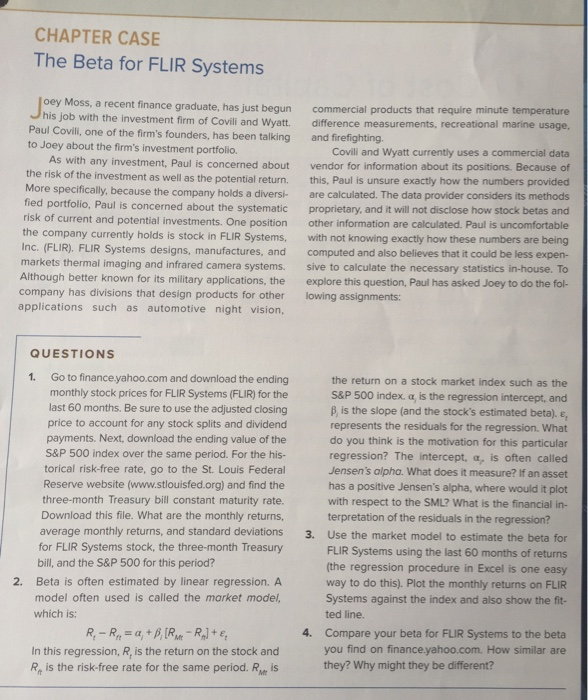

CHAPTER CASE The Beta for FLIR Systems oey Moss, a recent finance graduate, has just begun commercial products that require minute temperature and Wyatt. difference measurements, recreational marine usage. his job with the investment firm of Covili Paul Covili, one of the firm's founders, has been talking to Joey about the firm's investment portfolio. and fi Covili and Wyatt currently uses a commercial data As with any investment, Paul is concerned about vendor for information about its positions. Because of potential return. this, Paul is unsure exactly how the numbers provided are calculated. The data provider considers its methods fied portfolio, Paul is concerned about the systematic proprietary, and it will not disclose how stock betas and risk of current and potential investments. One position other information are calculated. Paul is uncomfortable e company currently holds is stock in FLIR Systems, with not knowing exactly how these numbers are being Inc. (FLIR). FLIR Systems designs, manufactures, and computed and also believes that it could be less expen- markets thermal imaging and infrared camera systems. sive to calculate the necessary statistics in-house. To though better known for its military applications, the explore this question, Paul has asked Joey to do the fol- the risk of the investment as well as the More specifically, because the company holds a diversi- company has divisions that design products for other lowing assignments applications such as automotive night vision, QUESTIONS 1. Go to finance.yahoo.com and download the ending monthly stock prices for FLIR Systems (FLIR) for the last 60 months. Be sure to use the adjusted closing price to account for any stock splits and dividend payments. Next, download the ending value of the S&P 500 index over the same period. For the his- torical risk-free rate, go to the St. Louis Federal Reserve website (www.stlouisfed.org) and find the three-month Treasury bill constant maturity rate Download this file. What are the monthly returns average monthly returns, and standard deviations for FLIR Systems stock, the three-month Treasury the return on a stock market index such as the S&P 500 index, , is the regression intercept, and B, is the slope (and the stock's estimated beta). represents the residuals for the regression. What do you think is the motivation for this particular regression? The intercept, a, is often called Jensen's alpha. What does it measure? If an asset has a positive Jensen's alpha, where would it plot with respect to the SML? What is the financial in- terpretation of the residuals in the regression? Use th FLIR Systems using the last 60 months of returns (the regression procedure in Excel is one easy way to do this). Plot the monthly returns on FLIR Systems against the index and also show the ted line 3. e market model to estimate the beta for bill, and the S&P 500 for this period? 2. Beta is often estimated by linear regression. A model often used is called the market model, which is: 4. Compare your beta for FLIR Systems to the beta you find on finance.yahoo.com. How similar In this regression, R, is the return on the stock and R, is the risk-free rate for the same period. R, is they? Why might they be different? CHAPTER CASE The Beta for FLIR Systems oey Moss, a recent finance graduate, has just begun commercial products that require minute temperature and Wyatt. difference measurements, recreational marine usage. his job with the investment firm of Covili Paul Covili, one of the firm's founders, has been talking to Joey about the firm's investment portfolio. and fi Covili and Wyatt currently uses a commercial data As with any investment, Paul is concerned about vendor for information about its positions. Because of potential return. this, Paul is unsure exactly how the numbers provided are calculated. The data provider considers its methods fied portfolio, Paul is concerned about the systematic proprietary, and it will not disclose how stock betas and risk of current and potential investments. One position other information are calculated. Paul is uncomfortable e company currently holds is stock in FLIR Systems, with not knowing exactly how these numbers are being Inc. (FLIR). FLIR Systems designs, manufactures, and computed and also believes that it could be less expen- markets thermal imaging and infrared camera systems. sive to calculate the necessary statistics in-house. To though better known for its military applications, the explore this question, Paul has asked Joey to do the fol- the risk of the investment as well as the More specifically, because the company holds a diversi- company has divisions that design products for other lowing assignments applications such as automotive night vision, QUESTIONS 1. Go to finance.yahoo.com and download the ending monthly stock prices for FLIR Systems (FLIR) for the last 60 months. Be sure to use the adjusted closing price to account for any stock splits and dividend payments. Next, download the ending value of the S&P 500 index over the same period. For the his- torical risk-free rate, go to the St. Louis Federal Reserve website (www.stlouisfed.org) and find the three-month Treasury bill constant maturity rate Download this file. What are the monthly returns average monthly returns, and standard deviations for FLIR Systems stock, the three-month Treasury the return on a stock market index such as the S&P 500 index, , is the regression intercept, and B, is the slope (and the stock's estimated beta). represents the residuals for the regression. What do you think is the motivation for this particular regression? The intercept, a, is often called Jensen's alpha. What does it measure? If an asset has a positive Jensen's alpha, where would it plot with respect to the SML? What is the financial in- terpretation of the residuals in the regression? Use th FLIR Systems using the last 60 months of returns (the regression procedure in Excel is one easy way to do this). Plot the monthly returns on FLIR Systems against the index and also show the ted line 3. e market model to estimate the beta for bill, and the S&P 500 for this period? 2. Beta is often estimated by linear regression. A model often used is called the market model, which is: 4. Compare your beta for FLIR Systems to the beta you find on finance.yahoo.com. How similar In this regression, R, is the return on the stock and R, is the risk-free rate for the same period. R, is they? Why might they be different