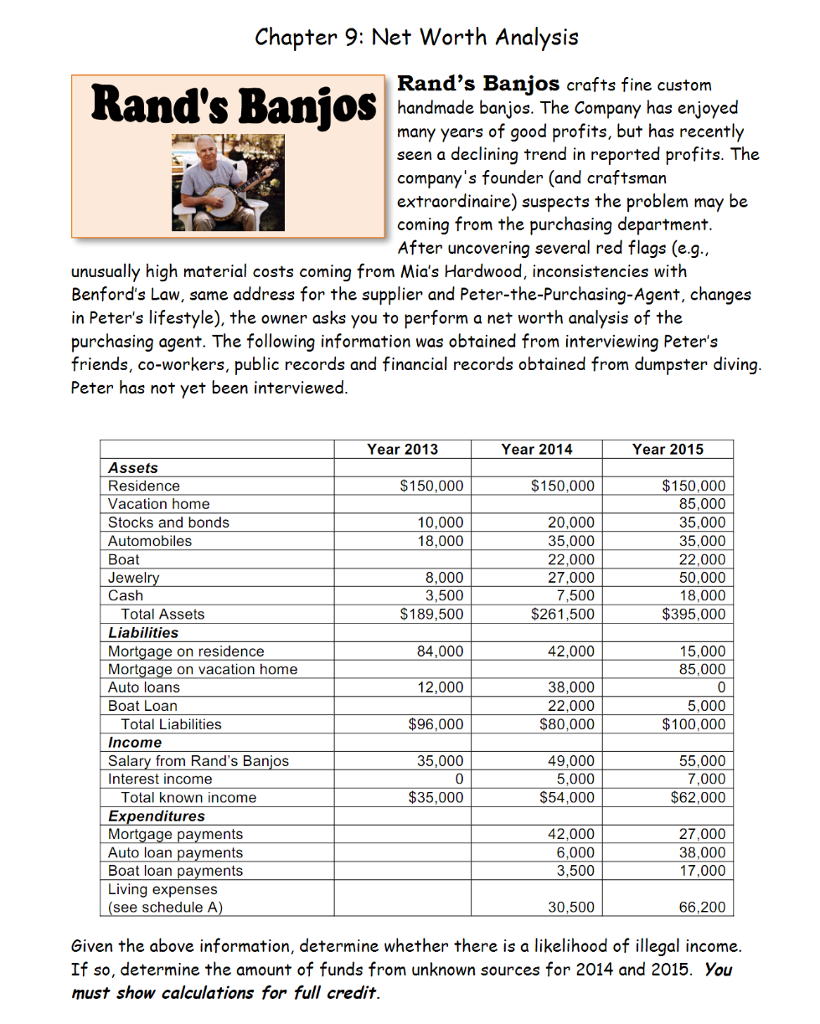

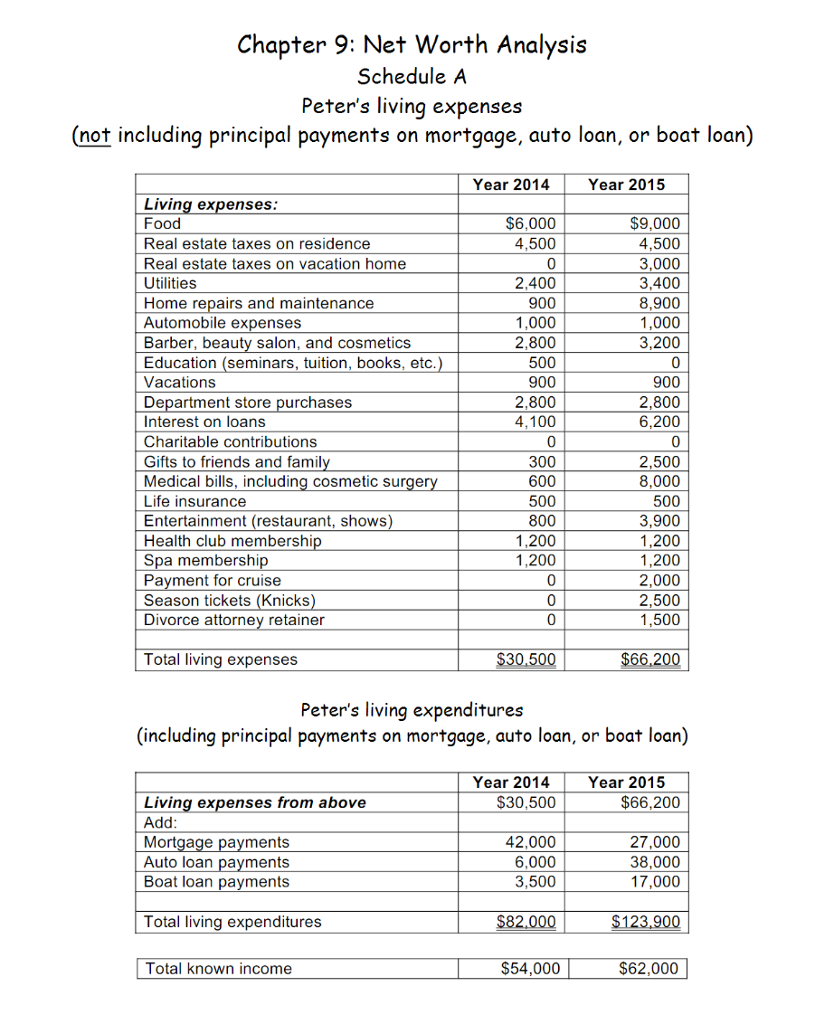

Chapter 9: Net Worth Analysis Rand's Banjos crafts fine custom Rand's Banjos handmade banjos. The Company has enjoyed many years of good profits, but has recently seen a declining trend in reported profits. The company's founder (and craftsman extraordinaire) suspects the problem may be coming from the purchasing department After uncovering several red flags (e.g unusually high material costs coming from Mia's Hardwood, inconsistencies Benford's Law, same address for the supplier and Peter-the-Purchasing-Agent, changes n Peter's lifestyle), the owner asks you to perform a net worth analysis of the purchasing agent. The following information was obtained from interviewing Peter's friends, co-workers, public records and financial records obtained from dumpster diving Peter has not yet been interviewed. Year 2013 Year 2014 Year 2015 Assets $150,000 $150,000 Residence $150,000 85,000 Vacation home 10.000 20.000 35.000 Stocks and bonds 18.000 35.000 35,000 Automobiles Boat 22,000 22,000 Jewelry 8,000 27 000 50,000 Cash 3,500 7500 18,000 Total Assets $189,500 $261,500 $395,000 Liabilities 84.000 42,000 15.000 Mortgage on residence 85,000 Mortgage on vacation home 12.000 38.000 Auto loans 22.000 5.000 Boat Loan Total Liabilities $96,000 $80,000 $100,000 Income Salary from Rand's Banios 35.000 49.000 55.000 0 5,000 7,000 Interest income S54.000 S62.000 $35,000 Total known income Expenditures 42.000 27.000 Mortgage payments 6,000 38,000 Auto loan payments 3,500 17000 Boat loan payments 30,500 00.200 Living expenses (see schedule A) Given the above information, determine whether there is a likelihood of illegal income. If so, determine the amount of funds from unknown sources for 2014 and 2015. You must show calculations for full credit. Chapter 9: Net Worth Analysis Rand's Banjos crafts fine custom Rand's Banjos handmade banjos. The Company has enjoyed many years of good profits, but has recently seen a declining trend in reported profits. The company's founder (and craftsman extraordinaire) suspects the problem may be coming from the purchasing department After uncovering several red flags (e.g unusually high material costs coming from Mia's Hardwood, inconsistencies Benford's Law, same address for the supplier and Peter-the-Purchasing-Agent, changes n Peter's lifestyle), the owner asks you to perform a net worth analysis of the purchasing agent. The following information was obtained from interviewing Peter's friends, co-workers, public records and financial records obtained from dumpster diving Peter has not yet been interviewed. Year 2013 Year 2014 Year 2015 Assets $150,000 $150,000 Residence $150,000 85,000 Vacation home 10.000 20.000 35.000 Stocks and bonds 18.000 35.000 35,000 Automobiles Boat 22,000 22,000 Jewelry 8,000 27 000 50,000 Cash 3,500 7500 18,000 Total Assets $189,500 $261,500 $395,000 Liabilities 84.000 42,000 15.000 Mortgage on residence 85,000 Mortgage on vacation home 12.000 38.000 Auto loans 22.000 5.000 Boat Loan Total Liabilities $96,000 $80,000 $100,000 Income Salary from Rand's Banios 35.000 49.000 55.000 0 5,000 7,000 Interest income S54.000 S62.000 $35,000 Total known income Expenditures 42.000 27.000 Mortgage payments 6,000 38,000 Auto loan payments 3,500 17000 Boat loan payments 30,500 00.200 Living expenses (see schedule A) Given the above information, determine whether there is a likelihood of illegal income. If so, determine the amount of funds from unknown sources for 2014 and 2015. You must show calculations for full credit