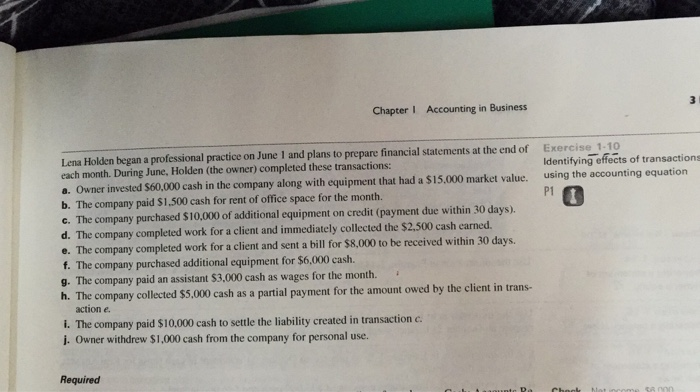

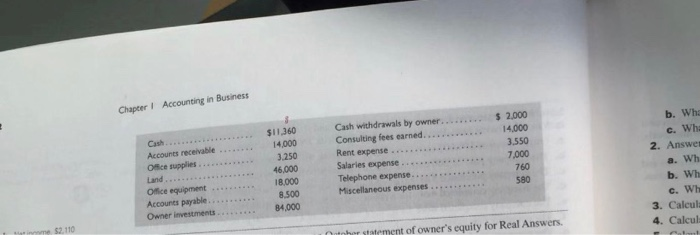

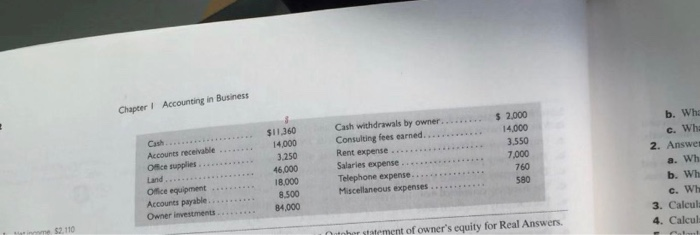

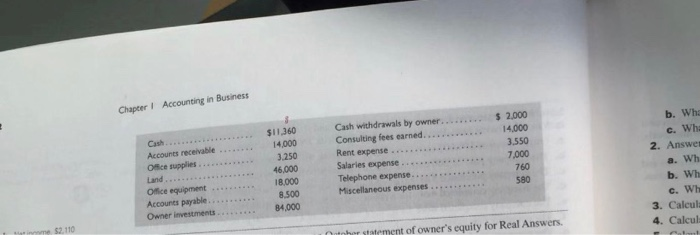

Chapter I Accounting in Business Exercise 1-10 Identifying effects of transactions using the accounting equation Lena Holden began a professional practice each month. During June, Holden (the owner) completed these transactions: a. Owner invested $60,000 cash in the company along with equipment that had a $15,000 market value. b. The company paid $1,500 cash for rent of office space for the month. c. The company purchased $10,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected the $2,500 cash earned. e. The company completed work for a client and sent a bill for $8,000 to be received within 30 days. f. The company purchased additional equipment for $6,000 cash. g. The company paid an assistant $3,000 cash as wages for the month. h. The company collected $5,000 cash as a partial payment for the amount owed by the client in trans- action e i. The company paid $10,000 cash to settle the liability created in transaction c. j. Owner withdrew $1,000 cash from the company for personal use. on June 1 and plans to prepare financial statements at the end of P1 Required Chock S8 000 Accounting in Business Chapeer $ 2,000 14,000 3.550 7,000 760 Cash withdrawals by owner . $11360 Cash Accounts receivable Office supplies Land Office equipment Accounts payable.... Owner investments. b. Wha Consulting fees earned.. Rent expense . Salaries expense.. Telephone expense.. Miscellaneous expenses 14,000 3.250 c. Wh 2. Answer 46,000 18.000 8.500 84,000 a. Wh b. Wh 580 c. Wh 3. Calcul 4. Calcul Answers. Accounting in Business Chapeer $ 2,000 14,000 3.550 7,000 760 Cash withdrawals by owner . $11360 Cash Accounts receivable Office supplies Land Office equipment Accounts payable.... Owner investments. b. Wha Consulting fees earned.. Rent expense . Salaries expense.. Telephone expense.. Miscellaneous expenses 14,000 3.250 c. Wh 2. Answer 46,000 18.000 8.500 84,000 a. Wh b. Wh 580 c. Wh 3. Calcul 4. Calcul Answers. Chapter I Accounting in Business Exercise 1-10 Identifying effects of transactions using the accounting equation Lena Holden began a professional practice each month. During June, Holden (the owner) completed these transactions: a. Owner invested $60,000 cash in the company along with equipment that had a $15,000 market value. b. The company paid $1,500 cash for rent of office space for the month. c. The company purchased $10,000 of additional equipment on credit (payment due within 30 days). d. The company completed work for a client and immediately collected the $2,500 cash earned. e. The company completed work for a client and sent a bill for $8,000 to be received within 30 days. f. The company purchased additional equipment for $6,000 cash. g. The company paid an assistant $3,000 cash as wages for the month. h. The company collected $5,000 cash as a partial payment for the amount owed by the client in trans- action e i. The company paid $10,000 cash to settle the liability created in transaction c. j. Owner withdrew $1,000 cash from the company for personal use. on June 1 and plans to prepare financial statements at the end of P1 Required Chock S8 000 Accounting in Business Chapeer $ 2,000 14,000 3.550 7,000 760 Cash withdrawals by owner . $11360 Cash Accounts receivable Office supplies Land Office equipment Accounts payable.... Owner investments. b. Wha Consulting fees earned.. Rent expense . Salaries expense.. Telephone expense.. Miscellaneous expenses 14,000 3.250 c. Wh 2. Answer 46,000 18.000 8.500 84,000 a. Wh b. Wh 580 c. Wh 3. Calcul 4. Calcul Answers. Accounting in Business Chapeer $ 2,000 14,000 3.550 7,000 760 Cash withdrawals by owner . $11360 Cash Accounts receivable Office supplies Land Office equipment Accounts payable.... Owner investments. b. Wha Consulting fees earned.. Rent expense . Salaries expense.. Telephone expense.. Miscellaneous expenses 14,000 3.250 c. Wh 2. Answer 46,000 18.000 8.500 84,000 a. Wh b. Wh 580 c. Wh 3. Calcul 4. Calcul Answers