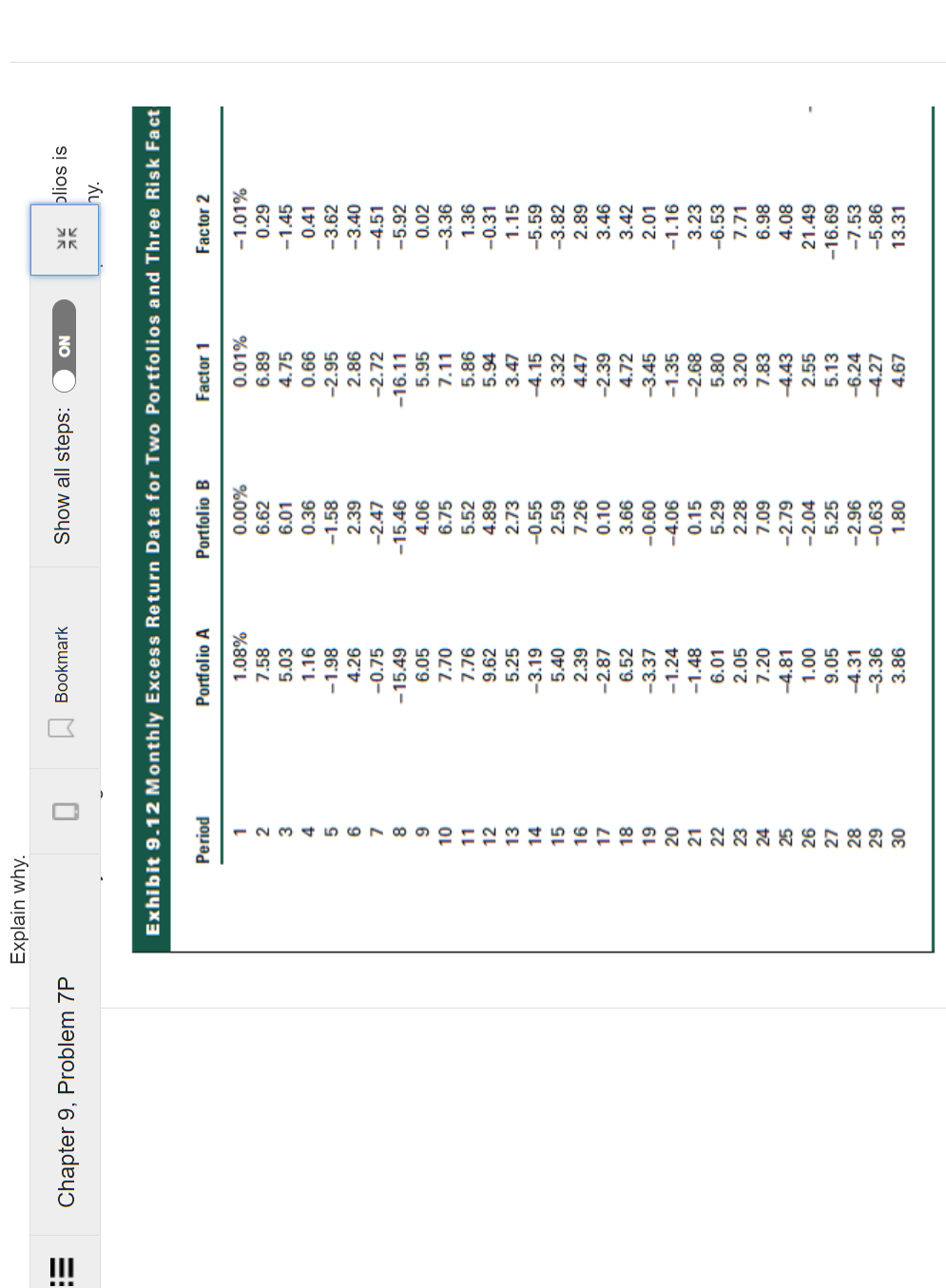

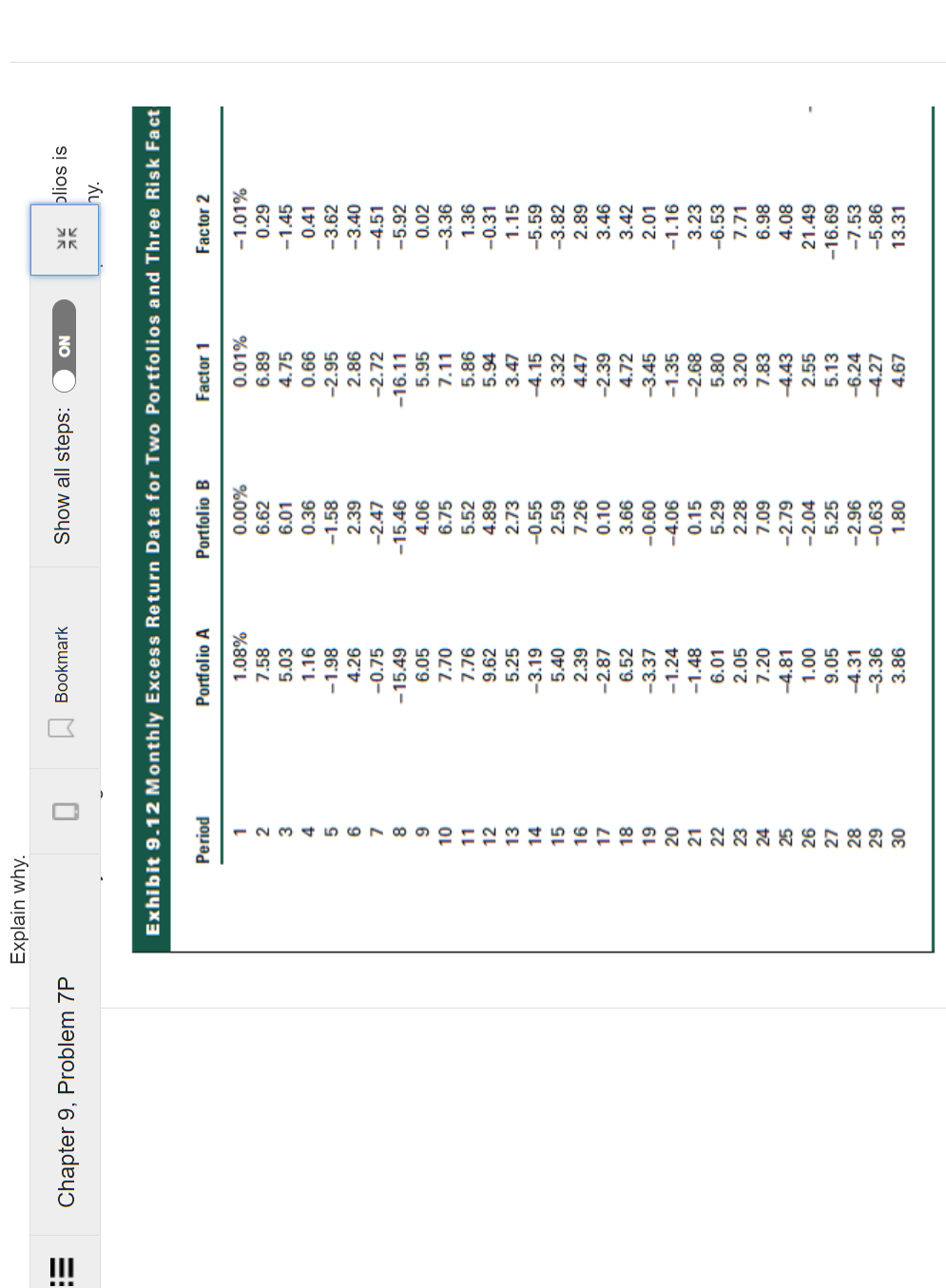

!!! Chapter 9, Problem 7P Bookmark Show all steps: ON YK 75 Problems 6 and 7 refer to the data contained in Exhibit 9.12, which lists 30 monthly excess returns to two different actively managed stock portfolios (A and B) and three different common risk factors (1, 2, and 3). (Note: You may find it useful to use a computer spreadsheet program such as Microsoft Excel to calculate your answers.) a. Using regression analysis, calculate the factor betas of each stock associated with each of the common risk factors. Which of these coefficients are statistically significant? b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? c. Suppose you are now told that the three factors in Exhibit 9.12 represent the risk exposures in the Fama-French characteristic-based model (i.e., excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why. d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why. !!! Chapter 9, Problem 7P Explain why. Period 1 2345678SPINNEFNHERZEDS 9 Exhibit 9.12 Monthly Excess Return Data for Two Portfolios and Three Risk Fact 10 11 12 13 14 15 16 17 18 19 20 21 22 29 Bookmark 30 Portfolio A 1.08% 7.58 5.03 1.16 -1.98 4.26 -0.75 -15.49 6.05 7.70 7.76 9.62 5.25 -3.19 5.40 2.39 -2.87 6.52 -3.37 -1.24 -1.48 6.01 2.05 7.20 -4.81 1.00 9.05 -4.31 Show all steps: -3.36 3.86 Portfolio B 0.00% 6.62 6.01 0.36 -1.58 2.39 -2.47 -15.46 4.06 6.75 5.52 4.89 2.73 -0.55 2.59 7.26 0.10 ON 3.66 -0.60 -4.06 0.15 5.29 2.28 7.09 -2.79 -2.04 5.25 -2.96 -0.63 1.80 Factor 1 0.01% 6.89 4.75 0.66 -2.95 2.86 -2.72 -16.11 5.95 7.11 5.86 5.94 3.47 -4.15 3.32 4.47 -2.39 4.72 -3.45 -1.35 -2.68 75 5.80 3.20 7.83 -4.43 2.55 5.13 -6.24 -4.27 4.67 blios is hy. Factor 2 -1.01% 0.29 -1.45 0.41 -3.62 -3.40 -4.51 -5.92 0.02 -3.36 1.36 -0.31 1.15 -5.59 -3.82 2.89 3.46 3.42 2.01 -1.16 3.23 -6.53 7.71 6.98 4.08 21.49 -16.69 -7.53 -5.86 13.31 !!! Chapter 9, Problem 7P Bookmark Show all steps: ON YK 75 Problems 6 and 7 refer to the data contained in Exhibit 9.12, which lists 30 monthly excess returns to two different actively managed stock portfolios (A and B) and three different common risk factors (1, 2, and 3). (Note: You may find it useful to use a computer spreadsheet program such as Microsoft Excel to calculate your answers.) a. Using regression analysis, calculate the factor betas of each stock associated with each of the common risk factors. Which of these coefficients are statistically significant? b. How well does the factor model explain the variation in portfolio returns? On what basis can you make an evaluation of this nature? c. Suppose you are now told that the three factors in Exhibit 9.12 represent the risk exposures in the Fama-French characteristic-based model (i.e., excess market, SMB, and HML). Based on your regression results, which one of these factors is the most likely to be the market factor? Explain why. d. Suppose it is further revealed that Factor 3 is the HML factor. Which of the two portfolios is most likely to be a growth-oriented fund and which is a value-oriented fund? Explain why. !!! Chapter 9, Problem 7P Explain why. Period 1 2345678SPINNEFNHERZEDS 9 Exhibit 9.12 Monthly Excess Return Data for Two Portfolios and Three Risk Fact 10 11 12 13 14 15 16 17 18 19 20 21 22 29 Bookmark 30 Portfolio A 1.08% 7.58 5.03 1.16 -1.98 4.26 -0.75 -15.49 6.05 7.70 7.76 9.62 5.25 -3.19 5.40 2.39 -2.87 6.52 -3.37 -1.24 -1.48 6.01 2.05 7.20 -4.81 1.00 9.05 -4.31 Show all steps: -3.36 3.86 Portfolio B 0.00% 6.62 6.01 0.36 -1.58 2.39 -2.47 -15.46 4.06 6.75 5.52 4.89 2.73 -0.55 2.59 7.26 0.10 ON 3.66 -0.60 -4.06 0.15 5.29 2.28 7.09 -2.79 -2.04 5.25 -2.96 -0.63 1.80 Factor 1 0.01% 6.89 4.75 0.66 -2.95 2.86 -2.72 -16.11 5.95 7.11 5.86 5.94 3.47 -4.15 3.32 4.47 -2.39 4.72 -3.45 -1.35 -2.68 75 5.80 3.20 7.83 -4.43 2.55 5.13 -6.24 -4.27 4.67 blios is hy. Factor 2 -1.01% 0.29 -1.45 0.41 -3.62 -3.40 -4.51 -5.92 0.02 -3.36 1.36 -0.31 1.15 -5.59 -3.82 2.89 3.46 3.42 2.01 -1.16 3.23 -6.53 7.71 6.98 4.08 21.49 -16.69 -7.53 -5.86 13.31