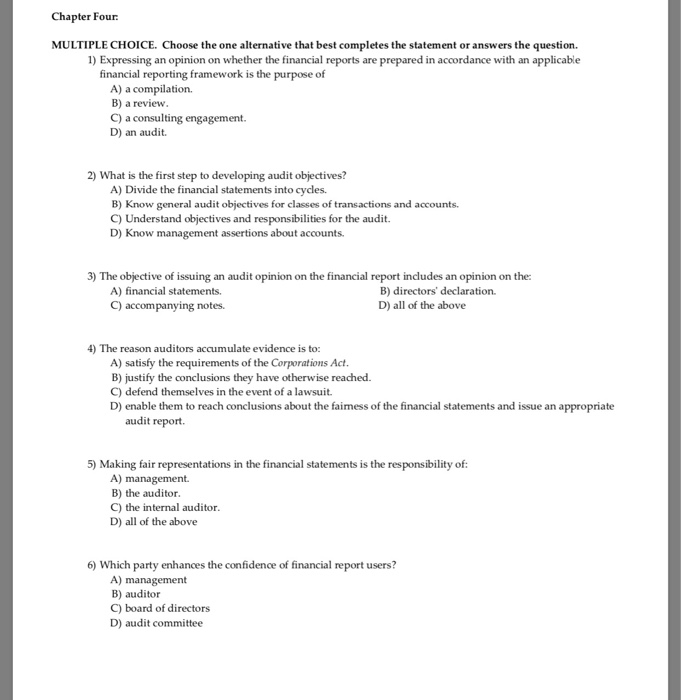

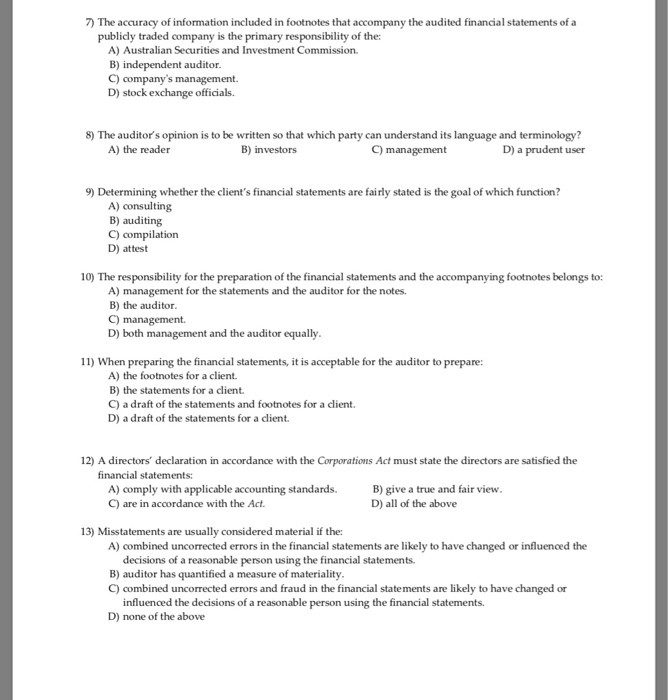

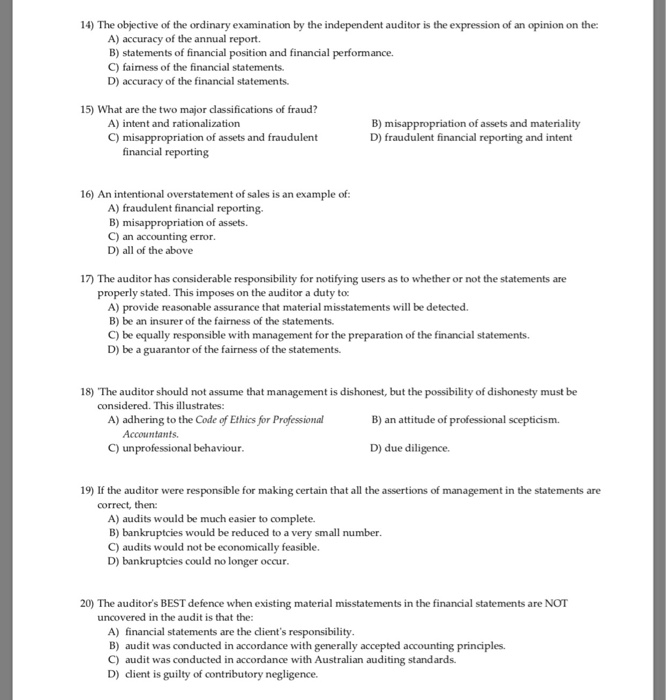

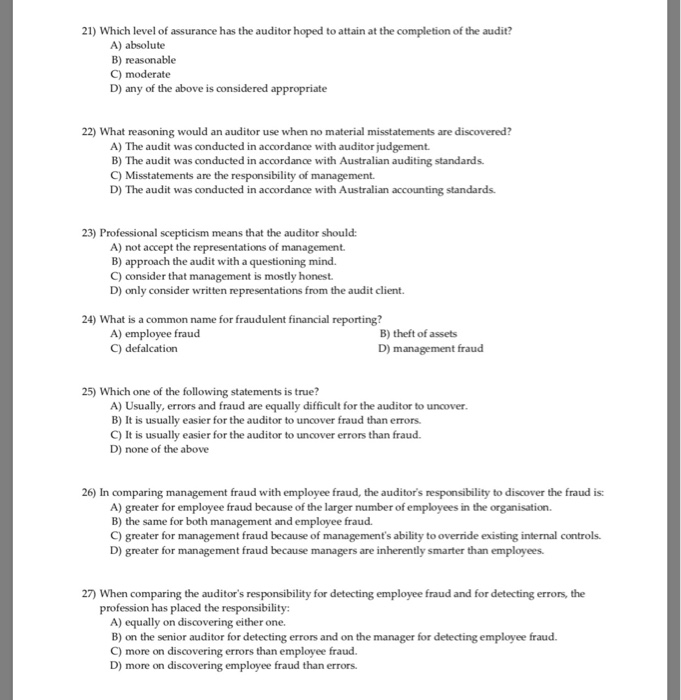

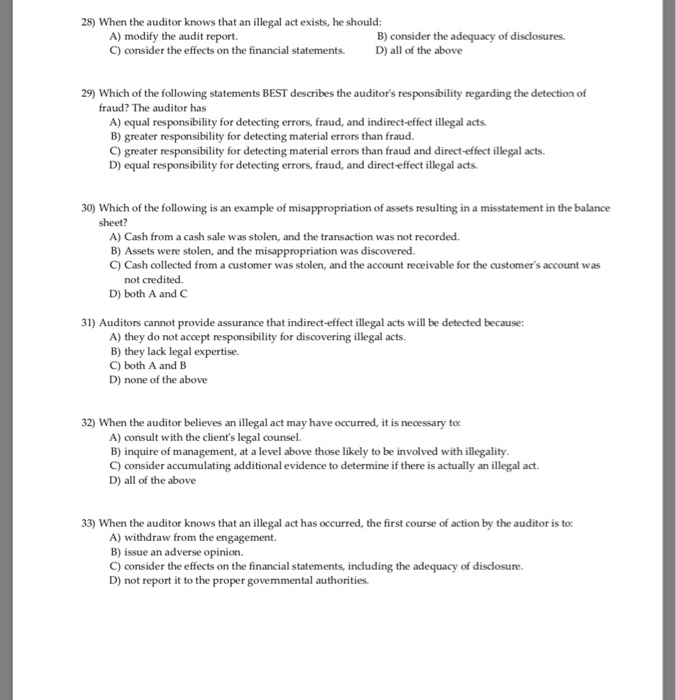

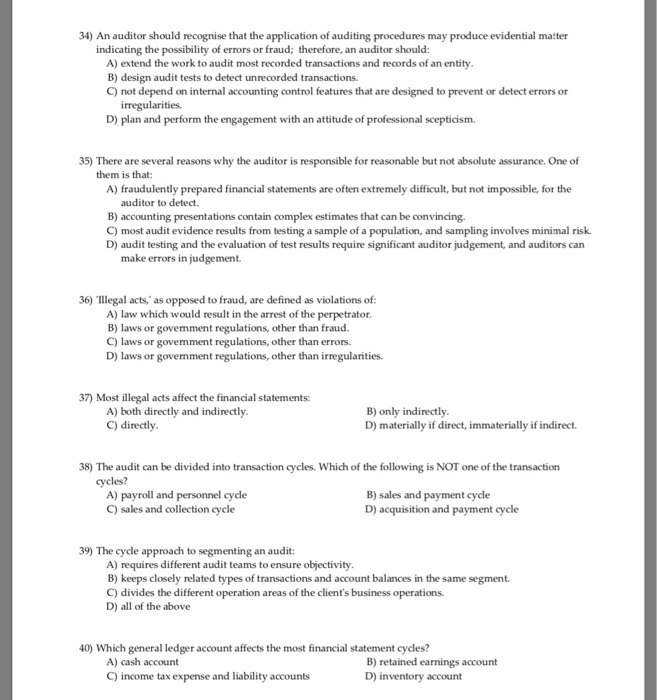

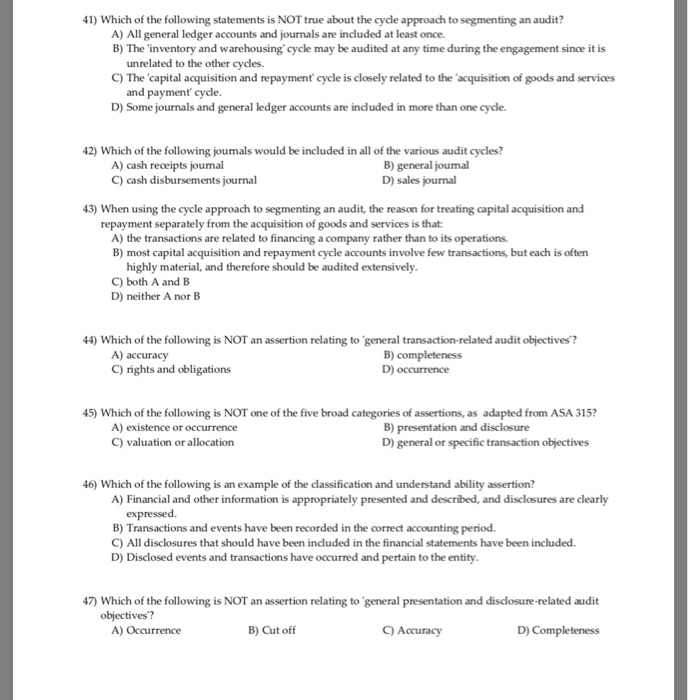

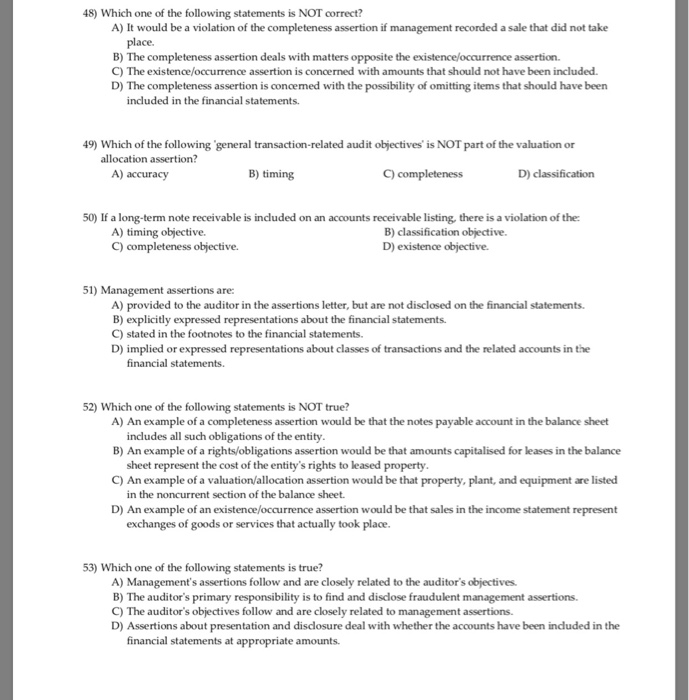

Chapter Four MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Expressing an opinion on whether the financial reports are prepared in accordance with an applicable financial reporting framework is the purpose of A) a compilation B) a review. C) a consulting engagement. D) an audit. 2) What is the first step to developing audit objectives? A) Divide the financial statements into cycles. B) Know general audit objectives for classes of transactions and accounts. C) Understand objectives and responsibilities for the audit. D) Know management assertions about accounts. 3) The objective of issuing an audit opinion on the financial report includes an opinion on the: A) financial statements. B) directors' declaration C) accompanying notes. D) all of the above 4) The reason auditors accumulate evidence is to: A) satisfy the requirements of the Corporations Act. B) justify the conclusions they have otherwise reached. C) defend themselves in the event of a lawsuit. D) enable them to reach conclusions about the faimess of the financial statements and issue an appropriate audit report 5) Making fair representations in the financial statements is the responsibility of: A) management. B) the auditor. C) the internal auditor. D) all of the above 6) Which party enhances the confidence of financial report users? A) management B) auditor C) board of directors D) audit committee 7) The accuracy of information included in footnotes that accompany the audited financial statements of a publicly traded company is the primary responsibility of the: A) Australian Securities and Investment Commission. B) independent auditor. C) company's management. D) stock exchange officials. 8) The auditor's opinion is to be written so that which party can understand its language and terminology? A) the reader B) investors C) management D) a prudent user 9) Determining whether the client's financial statements are fairly stated is the goal of which function? A) consulting B) auditing C) compilation D) attest 10) The responsibility for the preparation of the financial statements and the accompanying footnotes belongs to: A) management for the statements and the auditor for the notes. B) the auditor. C) management. D) both management and the auditor equally. 11) When preparing the financial statements, it is acceptable for the auditor to prepare: A) the footnotes for a client. B) the statements for a client. C) a draft of the statements and footnotes for a client. D) a draft of the statements for a client. 12) A directors' declaration in accordance with the Corporations Act must state the directors are satisfied the financial statements: A) comply with applicable accounting standards. B) give a true and fair view. C) are in accordance with the Act. D) all of the above 13) Misstatements are usually considered material if the: A) combined uncorrected errors in the financial statements are likely to have changed or influenced the decisions of a reasonable person using the financial statements. B) auditor has quantified a measure of materiality. C) combined uncorrected errors and fraud in the financial statements are likely to have changed or influenced the decisions of a reasonable person using the financial statements. D) none of the above 14) The objective of the ordinary examination by the independent auditor is the expression of an opinion on the: A) accuracy of the annual report. B) statements of financial position and financial performance. C) faimess of the financial statements. D) accuracy of the financial statements. 15) What are the two major classifications of fraud? A) intent and rationalization C) misappropriation of assets and fraudulent financial reporting B) misappropriation of assets and materiality D) fraudulent financial reporting and intent 16) An intentional overstatement of sales is an example of: A) fraudulent financial reporting. B) misappropriation of assets. C) an accounting error. D) all of the above 17) The auditor has considerable responsibility for notifying users as to whether or not the statements are properly stated. This imposes on the auditor a duty toc A) provide reasonable assurance that material misstatements will be detected. B) be an insurer of the fairness of the statements. C) be equally responsible with management for the preparation of the financial statements. D) be a guarantor of the fairness of the statements. 18) "The auditor should not assume that management is dishonest, but the possibility of dishonesty must be considered. This illustrates: A) adhering to the Code of Ethics for Professional B) an attitude of professional scepticism. Accountants. C) unprofessional behaviour. D) due diligence. 19) If the auditor were responsible for making certain that all the assertions of management in the statements are correct, then: A) audits would be much easier to complete. B) bankruptcies would be reduced to a very small number. C) audits would not be economically feasible. D) bankruptcies could no longer occur. 20) The auditor's BEST defence when existing material misstatements in the financial statements are NOT uncovered in the audit is that the: A) financial statements are the client's responsibility. B) audit was conducted in accordance with generally accepted accounting principles. C) audit was conducted in accordance with Australian auditing standards. D) dient is guilty of contributory negligence. 21) Which level of assurance has the auditor hoped to attain at the completion of the audit? A) absolute B) reasonable C) moderate D) any of the above is considered appropriate 22) What reasoning would an auditor use when no material misstatements are discovered? A) The audit was conducted in accordance with auditor judgement. B) The audit was conducted in accordance with Australian auditing standards. C) Misstatements are the responsibility of management. D) The audit was conducted in accordance with Australian accounting standards. 23) Professional scepticism means that the auditor should: A) not accept the representations of management. B) approach the audit with a questioning mind. C) consider that management is mostly honest. D) only consider written representations from the audit client. 24) What is a common name for fraudulent financial reporting? A) employee fraud B) theft of assets C) defalcation D) management fraud 25) Which one of the following statements is true? A) Usually, errors and fraud are equally difficult for the auditor to uncover B) It is usually easier for the auditor to uncover fraud than errors. C) It is usually easier for the auditor to uncover errors than fraud. D) none of the above 26) In comparing management fraud with employee fraud, the auditor's responsibility to discover the fraud is: A) greater for employee fraud because of the larger number of employees in the organisation B) the same for both management and employee fraud. C) greater for management fraud because of management's ability to override existing internal controls. D) greater for management fraud because managers are inherently smarter than employees. 27) When comparing the auditor's responsibility for detecting employee fraud and for detecting errors, the profession has placed the responsibility: A) equally on discovering either one. B) on the senior auditor for detecting errors and on the manager for detecting employee fraud. C) more on discovering errors than employee fraud. D) more on discovering employee fraud than errors. 28) When the auditor knows that an illegal act exists, he should: A) modify the audit report. B) consider the adequacy of disclosures. C) consider the effects on the financial statements. D) all of the above 29) Which of the following statements BEST describes the auditor's responsibility regarding the detection of fraud? The auditor has A) equal responsibility for detecting errors, fraud, and indirect-effect illegal acts. B) greater responsibility for detecting material errors than fraud. C) greater responsibility for detecting material errors than fraud and direct-effect illegal acts. D) equal responsibility for detecting errors, fraud, and direct effect illegal acts. 30) Which of the following is an example of misappropriation of assets resulting in a misstatement in the balance sheet? A) Cash from a cash sale was stolen, and the transaction was not recorded. B) Assets were stolen, and the misappropriation was discovered C) Cash collected from a customer was stolen, and the account receivable for the customer's account was not credited. D) both A and C 31) Auditors cannot provide assurance that indirect-effect illegal acts will be detected because: A) they do not accept responsibility for discovering illegal acts. B) they lack legal expertise. C) both A and B D) none of the above 32) When the auditor believes an illegal act may have occurred, it is necessary to: A) consult with the client's legal counsel. B) inquire of management, at a level above those likely to be involved with illegality. C) consider accumulating additional evidence to determine if there is actually an illegal act. D) all of the above 33) When the auditor knows that an illegal act has occurred, the first course of action by the auditor is to A) withdraw from the engagement. B) issue an adverse opinion. C) consider the effects on the financial statements, including the adequacy of disclosure. D) not report it to the proper govemmental authorities. 34) An auditor should recognise that the application of auditing procedures may produce evidential matter indicating the possibility of errors or fraud; therefore, an auditor should: A) extend the work to audit most recorded transactions and records of an entity. B) design audit tests to detect unrecorded transactions. C) not depend on internal accounting control features that are designed to prevent or detect errors or irregularities. D) plan and perform the engagement with an attitude of professional scepticism. 35) There are several reasons why the auditor is responsible for reasonable but not absolute assurance. One of them is that: A) fraudulently prepared financial statements are often extremely difficult, but not impossible, for the auditor to detect. B) accounting presentations contain complex estimates that can be convincing C) most audit evidence results from testing a sample of a population, and sampling involves minimal risk. D) audit testing and the evaluation of test results require significant auditor judgement, and auditors can make errors in judgement. 36) 'Illegal acts,' as opposed to fraud, are defined as violations of: A) law which would result in the arrest of the perpetrator. B) laws or govemment regulations, other than fraud. C) laws or goverment regulations, other than errors. D) laws or goverment regulations, other than irregularities. 37) Most illegal acts affect the financial statements: A) both directly and indirectly. C) directly B) only indirectly. D) materially if direct, immaterially if indirect. 38) The audit can be divided into transaction cycles. Which of the following is NOT one of the transaction cycles? A) payroll and personnel cycle C) sales and collection cycle B) sales and payment cycle D) acquisition and payment cycle 39) The cycle approach to segmenting an audit: A) requires different audit teams to ensure objectivity. B) keeps closely related types of transactions and account balances in the same segment. C) divides the different operation areas of the client's business operations. D) all of the above 40) Which general ledger account affects the most financial statement cycles? A) cash account B) retained earnings account C) income tax expense and liability accounts D) inventory account of the following statements is NOT true about the cycle approach to segmenting an audit? A) All general ledger accounts and journals are included at least once. B) The 'inventory and warehousing cycle may be audited at any time during the engagement since it is unrelated to the other cycles. C) The 'capital acquisition and repayment' cycle is closely related to the acquisition of goods and services and payment' cycle. D) Some journals and general ledger accounts are included in more than one cycle. 42) Which of the following joumals would be included in all of the various audit cycles? A) cash receipts joumal B) general joumal C) cash disbursements journal D) sales journal 43) When using the cycle approach to segmenting an audit, the reason for treating capital acquisition and repayment separately from the acquisition of goods and services is that: A) the transactions are related to financing a company rather than to its operations. pital acquisition and repayment cycle accounts involve few transactions, but each is often highly material, and therefore should be audited extensively. C) both A and B D) neither A nor B 44) Which of the following is NOT an assertion relating to general transaction-related audit objectives? A) accuracy B) completeness C) rights and obligations D) occurrence 45) Which of the following is NOT one of the five broad categories of assertions, as adapted from ASA 315? A) existence or occurrence B) presentation and disclosure C) valuation or allocation D) general or specific transaction objectives 46) Which of the following is an example of the classification and understand ability assertion? A) Financial and other information is appropriately presented and described, and disclosures are clearly expressed B) Transactions and events have been recorded in the correct accounting period. C) All disclosures that should have been included in the financial statements have been included. D) Disclosed events and transactions have occurred and pertain to the entity. 47) Which of the following is NOT an assertion relating to general presentation and disclosure-related audit objectives? A) Occurrence B) Cut off C) Accuracy D) Completeness 48) Which one of the following statements is NOT correct? A) It would be a violation of the completeness assertion if management recorded a sale that did not take place. B) The completeness assertion deals with matters opposite the existence occurrence assertion. C) The existence/occurrence assertion is concerned with amounts that should not have been included. D) The completeness assertion is concemed with the possibility of omitting items that should have been included in the financial statements. 49) Which of the following 'general transaction-related audit objectives' is NOT part of the valuation or allocation assertion? ) accuracy B) timing C) completeness D) classification 50) If a long-term note receivable is included on an accounts receivable listing, there is a violation of the A) timing objective. B) classification objective. C) completeness objective. D) existence objective 51) Management assertions are: A) provided to the auditor in the assertions letter, but are not disclosed on the financial statements. B) explicitly expressed representations about the financial statements. C) stated in the footnotes to the financial statements. D) implied or expressed representations about classes of transactions and the related accounts in the financial statements. 52) Which one of the following statements is NOT true? A) An example of a completeness assertion would be that the notes payable account in the balance sheet includes all such obligations of the entity. B) An example of a rights/obligations assertion would be that amounts capitalised for leases in the balance sheet represent the cost of the entity's rights to leased property. C) An example of a valuation/allocation assertion would be that property, plant, and equipment are listed in the noncurrent section of the balance sheet. D) An example of an existence/occurrence assertion would be that sales in the income statement represent exchanges of goods or services that actually took place. 53) Which one of the following statements is true? A) Management's assertions follow and are closely related to the auditor's objectives. B) The auditor's primary responsibility is to find and disclose fraudulent management assertions. C) The auditor's objectives follow and are closely related to management assertions. D) Assertions about presentation and disclosure deal with whether the accounts have been included in the financial statements at appropriate amounts. 54) Which one of the following is NOT a management assertion category? A) account balances B) classes of transactions and events C) presentation and disclosure D) All of the above are management assertion categories. 55) For the most part, auditors treat each transaction cycle: A) as a joint venture with other clients in the same industry. B) separately as the audit is being performed. C) as an interrelated unit with the other cycles throughout the entire audit. D) as a separate business unit with different audit teams. 56) The completeness assertion addresses: A) the possibility of omitting transactions that should have been recorded. B) whether all transactions that should be included in the financial statements are in fact included. C) matters that are the opposite of those addressed by the occurrence assertion. D) all of the above 57) 'All assets, liabilities and equity interests that should have been recorded have been recorded' relates to which management assertion? A) rights and obligations B) valuation and allocation C) existence or occurrence D) completeness 58) Which management assertion is NOT associated with transaction-related audit objectives? A) existence or occurrence B) valuation or allocation C) presentation and disclosure D) completeness 59) Which one of the following is NOT an example of misclassification for sales? A) including retail sales as wholesale sales B) recording the sale of a subsidiary as a reduction in investments C) recording a sale of operating fixed assets as revenue D) including cash sales as credit sales 60) To which audit objective does the assertion 'recorded sales are for the amount of goods shipped and are correctly billed and recorded' relate? A) occurrence B) completeness C) accuracy D) valuation 61) Which one of the following statements about the existence and completeness objectives is true? A) Existence deals with understatements and completeness deals with overstatements. B) The existence and completeness objectives both emphasise the inclusion of all transactions. C) Existence deals with overstatements and completeness deals with understatements. D) The completeness objective deals with transactions being recorded in their entirety, 62) What is the objective in testing for cut-off? A) that no transactions of the current period have been delayed and recorded in a future period B) whether all of the current period's transactions are recorded C) whether transactions are recorded in the proper period D) that no transactions from the prior period are included in the current period's balances 63) After the general balance-related objectives are understood, specific objectives for each account balance on the financial statements can be developed. Which one of the following statements is true? A) There will be only one specific objective for each relevant general objective. B) There must be two specific objectives for each general objective. C) There will be many specific objectives developed for each relevant general objective D) There should be at least one specific objective for each relevant general objective. 64) An audit process is a well-defined methodology for organising an audit to ensure that: A) the evidence gathered is both sufficient and appropriate. B) all appropriate audit objectives are met. C) all appropriate audit objectives are specified. D) all of the above 65) Which one of the following statements is true? A) The circumstances may vary from audit to audit, but the evidence accumulated remains the same. B) The general audit objectives may vary from audit to audit, but the circumstances remain the same. C) The evidence that the auditor accumulates remains the same from audit to audit, but the general audit objectives vary, depending on the circumstances. D) The general audit objectives remain the same from audit to audit, but the evidence varies, depending on the circumstances. 66) To adequately plan the appropriate audit evidence, generally accepted auditing standards require the auditor to gain an understanding of the internal control structure. This understanding is obtained by: A) discussions with client personnel. B) observing client activities. C) reviewing organisational charts and procedural manuals. D) all of the above 67) When the auditor has assessed control risk of a particular area at a reduced level, he or she will then: A) proceed to expand the sample sizes in that area. B) test the effectiveness of the controls in that area. C) negotiate with management to determine which controls will be tested in that area. D) eliminate the need to gather evidence in that area. 68) Assessing the overall reasonableness of transactions and balances is the goal of: A) management assertions. B) auditing C) analytical procedures. D) fraud detection 69) What is the purpose of tests of details of balances? A) Test for monetary errors in the financial statements. B) Identify the details of the internal control system. C) Prove that the trial balance is correct. D) Prove that the accounts with material balances are correctly classified. 70) Which one of the following is NOT a proper match of audit objectives with management assertions? A) Timing matches with valuation or allocation. B) Completeness matches with completeness. C) Existence matches with existence/occurrence. D) Classification matches with presentation/disclosure. 71) Which of the following is NOT one of the four phases in the audit process? A) Complete the audit and issue the report. B) Plan and design an audit approach. C) Test controls and transactions. D) Inform the client of any adjustments or corrections to be made to the financial statements. 72) If the auditor has obtained a reasonable level of assurance about the fair presentation of the financial statements through understanding internal control, assessing control risk, testing controls, and performing analytical procedures, then the auditor: A) can significantly reduce the test of details. B) needs to do additional tests of controls so that the assurance level can be increased. C) can issue an unqualified opinion. D) can write the engagement letter. 73) After the auditor has completed all the procedures, it is necessary to combine the information obtained to reach an overall conclusion as to whether the financial statements are fairly presented. This is a highly subjective process that relies heavily on: A) the auditor's professional judgement. B) generally accepted accounting principles. the Code of Ethics for Professional Accountants. D) generally accepted auditing standards. 74) To adequately plan the appropriate audit evidence to gather, Australian auditing standards require the auditor to gain an understanding of: A) the client's procedural manuals. B) the client's organisation charts. C) the client's internal controls. D) all of the above 75) ASA 300 requires an auditor to gain a reasonable understanding of the client's: A) industry but not business. B) business and industry. C) business but not industry. D) specific entity structure but not its business or industry. 76) When planning an audit, which of the following should be an overriding consideration? A) the accumulation of appropriate audit evidence B) the accumulation of sufficient audit evidence C) the minimisation of costs incurred to accumulate evidence D) all of the above