Answered step by step

Verified Expert Solution

Question

1 Approved Answer

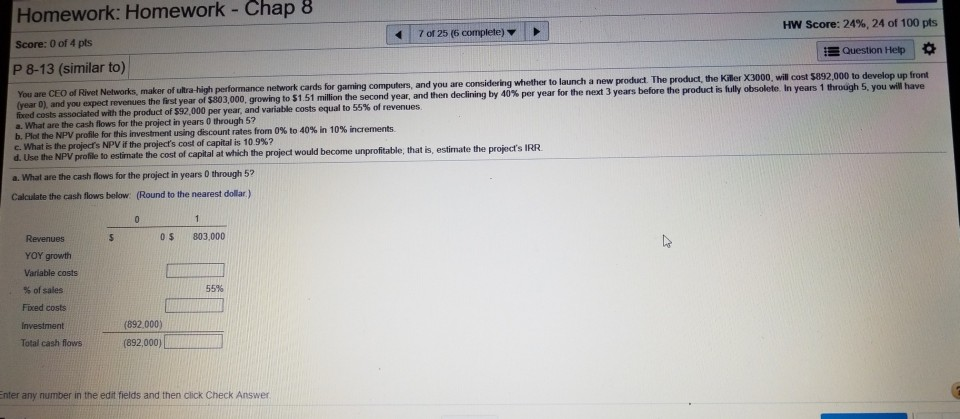

chapter 8 question 7 please explain this problem and where the numbers come from also need help explaining the graph and table solve from a

chapter 8 question 7 please explain this problem and where the numbers come from also need help explaining the graph and table

solve from a to d

Chap8 Homework: Homework - Score: 0 of 4 pts P 8-13 (similar to) You are CEO of Rivet HW Score: 24%, 24 of 100 pts 70125 (6 complete) Question Help X3000, will cost $892,000 to develop up front computers, and you are considering whether to launch a new product. The product, the Kiler second year, and then dedining by 40% per year for the next 3 years before the product is fully obsolete in years 1 Networks, maker of ultra-high performance network cards for (year 0), and you expect revenues the first year of $803,000, growing to $1.51 million the second year, and then costs associated with the product of $92,000 per year, and variable costs equal to 55% of revenues What are the cash flows for the project in years 0 through 5? for this investment using discount rates from 0% to 40% in 10% increments c. What is the projet NPV if the project's cost of capital is 10.9%? Use the NPV profile to estimate the cost of capital at which the project would become unprofitable, that is, estimate the project's IRR a. What are the cash flows for the project in years 0 through 52 Calculate the cash flows below: (Round to the nearest dollar) $ 803,000 Revenues YOY growth Varlable costs %Of sales Fixed costs Investment Total cash flows 55% (892.000) (892,000) nter any number in the edit fields and then click Check Answer Chap8 Homework: Homework - Score: 0 of 4 pts P 8-13 (similar to) You are CEO of Rivet HW Score: 24%, 24 of 100 pts 70125 (6 complete) Question Help X3000, will cost $892,000 to develop up front computers, and you are considering whether to launch a new product. The product, the Kiler second year, and then dedining by 40% per year for the next 3 years before the product is fully obsolete in years 1 Networks, maker of ultra-high performance network cards for (year 0), and you expect revenues the first year of $803,000, growing to $1.51 million the second year, and then costs associated with the product of $92,000 per year, and variable costs equal to 55% of revenues What are the cash flows for the project in years 0 through 5? for this investment using discount rates from 0% to 40% in 10% increments c. What is the projet NPV if the project's cost of capital is 10.9%? Use the NPV profile to estimate the cost of capital at which the project would become unprofitable, that is, estimate the project's IRR a. What are the cash flows for the project in years 0 through 52 Calculate the cash flows below: (Round to the nearest dollar) $ 803,000 Revenues YOY growth Varlable costs %Of sales Fixed costs Investment Total cash flows 55% (892.000) (892,000) nter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started