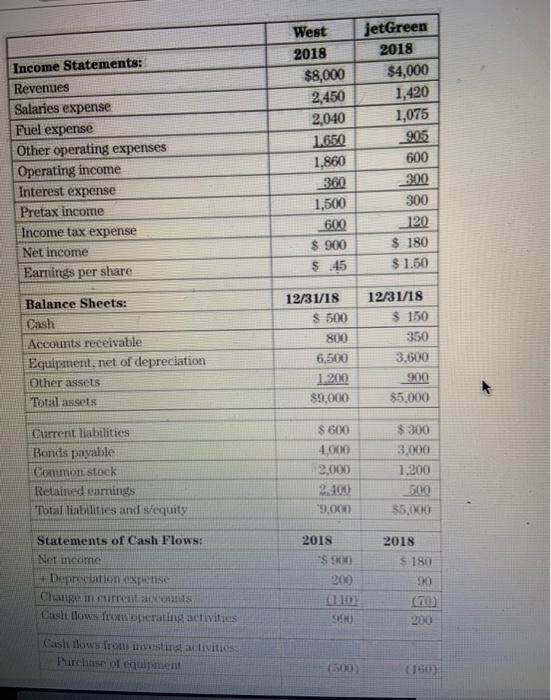

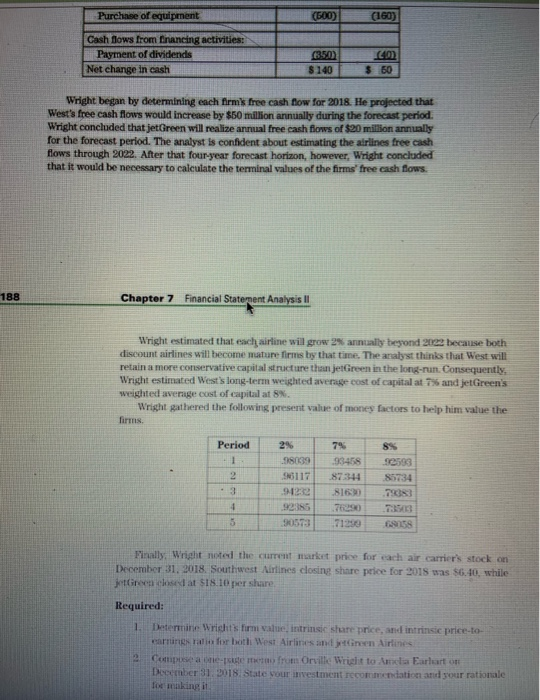

Chapter 7 Financial Statement Analysis II Chapter 7 CASE 7-1 Orville Wright analyzes the airline industry. Investors with an interest in or lending to airlines seek his advice and recommendations. Amelia Earhart, Orville's wealthiest client, asked him to determine which of two airlines offered her the better investment opportu- nity at the end of 2018. Amelia's interest centered on two of the so-called discount airlines. West Airlines was created after the United States deregulated the airline industry. Prior to deregula- Lion, airlines priced tickets on a cost-plus basis. This arrangement allowed carriers to recover all of their costs and earn acceptable profit margins and returns on investment. In this environment older legacy carriers, such as American, Delta, and United, did not have an incentive for containing costs. The air carriers merely passed on those cost to their passengers in the form of ever escalating ticket prices. Mounting pressure from the public spurred Congress to substantially deregulate the passenger airline industry in the late 1970s. Sensing an opportunity to capitalize on airline deregulation, investors formed West Airlines. This post-regulatory start-up's business model focused on containing costs, such as non-unionized labor, and passing the cost savings on to their passengers in the form of lower ticket prices. The strategy proved financially successful as West gained market share from Tegacy carriers and stimulated demand in consumers who previously did Hottier travel. The financial success of West spawned other discount competitors. the most success of which was jetGreen Airlines Anu r ut wanted to purchase stock in either Westor jetGreen. She paid Orville Wright for us alysis and recommendation. Orville begins his assignment by gathering the most recent financial statements for West and eGreen Airlines (amounts in millions arrim sipers Income Statements: Revenues Salaries expense Fuel expense Other operating expenses Operating income Interest expense Pretax income Income tax expense Net income Earnings per share West 2018 $8,000 2,450 2,040 1.650 1,860 360 1,500 600 $ 900 $ .45 jetGreen 2018 $4,000 1,420 1,075 905 600 300 300 120 $ 180 $ 1.50 Balance Sheets: Cash Accounts receivable Equipment, net of depreciation Other assets Total assets 12/31/18 $ 500 800 6,500 1.200 $9,000 12/31/18 $ 150 350 3,600 900 $5,000 $ 300 $ 600 4,000 3.000 Current liabilities Bonds payable Common stock Retained earnings Total liabilities and s/equity 2.000 1,200 500 2.400 9.00 55,000 2018 Statements of Cash Flows: Net income + Depreciation expense Change in current accounts Cash flows from operating activities 2018 $ 900 200 $ 180 (0 990 200 Cash flows from investing activities: Purchase of equipment (500) (160) Purchase of equipment (500 (160 Cash Bows from Enancing activities: Payment of dividends Net change in cash 650 SBC Wright began by determining each firm's free cash flow for 2018. He projected that West's free cash flows would increase by $50 million annually during the forecast period Wright concluded that jetGreen will realize annual free cash flows of $20 million annually for the forecast period. The analyst is confident about estimating the airlines free cash flows through 2022. After that four year forecast horizon, however, Wright concluded that it would be necessary to calculate the terminal values of the firms free cash flows. 188 Chapter 7 Financial Statement Analysis Il Wright estimated that each airline will grow 2% annually beyond 2022 because both discount airlines will become mature firms by that time. The analyst think that West will retain a more conservative capital structure than jetGreen in the long run. Consequently Wright estimated West's long-term weighted average cost of capital at 7% and jetireen's weighted average cost of capital at 8% Wright gathered the following present value of mones factors to help him value the Period 8 ASS 4 912 79083 TA 92 Finally, Wright not the current market price for each air carrier's stock on December 31, 2018 Southwest Airlines closing share price for 2015 was 6.40. while Green closed at $18.1 per share Required: 1. Determine Wrichts firm value, intrinsic sure price, and intrinsic price-to- earing for both West Airlines inn i 2 Companie s from Orville Wright to Anel Earlato December 31, 2018 State your investment recommendations and our rationale e making it