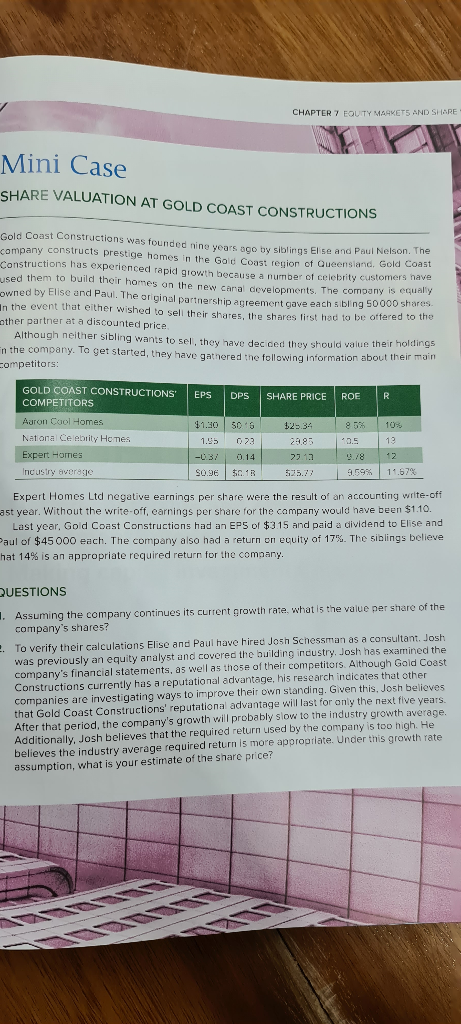

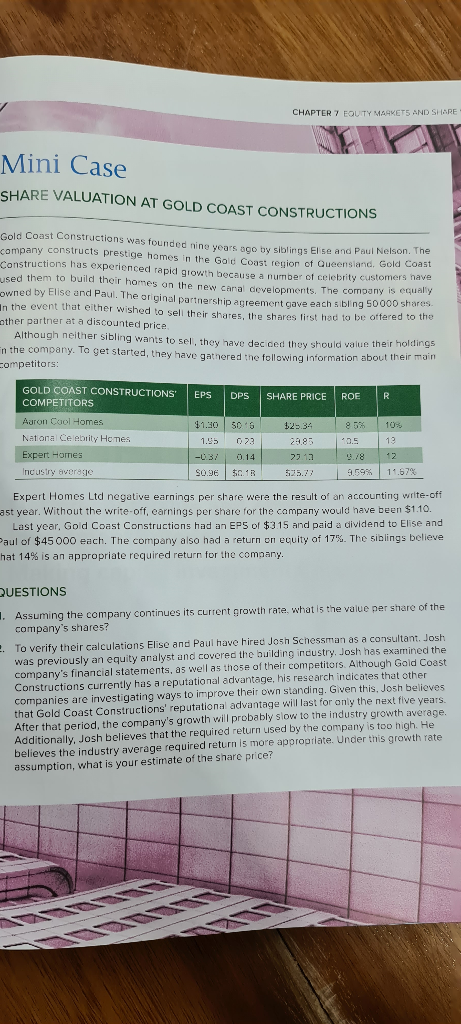

CHAPTER 7 EQUITY MARKETS AND SHARE Mini Case SHARE VALUATION AT GOLD COAST CONSTRUCTIONS Gold Coast Constructions was founded nine years ago by siblings Elsa and Paul Nelson. The company constructs prestige homes in the Gold Coast region of Queensland, Gold Coast Constructions has experienced rapid growth because a number of celebrity customers have used them to build their homes on the new caral developments. The company is equally owned by Else and Paul. The original partnership agreement gave each sibling 50000 shares In the event that either wished to sell their shares, the shares first had to be offered to the other partner at a discounted price. Although neither sibling wants to sel, they have decided they should value their holdings in the company. To get started, they have gathered the following information about their main competitors: 27.17 GOLD COAST CONSTRUCTIONS EPS DPS SHARE PRICE ROE R COMPETITORS Aaron Cool Homes $1.30 SO's $25.34 10% National Celebrity Homes 1.95 19 Expert Homes -0.37 0.14 12 Industry avera So.ge $0.18 9.59% 11.67% Expert Homes Ltd negative earnings per share were the result of an accounting write-off Last year. Without the write-off, earnings per share for the company would have been $1.10. Last year, Gold Coast Constructions had an EPS of $315 and paid a dividend to Elise and Paul of $45 000 each. The company also had a return on equity of 17%. The siblings believe hat 14% is an appropriate required return for the company. QUESTIONS 1. Assuming the company continues its current growth rate, what is the value per share of the company's shares? To verify their calculations Elise and Paul have hired Josh Schessman as a consultant, Josh was previously an equity analyst and covered the building industry, Josh has examined the company's financial statements, as well as those of their competitors. Although Gold Coast Constructions currently has a reputational advantage, his research indicates that other companies are investigating ways to improve their own standing. Given this, Josh believes that Gold Coast Constructions' reputational advantage will last for only the next five years After that period, the company's growth will probably slow to the industry growth average. Additionally, Josh believes that the required return used by the company is too high. He believes the industry average required return is more appropriate. Under this growth rate assumption, what is your estimate of the share price? CHAPTER 7 EQUITY MARKETS AND SHARE Mini Case SHARE VALUATION AT GOLD COAST CONSTRUCTIONS Gold Coast Constructions was founded nine years ago by siblings Elsa and Paul Nelson. The company constructs prestige homes in the Gold Coast region of Queensland, Gold Coast Constructions has experienced rapid growth because a number of celebrity customers have used them to build their homes on the new caral developments. The company is equally owned by Else and Paul. The original partnership agreement gave each sibling 50000 shares In the event that either wished to sell their shares, the shares first had to be offered to the other partner at a discounted price. Although neither sibling wants to sel, they have decided they should value their holdings in the company. To get started, they have gathered the following information about their main competitors: 27.17 GOLD COAST CONSTRUCTIONS EPS DPS SHARE PRICE ROE R COMPETITORS Aaron Cool Homes $1.30 SO's $25.34 10% National Celebrity Homes 1.95 19 Expert Homes -0.37 0.14 12 Industry avera So.ge $0.18 9.59% 11.67% Expert Homes Ltd negative earnings per share were the result of an accounting write-off Last year. Without the write-off, earnings per share for the company would have been $1.10. Last year, Gold Coast Constructions had an EPS of $315 and paid a dividend to Elise and Paul of $45 000 each. The company also had a return on equity of 17%. The siblings believe hat 14% is an appropriate required return for the company. QUESTIONS 1. Assuming the company continues its current growth rate, what is the value per share of the company's shares? To verify their calculations Elise and Paul have hired Josh Schessman as a consultant, Josh was previously an equity analyst and covered the building industry, Josh has examined the company's financial statements, as well as those of their competitors. Although Gold Coast Constructions currently has a reputational advantage, his research indicates that other companies are investigating ways to improve their own standing. Given this, Josh believes that Gold Coast Constructions' reputational advantage will last for only the next five years After that period, the company's growth will probably slow to the industry growth average. Additionally, Josh believes that the required return used by the company is too high. He believes the industry average required return is more appropriate. Under this growth rate assumption, what is your estimate of the share price