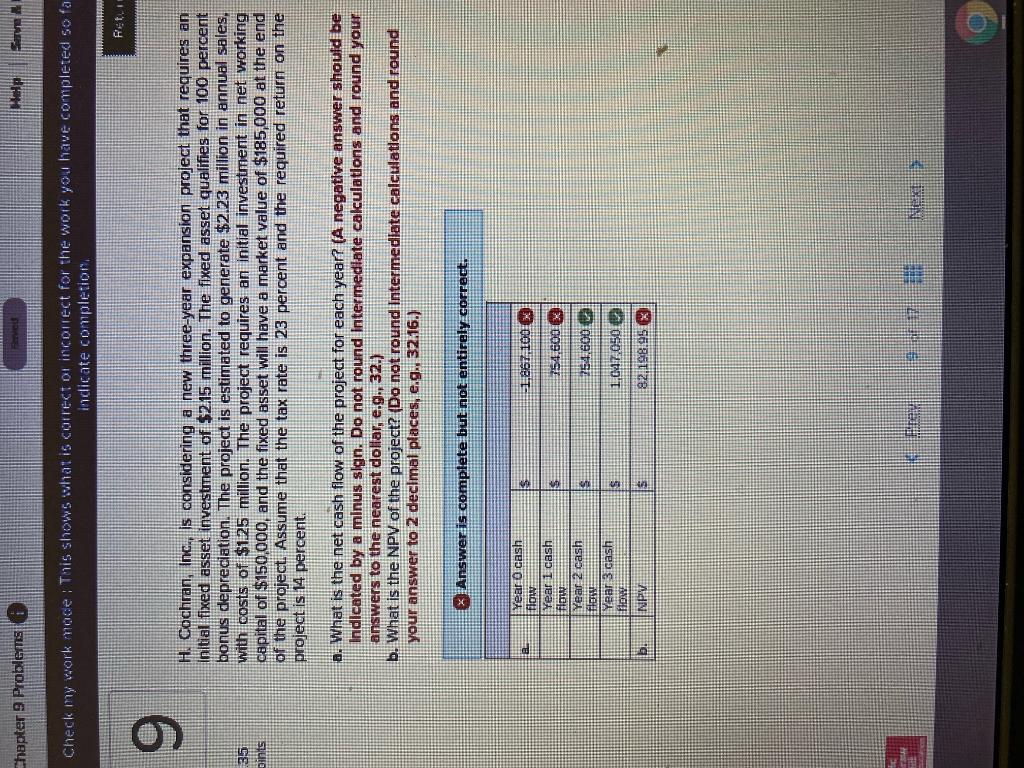

Chapter 9 Problems merveis Help EMEA Check my work mode: This shows what is correct or incorrect for the work you have completed so fa indicate completion. Ratu 9 85 oints H. Cochran, Inc., is considering a new three-year expansion project that requires an Initial fixed asset investment of $215 million. The fixed asset qualifies for 100 percent bonus depreciation. The project is estimated to generate $2.23 million in annual sales. with costs of $125 million. The project requires an initial investment in net working capital of $150,000, and the fixed asset will have a market value of $185,000 at the end of the project. Assume that the tax rate is 23 percent and the required return on the project is 14 percent. a. What is the net cash flow of the project for each year? (A negative answer should be Indicated by a minus slgn. Do not round Intermediate calculations and round your answers to the nearest dollar, e.g., 32.) b. What is the NPV of the project? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) Answer is complete but not entirely correct. BL $ -1.867.100 $ 154.600 x Year O cash flow Year 1 cash flow Year 2 cash flow Year 3 cash HBE NPV 754,600 $ 1.047 050 bl IS 82.198.95 19 Next Chapter 9 Problems merveis Help EMEA Check my work mode: This shows what is correct or incorrect for the work you have completed so fa indicate completion. Ratu 9 85 oints H. Cochran, Inc., is considering a new three-year expansion project that requires an Initial fixed asset investment of $215 million. The fixed asset qualifies for 100 percent bonus depreciation. The project is estimated to generate $2.23 million in annual sales. with costs of $125 million. The project requires an initial investment in net working capital of $150,000, and the fixed asset will have a market value of $185,000 at the end of the project. Assume that the tax rate is 23 percent and the required return on the project is 14 percent. a. What is the net cash flow of the project for each year? (A negative answer should be Indicated by a minus slgn. Do not round Intermediate calculations and round your answers to the nearest dollar, e.g., 32.) b. What is the NPV of the project? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) Answer is complete but not entirely correct. BL $ -1.867.100 $ 154.600 x Year O cash flow Year 1 cash flow Year 2 cash flow Year 3 cash HBE NPV 754,600 $ 1.047 050 bl IS 82.198.95 19 Next