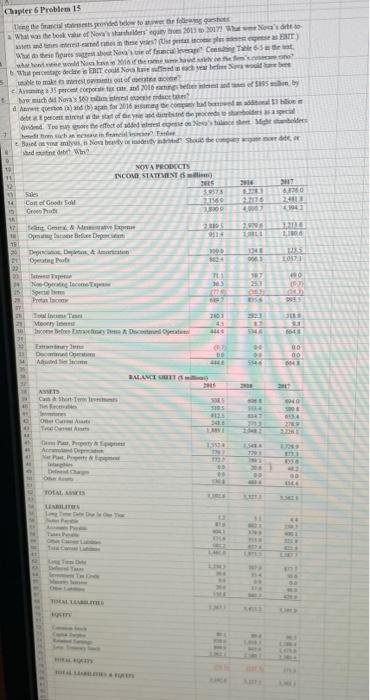

Chapter 6 Problem 15 Using the financial statssents provided below to answer the following users What was the book value of Nowa's sharshalders' equity troms 2013 to 2017? What assets and its enterest-earned rates in these yees? (Ust gestat income ples What do these figures suggest about Nova's fsacul leverage Consing Table + R Nora's deteto epse as EBIT) rat what hond nine would Novs have in 2016 if the came Laskly What percentage decline in EBIT could No have suffined in each year before Sea would unable to make a be nest otse tof operate ace of $895 mon by Avning a 35 percent corporate tax rate and 2016 rangs beter med a how much did Nova's 500 lm interest se dice tan d Anant question (x) and (b) again for 2016 assuming the company had bed an additional be debeat percent minest at the start of the yne and durisited the peoceeds to stuboldes special 32 43 14 15 16 37 18 20 21 vided You may ore the effect of added interest expesse on Neva's fulance shet Might shanbolders heselt hom such an nessa in financid der Based on yn analysis Nova bravity o modesty indred Shout the compagner d shnd mutine debt Why? Sales Cast of Good Foll Gros Prod Seng Gm & Mesave Expe Opmang bacane Bele Depection Depectos Depo & Amaraton Operating Poots 40 0 Exp Non-Operating Tecoma Spect 45 Emandney Jun Dected Operat And com Total Income Tans Moorry In Income Bebe Extraedry A Decostun Ojerat ASSETS Cas & Short-Term Other Can Arts Telts Papety & Pa, P&F langes Defend Charge TOTAL ASSIS LIABILITIES Ting! One Care Long T INCOME STATEMENT T NOVA PRODUCTS Del Tr TIRAL LEABILIT Agen BALANCE SET HOLALLIARDS & FOOT 2015 5.9575 21569 3809 2.0005 9114 3000 1024 711 30.3 (77.5 NG? 2003 45 4465 07 DD ANLE 2015 YORE $195 412.5 348.8 13504 INT 1722 ** 19 THE LIBLA 13 416 3758 LANCE N ME THE THIRR 2014 6.283 27116 4007 2006 LIBLE 1348 006 3 107 253 DISS 5146 2008 00 #F FER4 8147 3713 1541 7293 308 # 460 4 41 XN9 BA MU 2017 6,375.0 24813 43943 3.2014 1,300,6 1385 10573 400 C Lach 9955 JILE 11 6648 00 00 HE 1940 500 0134 278.M 2228 UN9 1133 103.4 44.2 00 4544 44 400 311.9 KT17 55 UNG Chapter 6 Problem 15 Using the financial statssents provided below to answer the following users What was the book value of Nowa's sharshalders' equity troms 2013 to 2017? What assets and its enterest-earned rates in these yees? (Ust gestat income ples What do these figures suggest about Nova's fsacul leverage Consing Table + R Nora's deteto epse as EBIT) rat what hond nine would Novs have in 2016 if the came Laskly What percentage decline in EBIT could No have suffined in each year before Sea would unable to make a be nest otse tof operate ace of $895 mon by Avning a 35 percent corporate tax rate and 2016 rangs beter med a how much did Nova's 500 lm interest se dice tan d Anant question (x) and (b) again for 2016 assuming the company had bed an additional be debeat percent minest at the start of the yne and durisited the peoceeds to stuboldes special 32 43 14 15 16 37 18 20 21 vided You may ore the effect of added interest expesse on Neva's fulance shet Might shanbolders heselt hom such an nessa in financid der Based on yn analysis Nova bravity o modesty indred Shout the compagner d shnd mutine debt Why? Sales Cast of Good Foll Gros Prod Seng Gm & Mesave Expe Opmang bacane Bele Depection Depectos Depo & Amaraton Operating Poots 40 0 Exp Non-Operating Tecoma Spect 45 Emandney Jun Dected Operat And com Total Income Tans Moorry In Income Bebe Extraedry A Decostun Ojerat ASSETS Cas & Short-Term Other Can Arts Telts Papety & Pa, P&F langes Defend Charge TOTAL ASSIS LIABILITIES Ting! One Care Long T INCOME STATEMENT T NOVA PRODUCTS Del Tr TIRAL LEABILIT Agen BALANCE SET HOLALLIARDS & FOOT 2015 5.9575 21569 3809 2.0005 9114 3000 1024 711 30.3 (77.5 NG? 2003 45 4465 07 DD ANLE 2015 YORE $195 412.5 348.8 13504 INT 1722 ** 19 THE LIBLA 13 416 3758 LANCE N ME THE THIRR 2014 6.283 27116 4007 2006 LIBLE 1348 006 3 107 253 DISS 5146 2008 00 #F FER4 8147 3713 1541 7293 308 # 460 4 41 XN9 BA MU 2017 6,375.0 24813 43943 3.2014 1,300,6 1385 10573 400 C Lach 9955 JILE 11 6648 00 00 HE 1940 500 0134 278.M 2228 UN9 1133 103.4 44.2 00 4544 44 400 311.9 KT17 55 UNG