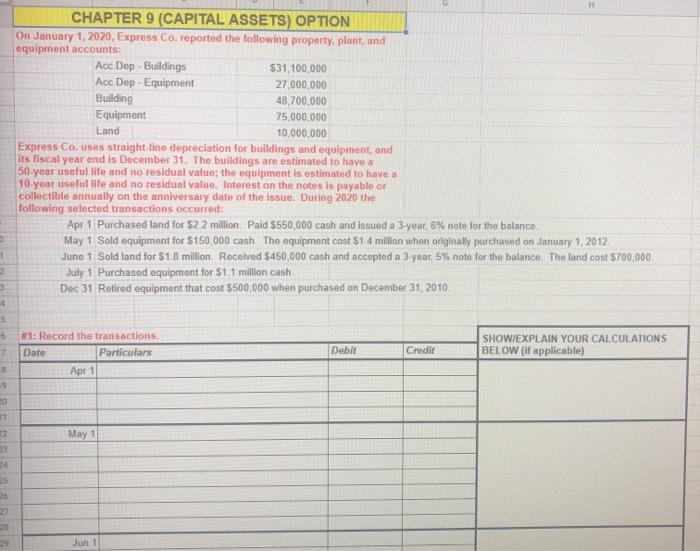

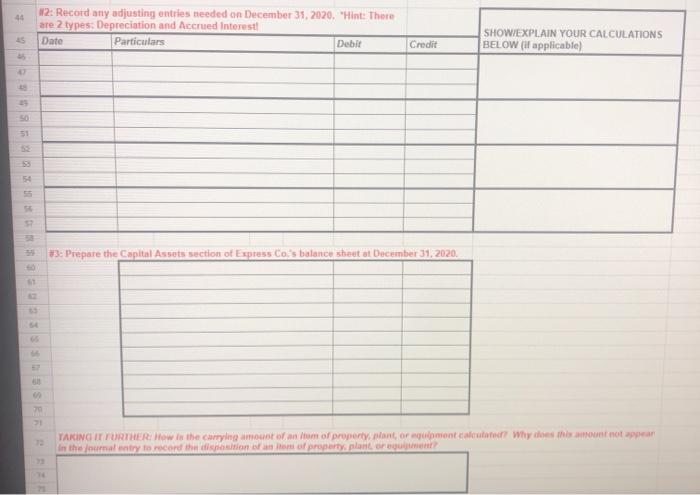

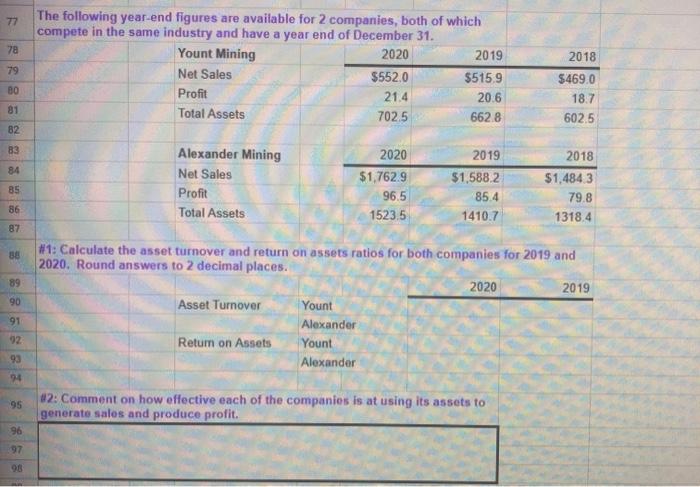

CHAPTER 9 (CAPITAL ASSETS) OPTION On January 1, 2020, Express Co, reported the following property, plant, and equipment accounts: Ace Dep - Buildings $31,100.000 Ace Dep - Equipment 27,000,000 Building 48,700.000 Equipment 75,000,000 Land 10,000,000 Express Couses straight line depreciation for buildings and equipment, and its fiscal year end is December 31. The buildings are estimated to have a 50 year useful life and no residual value; the equipment is estimated to have a 10 year useful life and no residual value. Interest on the notes is payable or collectible annually on the anniversary date of the issue. During 2020 the following selected transactions occurred: Apr 1Purchased land for 52 2 million. Pald 5550,000 cash and issued a 3-year, 6% note for the balance May 1 Sold equipment for 5150,000 cash The equipment cost 51.4 million whon originally purchased on January 1, 2012 Juna 1 Sold land for $1.8 million Received 5450,000 cash and accepted a 3 year, 5% note for the balance. The land cost $700,000 July 1 Purchased equipment for 51 1 million cash Dec 31 Retired equipment that cost $500,000 when purchased on December 31, 2010 1 4 5 1: Record the transactions Date Particulars SHOWIEXPLAIN YOUR CALCULATIONS BELOW (if applicable) 7 Debit Credit 3 Apr1 11 May 1 23 24 Jun 1 14 #2: Record any adjusting entries needed on December 31, 2020. 'Hint: There are 2 tyness Depreciation and Accrued Interest Date Particulars Debir 15 Credit SHOWEXPLAIN YOUR CALCULATIONS BELOW (if applicable) 35 90 51 33: Prepare the Capital Assets section of Express Cos balance sheet at December 31, 2020. TAKING IT FURTHER How in the carrying amount of an em of property, plant or equipment Moottor? Why con mount not appear In the formaty to record the snosition of not of roperty.planter 77 78 The following year-end figures are available for 2 companies, both of which compete in the same industry and have a year end of December 31. Yount Mining 2020 2019 Net Sales $552.0 $5159 Profit 21.4 20.6 Total Assets 7025 6628 79 BO 2018 $469.0 18.7 602.5 81 82 83 84 Alexander Mining Net Sales Profit Total Assets 85 2020 $1,762.9 96.5 1523.5 2019 $1,588.2 85.4 1410.7 2018 $1,4843 79.8 1318.4 86 87 38 89 90 91 #1: Calculate the asset turnover and return on assets ratios for both companies for 2019 and 2020. Round answers to 2 decimal places. 2020 2019 Asset Turnover Yount Alexander Retum on Assets Yount Alexander 02 93 24 #2: Comment on how effective each of the companies is at using its assets to generate sales and produce profit. 96 97 98