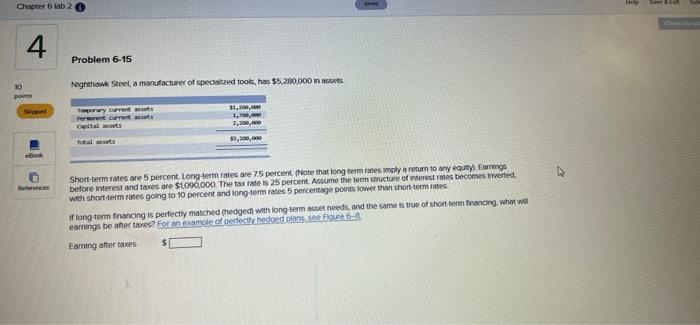

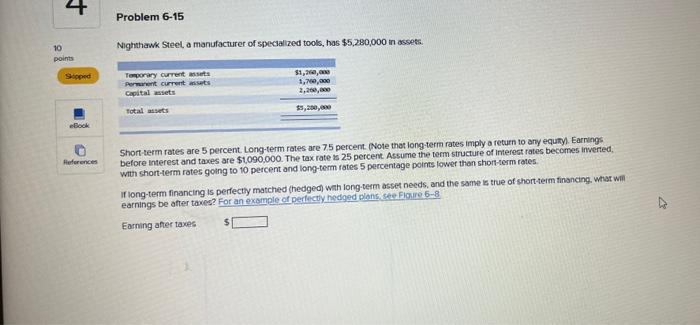

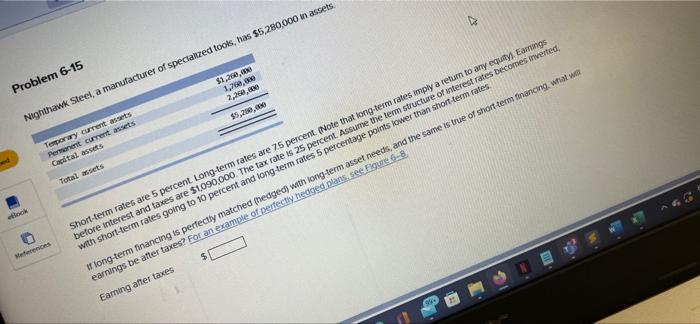

Chapter lab 2 4 Problem 6-15 Nighthawk Steel, a manufacturer of specialized tools, has $5,200,000 in assets. 10 pom | THD turn Perwer current Gapitalists 11, 1, 2,100, Total 99,00 bo Short-term rates are 5 percent. Long-term rates are 75 percent. Note that long term rates moly a return to any equitys Earrings before interest and taxes are $1090,000 The tax rates 25 percent. Assume the term structure of interest rates becomes inverted, with short-term rates going to 10 percent and long-term rates 5 percentage points lower than short-term rates if long-term financing is perfectly matched hedged with long term asset needs, and the same is true of short-term financing, what wil earnings be after taxesFor an example of perfect hedoed plans see figure 6-8 Earning after taxes Problem 6-15 Nighthawk Steel, a manufacturer of specialized tools, has $5,280,000 in assets. Skipped Temporary current assets Permanent current assets Capital assets $1,200,000 1,700,000 2,200,000 Total assets $5,200,000 eBook References Short-term rates are 5 percent. Long-term rates are 7.5 percent. (Note that long-term rates imply a return to any equity). Earnings before interest and taxes are $1,090,000. The tax rate is 25 percent. Assume the term structure of Interest rates becomes inverted, with short-term rates going to 10 percent and long-term rates 5 percentage points lower than short-term rates. if long-term financing is perfectly matched (hedged) with long-term asset needs, and the same is true of short-term financing, what will earnings be after taxes? For an example of perfectly hedged plans, see Figure 6-8 Earning after taxes $ 10 points Problem 6-15 $1,260,000 1,760,00 2,250,00 Nighthawk Steel, a manufacturer of specialzed tools, has $5,280,000 in assets. $5,200,000 Temporary current assets Permanent current assets Capital assets Total assets Neferences Short-term rates are 5 percent. Long-term rates are 75 percent. (Note that long term rates imply a return to any equity Eags before interest and taxes are $1,090,000. The tax rate is 25 percent. Assume the term structure of interest rates becomes verted, with short-term rates going to 10 percent and long-term rates 5 percentage points lower than short-term rates if long-term financing is perfectly matched hedged) with long term asset needs, and the same is true of short term financing, what was earnings be after taxes? For an example of perfectly hedged plans ses Figure 68 Eaming after taxes $