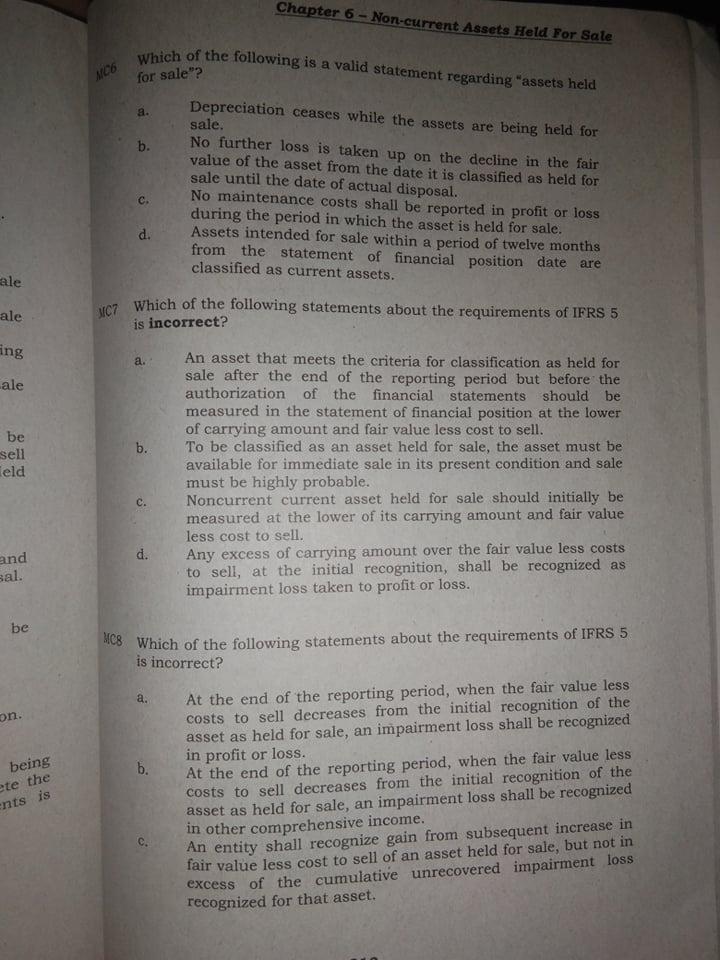

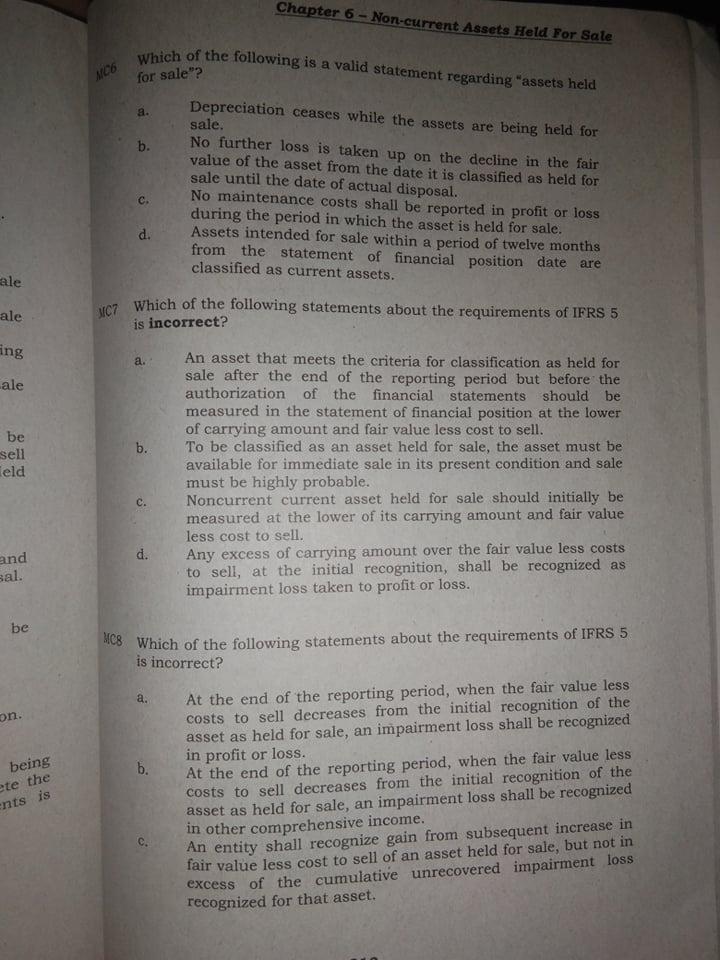

Chapter 6 - Non-current Assets Held For Sale which of the following is a valid statement regarding "assets held MICO for sale"? a. b. Depreciation ceases while the assets are being held for sale. No further loss is taken up on the decline in the fair value of the asset from the date it is classified as held for sale until the date of actual disposal. No maintenance costs shall be reported in profit or loss during the period in which the asset is held for sale. Assets intended for sale within a period of twelve months from the statement of financial position date are classified as current assets. C. d. ale ale MC7 Which of the following statements about the requirements of IFRS 5 is incorrect? ing a. ale b. be sell Teld An asset that meets the criteria for classification as held for sale after the end of the reporting period but before the authorization of the financial statements should be measured in the statement of financial position at the lower of carrying amount and fair value less cost to sell. To be classified as an asset held for sale, the asset must be available for immediate sale in its present condition and sale must be highly probable. Noncurrent current asset held for sale should initially be measured at the lower of its carrying amount and fair value less cost to sell. Any excess of carrying amount over the fair value less costs to sell, at the initial recognition, shall be recognized as impairment loss taken to profit or loss. C. and d. sal. be MCS Which of the following statements about the requirements of IFRS 5 is incorrect? a. on. being b. ete the ents is At the end of the reporting period, when the fair value less costs to sell decreases from the initial recognition of the asset as held for sale, an impairment loss shall be recognized in profit or loss. At the end of the reporting period, when the fair value less costs to sell decreases from the initial recognition of the asset as held for sale, an impairment loss shall be recognized in other comprehensive income. An entity shall recognize gain from subsequent increase in fair value less cost to sell of an asset held for sale, but not in excess of the cumulative unrecovered impairment loss recognized for that asset. c