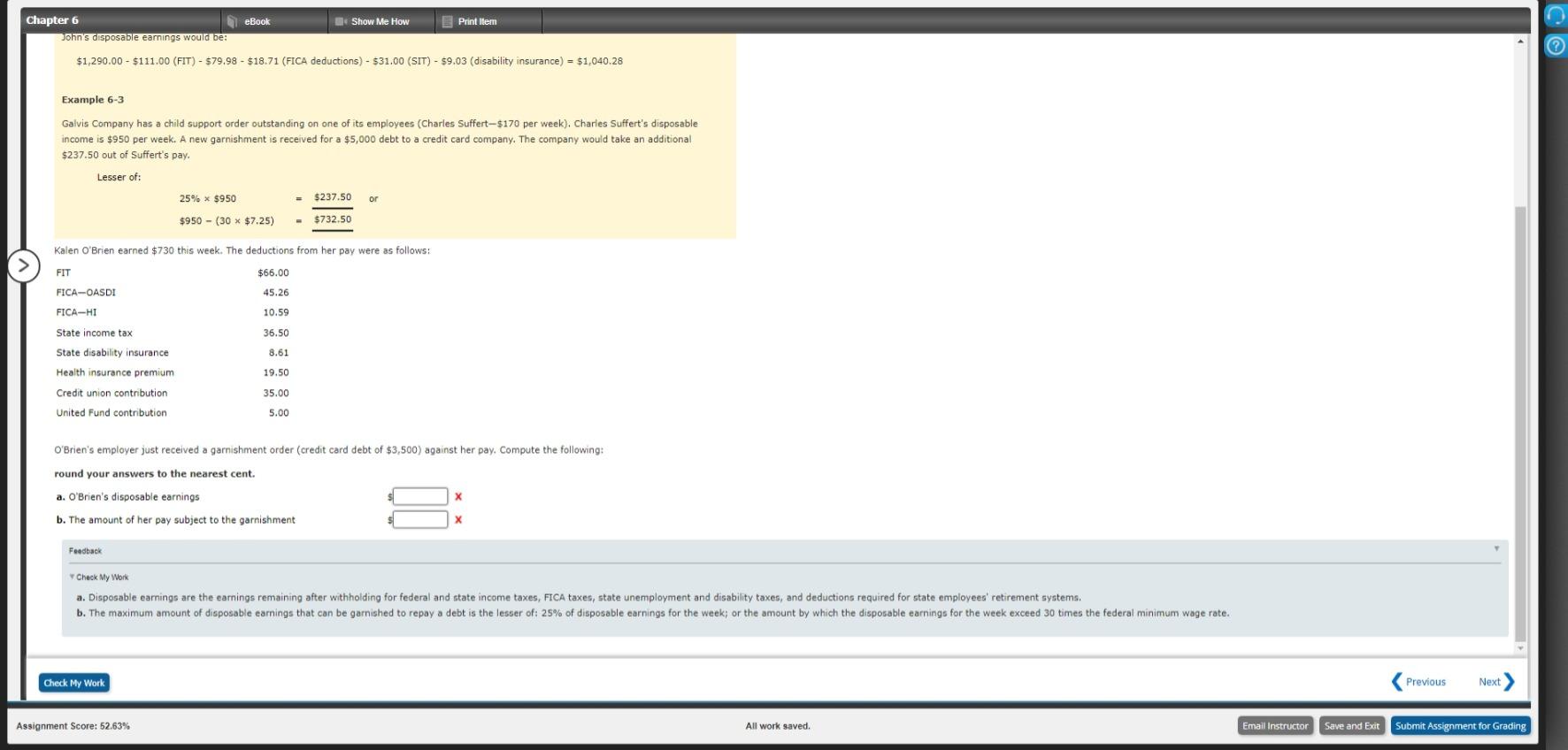

Chapter 6 eBook Show Me How Print Item Example 6-2 John Jenkins earns $1,290 per week. The deductions from his pay were: FIT $111.00 FICA-OASDI 79.98 FICA-HI 18.71 State income tax 31.00 State disability insurance 9.03 Credit union deduction 40.00 Health insurance premium 47.50 Charitable contribution 5.00 John's disposable earnings would be: $1,290.00 - $111.00 (FIT) - $79.98 - $18.71 (FICA deductions) - $31.00 (SIT) - 59.03 (disability insurance) = $1,040.28 Example 6-3 Galvis Company has a child support order outstanding on one of its employees (Charles Suffert-$170 per week), Charles Suffert's disposable income is $950 per week. A new garnishment is received for a $5,000 debt to a credit card company. The company would take an additional $237.50 out of Suffert's pay. Lesser of: 25% x 5950 $237.50 or $950 - (30 x $7.25) $732.50 Kalen O'Brien earned $730 this week. The deductions from her pay were as follows: FIT $66.00 45.26 FICA-OASDI FICA-HI 10.59 36.50 State income tax State disability insurance Health insurance premium 8.61 19.50 Credit union contribution 35.00 5.00 United Fund contribution Check My Work Previous Next Assignment Score: 52.63% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Show Me How Print Item Chapter 6 al eBook John's disposable earnings would be: ? $1,290.00 - $111.00 (FIT) - $79.98 - $18.71 (FICA deductions) - $31.00 (SIT) - 59.03 (disability insurance) = $1,040.28 Example 6-3 Galvis Company has a child support order outstanding on one of its employees (Charles Suffert-$170 per week), Charles Suffert's disposable income is $950 per week. A new garnishment is received for a $5,000 debt to a credit card company. The company would take an additional $237.50 out of Suffert's pay. Lesser of: 25% * $950 $237.50 $950 - (30 x $7.25) $732.50 Kalen O'Brien earned $730 this week. The deductions from her pay were as follows: FIT $66.00 FICA-OASDI 45.26 FICA-HI 10.59 State income tax 36.50 State disability insurance 8.61 Health insurance premium 19.50 Credit union contribution 35.00 United Fund contribution 5.00 O'Brien's employer just received a garnishment order (credit card debt of $3,500) against her pay. Compute the following: round your answers to the nearest cent. a. O'Brien's disposable earnings SI 9 b. The amount of her pay subject to the garnishment Feedback Check My Work a. Disposable earnings are the earnings remaining after withholding for federal and state income taxes, FICA taxes, state unemployment and disability taxes, and deductions required for state employees' retirement systems, b. The maximum amount of disposable carings that can be garnished to repay a debt is the lesser of: 25% of disposable earnings for the week; or the amount by which the disposable earnings for the week exceed 30 times the federal minimum wage rate. Check My Work Previous Next Assignment Score: 52.63% All work saved. Email Instructor Save and Exit Submit Assignment for Grading