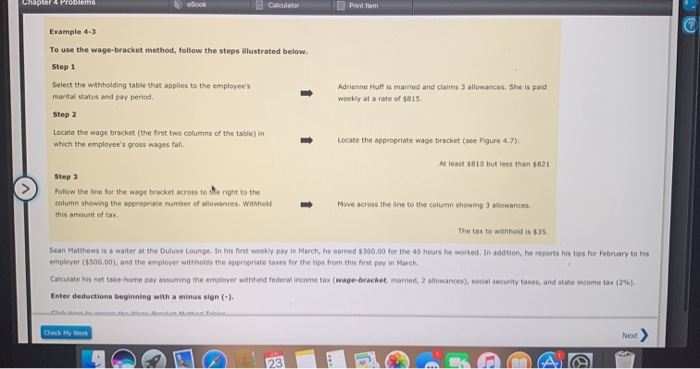

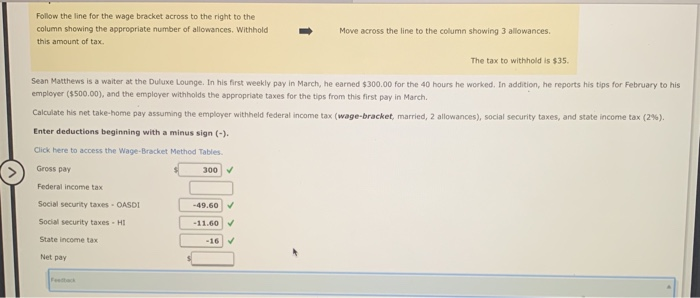

Chapter Problems eBook Calculator Print tem Example 4-3 To use the wage-bracket method, follow the steps illustrated below. Step 1 Select the withholding table that applies to the employee's marital status and pay period. Step 2 Locate the wage bracket (the first two columns of the table) in which the employee's gross wages fall Adrienne Huff is married and claims 3 allowances. She is paid weekly at a rate of $815. Locate the appropriate wage bracket (see Figure 4.7); At least 5010 but less than $821 Step 3 Follow the line for the wage bracket across to the right to the column showing the appropriate number of allowances. Withhold this amount of tax Move across the line to the column showing 3 allowances. The tax to withhold is $35. Sean Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he came $300.00 for the 40 hours he worked. In addition, he reports his ties for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March Calculate his net take home pay asuming the employer withheld federal income tax (wage bracket, married, allowances), social security taxes, and state income tax (296) Enter deductions beginning with a minus sign (-). Check My Work Next > 23 Follow the line for the wage bracket across to the right to the column showing the appropriate number of allowances. Withhold this amount of tax Move across the line to the column showing 3 allowances, The tax to withhold is $35. Sean Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March Calculate his net take-home pay assuming the employer withheld federal income tax (wage bracket married, 2 allowances), social security taxes, and state income tax (2%). Enter deductions beginning with a minus sign (-). Click here to access the Wage-Bracket Method Tables Gross pay 300 Federal income tax Social security taxes - OASDI -49.60 Social security taxes - HI -11.60 State income tax -16 Net pay Fette