Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 8 11. Bubbling Beverages Co. produces a soft drink that they sell to the local fast-food restaurants in their rural community. The drink is

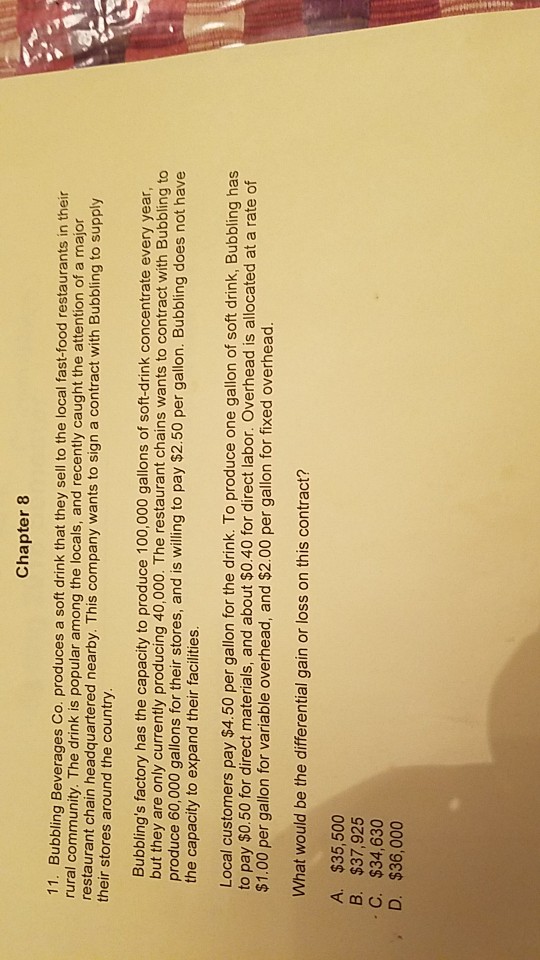

Chapter 8 11. Bubbling Beverages Co. produces a soft drink that they sell to the local fast-food restaurants in their rural community. The drink is popular among the locals, and recently caught the attention of a major restaurant chain headquartered nearby. This company wants to sign a contract with Bubbling to supply their stores around the country Bubbling's factory has the capacity to produce 100,000 gallons of soft-drink concentrate every year 2 3 but they are only currently producing 40,000. The restaurant chains wants to contract with Bubbling to 9 produce 60,000 gallons for their stores, and is willing to pay $2.50 per gallon. Bubbling does not have the capacity to expand their facilities. Local customers pay $4.50 per gallon for the drink. To produce one gallon of soft drink, Bubbling has to pay $0.50 for direct materials, and about $0.40 for direct labor. Overhead is allocated at a rate of $1.00 per gallon for variable overhead, and $2.00 per gallon for fixed overhead 2 3 What would be the differential gain or loss on this contract? A. $35,500 B. $37,925 C. $34,630 D. $36,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started