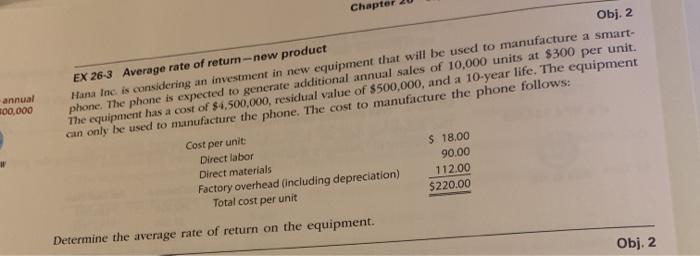

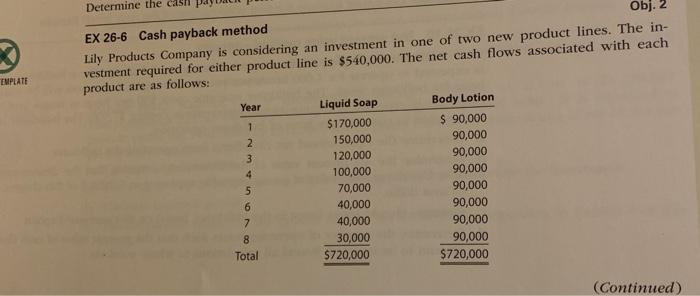

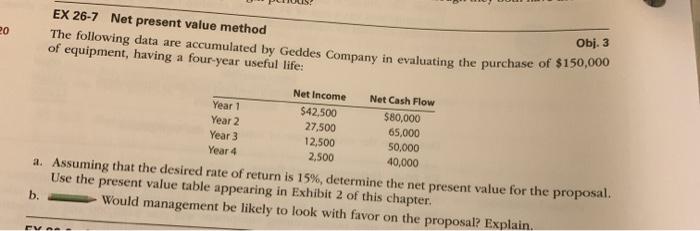

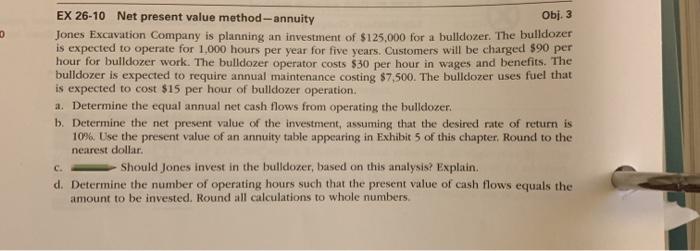

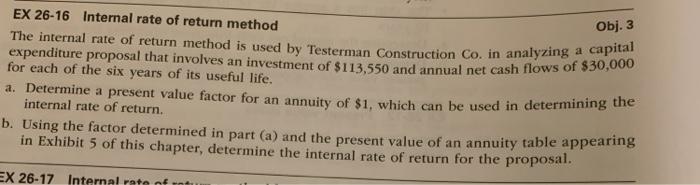

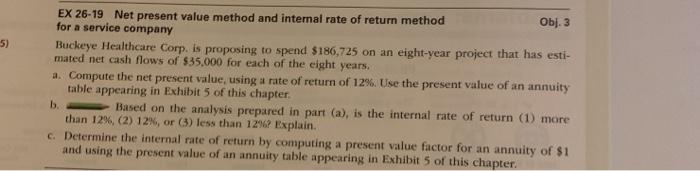

Chapter annual 100,000 Obj. 2 EX 26-3 Average rate of return-new product Hanalac is considering an investment in new equipment that will be used to manufacture a smart- phone. The phone is expected to generate additional annual sales of 10,000 units at $300 per unit. The equipment has a cost of $4,500,000, residual value of $500,000, and a 10-year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows: Cost per unit: Direct labor $ 18.00 Direct materials 90.00 Factory overhead (including depreciation) 112.00 Total cost per unit $220.00 Determine the average rate of return on the equipment. Obj. 2 Determine the EX 26-6 Cash payback method Obj. 2 Lily Products Company is considering an investment in one of two new product lines. The in- vestment required for either product line is $540,000. The net cash flows associated with each product are as follows: TMPLATE Year 1 2 3 4 Liquid Soap $170,000 150,000 120,000 100,000 70,000 40,000 40,000 30,000 $720,000 Body Lotion $ 90,000 90,000 90,000 90,000 90,000 90,000 90,000 90,000 $720,000 5 6 7 8 Total (Continued) 20 EX 26-7 Net present value method The following data are accumulated by Geddes Company in evaluating the purchase of $150,000 of equipment, having a four-year useful life: Obj. 3 Net Income Net Cash Flow Year 1 $42,500 $80,000 Year 2 27,500 65.000 Year 3 12,500 50,000 Year 4 2,500 40,000 a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the present value table appearing in Exhibit 2 of this chapter. b. Would management be likely to look with favor on the proposal? Explain. EVA Obj. 3 EX 26-10 Net present value method-annuity Jones Excavation Company is planning an investment of $125,000 for a bulldozer. The bulldozer is expected to operate for 1,000 hours per year for five years. Customers will be charged 890 per hour for bulldozer work. The bulldozer operator costs $30 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $7,500. The bulldozer uses fuel that is expected to cost $15 per hour of bulldozer operation. a. Determine the equal annual net cash flows from operating the bulldozer b. Determine the net present value of the investment, assuming that the desired rate of return is 10%. Use the present value of an annuity table appearing in Exhibit 5 of this chapter. Round to the nearest dollar. Should Jones invest in the bulldozer, based on this analysis? Explain. d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested. Round all calculations to whole numbers c. Obj. 3 EX 26-16 Internal rate of return method The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $113,550 and annual net cash flows of $30,000 for each of the six years of its useful life. a. Determine a present value factor for an annuity of $1, which can be used in determining the internal rate of return. b. Using the factor determined in part (a) and the present value of an annuity table appearing in Exhibit 5 of this chapter, determine the internal rate of return for the proposal. EX 26-17 Internal rate of entu 5) EX 26-19 Net present value method and internal rate of return method Obj. 3 for a service company Buckeye Healthcare Corp. is proposing to spend $186,725 on an eight-year project that has esti- mated net cash flows of $35,000 for each of the eight years. a. Compute the net present value, using a rate of return of 12%. Use the present value of an annuity table appearing in Exhibit 5 of this chapter b. Based on the analysis prepared in part (a), is the internal rate of return (1) more than 12%, (2) 12%, or (3) less than 12962 Explain. c. Determine the internal rate of return by computing a present value factor for an annuity of $1 and using the present value of an annuity table appearing in Exhibit 5 of this chapter