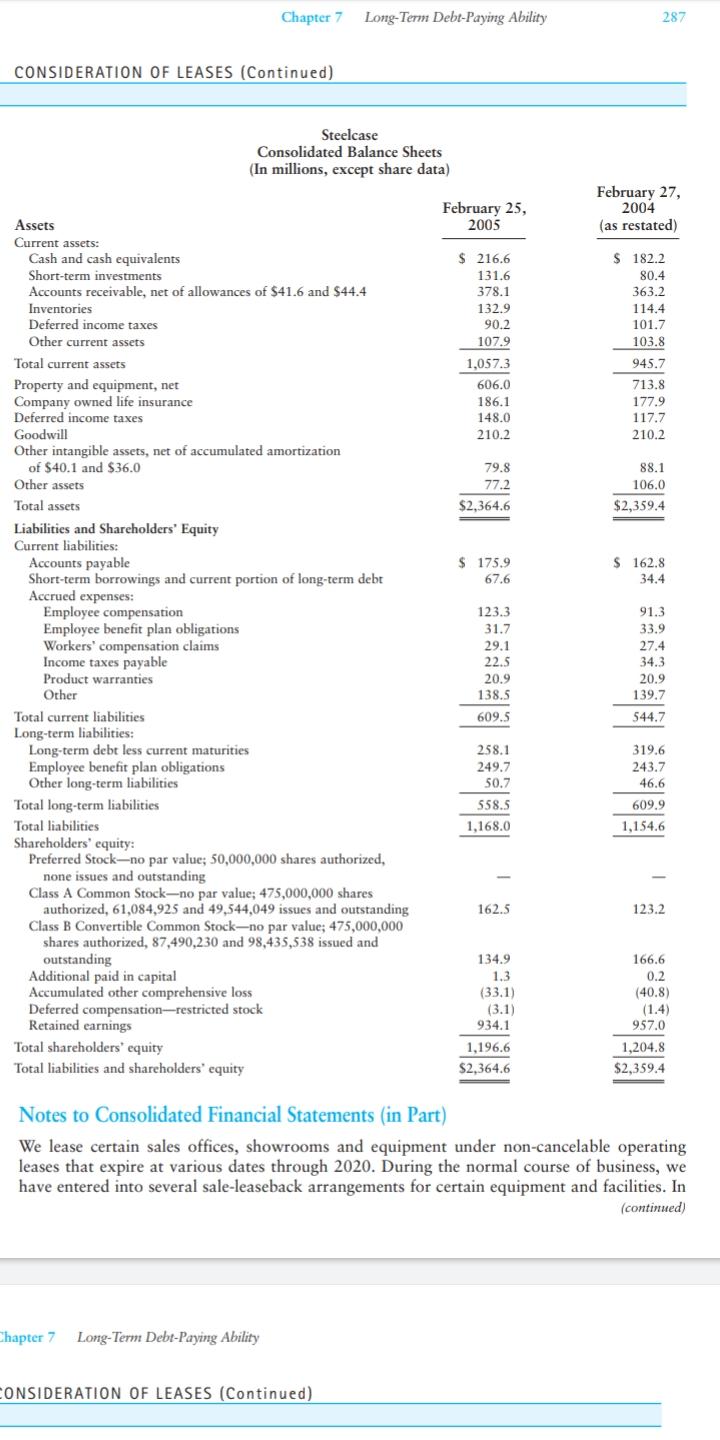

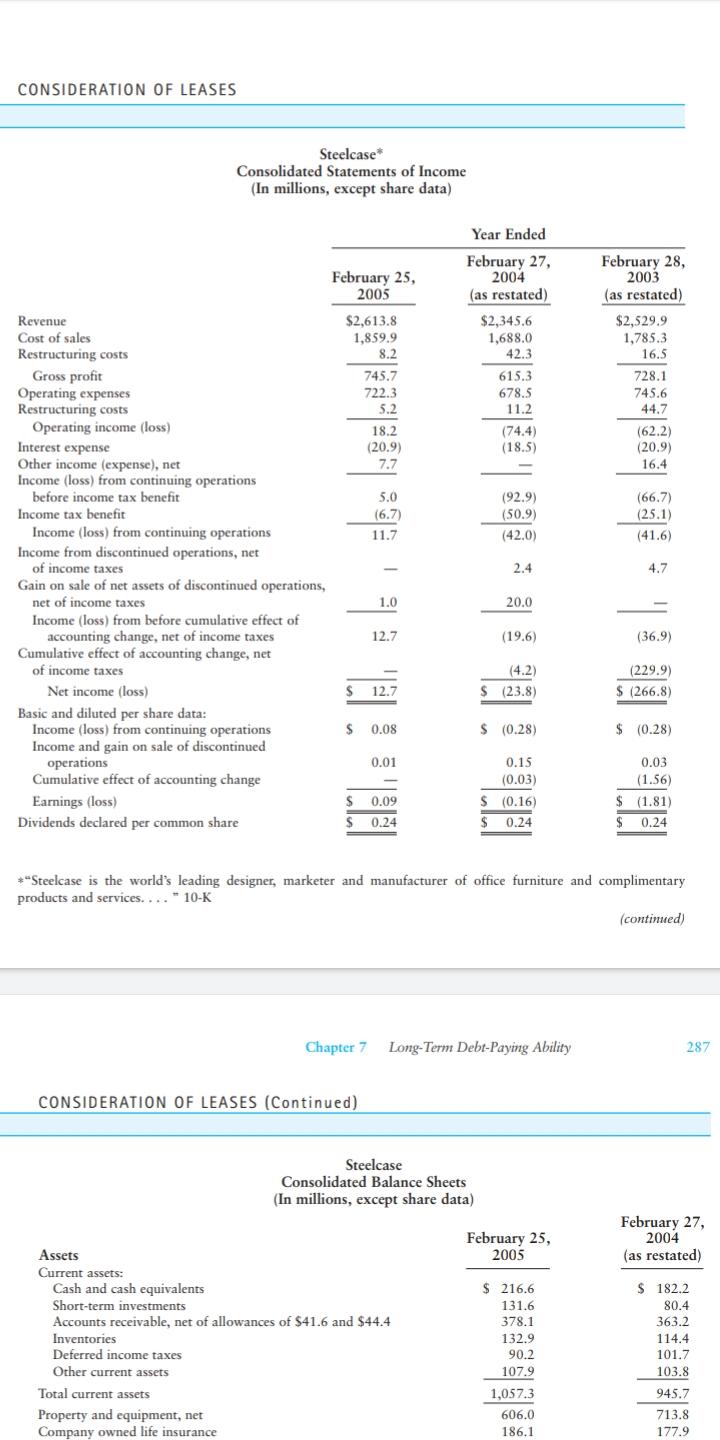

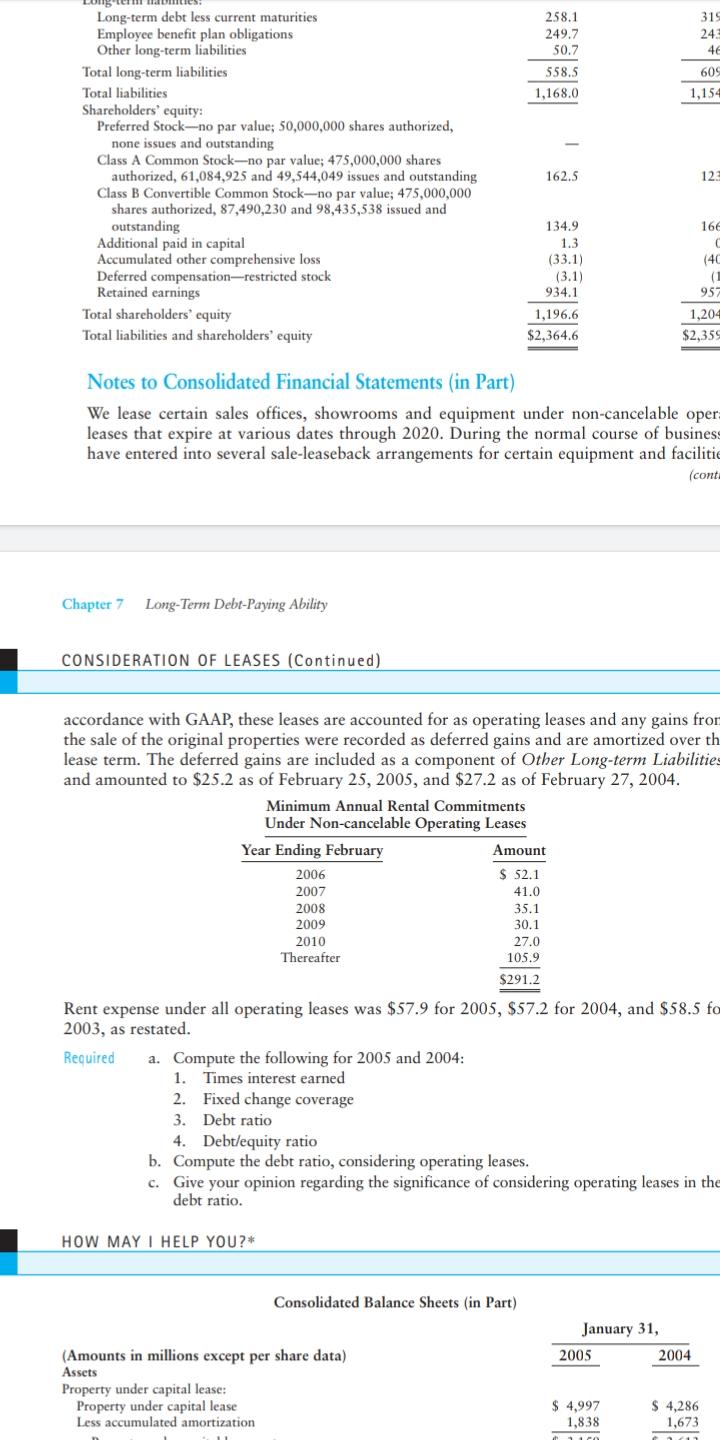

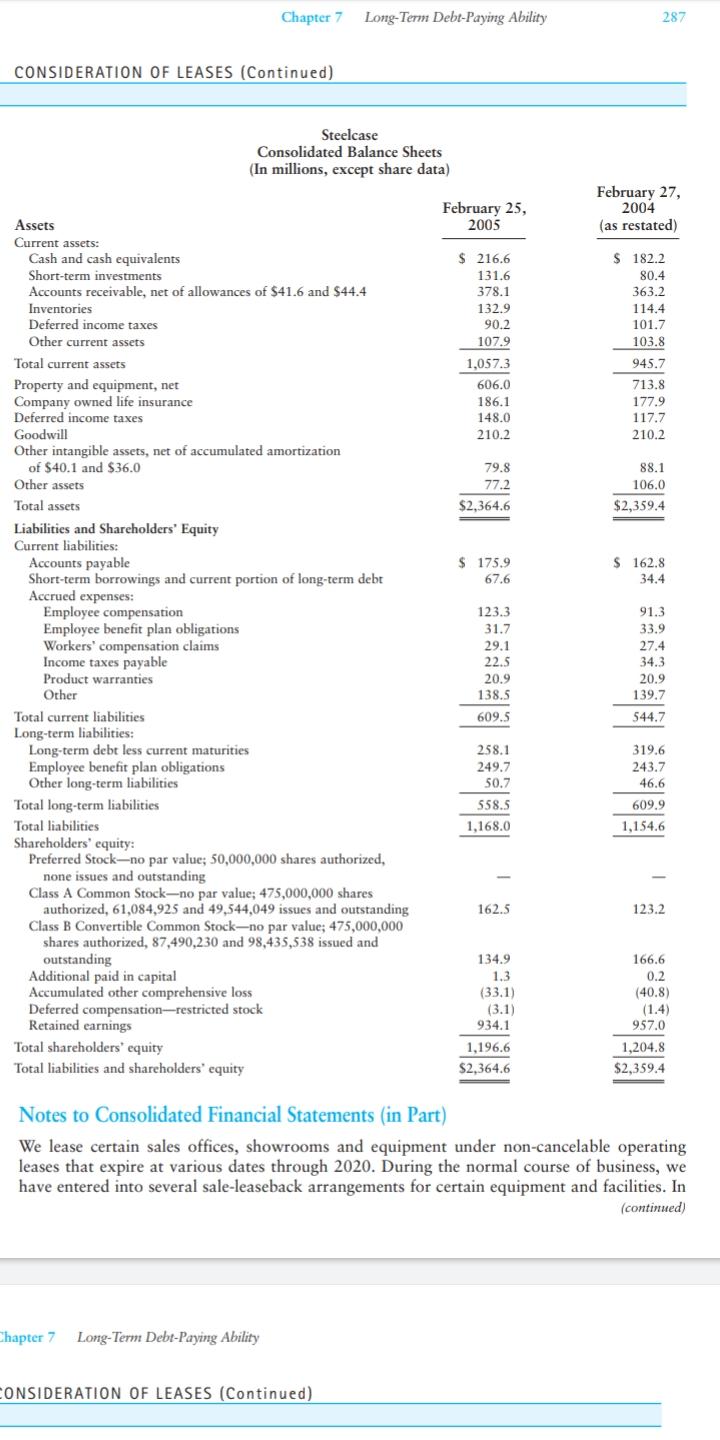

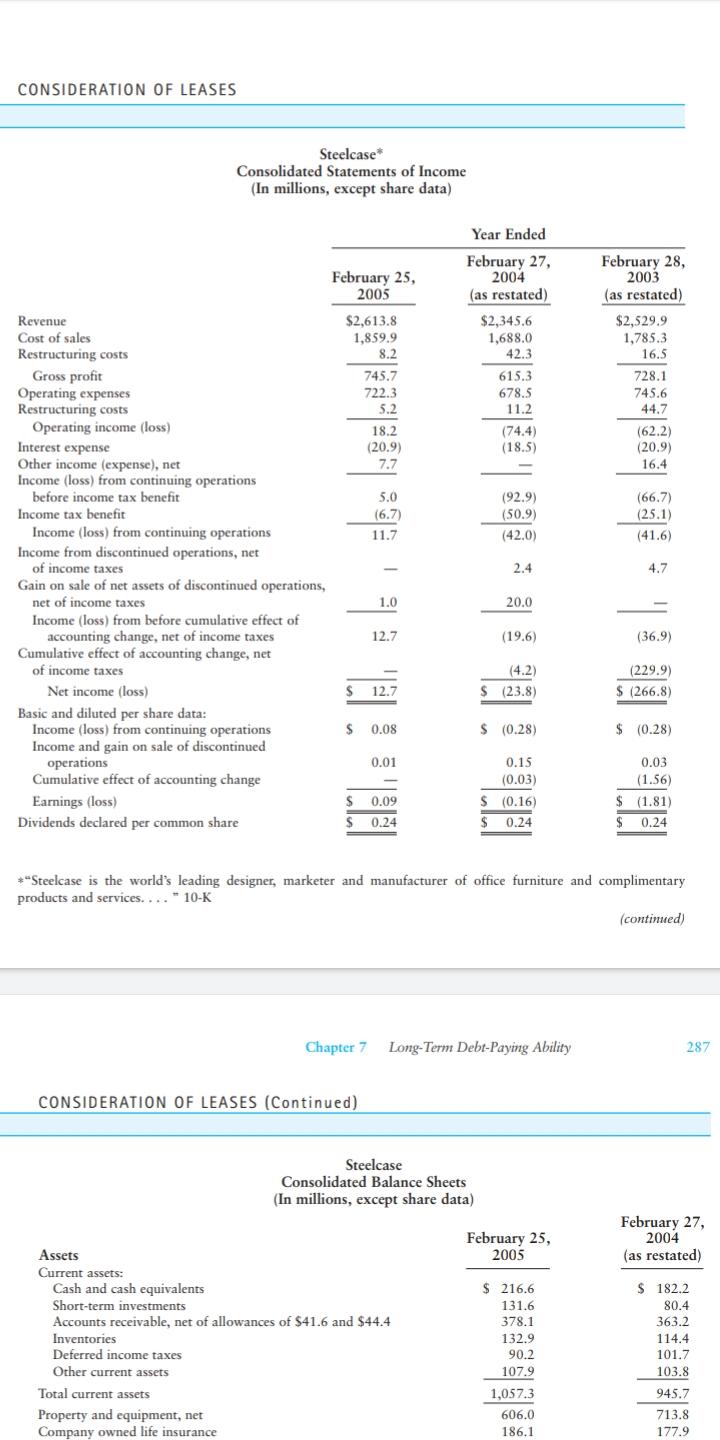

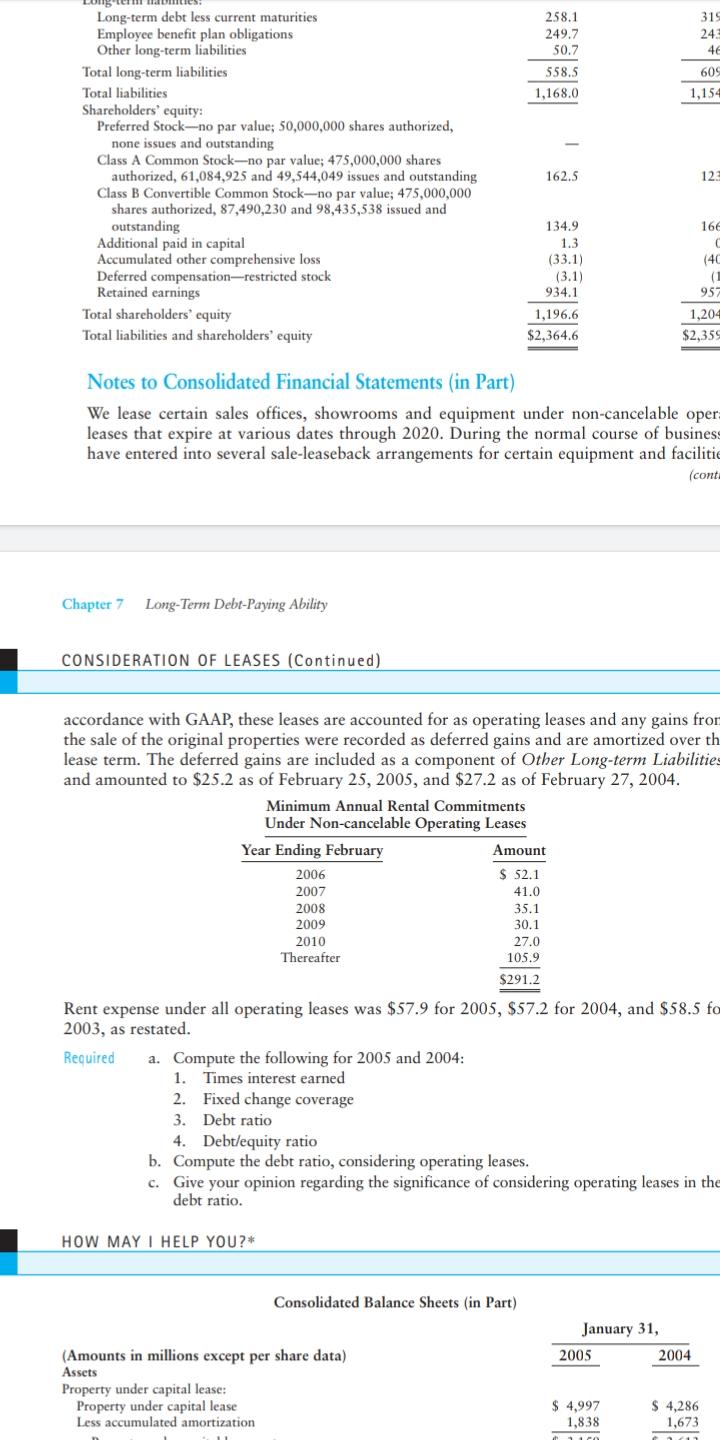

Chapter 7 Long-Term Debt-Paying Ability 287 CONSIDERATION OF LEASES (Continued) Steelcase Consolidated Balance Sheets (In millions, except share data) February 25, 2005 February 27, 2004 (as restated) Assets $ 182.2 80.4 Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowances of $41.6 and $44.4 Inventories Deferred income taxes Other current assets $ 216.6 131.6 378.1 132.9 90.2 107.9 363.2 114.4 101.7 103.8 Total current assets 1,057.3 945.7 606.0 Property and equipment, net Company owned life insurance Deferred income taxes Goodwill Other intangible assets, net of accumulated amortization of $40.1 and $36.0 Other assets 186.1 148.0 210.2 713.8 177.9 117.7 210.2 79.8 77.2 88.1 106.0 Total assets $2,364.6 $2,359.4 $ 175.9 67.6 $ 162.8 34.4 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Short-term borrowings and current portion of long-term debt Accrued expenses: Employee compensation Employee benefit plan obligations Workers' compensation claims Income taxes payable Product warranties Other 123.3 31.7 29.1 22.5 20.9 138.5 91.3 33.9 27.4 34.3 20.9 139.7 609.5 544.7 258.1 249.7 50.7 319.6 243.7 46.6 558.5 609.9 1,168.0 1,154.6 - Total current liabilities Long-term liabilities: Long-term debt less current maturities Employee benefit plan obligations Other long-term liabilities Total long-term liabilities Total liabilities Shareholders' equity: Preferred Stock-no par value; 50,000,000 shares authorized, none issues and outstanding Class A Common Stock-no par value; 475,000,000 shares authorized, 61,084,925 and 49,544,049 issues and outstanding Class B Convertible Common Stock-no par value; 475,000,000 shares authorized, 87,490,230 and 98,435,538 issued and outstanding Additional paid in capital Accumulated other comprehensive loss Deferred compensation-restricted stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 162.5 123.2 134.9 1.3 (33.1) (3.1) 934.1 166,6 0.2 (40.8) 957.0 1,196.6 1,204.8 $2,364.6 $2,359.4 Notes to Consolidated Financial Statements (in Part) We lease certain sales offices, showrooms and equipment under non-cancelable operating leases that expire at various dates through 2020. During the normal course of business, we have entered into several sale-leaseback arrangements for certain equipment and facilities. In (continued) Chapter 7 Long-Term Debt-Paying Ability CONSIDERATION OF LEASES (Continued) CONSIDERATION OF LEASES Steelcase Consolidated Statements of Income (In millions, except share data) Year Ended February 25, 2005 February 27, 2004 (as restated) February 28, 2003 (as restated) $2,613.8 1,859.9 8.2 $2,345,6 1,688.0 42.3 $2,529.9 1,785.3 16.5 745.7 722.3 5.2 615.3 678.5 11.2 728.1 745.6 44.7 18.2 (20.9) 7.7 (74.4) (18.5) (62.2) (20.9) 16.4 Revenue Cost of sales Restructuring costs Gross profit Operating expenses Restructuring costs Operating income (loss) Interest expense Other income (expense), net Income (loss) from continuing operations before income tax benefit Income tax benefit Income (loss) from continuing operations Income from discontinued operations, net of income taxes Gain on sale of net assets of discontinued operations, net of income taxes Income (loss) from before cumulative effect of accounting change, net of income taxes Cumulative effect of accounting change, net of income taxes 5.0 (6.7 (92.9) (50.9) (66.7) (25.1) 11.7 (42.0) (41.6) - 2.4 4.7 1.0 20.0 12.7 (19.6) (36.9) (4.2) (229.9) Net income (loss) S 12.7 $ (23.8) $ (266.8) $ 0.08 $ (0.28) $ (0.28) 0.01 Basic and diluted per share data: Income (loss) from continuing operations Income and gain on sale of discontinued operations Cumulative effect of accounting change Earnings (loss) Dividends declared per common share 0.15 (0.03) 0.03 (1.56) 0.09 (1.81) $ (0.16) $ 0.24 $ 0.24 0.24 *Steelcase is the world's leading designer, marketer and manufacturer of office furniture and complimentary products and services.... - 10-K (continued) Chapter 7 Long-Term Debt-Paying Ability 287 CONSIDERATION OF LEASES (Continued) Steelcase Consolidated Balance Sheets (In millions, except share data) February 25, 2005 February 27, 2004 (as restated) Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowances of $41.6 and $44.4 Inventories Deferred income taxes Other current assets $ 216.6 131.6 378.1 132.9 90.2 107.9 1,057.3 $ 182.2 80.4 363.2 114.4 101.7 103.8 Total current assets 945.7 606.0 Property and equipment, net Company owned life insurance 713.8 177.9 186.1 258.1 249.7 50.7 319 24 44 558,5 609 1,168.0 1,154 Long-term debt less current maturities Employee benefit plan obligations Other long-term liabilities Total long-term liabilities Total liabilities Shareholders' equity: Preferred Stock--no par value; 50,000,000 shares authorized, none issues and outstanding Class A Common Stock-no par value; 475,000,000 shares authorized, 61,084,925 and 49,544,049 issues and outstanding Class B Convertible Common Stock-no par value; 475,000,000 shares authorized, 87,490,230 and 98,435,538 issued and outstanding Additional paid in capital Accumulated other comprehensive loss Deferred compensation-restricted stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 162.5 123 134,9 16 1.3 (33.1) (3.1) 934.1 (40 (1 957 1,196.6 1,204 $2,364.6 $2.359 Notes to Consolidated Financial Statements in Part) We lease certain sales offices, showrooms and equipment under non-cancelable oper leases that expire at various dates through 2020. During the normal course of business have entered into several sale-leaseback arrangements for certain equipment and facilitie (cont. Chapter 7 Long-Term Debt-Paying Ability CONSIDERATION OF LEASES (Continued) accordance with GAAP, these leases are accounted for as operating leases and any gains from the sale of the original properties were recorded as deferred gains and are amortized over th lease term. The deferred gains are included as a component of Other Long-term Liabilities and amounted to $25.2 as of February 25, 2005, and $27.2 as of February 27, 2004. Minimum Annual Rental Commitments Under Non-cancelable Operating Leases Year Ending February Amount 52.1 41.0 35.1 2007 2008 2009 2010 Thereafter 30.1 27.0 105.9 $291.2 Rent expense under all operating leases was $57.9 for 2005, $57.2 for 2004, and $58.5 fo 2003, as restated. Required a. Compute the following for 2005 and 2004: 1. Times interest earned 2. Fixed change coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, considering operating leases. c. Give your opinion regarding the significance of considering operating leases in the debt ratio. HOW MAY I HELP YOU?* Consolidated Balance Sheets (in Part) January 31, 2005 2004 (Amounts in millions except per share data) Assets Property under capital lease: Property under capital lease Less accumulated amortization $ 4,997 1,838 $ 4,286 1,673 11a Chapter 7 Long-Term Debt-Paying Ability 287 CONSIDERATION OF LEASES (Continued) Steelcase Consolidated Balance Sheets (In millions, except share data) February 25, 2005 February 27, 2004 (as restated) Assets $ 182.2 80.4 Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowances of $41.6 and $44.4 Inventories Deferred income taxes Other current assets $ 216.6 131.6 378.1 132.9 90.2 107.9 363.2 114.4 101.7 103.8 Total current assets 1,057.3 945.7 606.0 Property and equipment, net Company owned life insurance Deferred income taxes Goodwill Other intangible assets, net of accumulated amortization of $40.1 and $36.0 Other assets 186.1 148.0 210.2 713.8 177.9 117.7 210.2 79.8 77.2 88.1 106.0 Total assets $2,364.6 $2,359.4 $ 175.9 67.6 $ 162.8 34.4 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Short-term borrowings and current portion of long-term debt Accrued expenses: Employee compensation Employee benefit plan obligations Workers' compensation claims Income taxes payable Product warranties Other 123.3 31.7 29.1 22.5 20.9 138.5 91.3 33.9 27.4 34.3 20.9 139.7 609.5 544.7 258.1 249.7 50.7 319.6 243.7 46.6 558.5 609.9 1,168.0 1,154.6 - Total current liabilities Long-term liabilities: Long-term debt less current maturities Employee benefit plan obligations Other long-term liabilities Total long-term liabilities Total liabilities Shareholders' equity: Preferred Stock-no par value; 50,000,000 shares authorized, none issues and outstanding Class A Common Stock-no par value; 475,000,000 shares authorized, 61,084,925 and 49,544,049 issues and outstanding Class B Convertible Common Stock-no par value; 475,000,000 shares authorized, 87,490,230 and 98,435,538 issued and outstanding Additional paid in capital Accumulated other comprehensive loss Deferred compensation-restricted stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 162.5 123.2 134.9 1.3 (33.1) (3.1) 934.1 166,6 0.2 (40.8) 957.0 1,196.6 1,204.8 $2,364.6 $2,359.4 Notes to Consolidated Financial Statements (in Part) We lease certain sales offices, showrooms and equipment under non-cancelable operating leases that expire at various dates through 2020. During the normal course of business, we have entered into several sale-leaseback arrangements for certain equipment and facilities. In (continued) Chapter 7 Long-Term Debt-Paying Ability CONSIDERATION OF LEASES (Continued) CONSIDERATION OF LEASES Steelcase Consolidated Statements of Income (In millions, except share data) Year Ended February 25, 2005 February 27, 2004 (as restated) February 28, 2003 (as restated) $2,613.8 1,859.9 8.2 $2,345,6 1,688.0 42.3 $2,529.9 1,785.3 16.5 745.7 722.3 5.2 615.3 678.5 11.2 728.1 745.6 44.7 18.2 (20.9) 7.7 (74.4) (18.5) (62.2) (20.9) 16.4 Revenue Cost of sales Restructuring costs Gross profit Operating expenses Restructuring costs Operating income (loss) Interest expense Other income (expense), net Income (loss) from continuing operations before income tax benefit Income tax benefit Income (loss) from continuing operations Income from discontinued operations, net of income taxes Gain on sale of net assets of discontinued operations, net of income taxes Income (loss) from before cumulative effect of accounting change, net of income taxes Cumulative effect of accounting change, net of income taxes 5.0 (6.7 (92.9) (50.9) (66.7) (25.1) 11.7 (42.0) (41.6) - 2.4 4.7 1.0 20.0 12.7 (19.6) (36.9) (4.2) (229.9) Net income (loss) S 12.7 $ (23.8) $ (266.8) $ 0.08 $ (0.28) $ (0.28) 0.01 Basic and diluted per share data: Income (loss) from continuing operations Income and gain on sale of discontinued operations Cumulative effect of accounting change Earnings (loss) Dividends declared per common share 0.15 (0.03) 0.03 (1.56) 0.09 (1.81) $ (0.16) $ 0.24 $ 0.24 0.24 *Steelcase is the world's leading designer, marketer and manufacturer of office furniture and complimentary products and services.... - 10-K (continued) Chapter 7 Long-Term Debt-Paying Ability 287 CONSIDERATION OF LEASES (Continued) Steelcase Consolidated Balance Sheets (In millions, except share data) February 25, 2005 February 27, 2004 (as restated) Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net of allowances of $41.6 and $44.4 Inventories Deferred income taxes Other current assets $ 216.6 131.6 378.1 132.9 90.2 107.9 1,057.3 $ 182.2 80.4 363.2 114.4 101.7 103.8 Total current assets 945.7 606.0 Property and equipment, net Company owned life insurance 713.8 177.9 186.1 258.1 249.7 50.7 319 24 44 558,5 609 1,168.0 1,154 Long-term debt less current maturities Employee benefit plan obligations Other long-term liabilities Total long-term liabilities Total liabilities Shareholders' equity: Preferred Stock--no par value; 50,000,000 shares authorized, none issues and outstanding Class A Common Stock-no par value; 475,000,000 shares authorized, 61,084,925 and 49,544,049 issues and outstanding Class B Convertible Common Stock-no par value; 475,000,000 shares authorized, 87,490,230 and 98,435,538 issued and outstanding Additional paid in capital Accumulated other comprehensive loss Deferred compensation-restricted stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 162.5 123 134,9 16 1.3 (33.1) (3.1) 934.1 (40 (1 957 1,196.6 1,204 $2,364.6 $2.359 Notes to Consolidated Financial Statements in Part) We lease certain sales offices, showrooms and equipment under non-cancelable oper leases that expire at various dates through 2020. During the normal course of business have entered into several sale-leaseback arrangements for certain equipment and facilitie (cont. Chapter 7 Long-Term Debt-Paying Ability CONSIDERATION OF LEASES (Continued) accordance with GAAP, these leases are accounted for as operating leases and any gains from the sale of the original properties were recorded as deferred gains and are amortized over th lease term. The deferred gains are included as a component of Other Long-term Liabilities and amounted to $25.2 as of February 25, 2005, and $27.2 as of February 27, 2004. Minimum Annual Rental Commitments Under Non-cancelable Operating Leases Year Ending February Amount 52.1 41.0 35.1 2007 2008 2009 2010 Thereafter 30.1 27.0 105.9 $291.2 Rent expense under all operating leases was $57.9 for 2005, $57.2 for 2004, and $58.5 fo 2003, as restated. Required a. Compute the following for 2005 and 2004: 1. Times interest earned 2. Fixed change coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, considering operating leases. c. Give your opinion regarding the significance of considering operating leases in the debt ratio. HOW MAY I HELP YOU?* Consolidated Balance Sheets (in Part) January 31, 2005 2004 (Amounts in millions except per share data) Assets Property under capital lease: Property under capital lease Less accumulated amortization $ 4,997 1,838 $ 4,286 1,673 11a