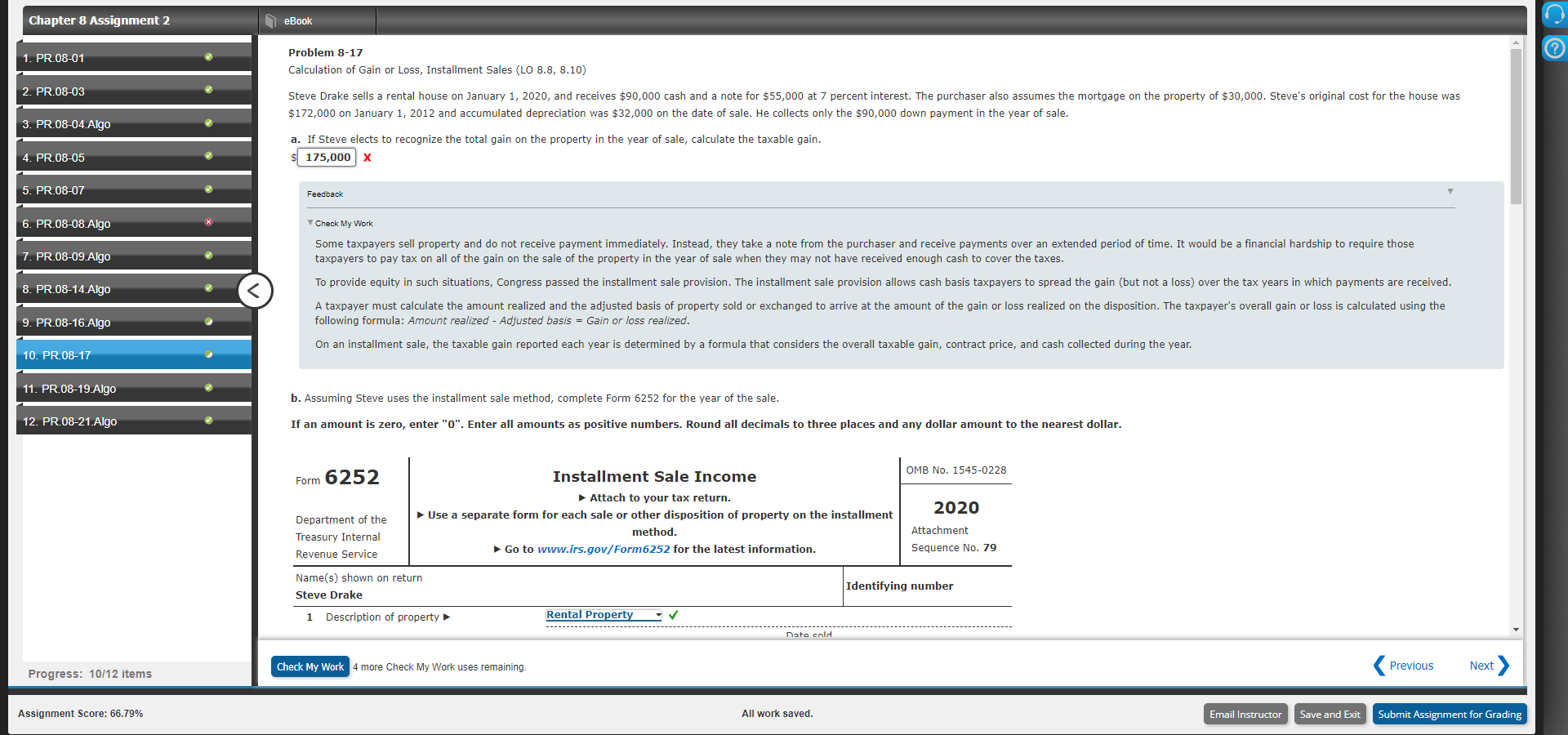

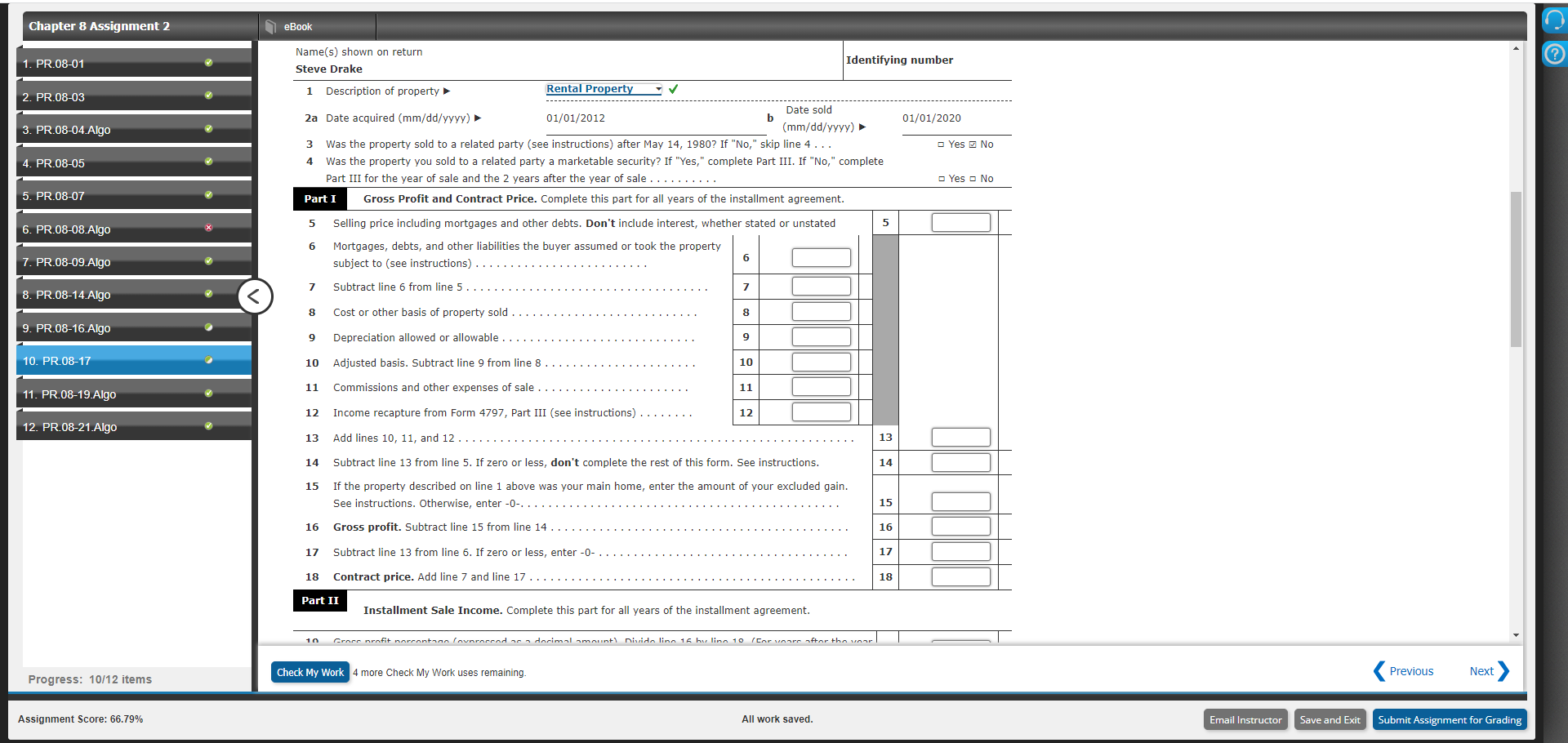

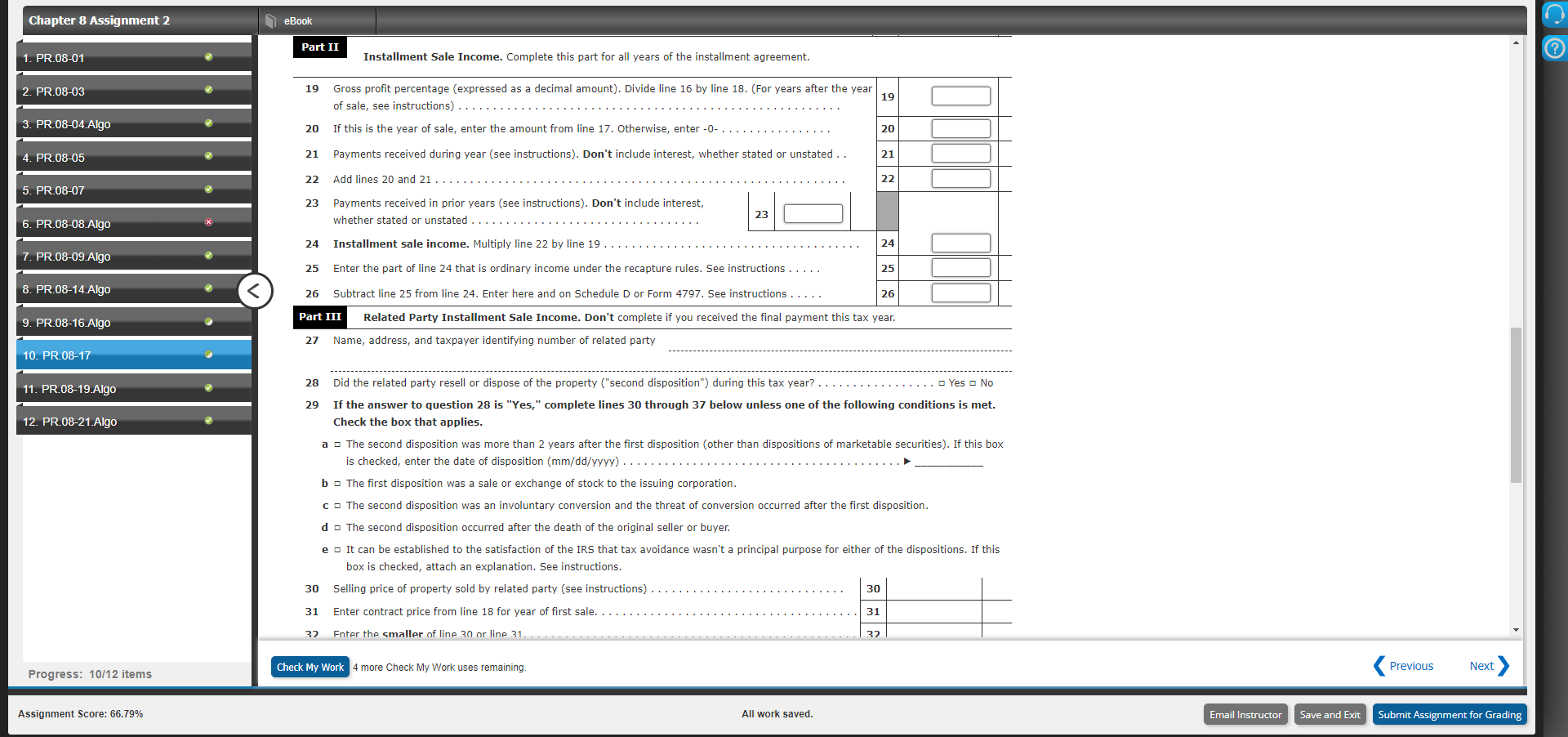

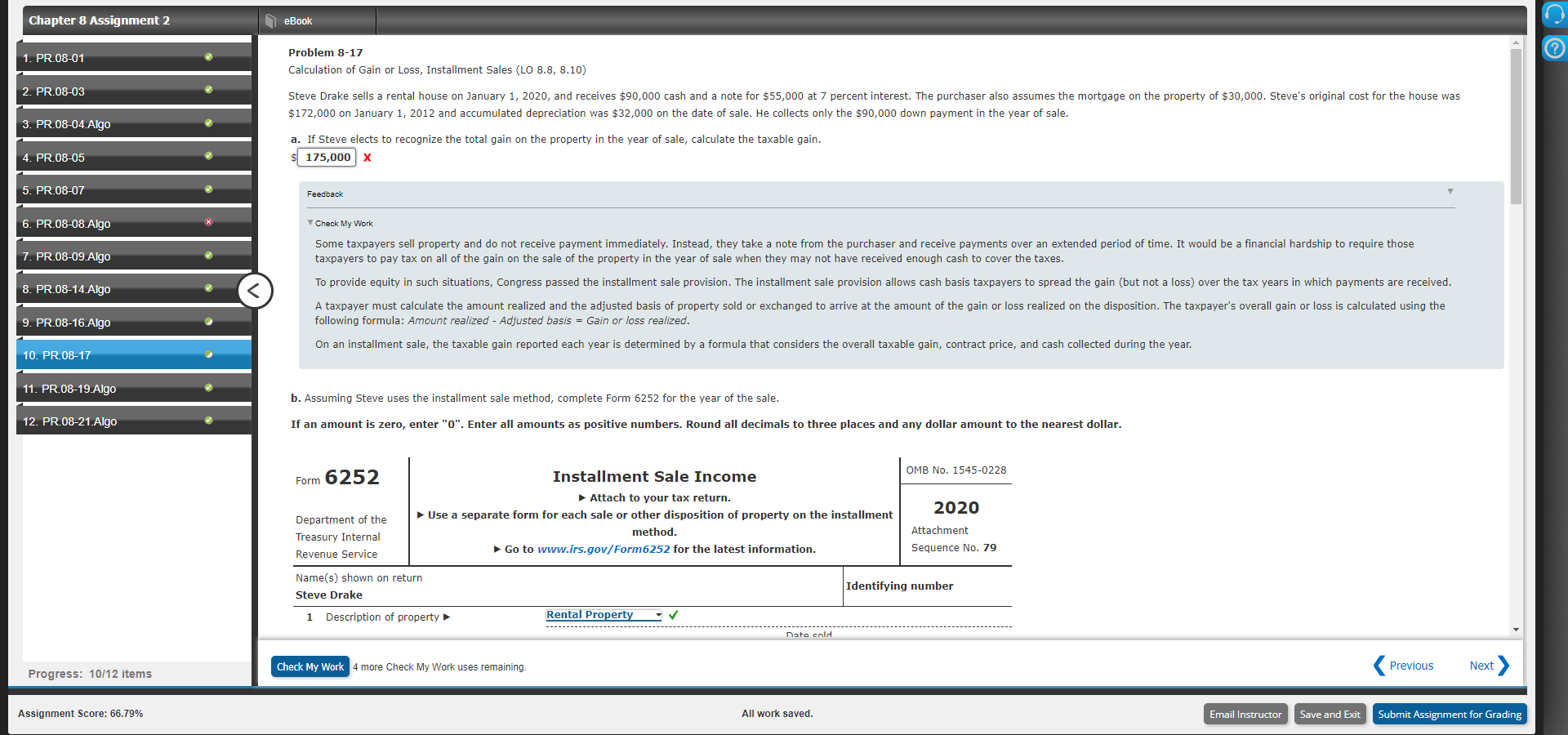

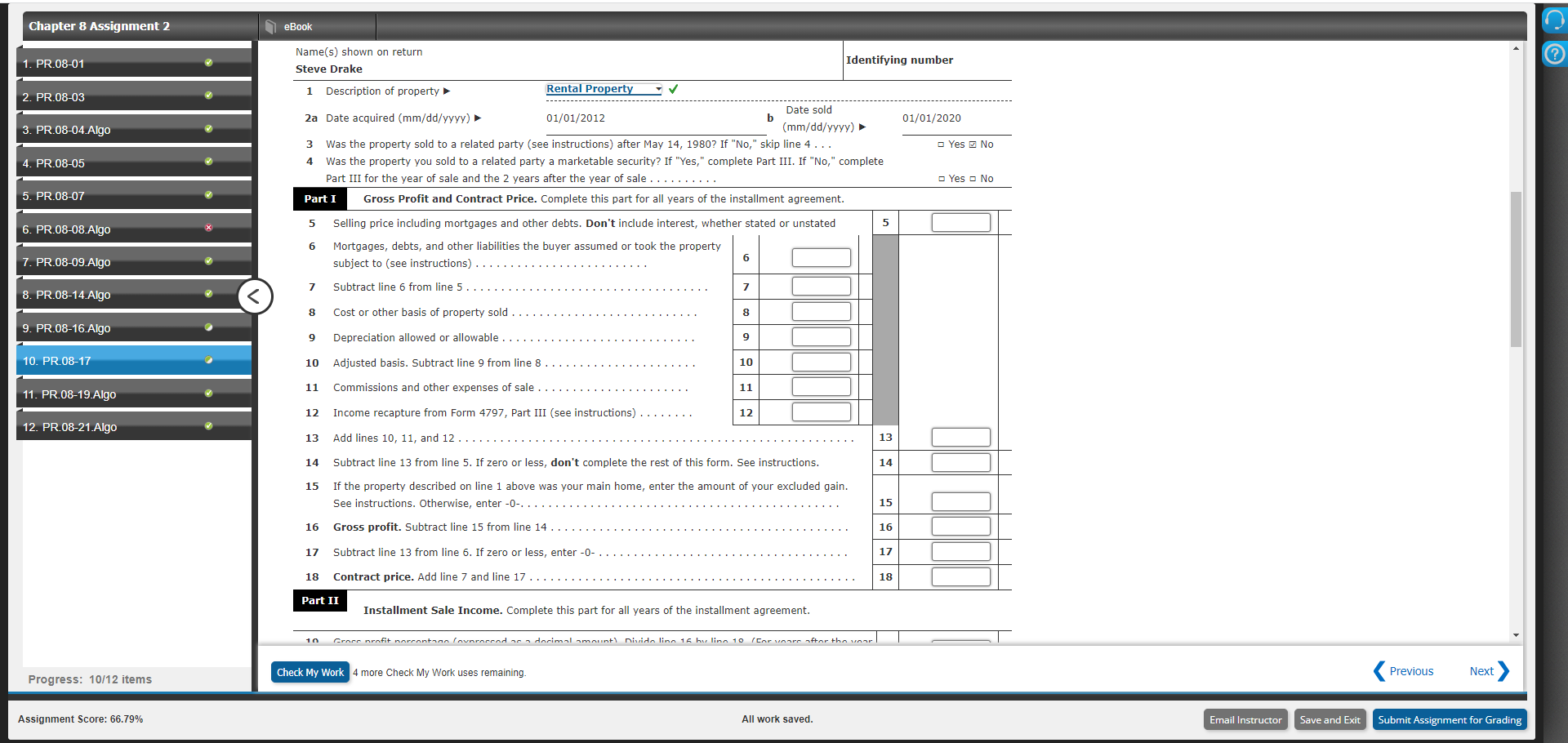

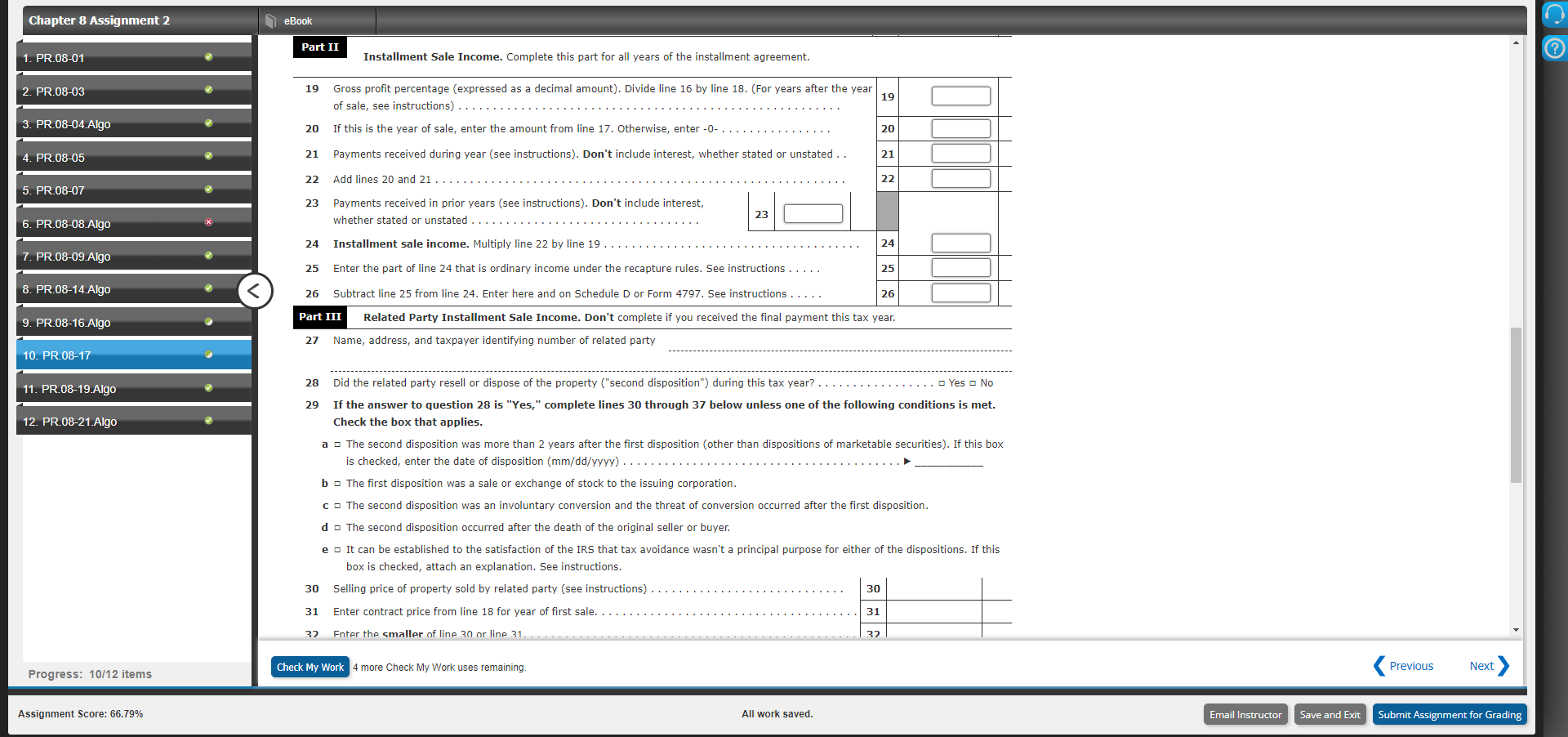

Chapter 8 Assignment 2 eBook ? 1. PR.08-01 Problem 8-17 Calculation of Gain or Loss, Installment Sales (LO 8.8, 8.10) 2. PR.08-03 Steve Drake sells a rental house on January 1, 2020, and receives $90,000 cash and a note for $55,000 at 7 percent interest. The purchaser also assumes the mortgage on the property of $30,000. Steve's original cost for the house was $172,000 on January 1, 2012 and accumulated depreciation was $32,000 on the date of sale. He collects only the $90,000 down payment in the year of sale. 3. PR.08-04.Algo a. If Steve elects to recognize the total gain on the property in the year of sale, calculate the taxable gain. 175,000 4. PR.08-05 5. PR.08-07 Feedback 6. PR.08-08. Algo Check My Work 7. PR.08-09. Algo 8. PR.08-14.Algo Some taxpayers sell property and do not receive payment immediately. Instead, they take a note from the purchaser and receive payments over an extended period of time. It would be a financial hardship to require those taxpayers to pay tax on all of the gain on the sale of the property in the year of sale when they may not have received enough cash to cover the taxes. To provide equity in such situations, Congress passed the installment sale provision. The installment sale provision allows cash basis taxpayers to spread the gain (but not a loss) over the tax years in which payments are received. A taxpayer must calculate the amount realized and the adjusted basis of property sold or exchanged to arrive at the amount of the gain or loss realized on the disposition. The taxpayer's overall gain or loss is calculated using the following formula: Amount realized - Adjusted basis = Gain or loss realized. On an installment sale, the taxable gain reported each year is determined by a formula that considers the overall taxable gain, contract price, and cash collected during the year. 9. PR.08-16.Algo 10. PR.08-17 11. PR.08-19.Algo b. Assuming Steve uses the installment sale method, complete Form 6252 for the year of the sale. 12. PR.08-21.Algo If an amount is zero, enter "0". Enter all amounts as positive numbers. Round all decimals to three places and any dollar amount to the nearest dollar. OMB No. 1545-0228 Form 6252 Installment Sale Income Attach to your tax return. Use a separate form for each sale or other disposition of property on the installment method. Go to www.irs.gov/Form 6252 for the latest information. 2020 Department of the Treasury Internal Revenue Service Attachment Sequence No. 79 Name(s) shown on return Steve Drake Identifying number 1 Description of property Rental Property Nato cold Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Chapter 8 Assignment 2 eBook 1. PR.08-01 2. PR.08-03 3. PR.08-04.Algo Name(s) shown on return Identifying number Steve Drake 1 Description of property Rental Property Date sold 2a Date acquired (mm/dd/yyyy) 01/01/2012 b 01/01/2020 (mm/dd/yyyy) 3 Was the property sold to a related party (see instructions) after May 14, 1980? If "No," skip line 4... Yes No 4 Was the property you sold to a related party a marketable security? If "Yes," complete Part III. If "No," complete Part III for the year of sale and the 2 years after the year of sale ...... Yes No Part I Gross Profit and Contract Price. Complete this part for all years of the installment agreement. 4. PR.08-05 5. PR.08-07 5 5 6. PR.08-08. Algo 6 Selling price including mortgages and other debts. Don't include interest, whether stated or unstated Mortgages, debts, and other liabilities the buyer assumed or took the property subject (see instructions) 6 7. PR.08-09. Algo 7 Subtract line 6 from line 5 7 8. PR.08-14 Algo 8 Cost or other basis of property sold 8 9. PR.08-16.Algo 9 Depreciation allowed or allowable. 9 10. PR.08-17 10 Adjusted basis. Subtract line 9 from line 8 10 11 11 11. PR.08-19.Algo Commissions and other expenses of sale 12 Income recapture from Form 4797, Part III (see instructions) 12 12. PR.08-21.Algo 13 Add lines 10, 11, and 12 ... 13 14 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form. See instructions. 14 15 If the property described on line 1 above was your main home, enter the amount of your excluded gain. See instructions. Otherwise, enter-O-.. 15 16 Gross profit. Subtract line 15 from line 14 ..... 16 17 Subtract line 13 from line 6. If zero or less, enter-O- 17 18 Contract price. Add line 7 and line 17 18 Part II Installment Sale Income. Complete this part for all years of the installment agreement. 10 Groce nrofit norrontaan launraceod an dorimolamount Divide lino 16 kulina 10 Carvoare after the voar Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Chapter 8 Assignment 2 eBook Part II ? 1. PR.08-01 Installment Sale Income. Complete this part for all years of the installment agreement. 2. PR.08-03 19 19 Gross profit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after the year of sale, see instructions) If this is the year of sale, enter the amount from line 17. Otherwise, enter-O- 3. PR.08-04.Algo 20 20 4. PR.08-05 21 Payments received during year (see instructions). Don't include interest, whether stated or unstated.. 21 22 Add lines 20 and 21 ... 22 5. PR.08-07 23 Payments received in prior years (see instructions). Don't include interest, whether stated or unstated 23 6. PR.08-08. Algo 24 Installment sale income. Multiply line 22 by line 19... 24 7. PR.08-09. Algo 25 Enter the part of line 24 that is ordinary income under the recapture rules. See instructions ..... 25 8. PR.08-14.Algo 26 Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797. See instructions ..... 26 9. PR.08-16.Algo Part III Related Party Installment Sale Income. Don't complete if you received the final payment this tax year. 27 Name, address, and taxpayer identifying number of related party 10. PR.08-17 11. PR.08-19.Algo 12. PR.08-21.Algo 28 Did the related party resell or dispose of the property ("second disposition") during this tax year? ... Yes No 29 If the answer to question 28 is "Yes," complete lines 30 through 37 below unless one of the following conditions is met. Check the box that applies. a - The second disposition was more than 2 years after the first disposition (other than dispositions of marketable securities). If this box is checked, enter the date of disposition (mm/dd/yyyy).. b - The first disposition was a sale or exchange of stock to the issuing corporation. c - The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition. d - The second disposition occurred after the death of the original seller or buyer. e It can be established to the satisfaction of the IRS that tax avoidance wasn't a principal purpose for either of the dispositions. If this box is checked, attach an explanation. See instructions. 30 Selling price of property sold by related party (see instructions) 30 31 Enter contract price from line 18 for year of first sale. 31 32 Enter the smaller of line 30 or line 31 32 Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Chapter 8 Assignment 2 eBook 30 1. PR.08-01 31 2. PR.08-03 32 32 33 3. PR.08-04.Algo 30 Selling price of property sold by related party (see instructions) 31 Enter contract price from line 18 for year of first sale. Enter the smaller of line 30 or line 31. ... 33 Total payments received by the end of your 2020 tax year (see instructions) 34 Subtract line 33 from line 32. If zero or less, enter - 0 - 35 Multiply line 34 by the gross profit percentage on line 19 for year of first sale .. 36 Enter the part of line 35 that is ordinary income under the recapture rules. See instructions .... 37 Subtract line 36 from line 35. Enter here and on Schedule D or Form 4797. See instructions For Paperwork Reduction Act Notice, see page 4. Cat. No. 13601R 34 4. PR.08-05 35 36 5. PR.08-07 37 6. PR.08-08. Algo Form 6252 (2020) 7. PR.08-09. Algo Feedback 8. PR.08-14.Algo 9. PR.08-16.Algo Check My Work Partially correct 10. PR.08-17 c. Assuming Steve collects $5,000 (not including interest) of the note principal in the year following the year of sale, calculate the amount of income recognized in that year under the installment sale method. 11. PR.08-19.Algo Round your answer to the nearest dollar. 1,205 12. PR.08-21. Algo Feedback Check My Work Correct Feedback Check My Work Partially correct Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Chapter 8 Assignment 2 eBook ? 1. PR.08-01 Problem 8-17 Calculation of Gain or Loss, Installment Sales (LO 8.8, 8.10) 2. PR.08-03 Steve Drake sells a rental house on January 1, 2020, and receives $90,000 cash and a note for $55,000 at 7 percent interest. The purchaser also assumes the mortgage on the property of $30,000. Steve's original cost for the house was $172,000 on January 1, 2012 and accumulated depreciation was $32,000 on the date of sale. He collects only the $90,000 down payment in the year of sale. 3. PR.08-04.Algo a. If Steve elects to recognize the total gain on the property in the year of sale, calculate the taxable gain. 175,000 4. PR.08-05 5. PR.08-07 Feedback 6. PR.08-08. Algo Check My Work 7. PR.08-09. Algo 8. PR.08-14.Algo Some taxpayers sell property and do not receive payment immediately. Instead, they take a note from the purchaser and receive payments over an extended period of time. It would be a financial hardship to require those taxpayers to pay tax on all of the gain on the sale of the property in the year of sale when they may not have received enough cash to cover the taxes. To provide equity in such situations, Congress passed the installment sale provision. The installment sale provision allows cash basis taxpayers to spread the gain (but not a loss) over the tax years in which payments are received. A taxpayer must calculate the amount realized and the adjusted basis of property sold or exchanged to arrive at the amount of the gain or loss realized on the disposition. The taxpayer's overall gain or loss is calculated using the following formula: Amount realized - Adjusted basis = Gain or loss realized. On an installment sale, the taxable gain reported each year is determined by a formula that considers the overall taxable gain, contract price, and cash collected during the year. 9. PR.08-16.Algo 10. PR.08-17 11. PR.08-19.Algo b. Assuming Steve uses the installment sale method, complete Form 6252 for the year of the sale. 12. PR.08-21.Algo If an amount is zero, enter "0". Enter all amounts as positive numbers. Round all decimals to three places and any dollar amount to the nearest dollar. OMB No. 1545-0228 Form 6252 Installment Sale Income Attach to your tax return. Use a separate form for each sale or other disposition of property on the installment method. Go to www.irs.gov/Form 6252 for the latest information. 2020 Department of the Treasury Internal Revenue Service Attachment Sequence No. 79 Name(s) shown on return Steve Drake Identifying number 1 Description of property Rental Property Nato cold Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Chapter 8 Assignment 2 eBook 1. PR.08-01 2. PR.08-03 3. PR.08-04.Algo Name(s) shown on return Identifying number Steve Drake 1 Description of property Rental Property Date sold 2a Date acquired (mm/dd/yyyy) 01/01/2012 b 01/01/2020 (mm/dd/yyyy) 3 Was the property sold to a related party (see instructions) after May 14, 1980? If "No," skip line 4... Yes No 4 Was the property you sold to a related party a marketable security? If "Yes," complete Part III. If "No," complete Part III for the year of sale and the 2 years after the year of sale ...... Yes No Part I Gross Profit and Contract Price. Complete this part for all years of the installment agreement. 4. PR.08-05 5. PR.08-07 5 5 6. PR.08-08. Algo 6 Selling price including mortgages and other debts. Don't include interest, whether stated or unstated Mortgages, debts, and other liabilities the buyer assumed or took the property subject (see instructions) 6 7. PR.08-09. Algo 7 Subtract line 6 from line 5 7 8. PR.08-14 Algo 8 Cost or other basis of property sold 8 9. PR.08-16.Algo 9 Depreciation allowed or allowable. 9 10. PR.08-17 10 Adjusted basis. Subtract line 9 from line 8 10 11 11 11. PR.08-19.Algo Commissions and other expenses of sale 12 Income recapture from Form 4797, Part III (see instructions) 12 12. PR.08-21.Algo 13 Add lines 10, 11, and 12 ... 13 14 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form. See instructions. 14 15 If the property described on line 1 above was your main home, enter the amount of your excluded gain. See instructions. Otherwise, enter-O-.. 15 16 Gross profit. Subtract line 15 from line 14 ..... 16 17 Subtract line 13 from line 6. If zero or less, enter-O- 17 18 Contract price. Add line 7 and line 17 18 Part II Installment Sale Income. Complete this part for all years of the installment agreement. 10 Groce nrofit norrontaan launraceod an dorimolamount Divide lino 16 kulina 10 Carvoare after the voar Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Chapter 8 Assignment 2 eBook Part II ? 1. PR.08-01 Installment Sale Income. Complete this part for all years of the installment agreement. 2. PR.08-03 19 19 Gross profit percentage (expressed as a decimal amount). Divide line 16 by line 18. (For years after the year of sale, see instructions) If this is the year of sale, enter the amount from line 17. Otherwise, enter-O- 3. PR.08-04.Algo 20 20 4. PR.08-05 21 Payments received during year (see instructions). Don't include interest, whether stated or unstated.. 21 22 Add lines 20 and 21 ... 22 5. PR.08-07 23 Payments received in prior years (see instructions). Don't include interest, whether stated or unstated 23 6. PR.08-08. Algo 24 Installment sale income. Multiply line 22 by line 19... 24 7. PR.08-09. Algo 25 Enter the part of line 24 that is ordinary income under the recapture rules. See instructions ..... 25 8. PR.08-14.Algo 26 Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797. See instructions ..... 26 9. PR.08-16.Algo Part III Related Party Installment Sale Income. Don't complete if you received the final payment this tax year. 27 Name, address, and taxpayer identifying number of related party 10. PR.08-17 11. PR.08-19.Algo 12. PR.08-21.Algo 28 Did the related party resell or dispose of the property ("second disposition") during this tax year? ... Yes No 29 If the answer to question 28 is "Yes," complete lines 30 through 37 below unless one of the following conditions is met. Check the box that applies. a - The second disposition was more than 2 years after the first disposition (other than dispositions of marketable securities). If this box is checked, enter the date of disposition (mm/dd/yyyy).. b - The first disposition was a sale or exchange of stock to the issuing corporation. c - The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition. d - The second disposition occurred after the death of the original seller or buyer. e It can be established to the satisfaction of the IRS that tax avoidance wasn't a principal purpose for either of the dispositions. If this box is checked, attach an explanation. See instructions. 30 Selling price of property sold by related party (see instructions) 30 31 Enter contract price from line 18 for year of first sale. 31 32 Enter the smaller of line 30 or line 31 32 Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Chapter 8 Assignment 2 eBook 30 1. PR.08-01 31 2. PR.08-03 32 32 33 3. PR.08-04.Algo 30 Selling price of property sold by related party (see instructions) 31 Enter contract price from line 18 for year of first sale. Enter the smaller of line 30 or line 31. ... 33 Total payments received by the end of your 2020 tax year (see instructions) 34 Subtract line 33 from line 32. If zero or less, enter - 0 - 35 Multiply line 34 by the gross profit percentage on line 19 for year of first sale .. 36 Enter the part of line 35 that is ordinary income under the recapture rules. See instructions .... 37 Subtract line 36 from line 35. Enter here and on Schedule D or Form 4797. See instructions For Paperwork Reduction Act Notice, see page 4. Cat. No. 13601R 34 4. PR.08-05 35 36 5. PR.08-07 37 6. PR.08-08. Algo Form 6252 (2020) 7. PR.08-09. Algo Feedback 8. PR.08-14.Algo 9. PR.08-16.Algo Check My Work Partially correct 10. PR.08-17 c. Assuming Steve collects $5,000 (not including interest) of the note principal in the year following the year of sale, calculate the amount of income recognized in that year under the installment sale method. 11. PR.08-19.Algo Round your answer to the nearest dollar. 1,205 12. PR.08-21. Algo Feedback Check My Work Correct Feedback Check My Work Partially correct Check My Work 4 more Check My Work uses remaining. Previous Next Progress: 10/12 items Assignment Score: 66.79% All work saved. Email Instructor Save and Exit Submit Assignment for Grading