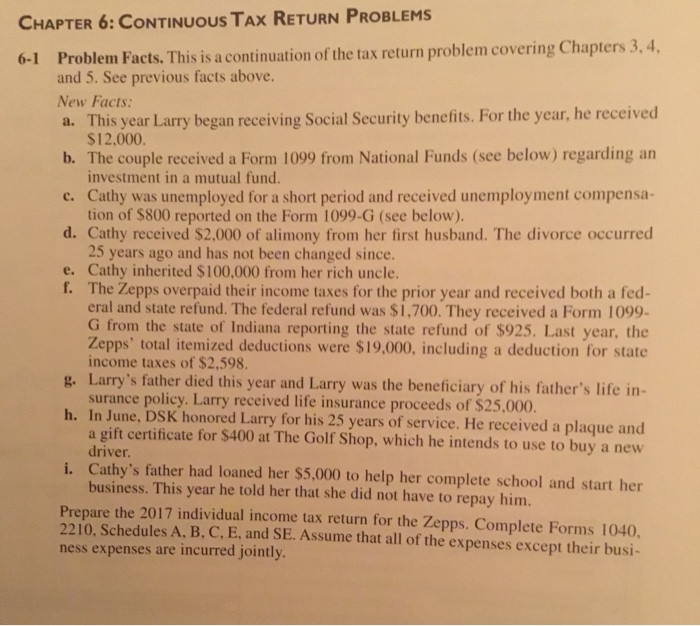

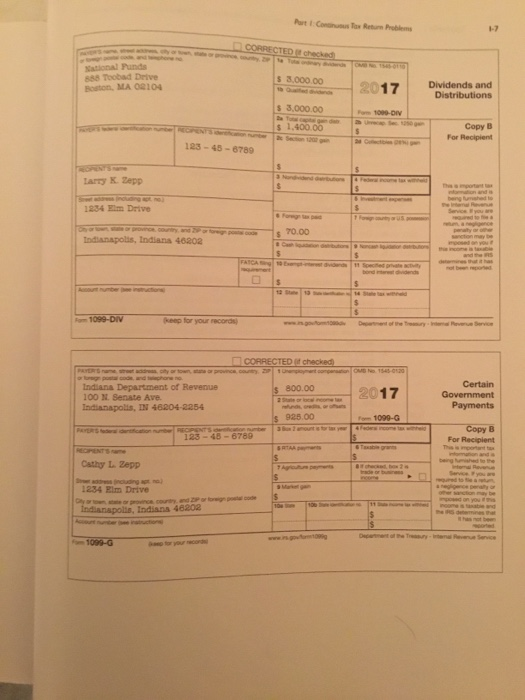

CHAPTER 6:CONTINUOUS TAX RETURN PROBLEMS 6-1 Problem Facts. This is a continuation of the tax return problem covering Chapters 3,4 and 5. See previous facts above. New Facts: a. This year Larry began receiving Social Security benefits. For the year, e received b. The couple received a Form 1099 from National Funds (see below) regarding an c. Cathy was unemployed for a short period and received unemployment compensa- d. Cathy received $2,000 of alimony from her first husband. The divorce occurred $12,000 investment in a mutual fund. tion of $800 reported on the Form 1099-G (see below) 25 years ago and has not been changed since. Cathy inherited $100,000 from her rich uncle. The Zepps overpaid their income taxes for the prior year and received both a fed- eral and state refund. The federal refund was $1,700. They received a Form 1099- G from the state of Indiana reporting the state refund of $925. Last year, the Zepps' total itemized deductions were S19,000, including a deduction for state income taxes of $2,598. e. f. 9 g. Larry's father died this year and Larry was the beneficiary of his father's life in surance policy. Larry received life insurance proceeds of $25,000 h. In June, DSK honored Larry i. Cathy's father had loaned her $5,000 to help her complete school and start her Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040 or his 25 years of service. He received a plaque and a gift certificate for $400 at The Golf Shop, which he intends to use to buy a new driver business. This year he told her that she did not have to repay him. 2210. Schedules A. B, C, E, and SE. Assume that all of the expenses except their busi- ness expenses are incurred jointly 888 Toobad Drive Boston, MA 02104 3,000.00 Dividends and s 3,000.00 s 1.400.00 Copy B 123- 45-8789 arry K. Zepp 1234 Elm Drive Indianapols, Indiana 46202 Indiana Department of Revenue 100 N Senate Ave 800.00 17 925.00 1099-G 123- 48-6789 For Recipient Cathy L. 2epp 234 Elm Drive CHAPTER 6:CONTINUOUS TAX RETURN PROBLEMS 6-1 Problem Facts. This is a continuation of the tax return problem covering Chapters 3,4 and 5. See previous facts above. New Facts: a. This year Larry began receiving Social Security benefits. For the year, e received b. The couple received a Form 1099 from National Funds (see below) regarding an c. Cathy was unemployed for a short period and received unemployment compensa- d. Cathy received $2,000 of alimony from her first husband. The divorce occurred $12,000 investment in a mutual fund. tion of $800 reported on the Form 1099-G (see below) 25 years ago and has not been changed since. Cathy inherited $100,000 from her rich uncle. The Zepps overpaid their income taxes for the prior year and received both a fed- eral and state refund. The federal refund was $1,700. They received a Form 1099- G from the state of Indiana reporting the state refund of $925. Last year, the Zepps' total itemized deductions were S19,000, including a deduction for state income taxes of $2,598. e. f. 9 g. Larry's father died this year and Larry was the beneficiary of his father's life in surance policy. Larry received life insurance proceeds of $25,000 h. In June, DSK honored Larry i. Cathy's father had loaned her $5,000 to help her complete school and start her Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040 or his 25 years of service. He received a plaque and a gift certificate for $400 at The Golf Shop, which he intends to use to buy a new driver business. This year he told her that she did not have to repay him. 2210. Schedules A. B, C, E, and SE. Assume that all of the expenses except their busi- ness expenses are incurred jointly 888 Toobad Drive Boston, MA 02104 3,000.00 Dividends and s 3,000.00 s 1.400.00 Copy B 123- 45-8789 arry K. Zepp 1234 Elm Drive Indianapols, Indiana 46202 Indiana Department of Revenue 100 N Senate Ave 800.00 17 925.00 1099-G 123- 48-6789 For Recipient Cathy L. 2epp 234 Elm Drive