Question

Chapter 9 Homework 1. How do successful efforts companies account for developmental costs? 2. What is a service well? How is it classified? 3. What

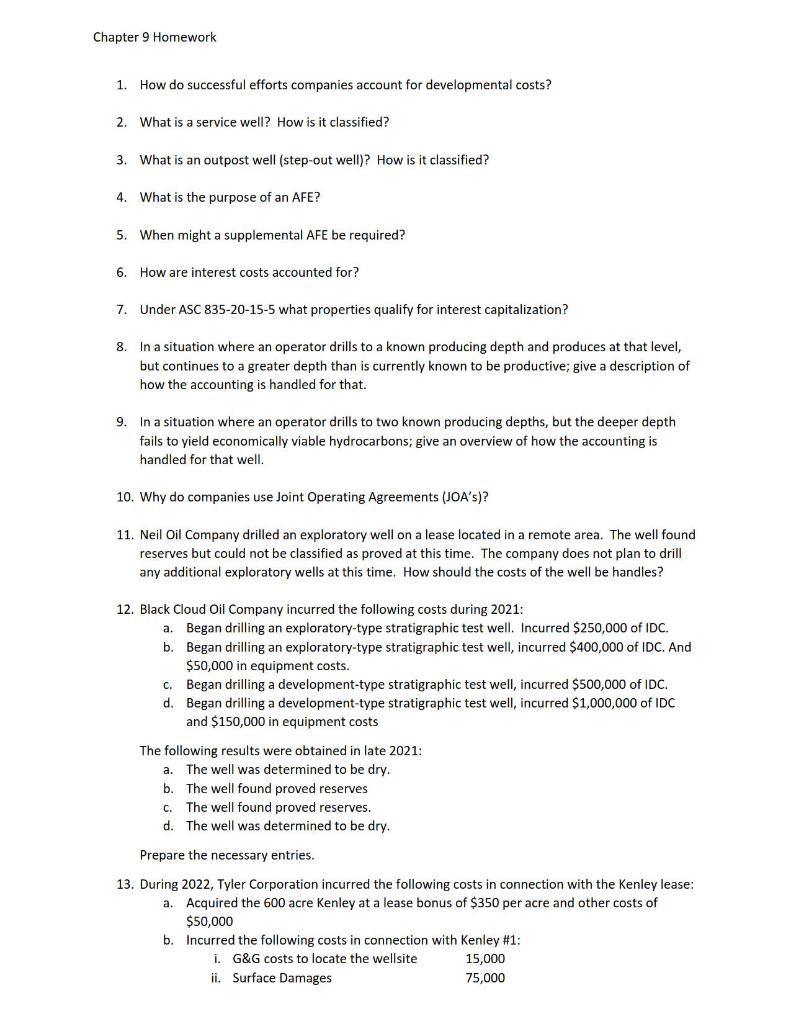

Chapter 9 Homework

1. How do successful efforts companies account for developmental costs?

2. What is a service well? How is it classified?

3. What is an outpost well (step-out well)? How is it classified?

4. What is the purpose of an AFE?

5. When might a supplemental AFE be required?

6. How are interest costs accounted for?

7. Under ASC 835-20-15-5 what properties qualify for interest capitalization?

8. In a situation where an operator drills to a known producing depth and produces at that level, but continues to a greater depth than is currently known to be productive; give a description of how the accounting is handled for that.

9. In a situation where an operator drills to two known producing depths, but the deeper depth fails to yield economically viable hydrocarbons; give an overview of how the accounting is handled for that well.

10. Why do companies use Joint Operating Agreements (JOAs)?

11. Neil Oil Company drilled an exploratory well on a lease located in a remote area. The well found reserves but could not be classified as proved at this time. The company does not plan to drill any additional exploratory wells at this time. How should the costs of the well be handles?

12. Black Cloud Oil Company incurred the following costs during 2021: a. Began drilling an exploratory-type stratigraphic test well. Incurred $250,000 of IDC. b. Began drilling an exploratory-type stratigraphic test well, incurred $400,000 of IDC. And $50,000 in equipment costs. c. Began drilling a development-type stratigraphic test well, incurred $500,000 of IDC. d. Began drilling a development-type stratigraphic test well, incurred $1,000,000 of IDC and $150,000 in equipment costs The following results were obtained in late 2021: a. The well was determined to be dry. b. The well found proved reserves c. The well found proved reserves. d. The well was determined to be dry. Prepare the necessary entries.

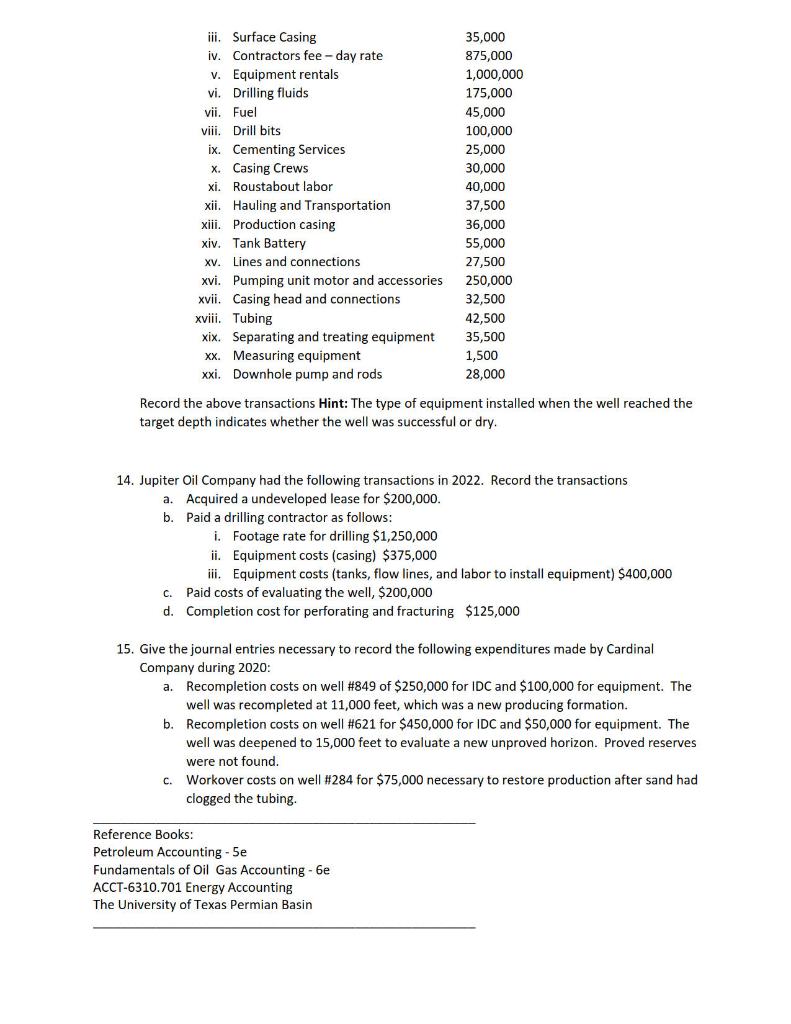

13. During 2022, Tyler Corporation incurred the following costs in connection with the Kenley lease: a. Acquired the 600 acre Kenley at a lease bonus of $350 per acre and other costs of $50,000 b. Incurred the following costs in connection with Kenley #1: i. G&G costs to locate the wellsite 15,000 ii. Surface Damages 75,000 iii. Surface Casing 35,000 iv. Contractors fee day rate 875,000 v. Equipment rentals 1,000,000 vi. Drilling fluids 175,000 vii. Fuel 45,000 viii. Drill bits 100,000 ix. Cementing Services 25,000 x. Casing Crews 30,000 xi. Roustabout labor 40,000 xii. Hauling and Transportation 37,500 xiii. Production casing 36,000 xiv. Tank Battery 55,000 xv. Lines and connections 27,500 xvi. Pumping unit motor and accessories 250,000 xvii. Casing head and connections 32,500 xviii. Tubing 42,500 xix. Separating and treating equipment 35,500 xx. Measuring equipment 1,500 xxi. Downhole pump and rods 28,000 Record the above transactions Hint: The type of equipment installed when the well reached the target depth indicates whether the well was successful or dry.

14. Jupiter Oil Company had the following transactions in 2022. Record the transactions a. Acquired a undeveloped lease for $200,000. b. Paid a drilling contractor as follows: i. Footage rate for drilling $1,250,000 ii. Equipment costs (casing) $375,000 iii. Equipment costs (tanks, flow lines, and labor to install equipment) $400,000 c. Paid costs of evaluating the well, $200,000 d. Completion cost for perforating and fracturing $125,000

15. Give the journal entries necessary to record the following expenditures made by Cardinal Company during 2020: a. Recompletion costs on well #849 of $250,000 for IDC and $100,000 for equipment. The well was recompleted at 11,000 feet, which was a new producing formation. b. Recompletion costs on well #621 for $450,000 for IDC and $50,000 for equipment. The well was deepened to 15,000 feet to evaluate a new unproved horizon. Proved reserves were not found. c. Workover costs on well #284 for $75,000 necessary to restore production after sand had clogged the tubing. ______________________________________________________ Reference Books: Petroleum Accounting - 5e Fundamentals of Oil Gas Accounting - 6e ACCT-6310.701 Energy Accounting The University of Texas Permian Basin ______________________________________________________

6. How are interest costs accounted for? 7. Under ASC 835-20-15-5 what properties qualify for interest capitalization? 8. In a situation where an operator drills to a known producing depth and produces at that level, but continues to a greater depth than is currently known to be productive; give a description of how the accounting is handled for that. 9. In a situation where an operator drills to two known producing depths, but the deeper depth fails to yield economically viable hydrocarbons; give an overview of how the accounting is handled for that well. 10. Why do companies use Joint Operating Agreements (JOA's)? 11. Neil Oil Company drilled an exploratory well on a lease located in a remote area. The well found reserves but could not be classified as proved at this time. The company does not plan to drill any additional exploratory wells at this time. How should the costs of the well be handles? 12. Black Cloud Oil Company incurred the following costs during 2021: a. Began drilling an exploratory-type stratigraphic test well. Incurred \$250,000 of IDC. b. Began drilling an exploratory-type stratigraphic test well, incurred $400,000 of IDC. And $50,000 in equipment costs. c. Began drilling a development-type stratigraphic test well, incurred $500,000 of IDC. d. Began drilling a development-type stratigraphic test well, incurred $1,000,000 of IDC and \$150,000 in equipment costs The following results were obtained in late 2021 : a. The well was determined to be dry. b. The well found proved reserves c. The well found proved reserves. d. The well was determined to be dry. Prepare the necessary entries. 13. During 2022, Tyler Corporation incurred the following costs in connection with the Kenley lease: a. Acquired the 600 acre Kenley at a lease bonus of $350 per acre and other costs of $50,000 b. Record the above transactions Hint: The type of equipment installed when the well reached the target depth indicates whether the well was successful or dry. 14. Jupiter Oil Company had the following transactions in 2022 . Record the transactions a. Acquired a undeveloped lease for $200,000. b. Paid a drilling contractor as follows: i. Footage rate for drilling $1,250,000 ii. Equipment costs (casing) $375,000 iii. Equipment costs (tanks, flow lines, and labor to install equipment) $400,000 c. Paid costs of evaluating the well, $200,000 d. Completion cost for perforating and fracturing $125,000 15. Give the journal entries necessary to record the following expenditures made by Cardinal Company during 2020 : a. Recompletion costs on well #849 of $250,000 for IDC and $100,000 for equipment. The well was recompleted at 11,000 feet, which was a new producing formation. b. Recompletion costs on well #621 for $450,000 for IDC and $50,000 for equipment. The well was deepened to 15,000 feet to evaluate a new unproved horizon. Proved reserves were not found. c. Workover costs on well #284 for $75,000 necessary to restore production after sand had clogged the tubing. 6. How are interest costs accounted for? 7. Under ASC 835-20-15-5 what properties qualify for interest capitalization? 8. In a situation where an operator drills to a known producing depth and produces at that level, but continues to a greater depth than is currently known to be productive; give a description of how the accounting is handled for that. 9. In a situation where an operator drills to two known producing depths, but the deeper depth fails to yield economically viable hydrocarbons; give an overview of how the accounting is handled for that well. 10. Why do companies use Joint Operating Agreements (JOA's)? 11. Neil Oil Company drilled an exploratory well on a lease located in a remote area. The well found reserves but could not be classified as proved at this time. The company does not plan to drill any additional exploratory wells at this time. How should the costs of the well be handles? 12. Black Cloud Oil Company incurred the following costs during 2021: a. Began drilling an exploratory-type stratigraphic test well. Incurred \$250,000 of IDC. b. Began drilling an exploratory-type stratigraphic test well, incurred $400,000 of IDC. And $50,000 in equipment costs. c. Began drilling a development-type stratigraphic test well, incurred $500,000 of IDC. d. Began drilling a development-type stratigraphic test well, incurred $1,000,000 of IDC and \$150,000 in equipment costs The following results were obtained in late 2021 : a. The well was determined to be dry. b. The well found proved reserves c. The well found proved reserves. d. The well was determined to be dry. Prepare the necessary entries. 13. During 2022, Tyler Corporation incurred the following costs in connection with the Kenley lease: a. Acquired the 600 acre Kenley at a lease bonus of $350 per acre and other costs of $50,000 b. Record the above transactions Hint: The type of equipment installed when the well reached the target depth indicates whether the well was successful or dry. 14. Jupiter Oil Company had the following transactions in 2022 . Record the transactions a. Acquired a undeveloped lease for $200,000. b. Paid a drilling contractor as follows: i. Footage rate for drilling $1,250,000 ii. Equipment costs (casing) $375,000 iii. Equipment costs (tanks, flow lines, and labor to install equipment) $400,000 c. Paid costs of evaluating the well, $200,000 d. Completion cost for perforating and fracturing $125,000 15. Give the journal entries necessary to record the following expenditures made by Cardinal Company during 2020 : a. Recompletion costs on well #849 of $250,000 for IDC and $100,000 for equipment. The well was recompleted at 11,000 feet, which was a new producing formation. b. Recompletion costs on well #621 for $450,000 for IDC and $50,000 for equipment. The well was deepened to 15,000 feet to evaluate a new unproved horizon. Proved reserves were not found. c. Workover costs on well #284 for $75,000 necessary to restore production after sand had clogged the tubingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started