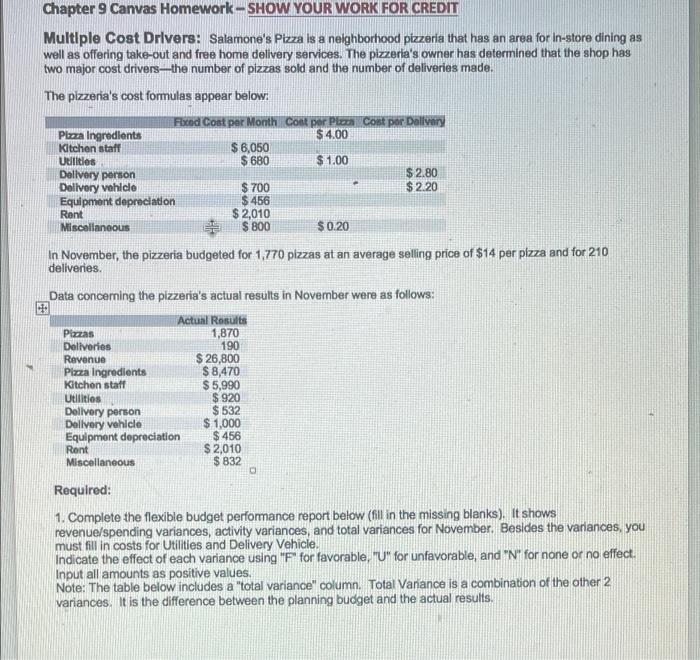

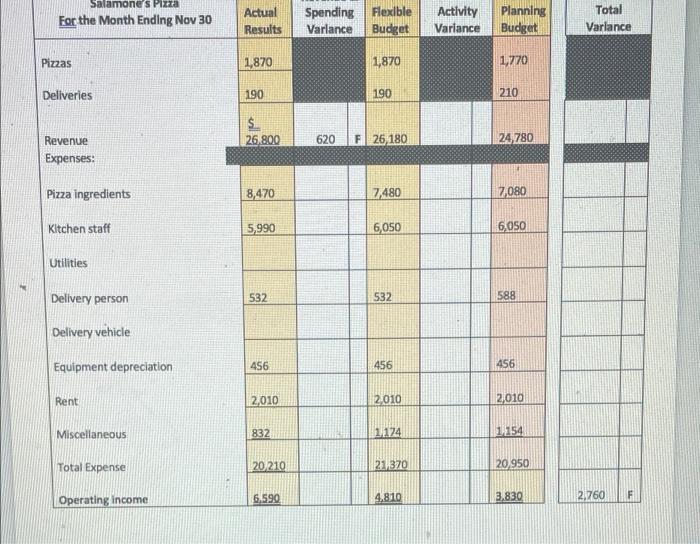

Chapter 9 Canvas Homework-SHOW YOUR WORK FOR CREDIT Multiple Cost Drivers: Salamone's Pizza is a neighborhood pizzeria that has an area for in-store dining as well as offering take-out and free home delivery services. The pizzeria's owner has determined that the shop has two major cost driversthe number of pizzas sold and the number of deliveries made. The pizzeria's cost formulas appear below. Rated Cost per Month Cont per Pizza Cost per Delivery Plan Ingredients $ 4.00 Kitchen staff $ 6,050 Utilities $ 680 $ 1.00 Delivery person $ 2.80 Delivery vehicle $ 700 $ 2.20 Equipment depreciation $ 456 Rent $ 2,010 Miscellaneous $ 800 $0.20 In November, the pizzeria budgeted for 1,770 pizzas at an average selling price of $14 per pizza and for 210 deliveries. Data concerning the pizzeria's actual results in November were as follows: Actual Results Pizzas 1,870 Deliveries 190 Revenue $ 26,800 Pizza Ingredients $ 8,470 Kitchon staff $ 5,990 Utilities $920 Delivery person $ 532 Delivery vehicle $ 1,000 Equipment depreciation $ 456 Rent $ 2,010 Miscellaneous $ 832 O Required: 1. Complete the flexible budget performance report below (fill in the missing blanks). It shows revenue/spending variances, activity variances, and total variances for November. Besides the variances, you must fill in costs for Utilities and Delivery Vehicle. Indicate the effect of each variance using "F" for favorable, "U" for unfavorable, and "N" for none or no effect. Input all amounts as positive values. Note: The table below includes a "total variance" column. Total Variance is a combination of the other 2 variances. It is the difference between the planning budget and the actual results. Salamones Pizza For the Month Ending Nov 30 Actual Results Spending Flexble Varlance Budget Activity Variance Planning Budget Total Varlance Pizzas 1,870 1,870 1,770 Deliveries 190 190 210 will GM 26.800 620 E 26 180 24,780 Revenue Expenses: Pizza ingredients 8,470 7,480 7,080 Kitchen staff 5,990 6,050 6,050 Utilities Delivery person 532 532 588 Delivery vehicle Equipment depreciation 456 456 456 Rent 2,010 2,010 2,010 Miscellaneous 832 12.24 1.154 Total Expense 20210 21370 20,950 6,590 4.810 Operating income 3.830 2,760 F