Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chapter 8 question 4 will also be posted many many more questiond if this was easy please find the other questions thank you Diaz Company

chapter 8 question 4

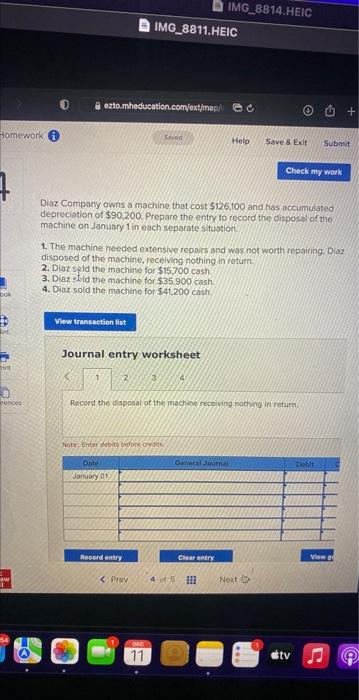

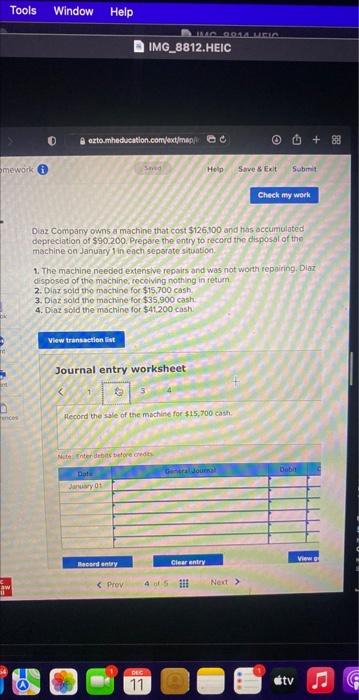

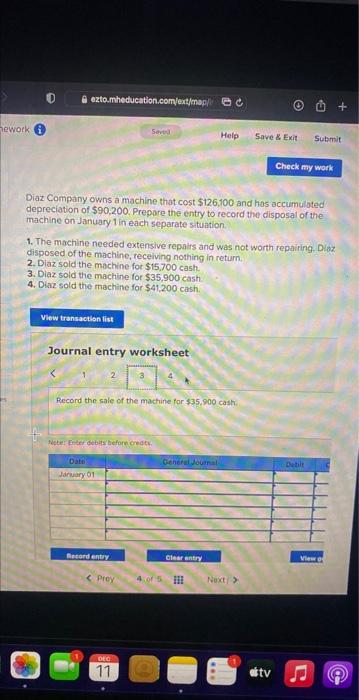

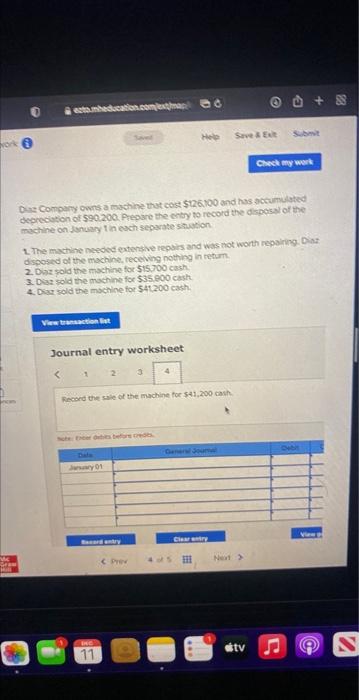

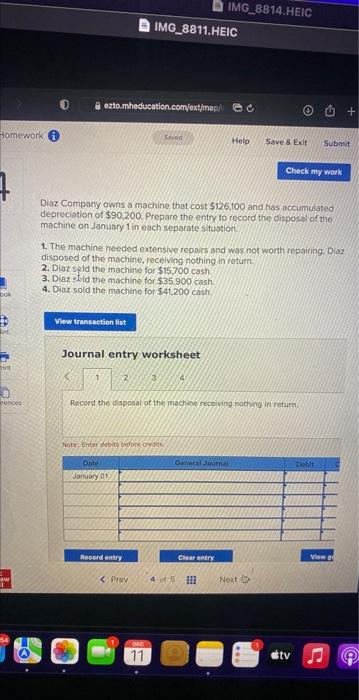

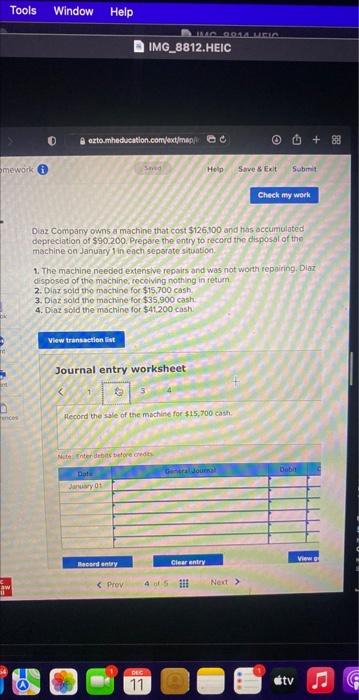

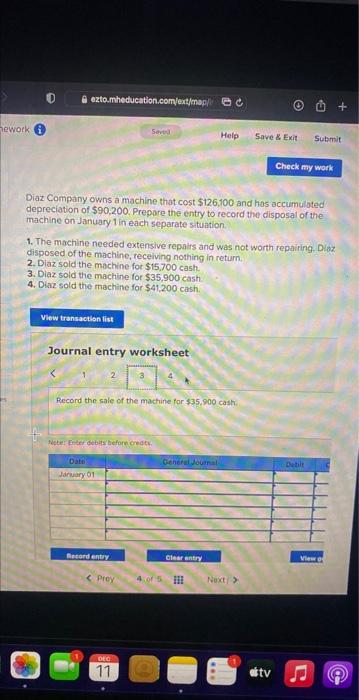

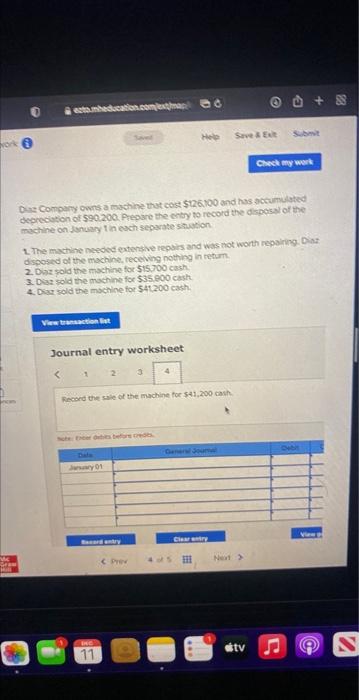

Diaz Company owns a machine that cost $126,100 and fias accumulated depreciation of $90,200. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repails and was not wonth repaining Diaz disposed of the machine, receiving nothing in retum. 2. Diaz seld the machine for $15700 cash 3. Diaz s.id the machine for $35,900 cash. 4. Diaz sold the machine for $41.200 cash Journal entry worksheet 2. 21/3 Pecord the disposal of the machire receling nothing in return. Fenter Enter debits pefore critith. Diaz Compary owns a machine that cost $126,00 and thas oceumulated depreciation of $90,200. Prepave the entry to recard the disposal of the machine on January 1 in each seporate situabion. 1. The machine needed extensive repairs and was not worth repoiring. Diaz disposed of the machine, recoiving nothing in retum 2. Dinz sold the machine for $15.700cash 3. Diaz sold the machine for $35,900cash. 4. Diaz sold the machine for $41.200cash. Journal entry worksheet Hecond the sale of the machine for 315,700 cash. Diaz Company owns a machine that cost $126,100 and has accumulated depreciation of $90,200. Prepare the entry to record the disposal of the machine on January 1 in each separate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, recelving nothing in return. 2. Diaz sold the machine for $15,700cash. 3. Diaz sold the machine for $35,900 cash. 4. Diaz sold the machine for $41,200cash. Journal entry worksheet will also be posted many many more questiond if this was easy please find the other questions thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started