Answered step by step

Verified Expert Solution

Question

1 Approved Answer

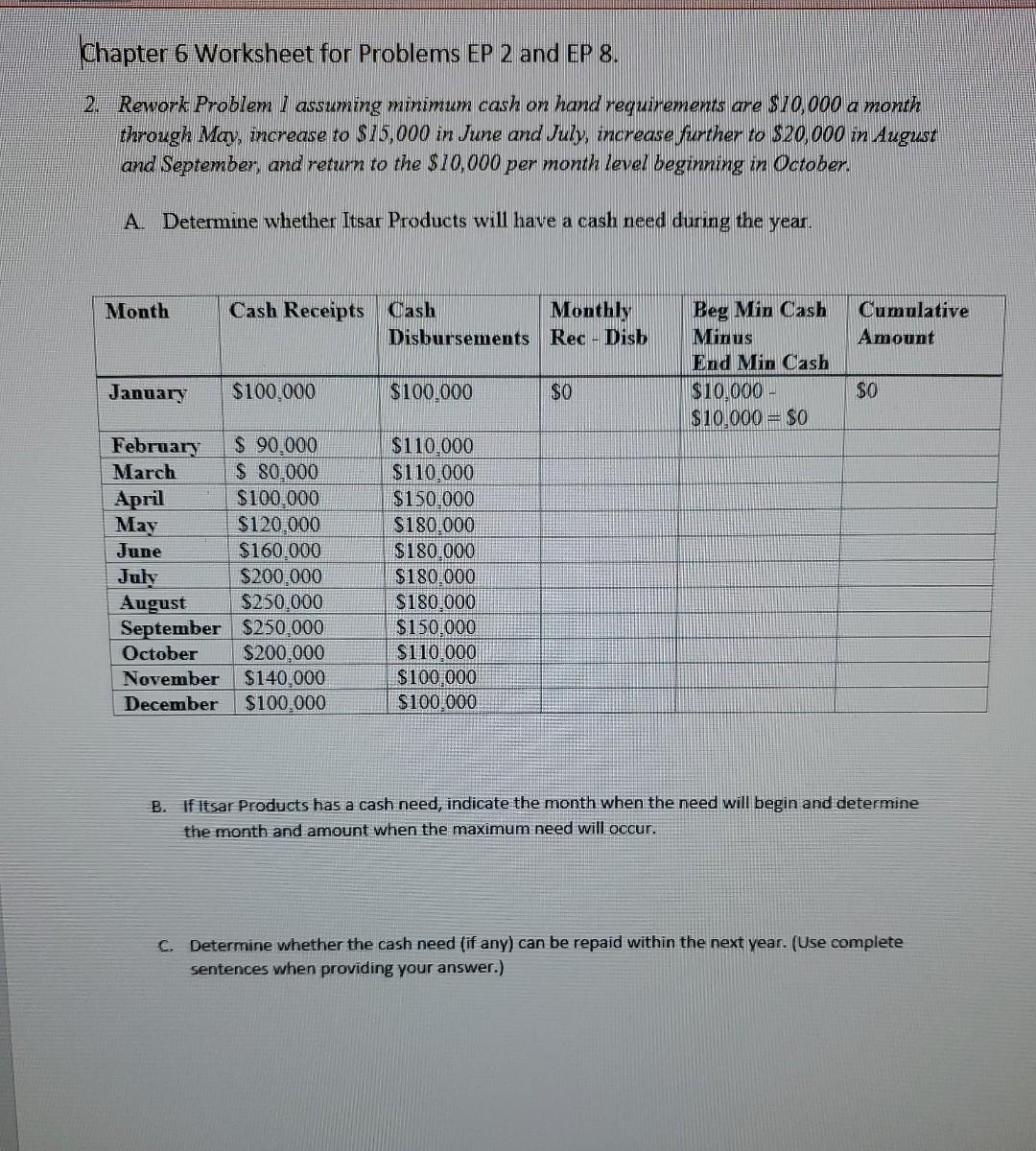

Chapter 6 Worksheet for Problems EP 2 and EP 8. 2. Rework Problem 1 assuming minimum cash on hand requirements are $10,000 a month through

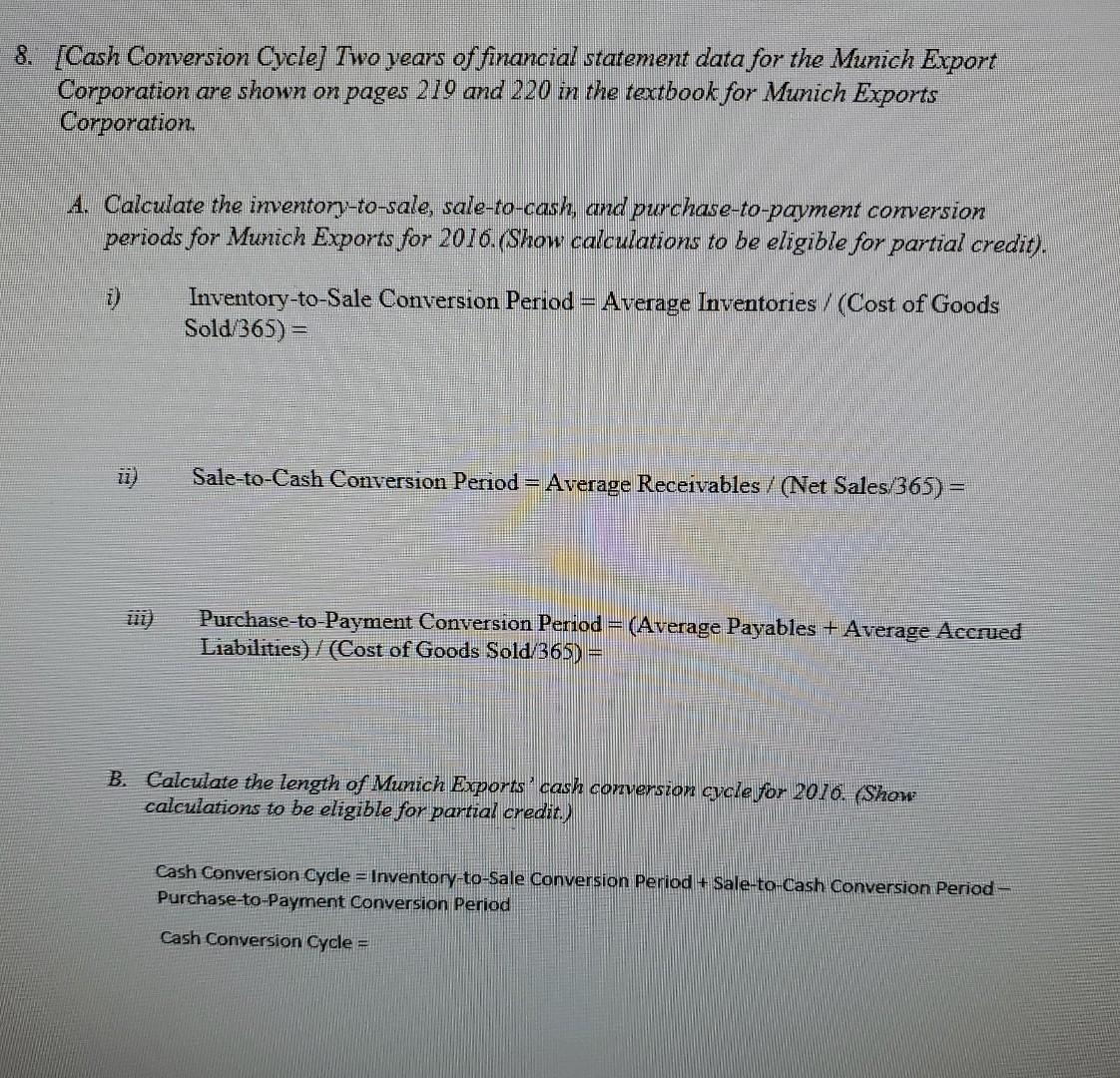

Chapter 6 Worksheet for Problems EP 2 and EP 8. 2. Rework Problem 1 assuming minimum cash on hand requirements are $10,000 a month through May, increase to $15,000 in June and July, increase further to $20,000 in August and September, and return to the $10,000 per month level beginning in October. A. Determine whether Itsar Products will have a cash need during the year. B. If Itsar Products has a cash need, indicate the month when the need will begin and determine the month and amount when the maximum need will occur. C. Determine whether the cash need (if any) can be repaid within the next year. (Use complete sentences when providing your answer.) [Cash Conversion Cycle] Two years of financial statement data for the Munich Export Corporation are shown on pages 219 and 220 in the textbook for Munich Exports Corporation. A. Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for Munich Exports for 2016. (Show calculations to be eligible for partial credit). i) Inventory-to-Sale Conversion Period = Average Inventories / (Cost of Goods Sold 365)= ii) Sale-to-Cash Conversion Period = Average Receivables /( Net Sales /365)= iii) Purchase-to-Payment Conversion Period = (Average Payables + Average Accrued Liabilities )/( Cost of Goods Sold /365)= B. Calculate the length of Munich Exports' cash conversion cyclefor 2016. (Show calculations to be eligible for partial credit.) Cash Conversion Cycle = Inventory to-Sale Conversion Period + Sale-to-Cash Conversion Period Purchase-to-Payment Conversion Period Cash Conversion cycle = *Assignments/Quizzes Content After reading the chapter, work either Exercises/Problems (EP) \#2 A, B \& C or \#8 A \& B, located on pages 217-220 of your textbook. If you choose to work both exercises, mark the one you want counted for Extra Credit. You can earn up to 10 bonus points ( 10=100% on the problem), to be added to your lowest homework grade from Chapters 1 through 5. But ... you must show your work to be eligible for partial credit. EP2. (Short-Term Financial Planning) Rework Problem 1 assuming minimum cash-on-hand requirements are $10,000 a month ... read the entire problem on page 218. Use the attached Worksheet to complete this problem. ...OR... EP8. (Cash Conversion Cycle) Two years of financial statement data for the Munich Export Corporation are shown below ... read the entire problem on pages 219 and 220. Show the calculations for your work requested by A and B. Use the attached Worksheet to complete this problem. Your answers should be typed into the attached Worksheet showing calculations and using complete sentences where appropriate. Submit your completed assignment to this drop box by the due date listed in the course schedule. Chapter 6 Worksheet for Problems EP 2 and EP 8. 2. Rework Problem 1 assuming minimum cash on hand requirements are $10,000 a month through May, increase to $15,000 in June and July, increase further to $20,000 in August and September, and return to the $10,000 per month level beginning in October. A. Determine whether Itsar Products will have a cash need during the year. B. If Itsar Products has a cash need, indicate the month when the need will begin and determine the month and amount when the maximum need will occur. C. Determine whether the cash need (if any) can be repaid within the next year. (Use complete sentences when providing your answer.) [Cash Conversion Cycle] Two years of financial statement data for the Munich Export Corporation are shown on pages 219 and 220 in the textbook for Munich Exports Corporation. A. Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for Munich Exports for 2016. (Show calculations to be eligible for partial credit). i) Inventory-to-Sale Conversion Period = Average Inventories / (Cost of Goods Sold 365)= ii) Sale-to-Cash Conversion Period = Average Receivables /( Net Sales /365)= iii) Purchase-to-Payment Conversion Period = (Average Payables + Average Accrued Liabilities )/( Cost of Goods Sold /365)= B. Calculate the length of Munich Exports' cash conversion cyclefor 2016. (Show calculations to be eligible for partial credit.) Cash Conversion Cycle = Inventory to-Sale Conversion Period + Sale-to-Cash Conversion Period Purchase-to-Payment Conversion Period Cash Conversion cycle = *Assignments/Quizzes Content After reading the chapter, work either Exercises/Problems (EP) \#2 A, B \& C or \#8 A \& B, located on pages 217-220 of your textbook. If you choose to work both exercises, mark the one you want counted for Extra Credit. You can earn up to 10 bonus points ( 10=100% on the problem), to be added to your lowest homework grade from Chapters 1 through 5. But ... you must show your work to be eligible for partial credit. EP2. (Short-Term Financial Planning) Rework Problem 1 assuming minimum cash-on-hand requirements are $10,000 a month ... read the entire problem on page 218. Use the attached Worksheet to complete this problem. ...OR... EP8. (Cash Conversion Cycle) Two years of financial statement data for the Munich Export Corporation are shown below ... read the entire problem on pages 219 and 220. Show the calculations for your work requested by A and B. Use the attached Worksheet to complete this problem. Your answers should be typed into the attached Worksheet showing calculations and using complete sentences where appropriate. Submit your completed assignment to this drop box by the due date listed in the course schedule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started