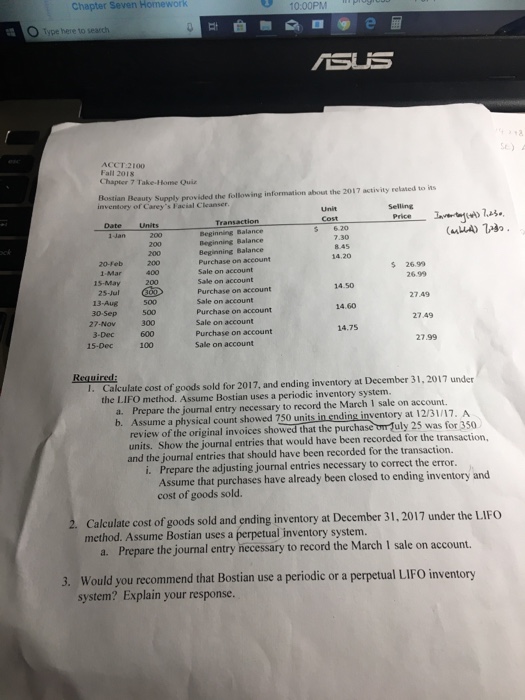

Chapter Seven Homework Type here to search SUS ACCT:2100 Fall 2018 Chapter 7 Take-Home Quiz Bostian Beauty Supply provided the following information about the 2017 activity related to ins inventory of Carey's Facial Cleanser sellin Price Javed. (H) 725. Beginning Balance Beginning Balance Beginning Balance 1-Jan 200 7.30 8.45 14.20 20-Feb200 1 Mar400 Sale on account Sale on account $ 2699 26.99 1s-May 14.50 14.60 14.75 25-Jul Purchase on account 27.49 13-Aug 500 30-Sep500 Sale on account Purchase on account Sale on account Purchase on account Sale on account 27.49 300 27-Nov600 3-Dec600 27.99 15-Dec Required T. Calculate cost of goods sold for 2017, and ending inventory at December 31,2017 under Prepare the journal entry necessary to record the March 1 sale on account. b. Assume a physical count showed 750 units in ending inventory at 12/31/17. A the LIFO method. Assume Bostian uses a periodic inventory system. a. review of the original invoices showed that the purchase omfuly 25 was for 350 units. Show the journal entries that would have been recorded for the transaction, and the journal entries that should have been recorded for the transaction. i. Prepare the adjusting journal entries necessary to correct the error. Assume that purchases have already been closed to ending inventory and cost of goods sold. Calculate cost of goods sold and ending inventory at December 31, 2017 under the LIFO method. Assume Bostian uses a perpetual inventory system. a. Prepare the journal entry necessary to record the March I sale on account. 3. Would you recommend that Bostian use a periodic or a perpetual LIFO inventory system? Explain your response. Chapter Seven Homework Type here to search SUS ACCT:2100 Fall 2018 Chapter 7 Take-Home Quiz Bostian Beauty Supply provided the following information about the 2017 activity related to ins inventory of Carey's Facial Cleanser sellin Price Javed. (H) 725. Beginning Balance Beginning Balance Beginning Balance 1-Jan 200 7.30 8.45 14.20 20-Feb200 1 Mar400 Sale on account Sale on account $ 2699 26.99 1s-May 14.50 14.60 14.75 25-Jul Purchase on account 27.49 13-Aug 500 30-Sep500 Sale on account Purchase on account Sale on account Purchase on account Sale on account 27.49 300 27-Nov600 3-Dec600 27.99 15-Dec Required T. Calculate cost of goods sold for 2017, and ending inventory at December 31,2017 under Prepare the journal entry necessary to record the March 1 sale on account. b. Assume a physical count showed 750 units in ending inventory at 12/31/17. A the LIFO method. Assume Bostian uses a periodic inventory system. a. review of the original invoices showed that the purchase omfuly 25 was for 350 units. Show the journal entries that would have been recorded for the transaction, and the journal entries that should have been recorded for the transaction. i. Prepare the adjusting journal entries necessary to correct the error. Assume that purchases have already been closed to ending inventory and cost of goods sold. Calculate cost of goods sold and ending inventory at December 31, 2017 under the LIFO method. Assume Bostian uses a perpetual inventory system. a. Prepare the journal entry necessary to record the March I sale on account. 3. Would you recommend that Bostian use a periodic or a perpetual LIFO inventory system? Explain your response