Question

Chapter 8 (6 marks, 12 minutes) Cardy Ltd. prepares an aging schedule for its accounts receivable at each month end and records bad debts expense

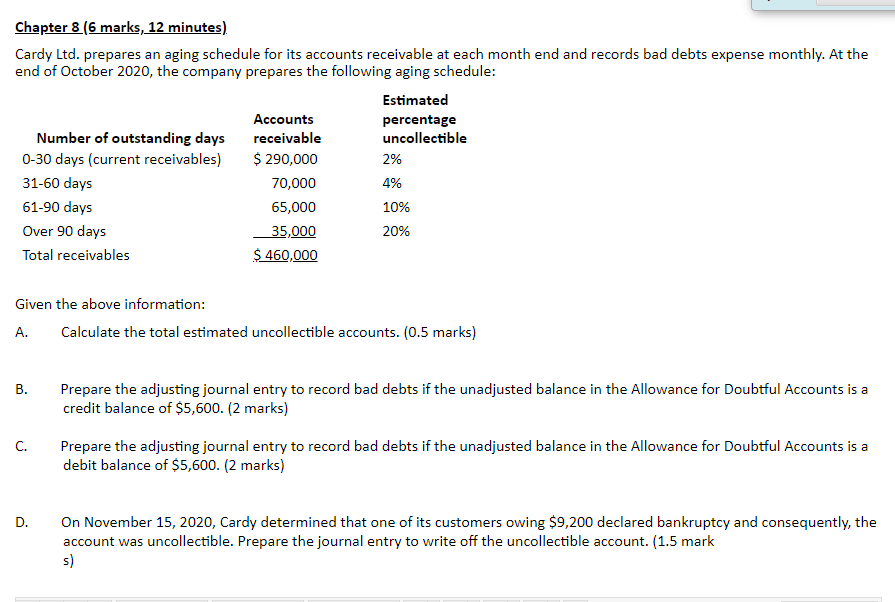

Chapter 8 (6 marks, 12 minutes)

Cardy Ltd. prepares an aging schedule for its accounts receivable at each month end and records bad debts expense monthly. At the end of October 2020, the company prepares the following aging schedule:

|

Number of outstanding days |

Accounts receivable | Estimated percentage uncollectible |

| 0-30 days (current receivables) | $ 290,000 | 2% |

| 31-60 days | 70,000 | 4% |

| 61-90 days | 65,000 | 10% |

| Over 90 days | 35,000 | 20% |

| Total receivables | $ 460,000 |

|

Given the above information:

A. Calculate the total estimated uncollectible accounts. (0.5 marks)

B. Prepare the adjusting journal entry to record bad debts if the unadjusted balance in the Allowance for Doubtful Accounts is a credit balance of $5,600. (2 marks)

C. Prepare the adjusting journal entry to record bad debts if the unadjusted balance in the Allowance for Doubtful Accounts is a debit balance of $5,600. (2 marks)

D. On November 15, 2020, Cardy determined that one of its customers owing $9,200 declared bankruptcy and consequently, the account was uncollectible. Prepare the journal entry to write off the uncollectible account. (1.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started