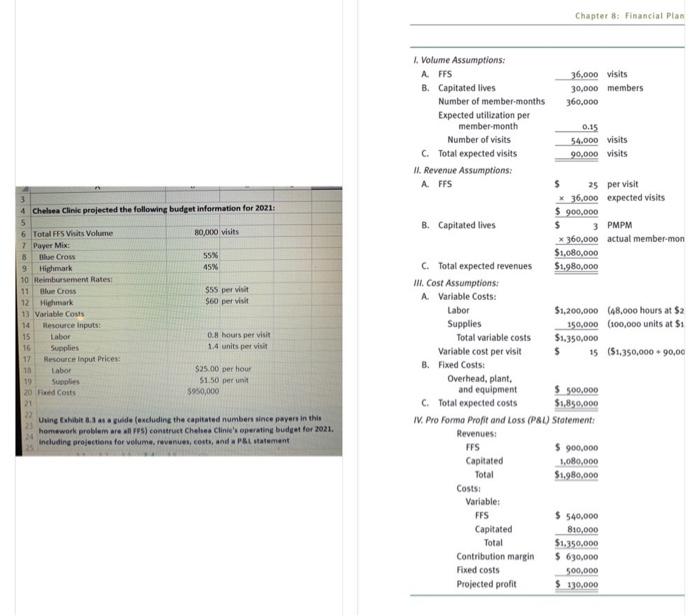

Chapter 8: Financial Plan 4 Chelsea Clinic projected the following budget information for 2021 80,000 visit: 55X 45% $55 per visit $60 per visit 6 Total FFs Visits Volume 7 Payer Mix 6 the Cross 9 Highmark 10 Heimbursement Rates 11 Blue Cross 12 Highmark 13 Variable costs 14 Resource Inputs: 15 Labor 16 Supplies 17 Resource Input Prices 10 Labor 19 Supplies 20 Red Costs Volume Assumptions: AFFS 36,000 visits B. Capitated lives 30,000 members Number of member-months 360,000 Expected utilization per member-month 0.15 Number of visits 54.000 visits C. Total expected visits 90,000 visits I. Revenue Assumptions: AFFS 25 per visit X 36,000 expected visits $ 900,000 B. Capitated lives 3 PMPM x 360,000 actual member-mon $1,080,000 Total expected revenues $1,980,000 III. Cost Assumptions: A Variable Costs: Labor $1,200,000 (48.000 hours at $2 Supplies 150,000 (100,000 units at $1 Total variable costs $1.350,000 Variable cost per visit 15 ($1.350,000 90,00 B. Fixed Costs: Overhead, plant, and equipment $ 300,000 Total expected costs $1,850,000 IV. Pro Forma Profit and Loss (P&U) Statement Revenues: FFS $ 900,000 Capitated 1,080,000 Total $1,980,000 Costs: Variable: FFS $540,000 Capitated 810,000 Total $1,350,000 Contribution margin $ 630,000 Fixed costs 500,000 Projected profit $ 130,000 0.8 hours per visit 1.4 units per visit $25.00 per hour 51 50 per un $950,000 Using Exhibit 8.3 guide (excluding the capitated numbers since payers in this homework problem are all FFS) construct Chelsea Clinie's operating budget for 2021. including projections for volume, revenues, costs, and a statement Chapter 8: Financial Plan 4 Chelsea Clinic projected the following budget information for 2021 80,000 visit: 55X 45% $55 per visit $60 per visit 6 Total FFs Visits Volume 7 Payer Mix 6 the Cross 9 Highmark 10 Heimbursement Rates 11 Blue Cross 12 Highmark 13 Variable costs 14 Resource Inputs: 15 Labor 16 Supplies 17 Resource Input Prices 10 Labor 19 Supplies 20 Red Costs Volume Assumptions: AFFS 36,000 visits B. Capitated lives 30,000 members Number of member-months 360,000 Expected utilization per member-month 0.15 Number of visits 54.000 visits C. Total expected visits 90,000 visits I. Revenue Assumptions: AFFS 25 per visit X 36,000 expected visits $ 900,000 B. Capitated lives 3 PMPM x 360,000 actual member-mon $1,080,000 Total expected revenues $1,980,000 III. Cost Assumptions: A Variable Costs: Labor $1,200,000 (48.000 hours at $2 Supplies 150,000 (100,000 units at $1 Total variable costs $1.350,000 Variable cost per visit 15 ($1.350,000 90,00 B. Fixed Costs: Overhead, plant, and equipment $ 300,000 Total expected costs $1,850,000 IV. Pro Forma Profit and Loss (P&U) Statement Revenues: FFS $ 900,000 Capitated 1,080,000 Total $1,980,000 Costs: Variable: FFS $540,000 Capitated 810,000 Total $1,350,000 Contribution margin $ 630,000 Fixed costs 500,000 Projected profit $ 130,000 0.8 hours per visit 1.4 units per visit $25.00 per hour 51 50 per un $950,000 Using Exhibit 8.3 guide (excluding the capitated numbers since payers in this homework problem are all FFS) construct Chelsea Clinie's operating budget for 2021. including projections for volume, revenues, costs, and a statement