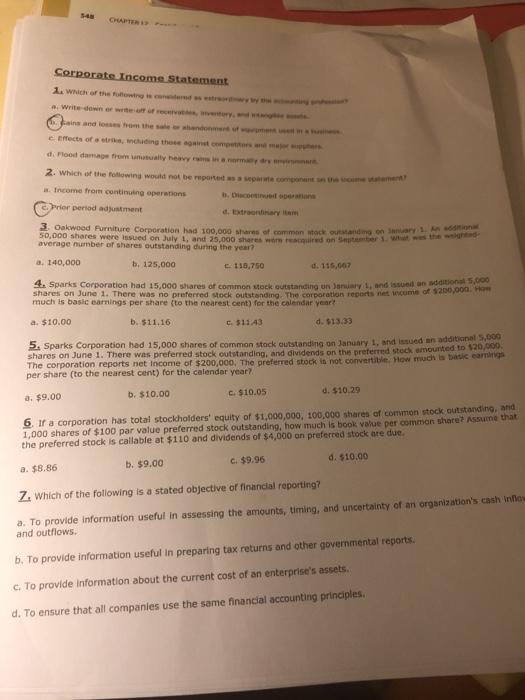

CHAPTER Corporate Income Statement 1. Which of the follow is condered tr y a. Write-down or we off of rec o rd ains and losses from the sale abandant the i e. Efects of a strike, including those against competitors and m d. Flood damage from unusually heavy rains in a normy dry w a n e nt 2. Which of the following would not be reported as a separate component on the income statemen a. Income from continuing operations . Discontinued operations Prior period adjustment d. Extraordinary item 3. Oakwood Furniture Corporation had 100,000 shares of common stock outstanding on January 50,000 shares were issued on July 1, and 25,000 shares were reacquired on September 1. What average number of shares outstanding during the year? d- a. 140,000 b. 125,000 c. 118,750 d. 116,667 200.000 How 4. Sparks Corporation had 15,000 shares of common stock outstanding on January 1, and issued shares on June 1. There was no preferred stock outstanding. The corporation reports net income of much is basic earnings per share to the nearest cent) for the calendar year? a. $10.00 b. $11.16 c. $11.43 d. $13.33 5. Sparks Corporation had 15,000 shares of common stock outstanding on January 1, and issued an additional 5,000 shares on June 1. There was preferred stock outstanding, and dividends on the preferred stock amounted to $20,000 The corporation reports net income of $200,000. The preferred stock is not convertible. How much is basic earnings per share (to the nearest cent) for the calendar year? d. $10.29 a. $9.00 b. $10.00 c. $10.05 6. If a corporation has total stockholders' equity of $1,000,000, 100,000 shares of common stock outstanding, and 1,000 shares of $100 par value preferred stock outstanding, how much is book value per common share? Assume that the preferred stock is callable at $110 and dividends of $4,000 on preferred stock are due. c. $9.96 d. $10.00 b. $9.00 a. $8.86 7. Which of the following is a stated objective of financial reporting? a. To provide information useful in assessing the amounts, timing, and uncertainty of an organization's cash Info and outflows. b. To provide information useful in preparing tax returns and other governmental report c. To provide information about the current cost of an enterprise's assets. d. To ensure that all companies use the same financial accounting principles