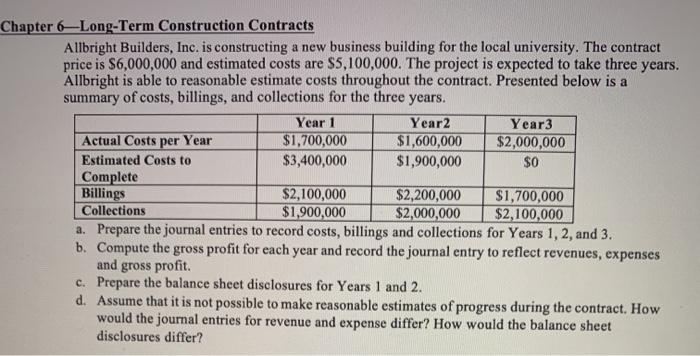

Chapter 6-Long-Term Construction Contracts Allbright Builders, Inc. is constructing a new business building for the local university. The contract price is $6,000,000 and estimated costs are $5,100,000. The project is expected to take three years. Allbright is able to reasonable estimate costs throughout the contract. Presented below is a summary of costs, billings, and collections for the three years. Year 1 Year2 Year3 Actual Costs per Year $1,700,000 $1,600,000 $2,000,000 Estimated Costs to $3,400,000 $1,900,000 $0 Complete Billings $2,100,000 $2,200,000 $1,700,000 Collections $1,900,000 $2,000,000 $2,100,000 a. Prepare the journal entries to record costs, billings and collections for Years 1, 2, and 3. b. Compute the gross profit for each year and record the journal entry to reflect revenues, expenses and gross profit. c. Prepare the balance sheet disclosures for Years 1 and 2. d. Assume that it is not possible to make reasonable estimates of progress during the contract. How would the journal entries for revenue and expense differ? How would the balance sheet disclosures differ? Chapter 6-Long-Term Construction Contracts Allbright Builders, Inc. is constructing a new business building for the local university. The contract price is $6,000,000 and estimated costs are $5,100,000. The project is expected to take three years. Allbright is able to reasonable estimate costs throughout the contract. Presented below is a summary of costs, billings, and collections for the three years. Year 1 Year2 Year3 Actual Costs per Year $1,700,000 $1,600,000 $2,000,000 Estimated Costs to $3,400,000 $1,900,000 $0 Complete Billings $2,100,000 $2,200,000 $1,700,000 Collections $1,900,000 $2,000,000 $2,100,000 a. Prepare the journal entries to record costs, billings and collections for Years 1, 2, and 3. b. Compute the gross profit for each year and record the journal entry to reflect revenues, expenses and gross profit. c. Prepare the balance sheet disclosures for Years 1 and 2. d. Assume that it is not possible to make reasonable estimates of progress during the contract. How would the journal entries for revenue and expense differ? How would the balance sheet disclosures differ