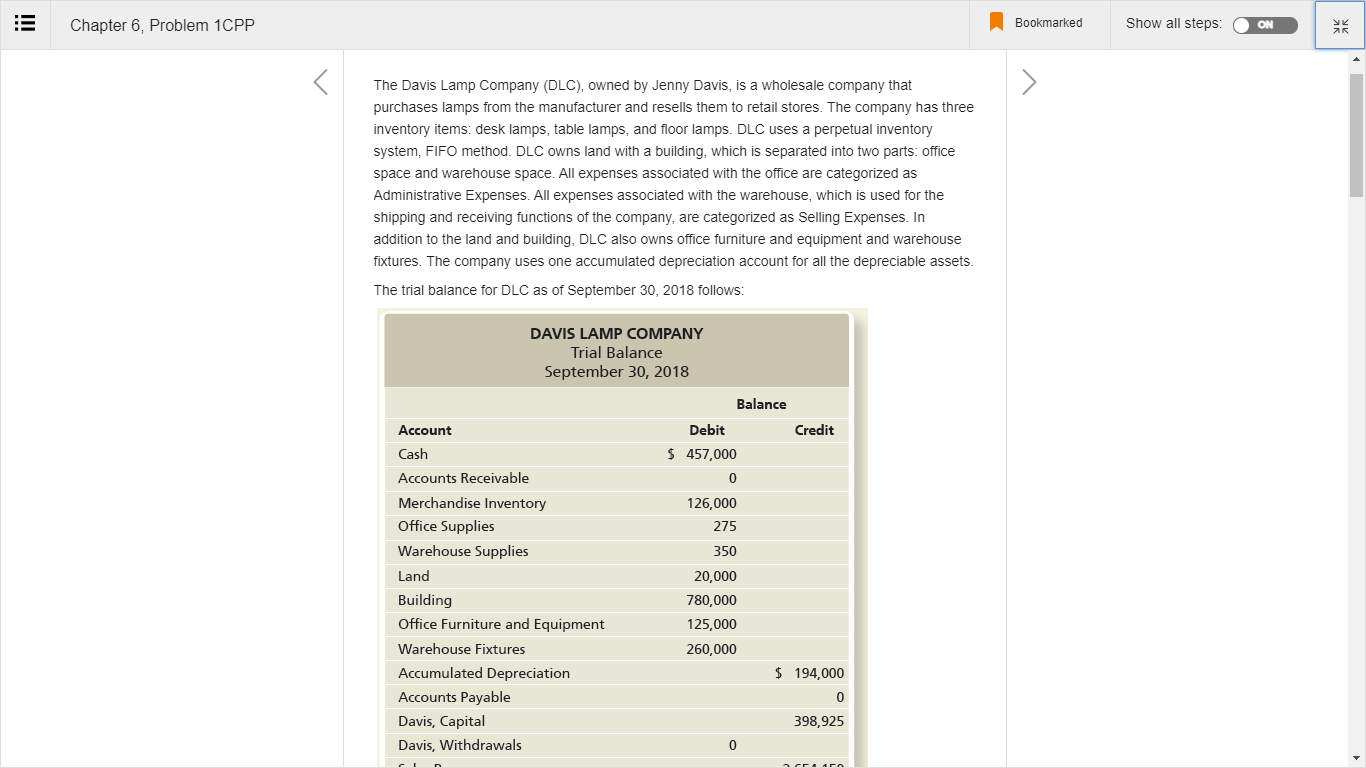

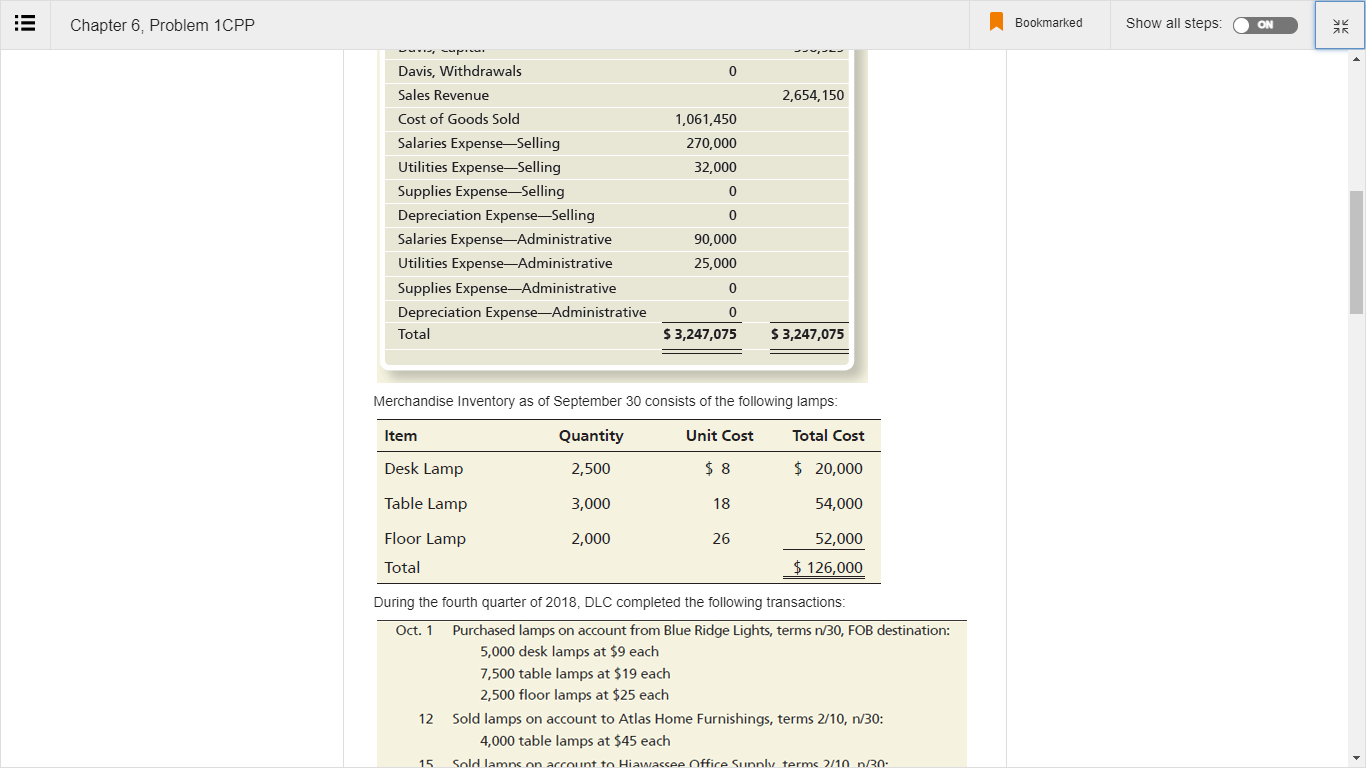

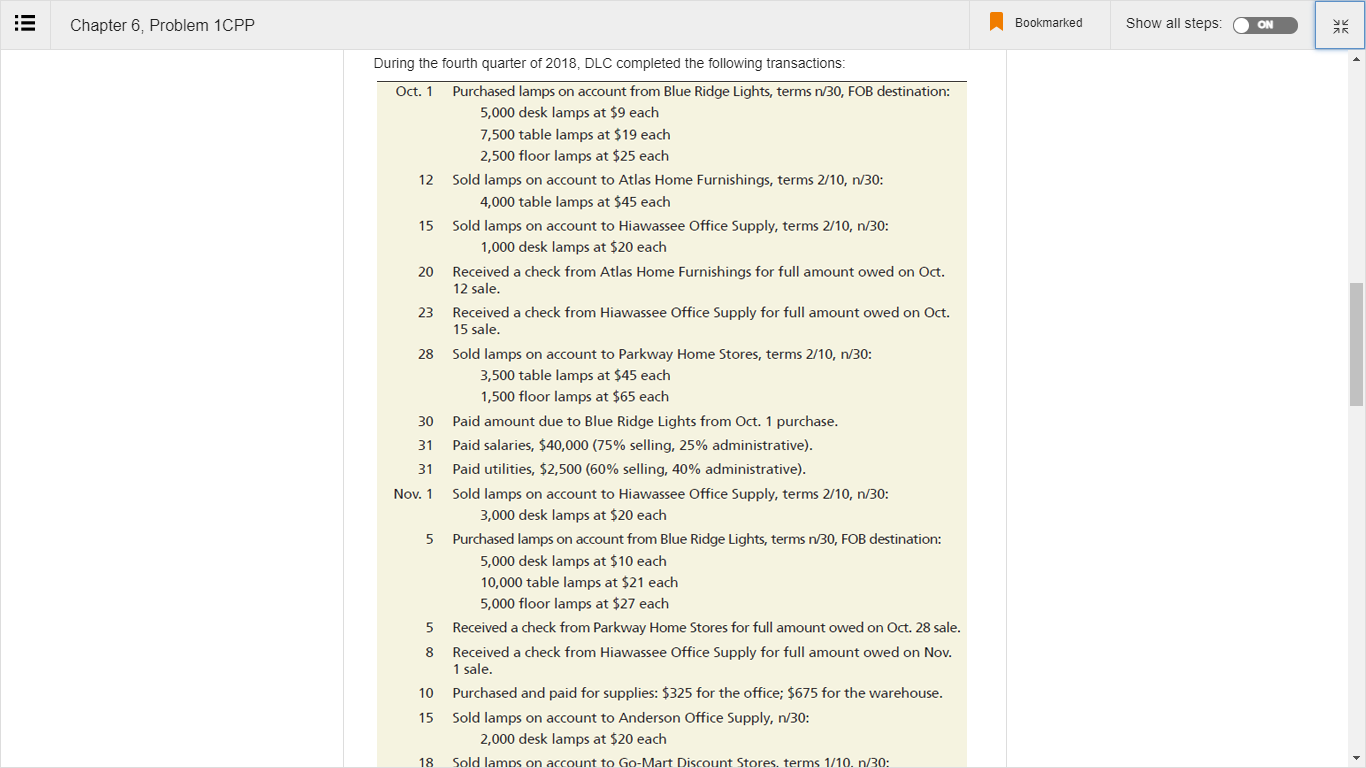

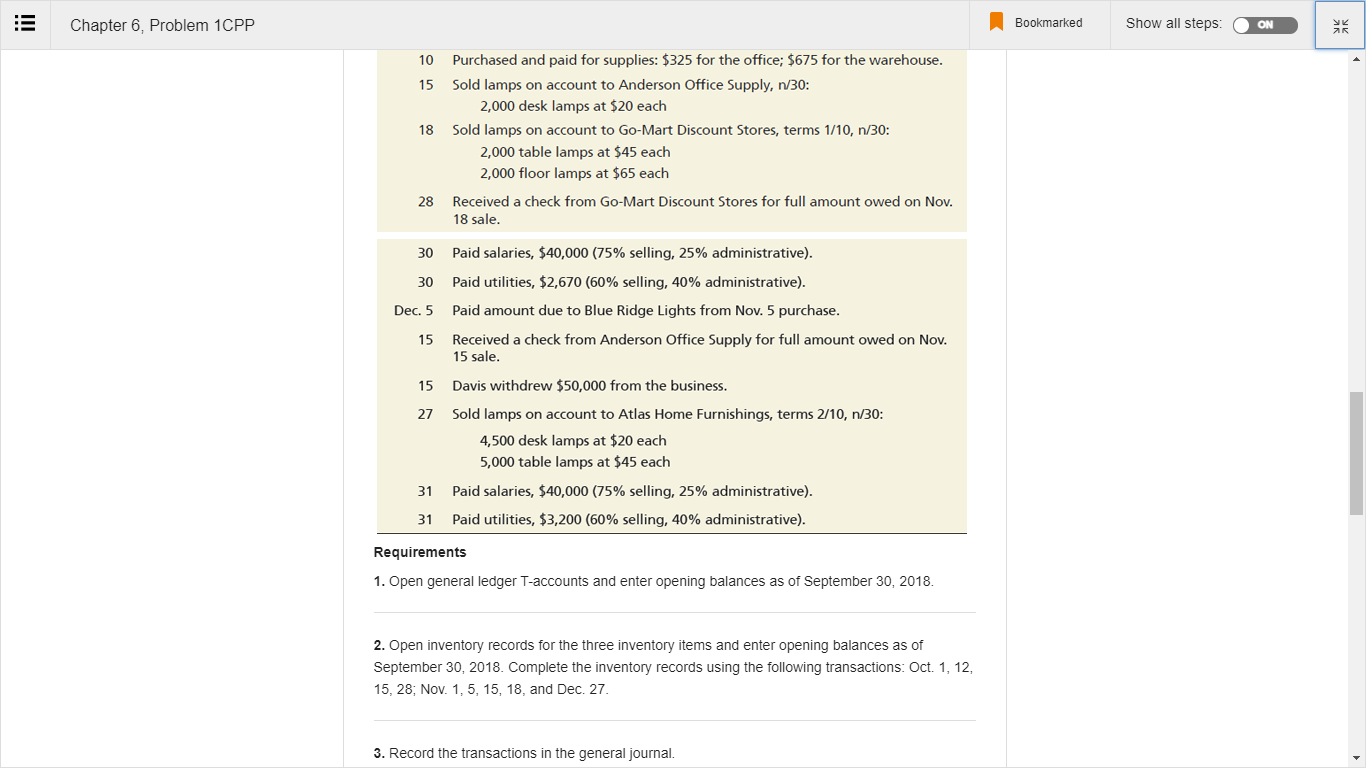

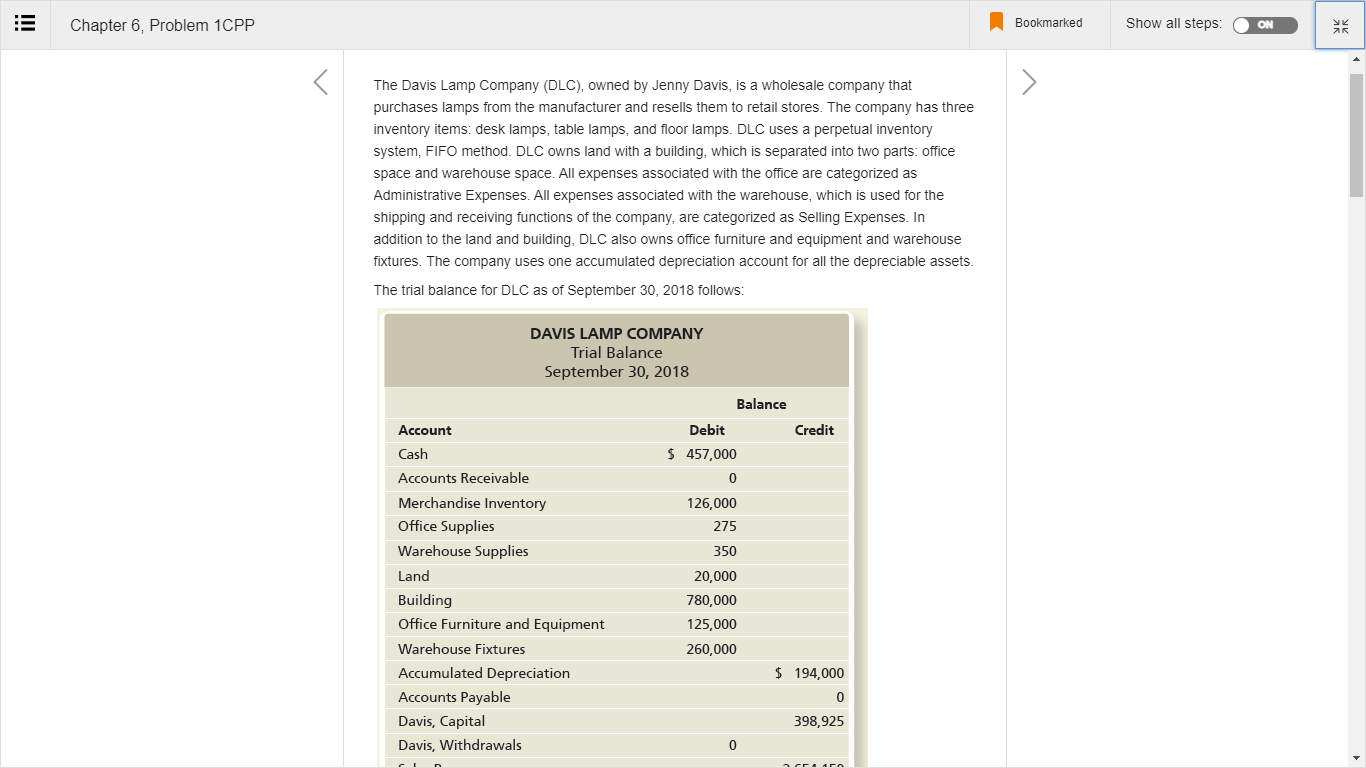

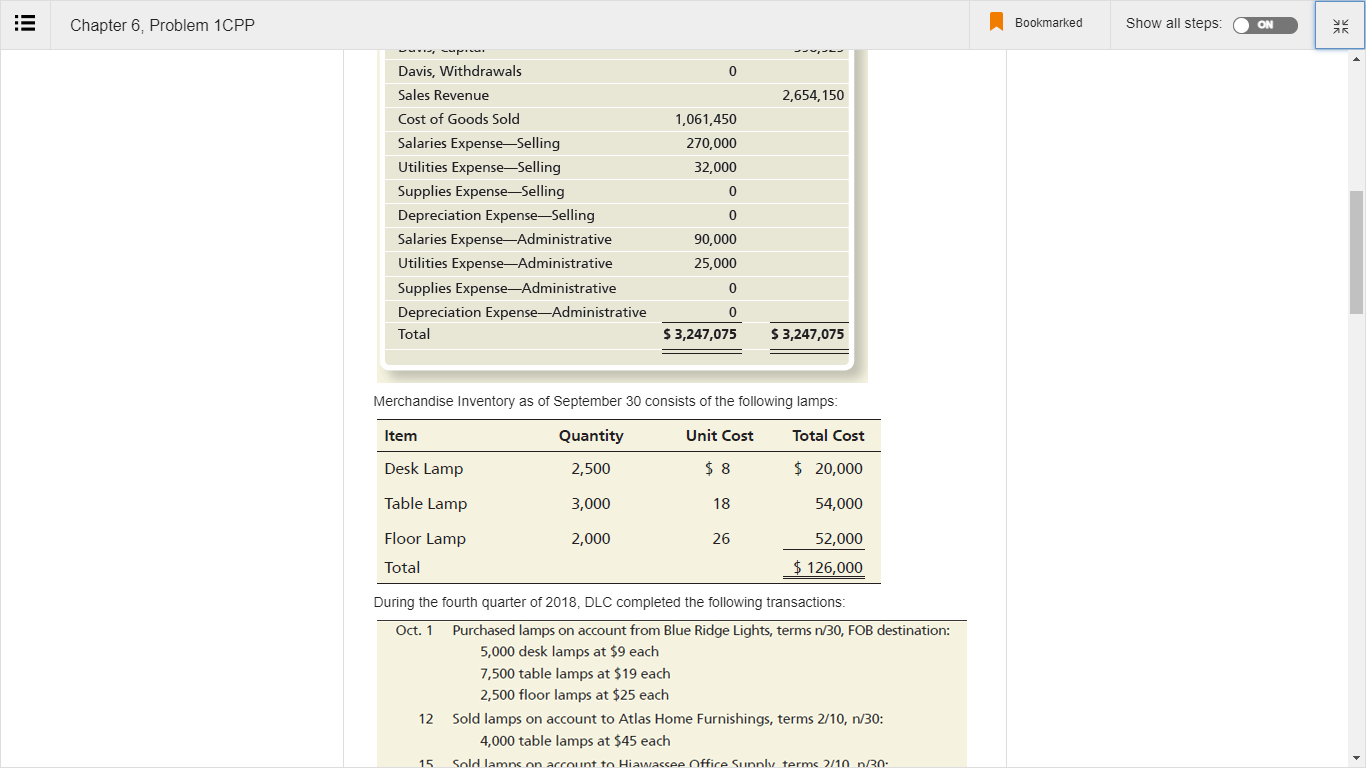

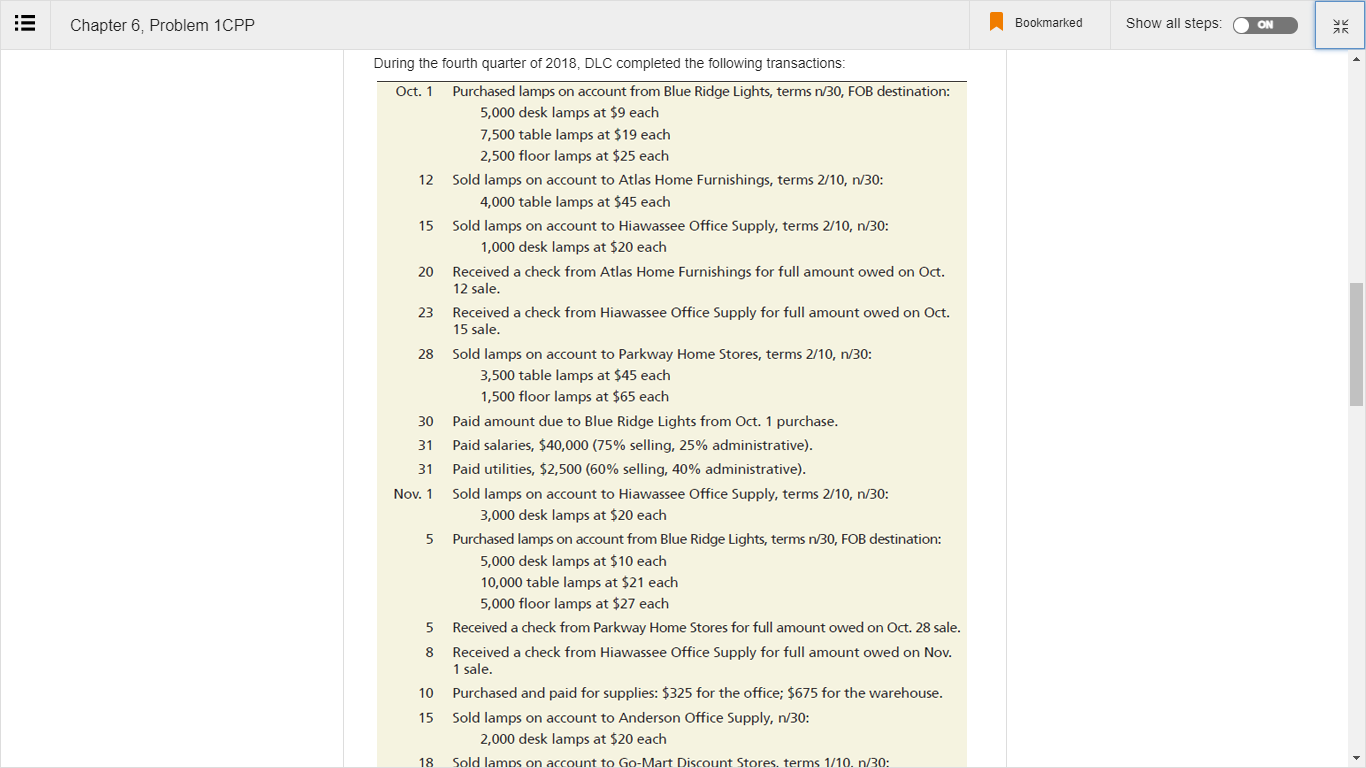

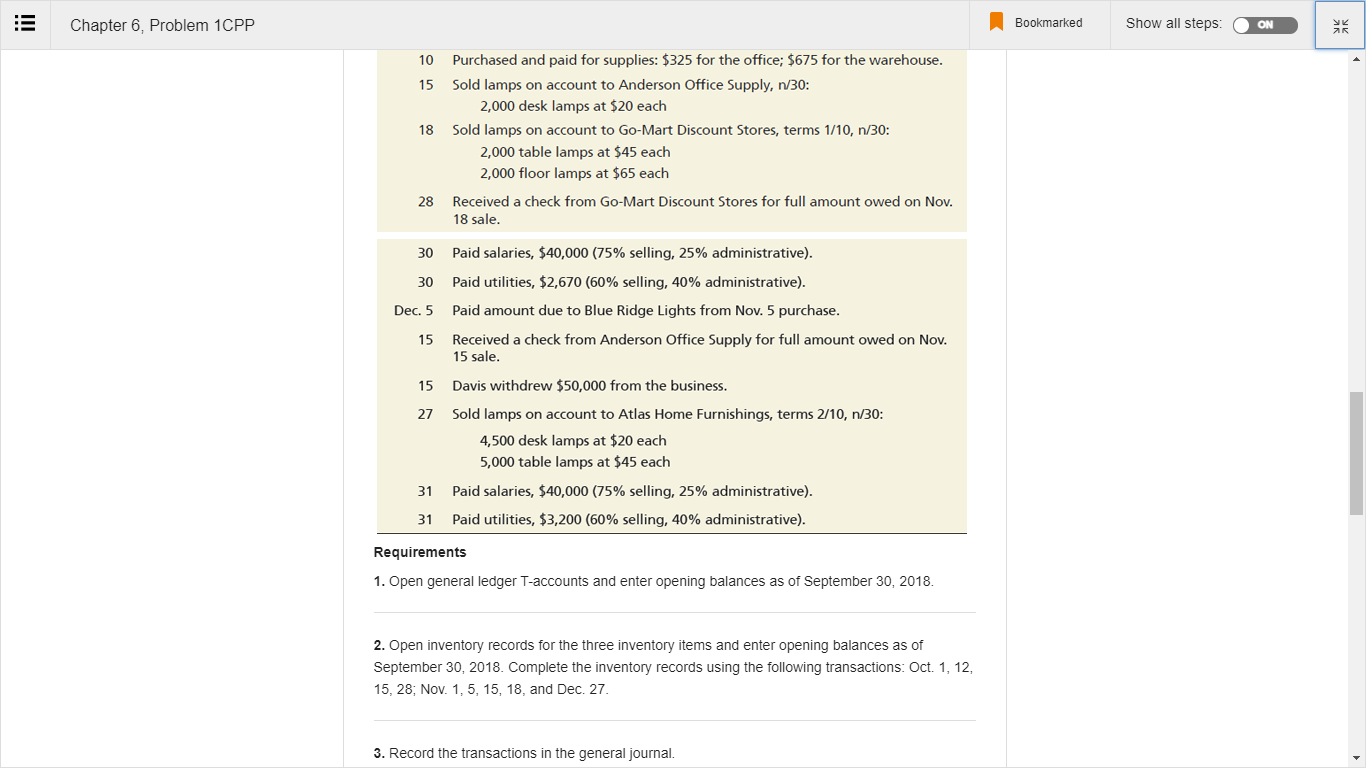

Chapter 6, Problem 1CPP Bookmarked Show all steps: ON ak The Davis Lamp Company (DLC), owned by Jenny Davis, is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. DLC uses a perpetual inventory system, FIFO method. DLC owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, DLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. The trial balance for DLC as of September 30, 2018 follows: DAVIS LAMP COMPANY Trial Balance September 30, 2018 Balance Debit Credit Account Cash $ 457,000 0 126,000 275 350 Accounts Receivable Merchandise Inventory Office Supplies Warehouse Supplies Land Building Office Furniture and Equipment Warehouse Fixtures Accumulated Depreciation Accounts Payable Davis, Capital Davis, Withdrawals 20,000 780,000 125,000 260,000 $ 194,000 0 398,925 0 Chapter 6, Problem 1CPP Bookmarked Show all steps: ON ak The Davis Lamp Company (DLC), owned by Jenny Davis, is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. DLC uses a perpetual inventory system, FIFO method. DLC owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, DLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. The trial balance for DLC as of September 30, 2018 follows: DAVIS LAMP COMPANY Trial Balance September 30, 2018 Balance Debit Credit Account Cash $ 457,000 0 126,000 275 350 Accounts Receivable Merchandise Inventory Office Supplies Warehouse Supplies Land Building Office Furniture and Equipment Warehouse Fixtures Accumulated Depreciation Accounts Payable Davis, Capital Davis, Withdrawals 20,000 780,000 125,000 260,000 $ 194,000 0 398,925 0