Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 7- Problem 4, 6,7, 8 Due 5-1-19 t References Mailings Review View Help Tell me what you want to do ,A--. ||1Norrmall1NoSpac . ,

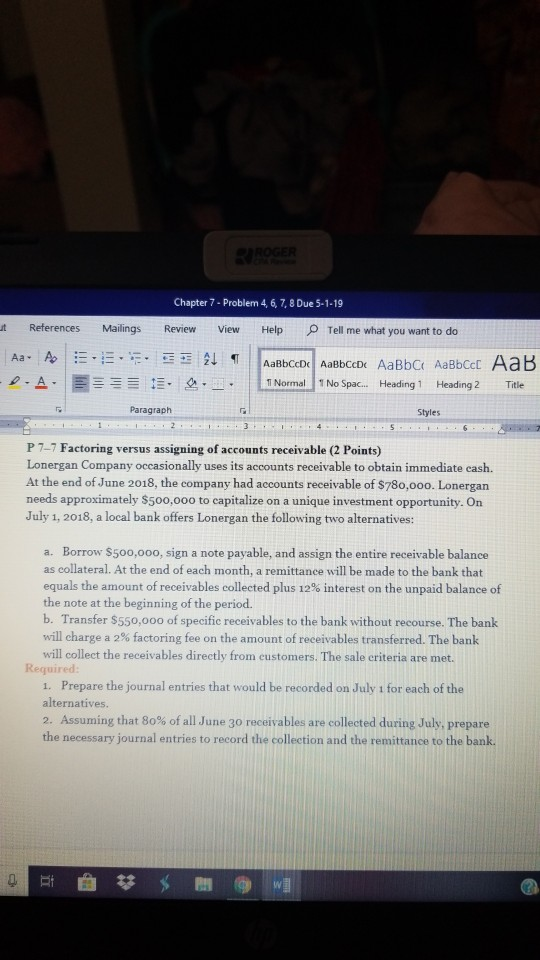

Chapter 7- Problem 4, 6,7, 8 Due 5-1-19 t References Mailings Review View Help Tell me what you want to do ,A--. ||1Norrmall1NoSpac . , Heading 1 Heading 2 Title Paragraph Styles P 7-7 Factoring versus assigning of accounts receivable (2 Points) Lonergan Company occasionally uses its accounts receivable to obtain immediate cash. At the end of June 2018, the company had accounts receivable of $780,ooo. Lonergan needs approximately $500,000 to capitalize on a unique investment opportunity. On July 1, 2018, a local bank offers Lonergan the following two alternatives: a. Borrow s500,000, sign a note payable, and assign the entire receivable balance as collateral. At the end of each month, a remittance will be made to the bank that equals the amount of receivables collected plus 12% interest on the unpaid balance of the note at the beginning of the period. b. Transfer $550,000 of specific receivables to the bank without recourse. The bank will charge a 2% factoring fee on the amount of receivables transferred. The bank will collect the receivables directly from eustomers. The sale criteria are met. Required 1. Prepare the journal entries that would be recorded on July 1 for each of the alternatives 2. Assuming that 80% of all June 30 receivables are collected during July, prepare the necessary journal entries to record the collection and the remittance to the bank. 3. For each alternative, explain any required note disclosures that woul included in the July 31, 2018, financial statements. 2 Points) -8 Factoring of accounts receivable; without recourse (

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started