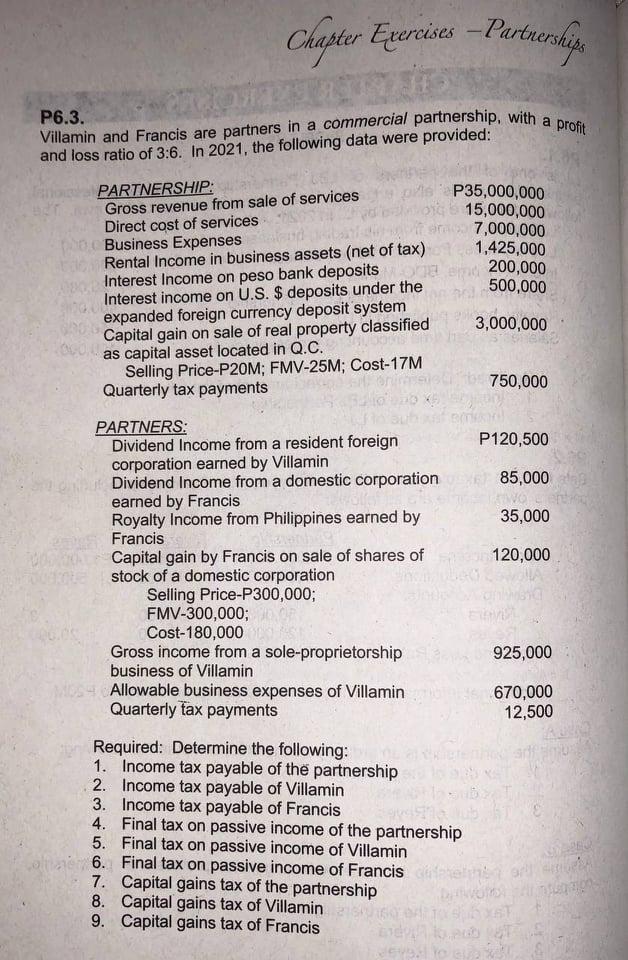

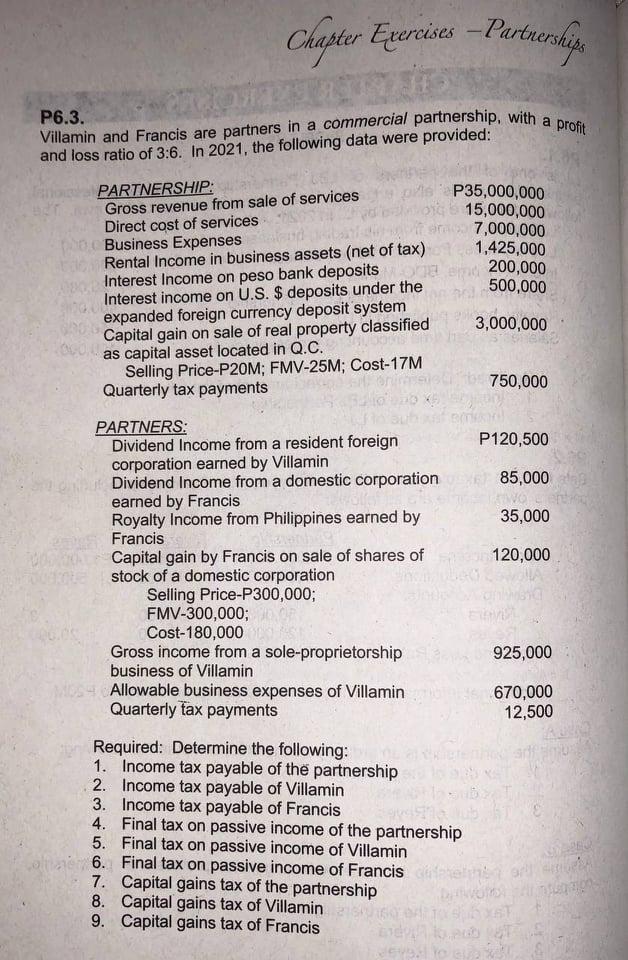

Chapter Exercises - Partnerskis P6.3. Villamin and Francis are partners in a commercial partnership with a profit and loss ratio of 3:6. In 2021, the following data were provided: PARTNERSHIP: Gross revenue from sale of services Direct cost of services Business Expenses Rental Income in business assets (net of tax) Interest Income on peso bank deposits Interest income on U.S. $ deposits under the expanded foreign currency deposit system Capital gain on sale of real property classified as capital asset located in Q.C. Selling Price-P20M; FMV-25M; Cost-17M Quarterly tax payments P35,000,000 15,000,000 7,000,000 1,425,000 200,000 500,000 3,000,000 750,000 P120,500 85,000 35,000 120,000 PARTNERS: Dividend Income from a resident foreign corporation earned by Villamin Dividend Income from a domestic corporation earned by Francis Royalty Income from Philippines earned by Francis Capital gain by Francis on sale of shares of stock of a domestic corporation Selling Price-P300,000; FMV-300,000; Cost-180,000 Gross income from a sole proprietorship business of Villamin Allowable business expenses of Villamin Quarterly fax payments 925,000 670,000 12,500 Required: Determine the following: 1. Income tax payable of the partnership 2. Income tax payable of Villamin 3. Income tax payable of Francis 4. Final tax on passive income of the partnership 5. Final tax on passive income of Villamin o 6. Final tax on passive income of Francis 7. Capital gains tax of the partnership 8. Capital gains tax of Villamin 9. Capital gains tax of Francis etap VO ET Chapter Exercises - Partnerskis P6.3. Villamin and Francis are partners in a commercial partnership with a profit and loss ratio of 3:6. In 2021, the following data were provided: PARTNERSHIP: Gross revenue from sale of services Direct cost of services Business Expenses Rental Income in business assets (net of tax) Interest Income on peso bank deposits Interest income on U.S. $ deposits under the expanded foreign currency deposit system Capital gain on sale of real property classified as capital asset located in Q.C. Selling Price-P20M; FMV-25M; Cost-17M Quarterly tax payments P35,000,000 15,000,000 7,000,000 1,425,000 200,000 500,000 3,000,000 750,000 P120,500 85,000 35,000 120,000 PARTNERS: Dividend Income from a resident foreign corporation earned by Villamin Dividend Income from a domestic corporation earned by Francis Royalty Income from Philippines earned by Francis Capital gain by Francis on sale of shares of stock of a domestic corporation Selling Price-P300,000; FMV-300,000; Cost-180,000 Gross income from a sole proprietorship business of Villamin Allowable business expenses of Villamin Quarterly fax payments 925,000 670,000 12,500 Required: Determine the following: 1. Income tax payable of the partnership 2. Income tax payable of Villamin 3. Income tax payable of Francis 4. Final tax on passive income of the partnership 5. Final tax on passive income of Villamin o 6. Final tax on passive income of Francis 7. Capital gains tax of the partnership 8. Capital gains tax of Villamin 9. Capital gains tax of Francis etap VO ET