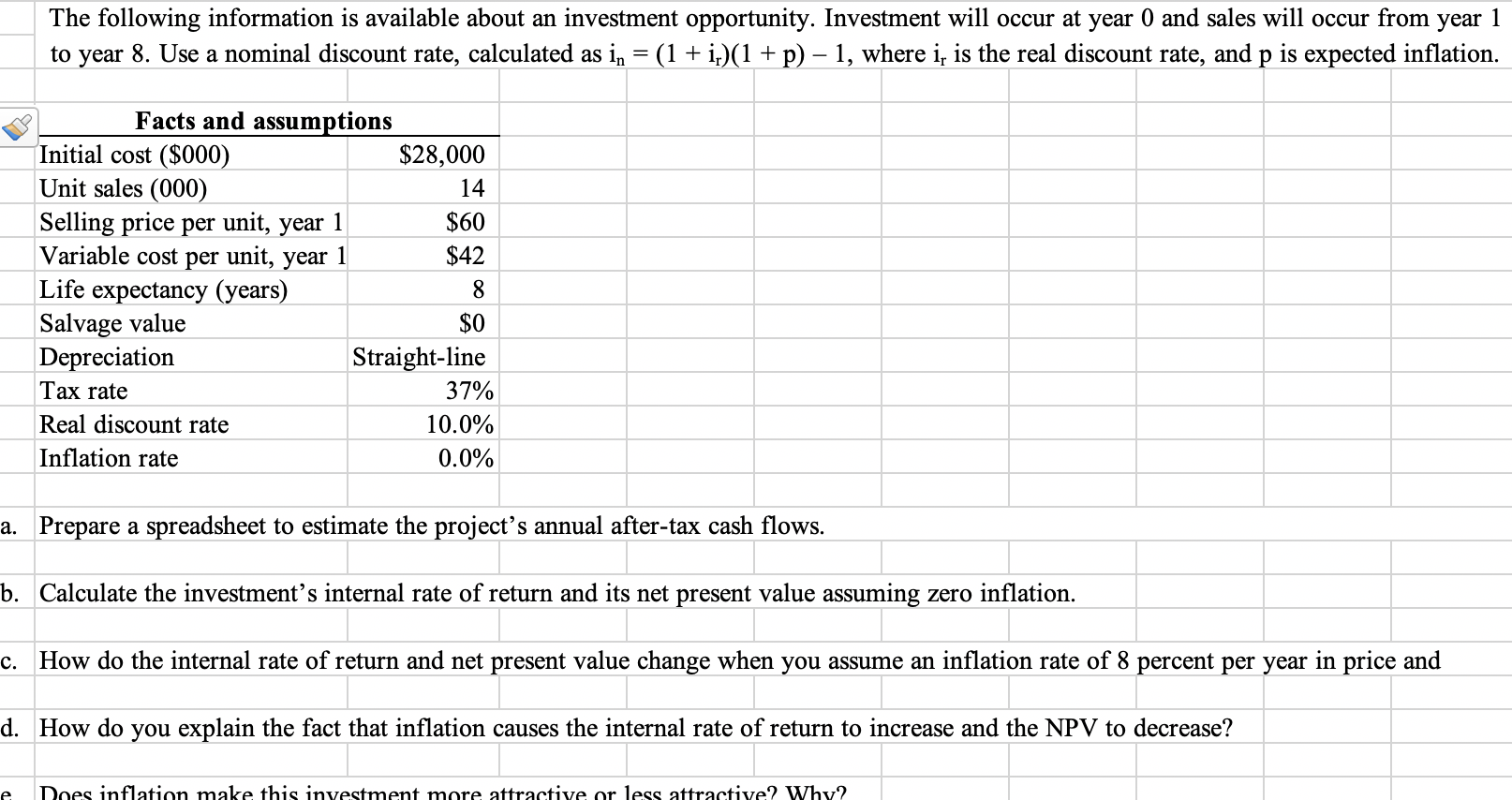

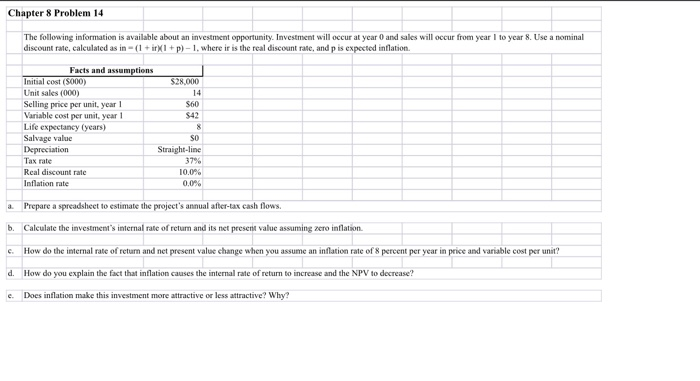

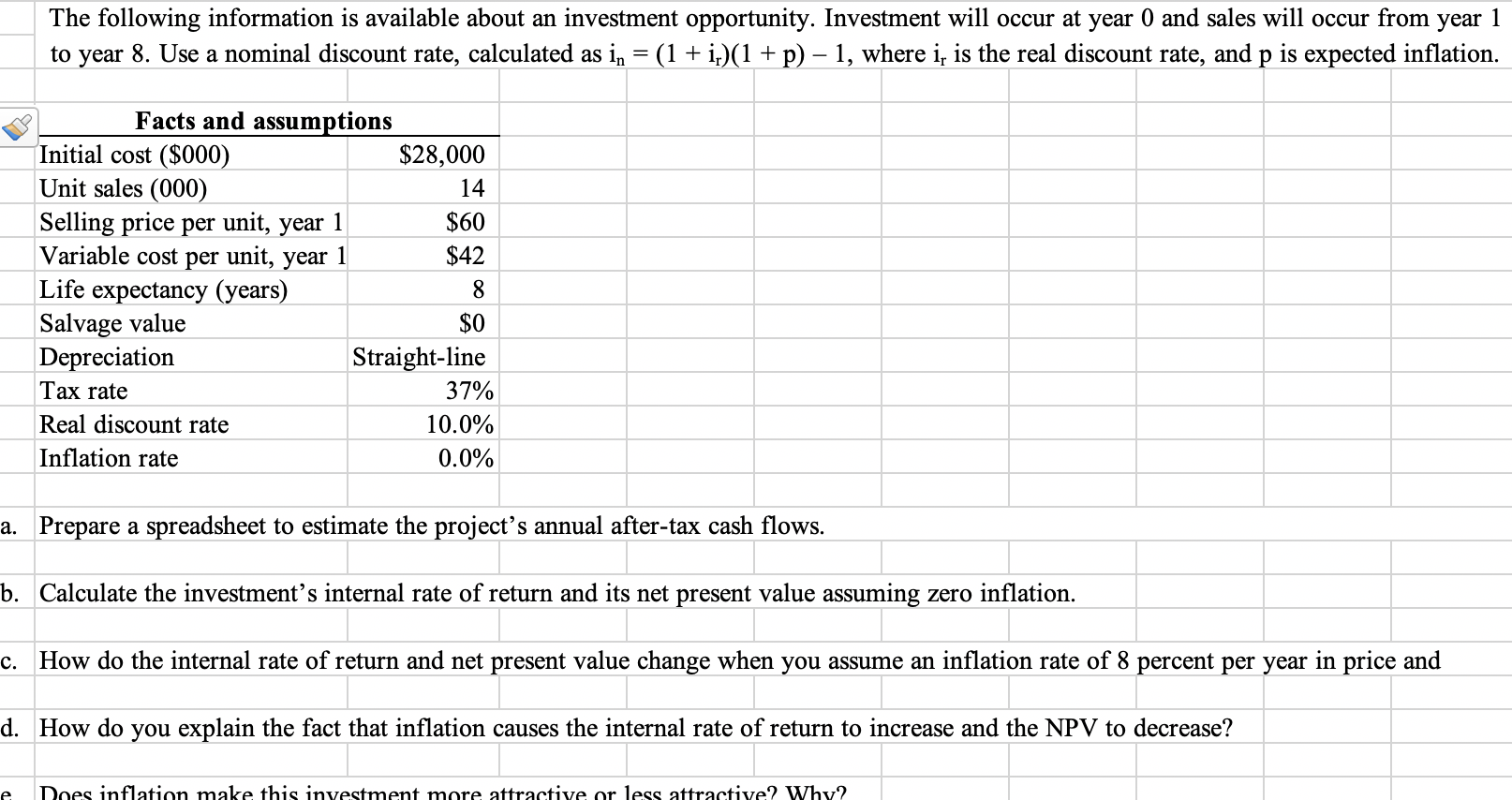

Chapter 8 Problem 14 The following information is available about an investment opportunity. Investment will occur at year and sales will occur from year I to year 8. Use a nominal discount rate, calculated as in- (1 + ir 1+ p)-1. where ir is the real discount rate, and p is expected inflation $28.000 14 S60 $42 Facts and assumptions Initial cost (5000) Unit sales (000) Selling price per unit, year! Variable cost per unit, year 1 Life expectancy (years) Salvage value Depreciation Tax rate Real discount rate Inflation rate Straight-line 37% 10.0% 0 0% Prepare a spreadsheet to estimate the project's annual after-tax cash flows. b. Calculate the investments internal rate of return and its net present value assuming zero inflation c. How do the internal rate of return and not present value change when you assume an inflation rate of 8 percent per year in price and variable cost per unit? d. How do you explain the fact that inflation causes the internal rate of return to increase and the NPV to decrease? c. Does inflation make this investment more attractive or less attractive? Why? Chapter 8 Problem 14 The following information is available about an investment opportunity. Investment will occur at year and sales will occur from year I to year 8. Use a nominal discount rate, calculated as in- (1 + ir 1+ p)-1. where ir is the real discount rate, and p is expected inflation $28.000 14 S60 $42 Facts and assumptions Initial cost (5000) Unit sales (000) Selling price per unit, year! Variable cost per unit, year 1 Life expectancy (years) Salvage value Depreciation Tax rate Real discount rate Inflation rate Straight-line 37% 10.0% 0 0% Prepare a spreadsheet to estimate the project's annual after-tax cash flows. b. Calculate the investments internal rate of return and its net present value assuming zero inflation c. How do the internal rate of return and not present value change when you assume an inflation rate of 8 percent per year in price and variable cost per unit? d. How do you explain the fact that inflation causes the internal rate of return to increase and the NPV to decrease? c. Does inflation make this investment more attractive or less attractive? Why