chapter 9 group work for examp please help!

9-4A

req A part B-Topeka paid November sales tax to the state agency on December 10 year one

part c-cash sales for December 84000 sales tax of 7%

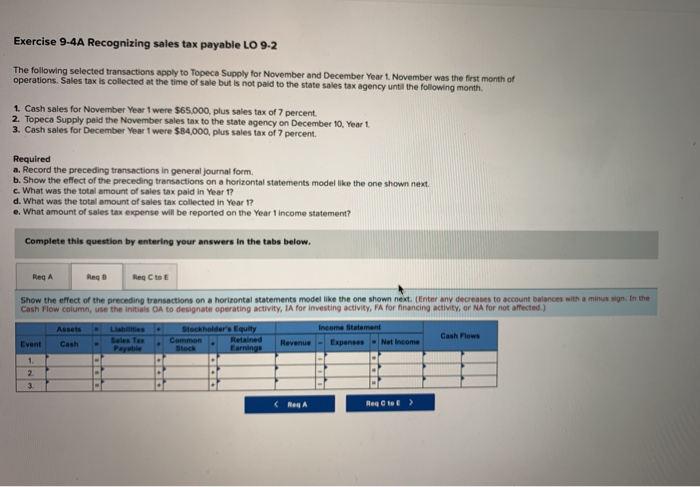

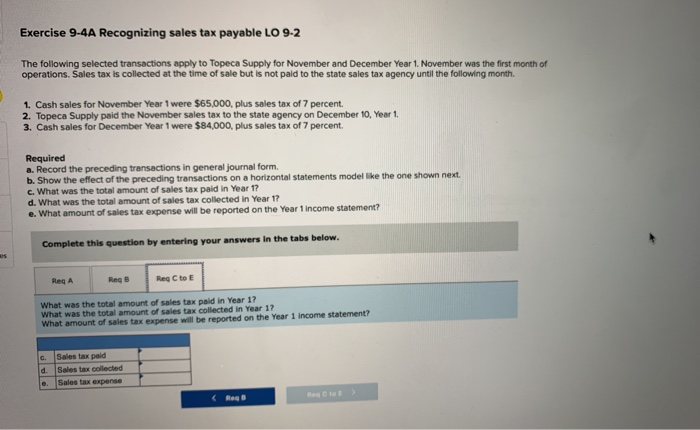

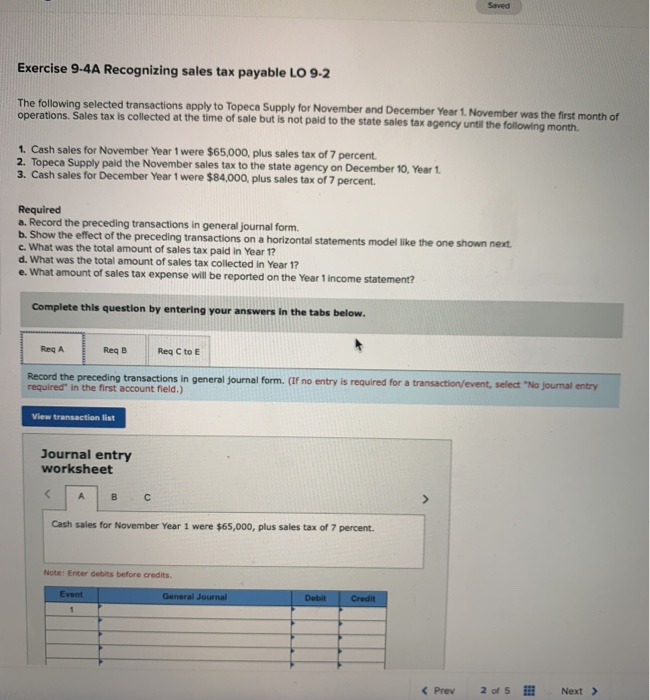

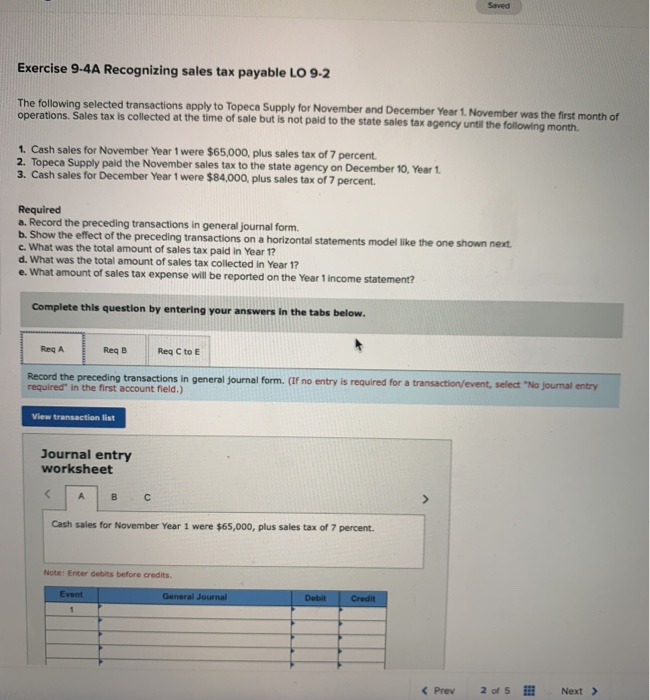

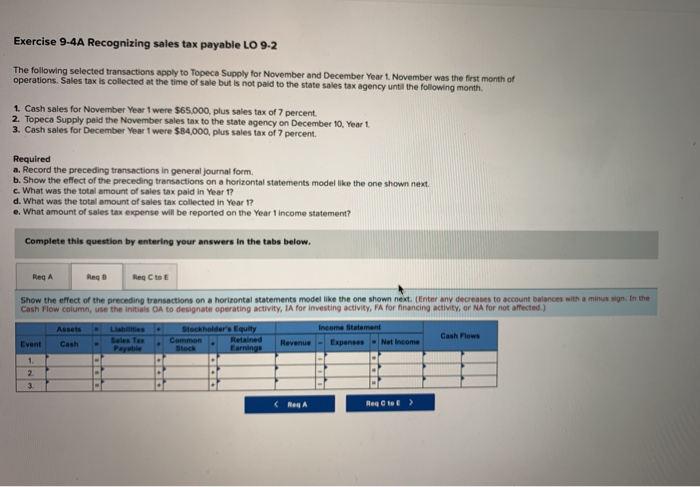

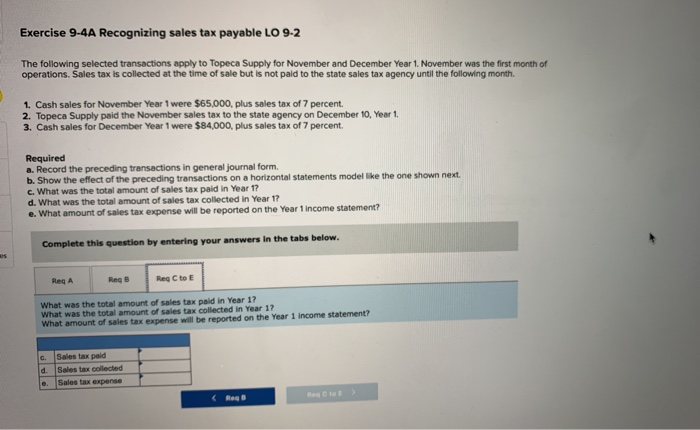

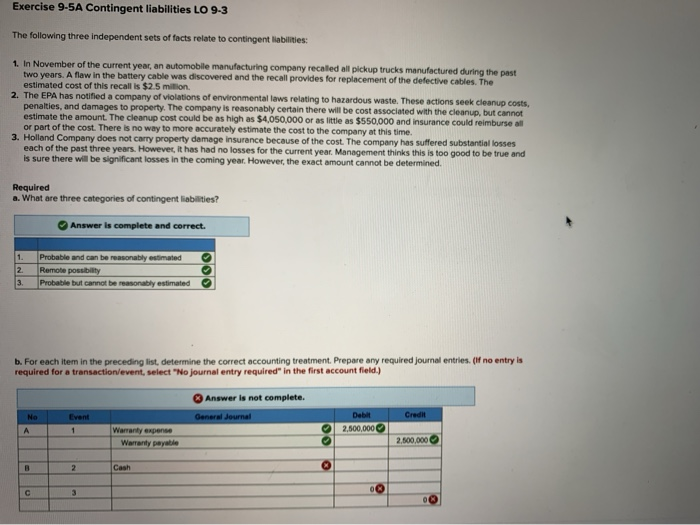

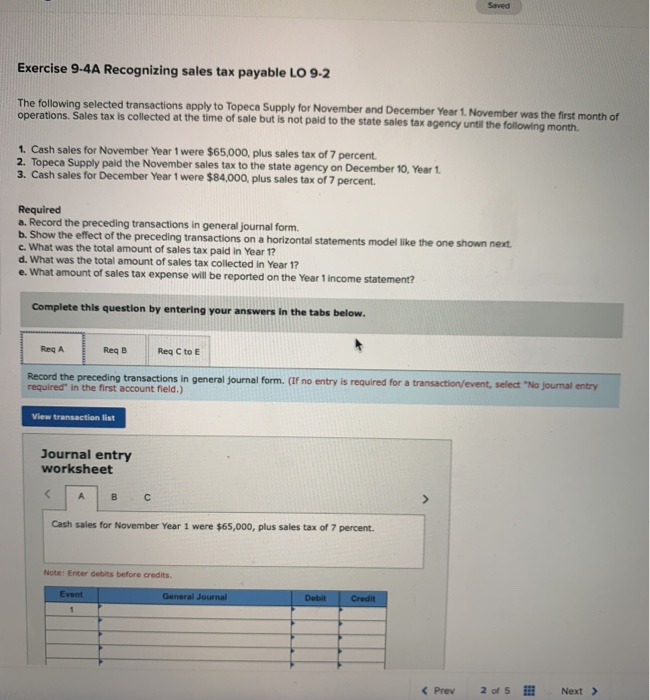

Saved Exercise 9.4A Recognizing sales tax payable LO 9-2 The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month 1. Cash sales for November Year 1 were $65,000, plus sales tax of 7 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10. Year 1 3. Cash sales for December Year 1 were $84,000, plus sales tax of 7 percent. Required a. Record the preceding transactions in general journal form. b. Show the effect of the preceding transactions on a horizontal statements model like the one shown next c. What was the total amount of sales tax paid in Year 1? d. What was the total amount of sales tax collected in Year 1? e. What amount of sales tax expense will be reported on the Year 1 income statement? Complete this question by entering your answers in the tabs below. ReqB Reg C to E Record the preceding transactions in general Journal form. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet ABC Cash sales for November Year 1 were $65,000, plus sales tax of 7 percent. Note: Enter debits before credits. Event General Journal Debit Credit Exercise 9-4A Recognizing sales tax payable LO 9-2 The following selected transactions apply to Topeca Supply for November and December Yeart. November was the first month of operations. Sales taxis collected at the time of a but is not paid to the state sales tax agency until the following month 1 Cash sales for November Year I were $65.000, plus sales tax of 7 percent 2. Topeca Supply paid the November sales tax to the state agency on December 10, Yeart 3. Cash sales for December Year I were $84.000, plus sales tax of 7 percent Required a. Record the preceding transactions in general journal form. b. Show the effect of the preceding transactions on a horizontal statements model like the one shown next. c. What was the total amount of sales tax paid in Year 17 d. What was the total amount of sales tax collected in Year 1? e. What amount of sales tax expense will be reported on the Year 1 income statement? Complete this question by entering your answers in the tabs below. ReqA Reg Reg tot Show the effect of the preceding transactions on a horirontal statements model like the one shown next. (Enter any decreases to account balances with a minus sign. In the Cash Flow column, use the initias OA to designate operating activity, IA for investing activity, FA for financing activity, or NA for not affected.) Assets - La alla Ca teholders Equity R etained Eage Cash Flows Revenue Expenses - Net Income Rect> Exercise 9-4A Recognizing sales tax payable LO 9-2 The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,000, plus sales tax of 7 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $84,000, plus sales tax of 7 percent. Required a. Record the preceding transactions in general Journal form. b. Show the effect of the preceding transactions on a horizontal statements model like the one shown next c. What was the total amount of sales tax paid in Year 17 d. What was the total amount of sales tax collected in Year 17 e. What amount of sales tax expense will be reported on the Year 1 income statement? Complete this question by entering your answers in the tabs below. Reg A Reg C to E What was the total amount of sales tax paid in Year 17 What was the total amount of sales tax collected in Year 17 What amount of sales tax expense will be reported on the Year 1 Income statement? C. Sales tax pald d. Sales tax collected le Sales tax expense Exercise 9-5A Contingent liabilities LO 9-3 The following three independent sets of facts relate to contingent liabilities: 1. In November of the current year, an automobile manufacturing company recated all pickup trucks manufactured during the past two years. A flaw in the battery cable was discovered and the recall provides for replacement of the defective cables. The estimated cost of this recall is $2.5 milion 2. The EPA has notified a company of violations of environmental laws relating to hazardous waste. These actions seek cleanup costs penalties, and damages to property. The company is reasonably certain there will be cost associated with the cleanup, but cannot estimate the amount. The cleanup cost could be as high as $4,050,000 or as little as $550,000 and insurance could reimburse all or part of the cost. There is no way to more accurately estimate the cost to the company at this time. 3. Holland Company does not carry property damage insurance because of the cost. The company has suffered substantial losses each of the past three years. However, it has had no losses for the current year. Management think this is too good to be true and is sure there will be significant losses in the coming year. However, the exact amount cannot be determined Required a. What are three categories of contingent liabilities? Answer is complete and correct. 1. 2 3. Probable and can be reasonably estimated Remote possibility Probable but cannot be e nably estimated b. For each item in the preceding list. determine the correct accounting treatment. Prepare any required journal entries. (If no entry is required for a transaction levent, select "No journal entry required in the first account field.) Answer is not complete. De General Journal Credit Event 2 Cash