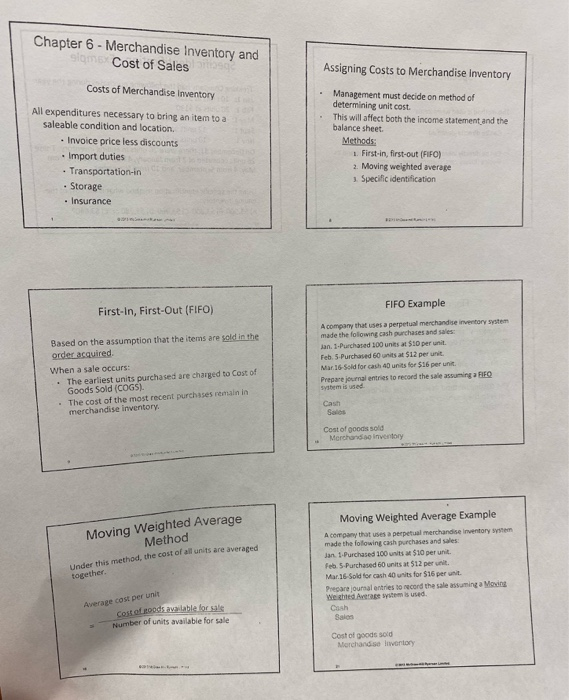

Chapter 6 - Merchandise Inventory and Cost of Sales Assigning Costs to Merchandise Inventory Costs of Merchandise Inventory All expenditures necessary to bring an item to a saleable condition and location. Invoice price less discounts Import duties Transportation in Storage Insurance Management must decide on method of determining unit cost. This will affect both the income statement and the balance sheet Methods: 1. First-in, first-out (FIFO) 2. Moving weighted average 3. Specific identification FIFO Example First-In, First-Out (FIFO) Based on the assumption that the items are sold in the order acquired When a sale occurs: The earliest units purchased are charged to Cost of Goods Sold (COGS). The cost of the most recent purchases remain in merchandise inventory. A company that uses a perpetual merchandise inventory system made the following cash purchases and sales: jan. 1.Purchased 100 units at $10 per unit. Feb. 5.Purchased 60 units at $12 per unit. Mar 16-Solid for cash 40 units for $16 per unit. Prepare journal entries to record the sale assuming a FIFO Cash Cost of goods sold Merchand inventory Moving Weighted Average Method Under this method, the cost of all units are averaged together. Moving Weighted Average Example A company that uses a perpetual merchandise Inventory we made the following cash purchases and sales: Jan 1Purchased 100 units $10 per unit. Feb 5 Purchased 60 units at $12 per unit. Mar 16-Sold for cash 40 units for $16 per unit Precare lumaltres oncord the sale asuming a Moving We hted Average system is used. Cash Sales Average cost per unit cost of roodsalable for sale Number of units available for sale Cost of goods sold Merchandisolwentory Chapter 6 - Merchandise Inventory and Cost of Sales Assigning Costs to Merchandise Inventory Costs of Merchandise Inventory All expenditures necessary to bring an item to a saleable condition and location. Invoice price less discounts Import duties Transportation in Storage Insurance Management must decide on method of determining unit cost. This will affect both the income statement and the balance sheet Methods: 1. First-in, first-out (FIFO) 2. Moving weighted average 3. Specific identification FIFO Example First-In, First-Out (FIFO) Based on the assumption that the items are sold in the order acquired When a sale occurs: The earliest units purchased are charged to Cost of Goods Sold (COGS). The cost of the most recent purchases remain in merchandise inventory. A company that uses a perpetual merchandise inventory system made the following cash purchases and sales: jan. 1.Purchased 100 units at $10 per unit. Feb. 5.Purchased 60 units at $12 per unit. Mar 16-Solid for cash 40 units for $16 per unit. Prepare journal entries to record the sale assuming a FIFO Cash Cost of goods sold Merchand inventory Moving Weighted Average Method Under this method, the cost of all units are averaged together. Moving Weighted Average Example A company that uses a perpetual merchandise Inventory we made the following cash purchases and sales: Jan 1Purchased 100 units $10 per unit. Feb 5 Purchased 60 units at $12 per unit. Mar 16-Sold for cash 40 units for $16 per unit Precare lumaltres oncord the sale asuming a Moving We hted Average system is used. Cash Sales Average cost per unit cost of roodsalable for sale Number of units available for sale Cost of goods sold Merchandisolwentory