Question

Chapter 7 Critical Thinking Case 2 Grant Gets His Outback Grant Tyson, a 27-year-old living in Arlington, Virginia, has been a high-school teacher for five

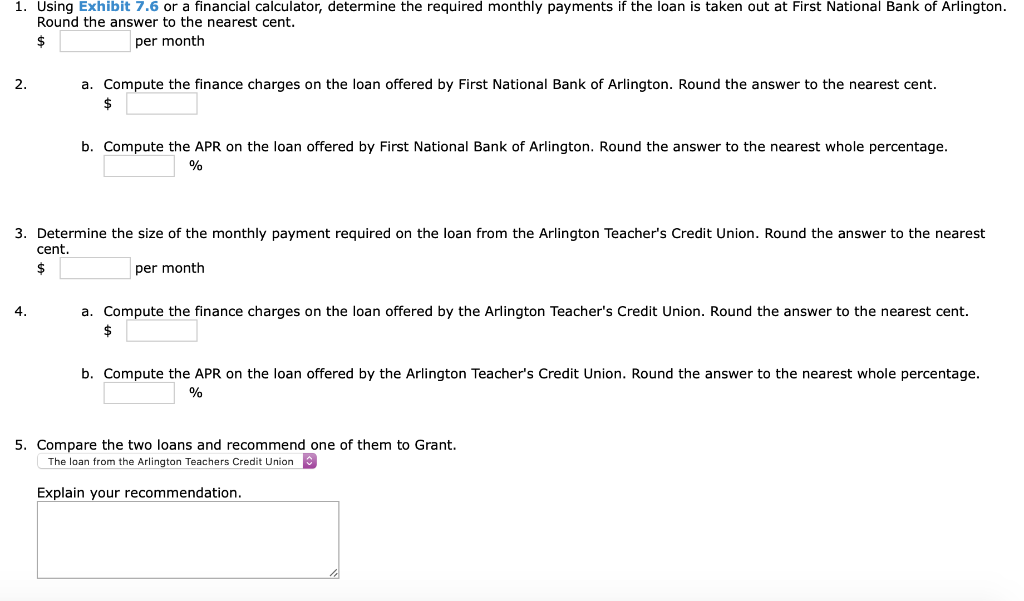

Chapter 7 Critical Thinking Case 2 Grant Gets His Outback Grant Tyson, a 27-year-old living in Arlington, Virginia, has been a high-school teacher for five years. For the past four months, he's been thinking about buying a Subaru Outback, but feels he can't afford a brand-new one. Recently, however, his friend Martin Grubbs has offered to sell Grant his fully loaded Subaru Outback 3.6R. Martin wants $ 26,900 for his Outback, which has been driven only 8,000 miles and is in very good condition. Grant is eager to buy the vehicle but has only $ 10,000 in his savings account at Central Bank. He expects to net $ 8,000 from the sale of his Chevrolet Malibu, but this will still leave him about $ 6,500 short. He has two alternatives for obtaining the money.

Borrow $ 6,500 from the First National Bank of Arlington at a fixed rate of 7 percent per annum, simple interest. The loan would be repaid in equal monthly installments over a three-year (36-month) period. Obtain a $ 6,500 installment loan requiring 36 monthly payments from the Arlington Teacher's Credit Union at a 6.5 percent stated rate of interest. The add-on method would be used to calculate the finance charges on this loan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started