chapter 9 problem 16 Harley Dividson 2004

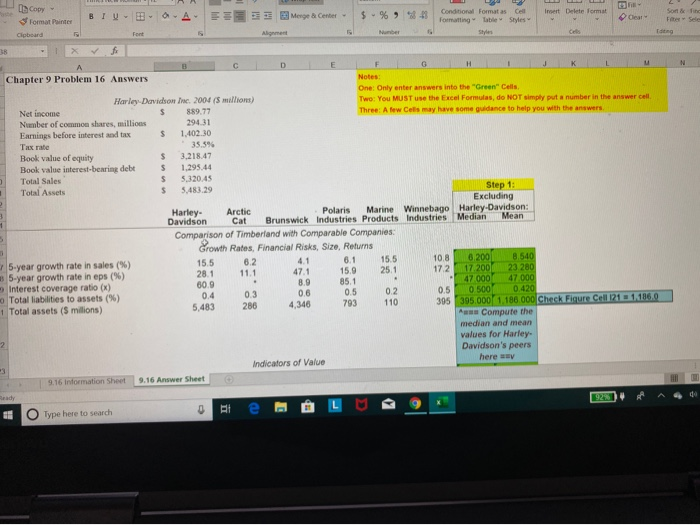

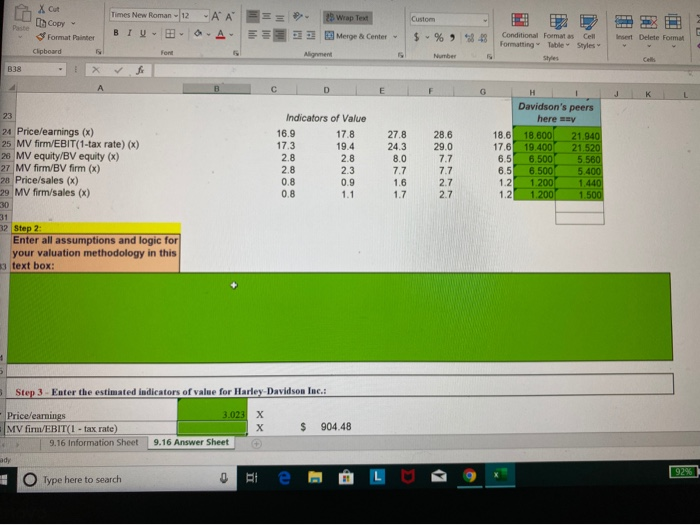

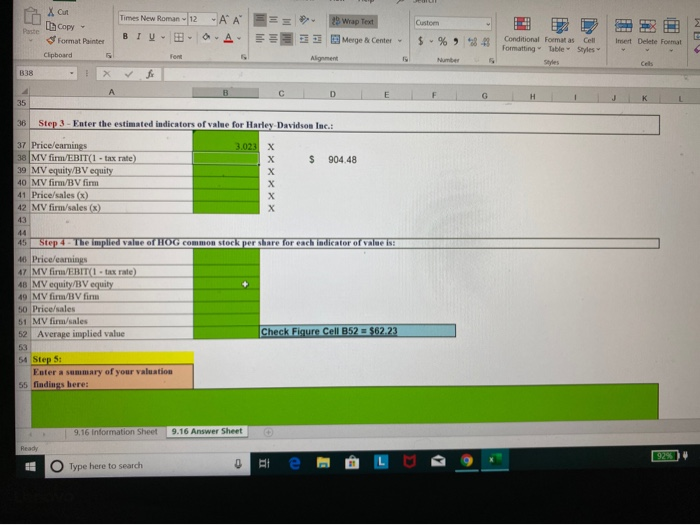

Copy Paste Son &fnc Fiter Sele Conditional Format as Cell Formatting lable Styles Insert Delete format A EE I Merge a Center BIU- O Oear Format Painter Styles Cels Edtng Number Alignment Cipboard Font 38 G. D. Notes: Chapter 9 Problem 16 Answers One: Only enter answers into the "Green" Cells. Two: You MUST use the Excel Formulas, do NOT simply put a number in the answer cell. Three: A few Cels may have some gudance to help you with the answers. Harley Davidson Inc. 2004 (S millions) Net income Number of common shares, millions Earnings before interest and tax Tax rate Book value of equity Book value interest-bearing debt Total Sales 889.77 294.31 1,402.30 35.5% 3,218.47 1,295.44 5,320.45 Step 1: Excluding Marine Winnebago Harley-Davidson: 5,483.29 Total Assets Polaris Brunswick Industries Products Industries Arctic Cat Harley- Davidson Median Mean Comparison of Timberland with Comparable Companies: Growth Rates, Financial Risks, Size, Returns 15.5 25.1 6.200 17 200 47.000 0 500 8.540 23 280 47.000 0.420 305 395.000 1,186.000 Check Figure Cell 121 = 1,186.0 A Compute the median and mean values for Harley- Davidson's peers 10.8 17.2 6.1 5-year growth rate in sales (%) 5-year growth rate in eps (%) Interest coverage ratio (x) o Total liabilities to assets (%) 1 Total assets (S millions) 15.5 28.1 60.9 0.4 6.2 4.1 15.9 47.1 11.1 8.9 0.6 4,346 85.1 0.5 0.2 0.5 793 0.3 110 5,483 286 here v Indicators of Value 9.16 Answer Sheet 9.16 Information Sheet 92% Ready Type here to search X Cut -A AE== . Times New Roman 12 25 Wrap Text Custom L Copy Paste BIU- O A-E Merge & Center - $- % 84 E Conditional Format as Cell Format Painter Insert Delete Format Formatting Table Styles Clipboard For Alignment Number Styles Cells B38 Davidson's peers 23 Indicators of Value here y 24 Price/earnings (x) 25 MV firm/EBIT(1-tax rate) (x) 26 MV equity/BV equity (x) 27 MV firm/BV firm (x) 28 Price/sales (x) 29 MV firm/sales (x) 30 31 32 Step 2: Enter all assumptions and logic for your valuation methodology in this 83 text box: 16.9 17.8 19.4 2.8 2.3 0.9 1.1 27.8 18.600 28.6 29.0 18.6 21.940 21.520 5.560 5.400 17.3 19.400 24.3 17.6 2.8 2.8 0.8 0.8 8.0 7.7 6.5 6.5 6.500 6.500 1.2 1.2 7.7 7.7 1.200 1.6 2.7 1.440 1.7 2.7 1.200 1.500 Step 3 - Enter the estimated indicators of value for Harley-Davidson Inc.: 3.023 X Price/earnings MV firm/EBIT(1 - tax rate) 904.48 9.16 Information Sheet 9.16 Answer Sheet (+ ady 92% Type here to search 637 O 22 OO X Cun Times New Roman 12 29 Wrap Text Custom Ua Copy Paste O A-E BIU- II E Merge & Center $- % 98 43 Conditional Format as Cell Formatting Table Styles Format Painter Insert Delete Format Clipboard Font Alignment Number Styles Cels B38 D. 35 36 Step 3- Enter the estimated indicators of value for Harley Davidson Inc.: 37 Price/earmings 38 MV firm/EBIT(1 - tax rate) 39 MV equity/BV equity 40 MV firm/BV firm 41 Price/sales (x) 42 MV firm/sales (x) 3.023 X %2$ 904.48 43 44 Step 4- The implied value of HOG common stock per share for each indicator of value is: 45 46 Price/earnings 47 MV firm/EBIT(1 - tax rate) 48 MV equity/BV equity 49 MV firm/BV firm 50 Price/sales 51 MV fim/sales Check Figure Cell B52 = $62.23 52 Average implied value 53 54 Step 5: Enter a summary of your valuation 55 findings here: 9.16 Information Sheet 9.16 Answer Sheet Ready 92% Type here to search Copy Paste Son &fnc Fiter Sele Conditional Format as Cell Formatting lable Styles Insert Delete format A EE I Merge a Center BIU- O Oear Format Painter Styles Cels Edtng Number Alignment Cipboard Font 38 G. D. Notes: Chapter 9 Problem 16 Answers One: Only enter answers into the "Green" Cells. Two: You MUST use the Excel Formulas, do NOT simply put a number in the answer cell. Three: A few Cels may have some gudance to help you with the answers. Harley Davidson Inc. 2004 (S millions) Net income Number of common shares, millions Earnings before interest and tax Tax rate Book value of equity Book value interest-bearing debt Total Sales 889.77 294.31 1,402.30 35.5% 3,218.47 1,295.44 5,320.45 Step 1: Excluding Marine Winnebago Harley-Davidson: 5,483.29 Total Assets Polaris Brunswick Industries Products Industries Arctic Cat Harley- Davidson Median Mean Comparison of Timberland with Comparable Companies: Growth Rates, Financial Risks, Size, Returns 15.5 25.1 6.200 17 200 47.000 0 500 8.540 23 280 47.000 0.420 305 395.000 1,186.000 Check Figure Cell 121 = 1,186.0 A Compute the median and mean values for Harley- Davidson's peers 10.8 17.2 6.1 5-year growth rate in sales (%) 5-year growth rate in eps (%) Interest coverage ratio (x) o Total liabilities to assets (%) 1 Total assets (S millions) 15.5 28.1 60.9 0.4 6.2 4.1 15.9 47.1 11.1 8.9 0.6 4,346 85.1 0.5 0.2 0.5 793 0.3 110 5,483 286 here v Indicators of Value 9.16 Answer Sheet 9.16 Information Sheet 92% Ready Type here to search X Cut -A AE== . Times New Roman 12 25 Wrap Text Custom L Copy Paste BIU- O A-E Merge & Center - $- % 84 E Conditional Format as Cell Format Painter Insert Delete Format Formatting Table Styles Clipboard For Alignment Number Styles Cells B38 Davidson's peers 23 Indicators of Value here y 24 Price/earnings (x) 25 MV firm/EBIT(1-tax rate) (x) 26 MV equity/BV equity (x) 27 MV firm/BV firm (x) 28 Price/sales (x) 29 MV firm/sales (x) 30 31 32 Step 2: Enter all assumptions and logic for your valuation methodology in this 83 text box: 16.9 17.8 19.4 2.8 2.3 0.9 1.1 27.8 18.600 28.6 29.0 18.6 21.940 21.520 5.560 5.400 17.3 19.400 24.3 17.6 2.8 2.8 0.8 0.8 8.0 7.7 6.5 6.5 6.500 6.500 1.2 1.2 7.7 7.7 1.200 1.6 2.7 1.440 1.7 2.7 1.200 1.500 Step 3 - Enter the estimated indicators of value for Harley-Davidson Inc.: 3.023 X Price/earnings MV firm/EBIT(1 - tax rate) 904.48 9.16 Information Sheet 9.16 Answer Sheet (+ ady 92% Type here to search 637 O 22 OO X Cun Times New Roman 12 29 Wrap Text Custom Ua Copy Paste O A-E BIU- II E Merge & Center $- % 98 43 Conditional Format as Cell Formatting Table Styles Format Painter Insert Delete Format Clipboard Font Alignment Number Styles Cels B38 D. 35 36 Step 3- Enter the estimated indicators of value for Harley Davidson Inc.: 37 Price/earmings 38 MV firm/EBIT(1 - tax rate) 39 MV equity/BV equity 40 MV firm/BV firm 41 Price/sales (x) 42 MV firm/sales (x) 3.023 X %2$ 904.48 43 44 Step 4- The implied value of HOG common stock per share for each indicator of value is: 45 46 Price/earnings 47 MV firm/EBIT(1 - tax rate) 48 MV equity/BV equity 49 MV firm/BV firm 50 Price/sales 51 MV fim/sales Check Figure Cell B52 = $62.23 52 Average implied value 53 54 Step 5: Enter a summary of your valuation 55 findings here: 9.16 Information Sheet 9.16 Answer Sheet Ready 92% Type here to search