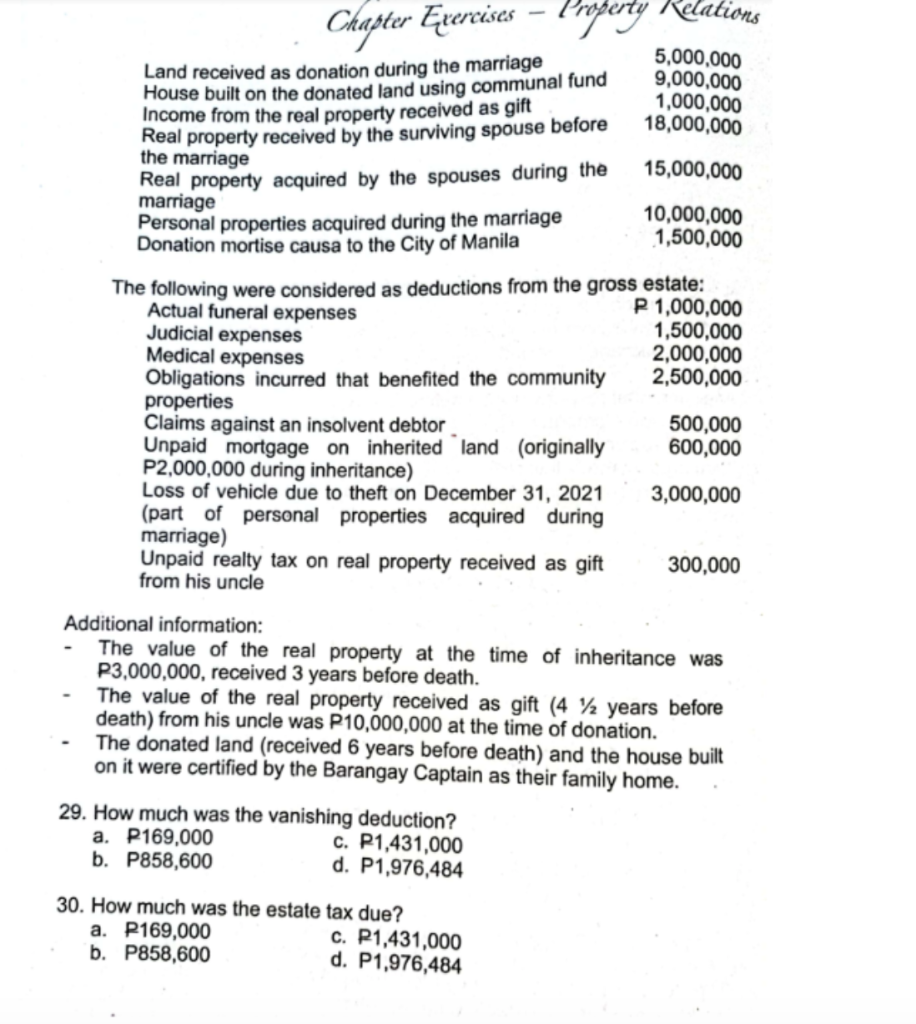

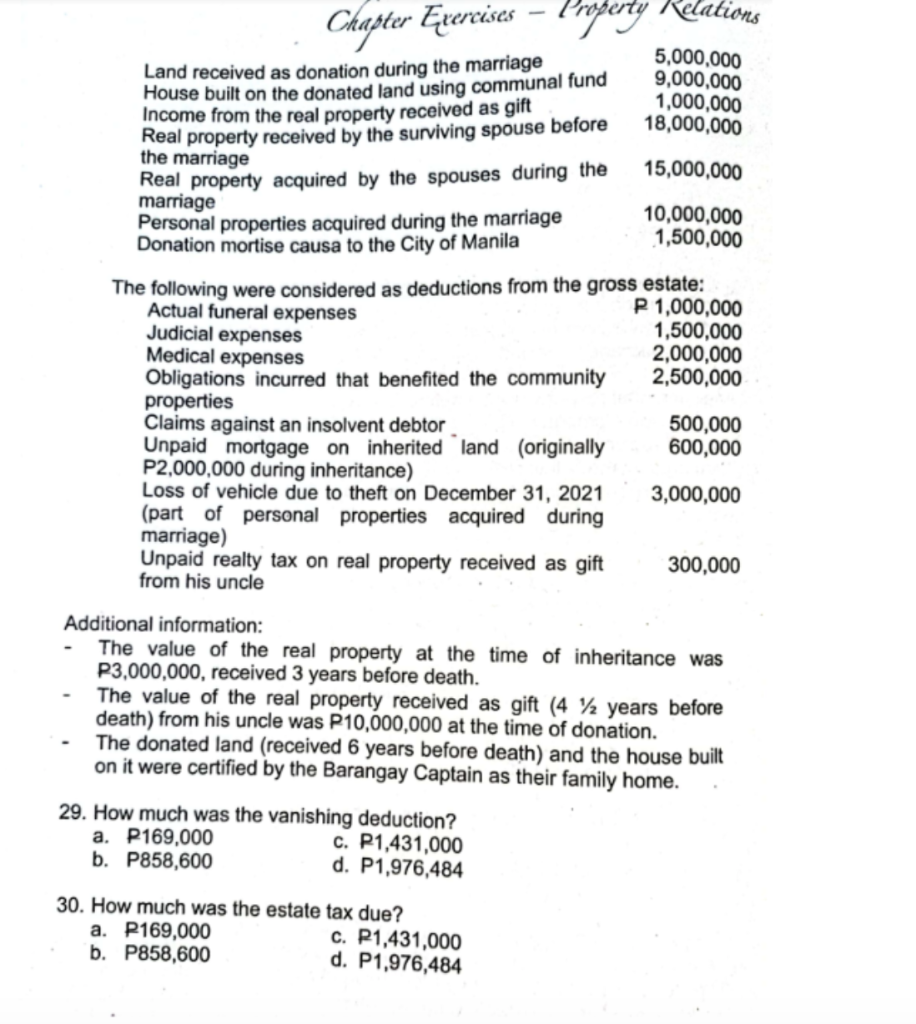

Chapter Exercises Property Relations 5,000,000 Land received as donation during the marriage 9,000,000 House built on the donated land using communal fund 1,000,000 Income from the real property received as gift 18,000,000 Real property received by the surviving spouse before the marriage 15,000,000 Real property acquired by the spouses during the marriage 10,000,000 Personal properties acquired during the marriage 1,500,000 Donation mortise causa to the City of Manila The following were considered as deductions from the gross estate: Actual funeral expenses P 1,000,000 Judicial expenses 1,500,000 Medical expenses 2,000,000 Obligations incurred that benefited the community 2,500,000 properties Claims against an insolvent debtor 500,000 Unpaid mortgage on inherited land (originally 600,000 P2,000,000 during inheritance) Loss of vehicle due to theft on December 31, 2021 3,000,000 (part of personal properties acquired during marriage) Unpaid realty tax on real property received as gift 300,000 from his uncle Additional information: The value of the real property at the time of inheritance was P3,000,000, received 3 years before death. The value of the real property received as gift (4 12 years before death) from his uncle was P10,000,000 at the time of donation. The donated land (received 6 years before death) and the house built on it were certified by the Barangay Captain as their family home. 29. How much was the vanishing deduction? a. P169,000 c. P1,431,000 b. P858,600 d. P1,976,484 30. How much was the estate tax due? a. P169,000 c. P1,431,000 b. P858,600 d. P1,976,484 Chapter Exercises Property Relations 5,000,000 Land received as donation during the marriage 9,000,000 House built on the donated land using communal fund 1,000,000 Income from the real property received as gift 18,000,000 Real property received by the surviving spouse before the marriage 15,000,000 Real property acquired by the spouses during the marriage 10,000,000 Personal properties acquired during the marriage 1,500,000 Donation mortise causa to the City of Manila The following were considered as deductions from the gross estate: Actual funeral expenses P 1,000,000 Judicial expenses 1,500,000 Medical expenses 2,000,000 Obligations incurred that benefited the community 2,500,000 properties Claims against an insolvent debtor 500,000 Unpaid mortgage on inherited land (originally 600,000 P2,000,000 during inheritance) Loss of vehicle due to theft on December 31, 2021 3,000,000 (part of personal properties acquired during marriage) Unpaid realty tax on real property received as gift 300,000 from his uncle Additional information: The value of the real property at the time of inheritance was P3,000,000, received 3 years before death. The value of the real property received as gift (4 12 years before death) from his uncle was P10,000,000 at the time of donation. The donated land (received 6 years before death) and the house built on it were certified by the Barangay Captain as their family home. 29. How much was the vanishing deduction? a. P169,000 c. P1,431,000 b. P858,600 d. P1,976,484 30. How much was the estate tax due? a. P169,000 c. P1,431,000 b. P858,600 d. P1,976,484