Chapter: Statutory Income- Capital Gains

How can we solve the following MCQ?

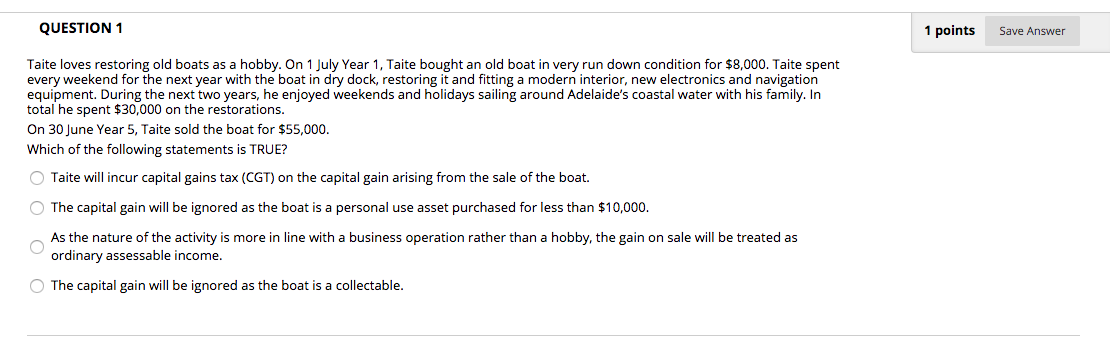

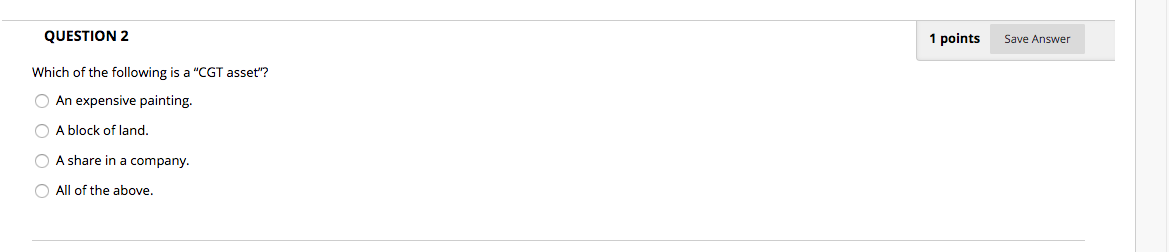

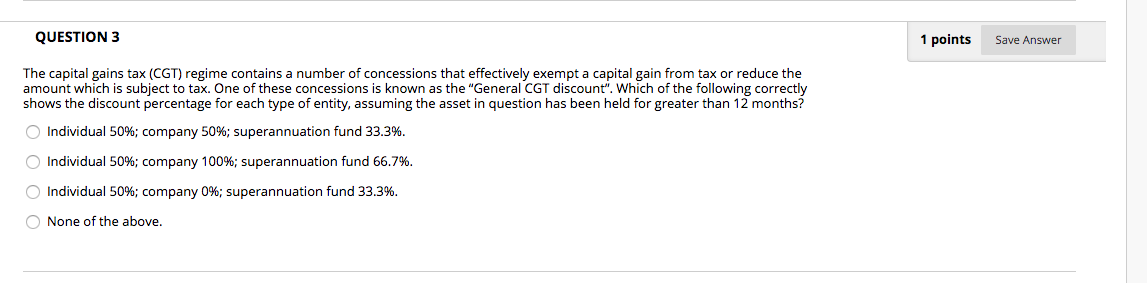

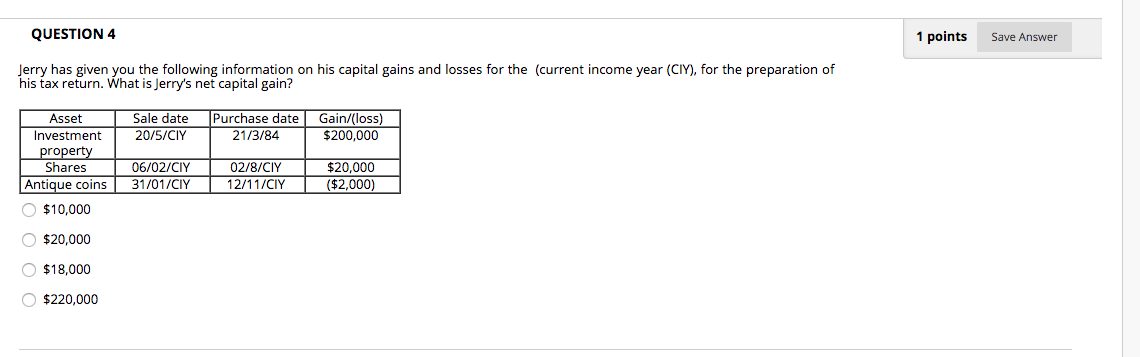

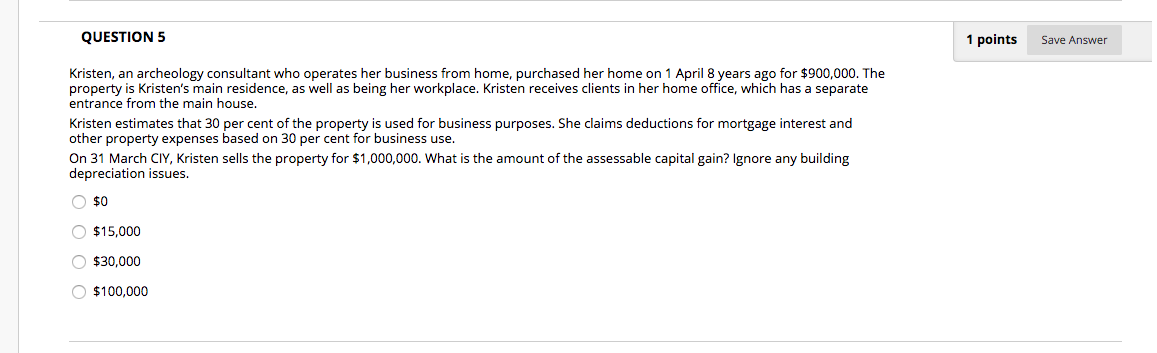

QUESTION 1 1 points Save Answer Taite loves restoring old boats as a hobby. On 1 July Year 1, Taite bought an old boat in very run down condition for $8,000. Taite spent every weekend for the next year with the boat in dry dock, restoring it and fitting a modern interior, new electronics and navigation equipment. During the next two years, he enjoyed weekends and holidays sailing around Adelaide's coastal water with his family. In total he spent $30,000 on the restorations. On 30 June Year 5, Taite sold the boat for $55,000. Which of the following statements is TRUE? Taite will incur capital gains tax (CGT) on the capital gain arising from the sale of the boat. The capital gain will be ignored as the boat is a personal use asset purchased for less than $10,000. O As the nature of the activity is more in line with a business operation rather than a hobby, the gain on sale will be treated as ordinary assessable income. O The capital gain will be ignored as the boat is a collectable.QUESTION 2 1 points Save Answer Which of the following is a "CGT asset"? O An expensive painting. O A block of land. A share in a company. O All of the above.QU ESTIO N 3 The capital gains tax (CGT) regime contains a number of concessions that elafectivelyr exempt a capital gain from tax or reduce the amount which is subject to tax. One of these concessions is known as the "General CGT discount". Which of the following correctly shows the discount percentage for each type of entity, assuming the asset in question has been held for greater than 12 months? O Individual 5096; company 50%; superannuation fund 33.396. 0 Individual 5096; company 100%; superannuation fund 65.?%. O Individual 50%; company 0%; superannuation fund 33.3%. O None of the above. 1 palms SaveAnswer QUESTION 4 1 points Save Answer Jerry has given you the following information on his capital gains and losses for the (current income year (CMY), for the preparation of his tax return. What is Jerry's net capital gain? Asset Sale date Purchase date Gain/(loss) Investment 20/5/CIY 21/3/84 $200,000 property Shares 06/02/CIY 02/8/CIY $20,000 Antique coins 31/01/CIY 12/11/CIY ($2,000) O $10,000 $20,000 O $18,000 $220,000QUESTION 5 1 points Save Answer Kristen, an archeology consultant who operates her business from home, purchased her home on 1 April 8 years ago for $900,000. The property is Kristen's main residence, as well as being her workplace. Kristen receives clients in her home office, which has a separate entrance from the main house. Kristen estimates that 30 per cent of the property is used for business purposes. She claims deductions for mortgage interest and other property expenses based on 30 per cent for business use. On 31 March CIY, Kristen sells the property for $1,000,000. What is the amount of the assessable capital gain? Ignore any building depreciation issues. O $0 O $15,000 $30,000 $100,000