Answered step by step

Verified Expert Solution

Question

1 Approved Answer

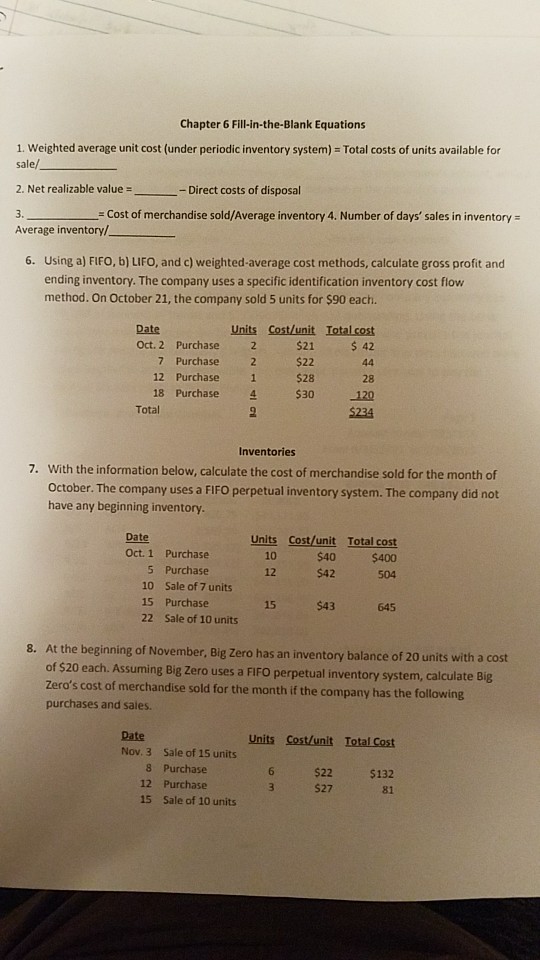

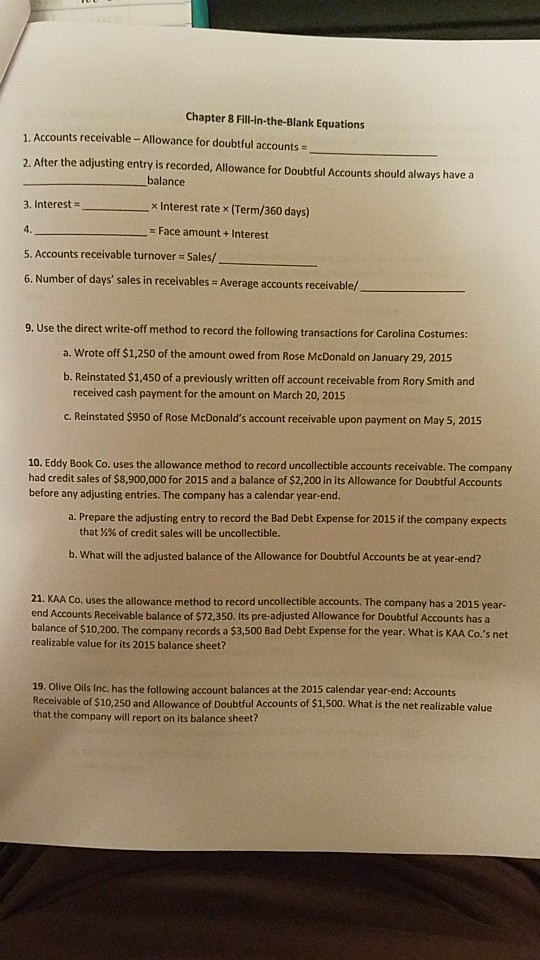

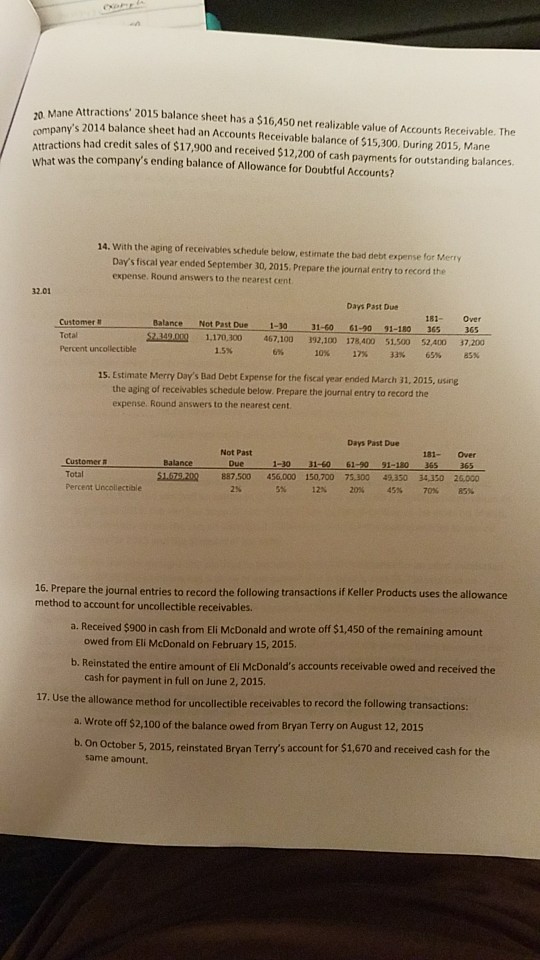

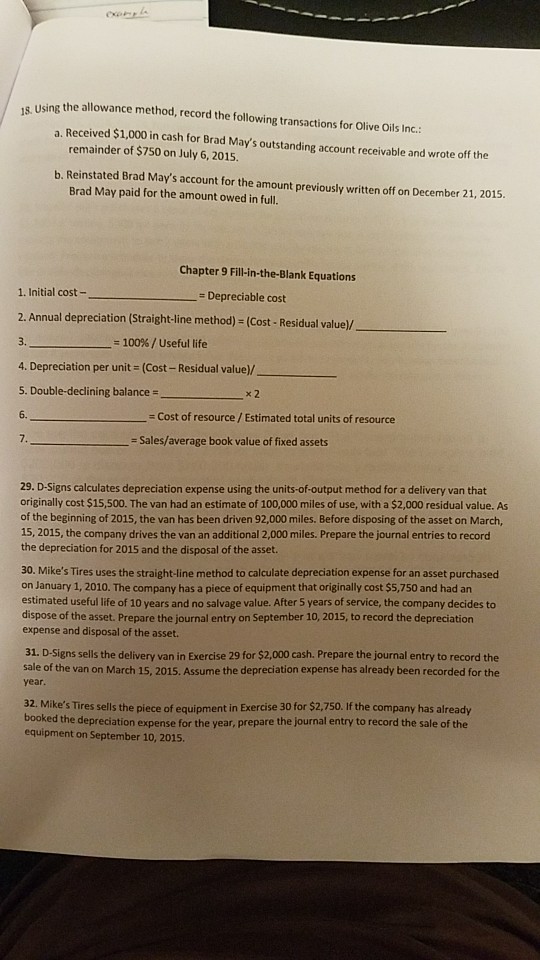

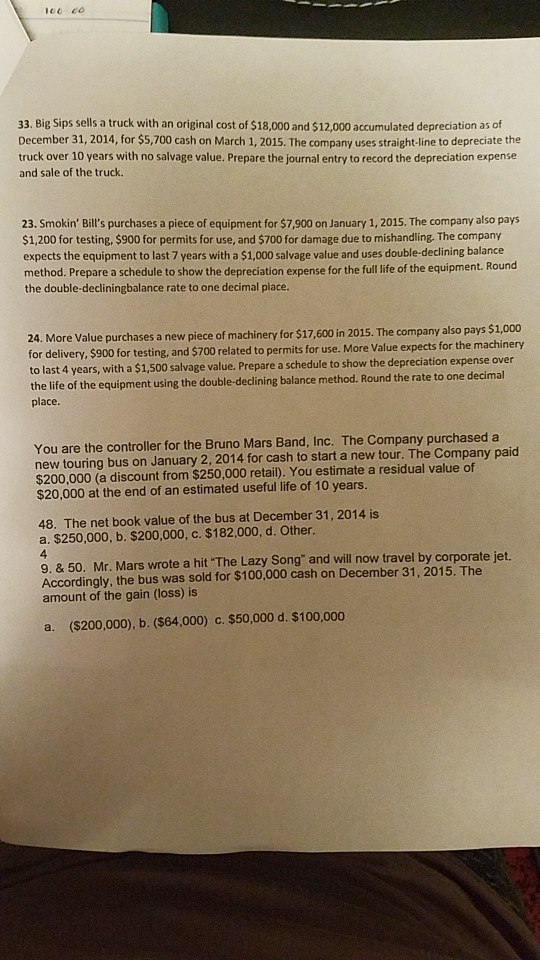

Chapter 6 Fill-in-the-Blank Equations 1. Weighted average unit cost (under periodic inventory system) Total costs of units available for sale/ 2. Net realizable value Direct

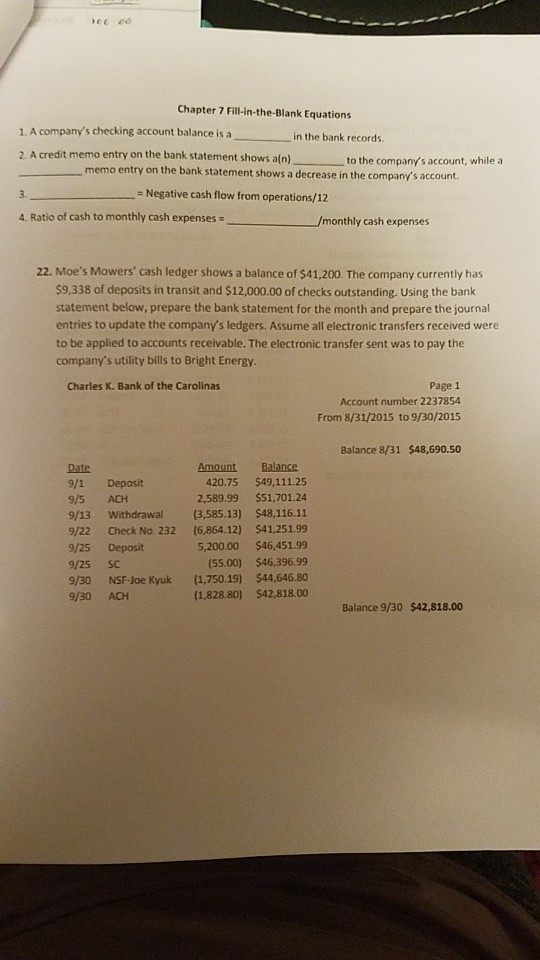

Chapter 6 Fill-in-the-Blank Equations 1. Weighted average unit cost (under periodic inventory system) Total costs of units available for sale/ 2. Net realizable value Direct costs of disposal 3.Cost of merchandise sold/Average inventory 4. Number of days' sales in inventory Average inventory/ 6. Using a) FIFO, b) LIFO, and c) weighted-average cost methods, calculate gross profit and ending inventory. The company uses a specific identification inventory cost flow method. On October 21, the company sold 5 units for $90 each. Date Units Cost/unit Iotal cost 42 Oct. 2 Purchase 2 7 Purchase 2 12 Purchase 1 18 Purchase 4 S21 $22 $28 28 $30120 Total Inventories With the information below, calculate the cost of merchandise sold for the month of October. The company uses a FIFO perpetual inventory system. The company did not have any beginning inventory 7. Date Oct. 1 Purchase Units Cost/unit Total cost S40 $42 10 12 $400 504 5 10 15 22 Purchase Sale of 7 units Purchase Sale of 10 units 15 $43 645 At the beginning of November, Big Zero has an inventory balance of 20 units with a cost of $20 each. Assuming Big Zero uses a FIFO perpetual inventory system, calculate Big Zero's cost of merchandise sold for the month if the company has the following purchases and sales. 8. Units Cost/unit Iotal Cost Nov.3 Sale of 15 units 8 Purchase 12 Purchase 6 $22 3 S27 $132 81 15 Sale of 10 units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started