Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 7 Tutorial Solutions INTERNAL CONTROLS Instructions: Complete the questions below by determining if questions 1-10 are TRUE OR FALSE and questions 11-20 select the

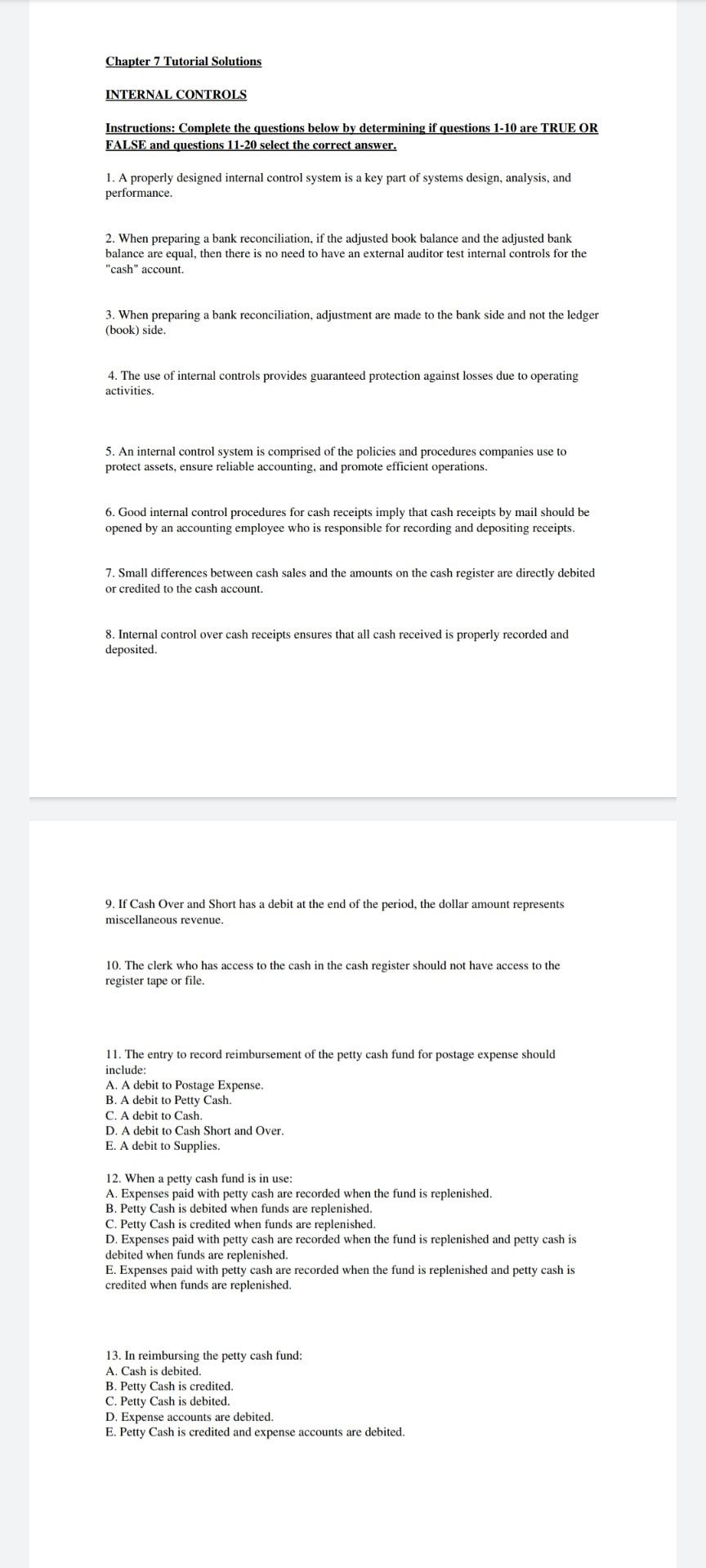

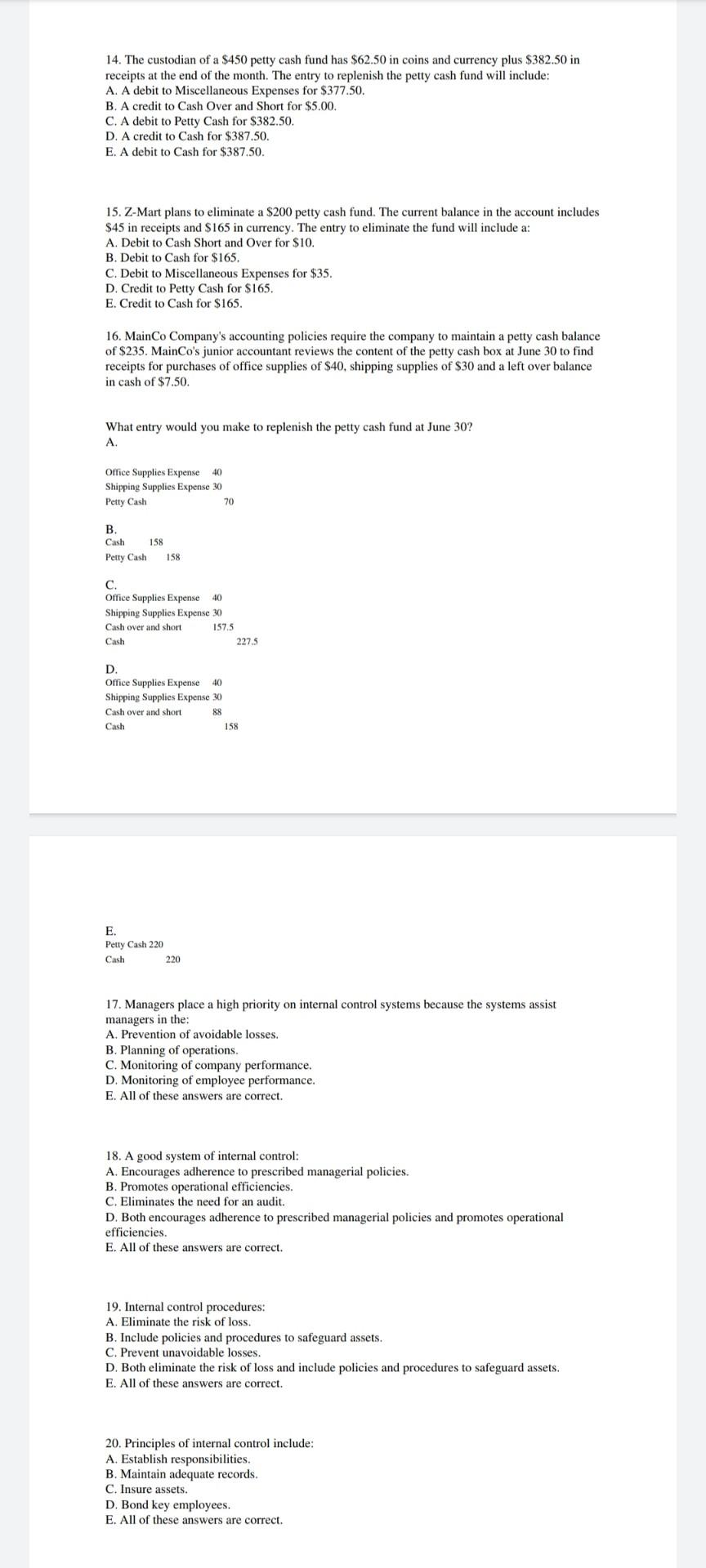

Chapter 7 Tutorial Solutions INTERNAL CONTROLS Instructions: Complete the questions below by determining if questions 1-10 are TRUE OR FALSE and questions 11-20 select the correct answer. 1. A properly designed internal control system is a key part of systems design, analysis, and performance. 2. When preparing a bank reconciliation, if the adjusted book balance and the adjusted bank balance are equal, then there is no need to have an external auditor test internal controls for the "cash" account 3. When preparing a bank reconciliation, adjustment are made to the bank side and not the ledger (book) side. 4. The use of internal controls provides guaranteed protection against losses due to operating activities. 5. An internal control system is comprised of the policies and procedures companies use to protect assets, ensure reliable accounting, and promote efficient operations. 6. Good internal control procedures for cash receipts imply that cash receipts by mail should be opened by an accounting employee who is responsible for recording and depositing receipts. 7. Small differences between cash sales and the amounts on the cash register are directly debited or credited to the cash account. 8. Internal control over cash receipts ensures that all cash received is properly recorded and deposited. 9. If Cash Over and Short has a debit at the end of the period, the dollar amount represents miscellaneous revenue. 10. The clerk who has access to the cash in the cash register should not have access to the register tape or file. 11. The entry to record reimbursement of the petty cash fund for postage expense should include: A. A debit to Postage Expense. B. A debit to Petty Cash. C. A debit to Cash. D. A debit to Cash Short and Over. E. A debit to Supplies. 12. When a petty cash fund is in use: A. Expenses paid with petty cash are recorded when the fund is replenished. B. Petty Cash is debited when funds are replenished. C. Petty Cash is credited when funds are replenished. D. Expenses paid with petty cash are recorded when the fund is replenished and petty cash is debited when funds are replenished. E. Expenses paid with petty cash are recorded when the fund is replenished and petty cash is credited when funds are replenished. 13. In reimbursing the petty cash fund: A. Cash is debited. B. Petty Cash is credited. C. Petty Cash is debited. D. Expense accounts are debited. E. Petty Cash is credited and expense accounts are debited. 14. The custodian of a $450 petty cash fund has $62.50 in coins and currency plus $382.50 in receipts at the end of the month. The entry to replenish the petty cash fund will include: A. A debit to Miscellaneous Expenses for $377.50. B. A credit to Cash Over and Short for $5.00. C. A debit to Petty Cash for $382.50. D. A credit to Cash for $387.50. E. A debit to Cash for $387,50. 15. Z-Mart plans to eliminate a $200 petty cash fund. The current balance in the account includes $45 in receipts and $165 in currency. The entry to eliminate the fund will include a: A. Debit to Cash Short and Over for $10. B. Debit to Cash for $165. C. Debit to Miscellaneous Expenses for $35. D. Credit to Petty Cash for $165. E. Credit to Cash for $165. 16. MainCo Company's accounting policies require the company to maintain a petty cash balance of $235. MainCo's junior accountant reviews the content of the petty cash box at June 30 to find receipts for purchases of office supplies of $40, shipping supplies of $30 and a left over balance in cash of $7.50. What entry would you make to replenish the petty cash fund at June 30? A. Office Supplies Expense 40 Shipping Supplies Expense 30 Petty Cash 70 B Cash 158 Petty Cash 158 C Office Supplies Expense 40 Shipping Supplies Expense 30 Cash over and short 1575 Cash 227.5 D Office Supplies Expense 40 Shipping Supplies Expense 30 Cash over and short 88 158 Cash E. Petty Cash 220 Cash 220 17. Managers place a high priority on internal control systems because the systems assist managers in the: A. Prevention of avoidable losses. B. Planning of operations. C. Monitoring of company performance. D. Monitoring of employee performance. E. All of these answers are correct. 18. A good system of internal control: A. Encourages adherence to prescribed managerial policies. B. Promotes operational efficiencies. C. Eliminates the need for an audit. D. Both encourages adherence to prescribed managerial policies and promotes operational efficiencies. E. All of these answers are correct. 19. Internal control procedures: A. Eliminate the risk of loss. B. Include policies and procedures to safeguard assets. C. Prevent unavoidable losses. D. Both eliminate the risk of loss and include policies and procedures to safeguard assets. E. All of these answers are correct. 20. Principles of internal control include: A. Establish responsibilities. B. Maintain adequate records. C. Insure assets. D. Bond key employees. E. All of these answers are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started