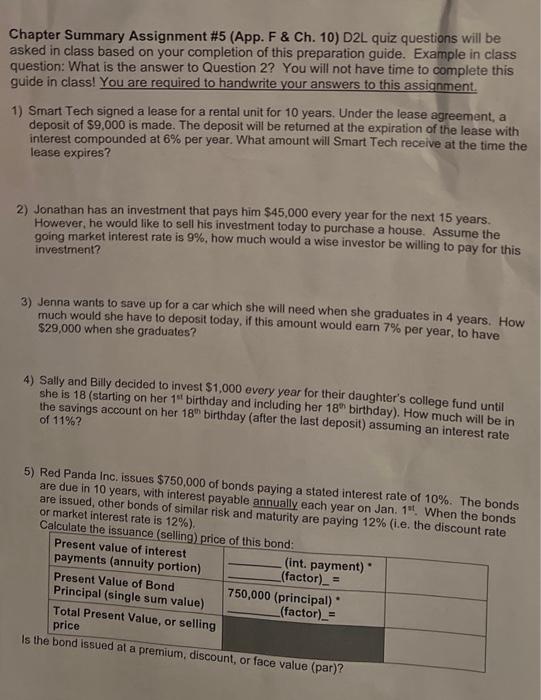

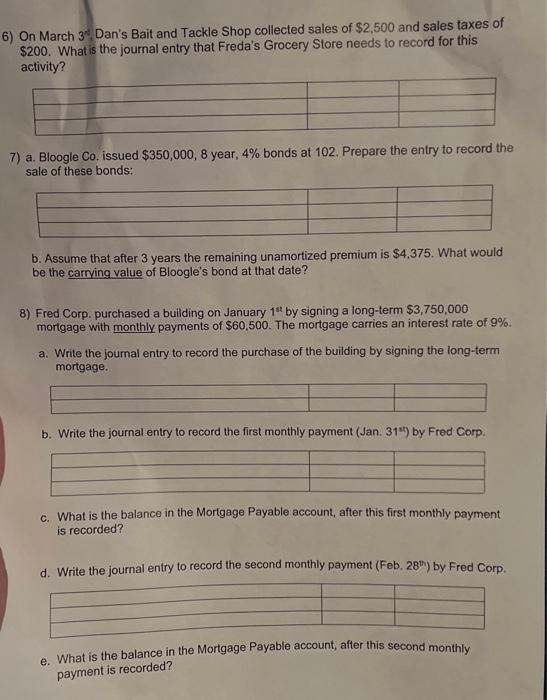

Chapter Summary Assignment \#5 (App. F \& Ch. 10) D2L quiz questions will be asked in class based on your completion of this preparation guide. Example in class question: What is the answer to Question 2? You will not have time to complete this guide in class! You are required to handwrite your answers to this assignment. 1) Smart Tech signed a lease for a rental unit for 10 years, Under the lease agreement, a deposit of $9,000 is made. The deposit will be returned at the expiration of the lease with interest compounded at 6% per year. What amount will Smart Tech receive at the time the lease expires? 2) Jonathan has an investment that pays him $45,000 every year for the next 15 years. However, he would like to sell his investment today to purchase a house. Assume the going market interest rate is 9%, how much would a wise investor be willing to pay for this investment? 3) Jenna wants to save up for a car which she will need when she graduates in 4 years. How $29,000 when she have to deposit today, if this amount would earn 7% per year, to have 4) Sally and Billy decided to invest $1,000 every year for their daughter's college fund until she is 18 (starting on her 111 birthday and including her 18n birthday). How much will be in the saving of 11% ? 5) Red Panda Inc. issues $750,000 of bonds paying a stated interest rate of 10%. The bonds are due in 10 years, with interest payable annually each year on Jan. 1 ot. When the bonds or market interest rate is of 12% ). 6) On March 3 Dan's Bait and Tackle Shop collected sales of $2,500 and sales taxes of $200. What is the journal entry that Freda's Grocery Store needs to record for this activity? 7) a. Bloogle Co. issued $350,000,8 year, 4% bonds at 102 . Prepare the entry to record the sale of these bonds: b. Assume that after 3 years the remaining unamortized premium is $4,375. What would be the carrving value of Bloogle's bond at that date? 8) Fred Corp. purchased a building on January 1"t by signing a long-term $3,750,000 mortgage with monthly payments of $60,500. The mortgage carries an interest rate of 9%. a. Write the joumal entry to record the purchase of the building by signing the long-term mortgage. b. Write the journal entry to record the first monthly payment (Jan. 31t") by Fred Corp. c. What is the balance in the Mortgage Payable account, after this first monthly payment is recorded? d. Write the journal entry to record the second monthly payment (Feb, 28") by Fred Corp. e. What is the balance in the Mortgage Payable account, after this second monthly payment is recorded? Chapter Summary Assignment \#5 (App. F \& Ch. 10) D2L quiz questions will be asked in class based on your completion of this preparation guide. Example in class question: What is the answer to Question 2? You will not have time to complete this guide in class! You are required to handwrite your answers to this assignment. 1) Smart Tech signed a lease for a rental unit for 10 years, Under the lease agreement, a deposit of $9,000 is made. The deposit will be returned at the expiration of the lease with interest compounded at 6% per year. What amount will Smart Tech receive at the time the lease expires? 2) Jonathan has an investment that pays him $45,000 every year for the next 15 years. However, he would like to sell his investment today to purchase a house. Assume the going market interest rate is 9%, how much would a wise investor be willing to pay for this investment? 3) Jenna wants to save up for a car which she will need when she graduates in 4 years. How $29,000 when she have to deposit today, if this amount would earn 7% per year, to have 4) Sally and Billy decided to invest $1,000 every year for their daughter's college fund until she is 18 (starting on her 111 birthday and including her 18n birthday). How much will be in the saving of 11% ? 5) Red Panda Inc. issues $750,000 of bonds paying a stated interest rate of 10%. The bonds are due in 10 years, with interest payable annually each year on Jan. 1 ot. When the bonds or market interest rate is of 12% ). 6) On March 3 Dan's Bait and Tackle Shop collected sales of $2,500 and sales taxes of $200. What is the journal entry that Freda's Grocery Store needs to record for this activity? 7) a. Bloogle Co. issued $350,000,8 year, 4% bonds at 102 . Prepare the entry to record the sale of these bonds: b. Assume that after 3 years the remaining unamortized premium is $4,375. What would be the carrving value of Bloogle's bond at that date? 8) Fred Corp. purchased a building on January 1"t by signing a long-term $3,750,000 mortgage with monthly payments of $60,500. The mortgage carries an interest rate of 9%. a. Write the joumal entry to record the purchase of the building by signing the long-term mortgage. b. Write the journal entry to record the first monthly payment (Jan. 31t") by Fred Corp. c. What is the balance in the Mortgage Payable account, after this first monthly payment is recorded? d. Write the journal entry to record the second monthly payment (Feb, 28") by Fred Corp. e. What is the balance in the Mortgage Payable account, after this second monthly payment is recorded